Wall Street sees consolidation in the cards for next week, Main Street maintains bullish bent

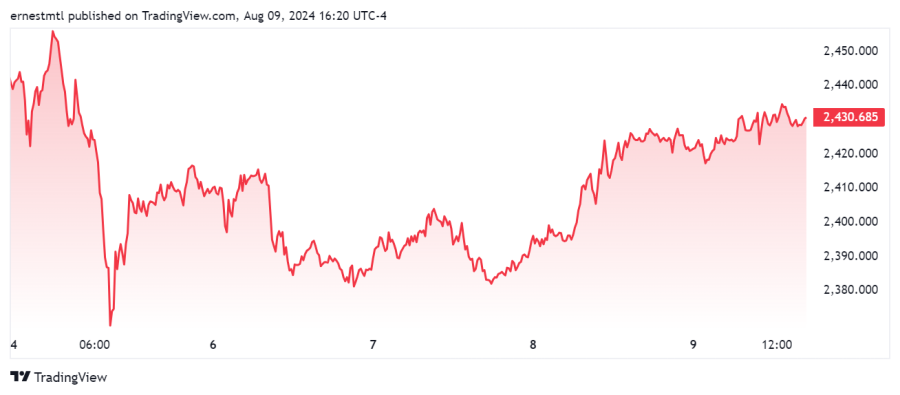

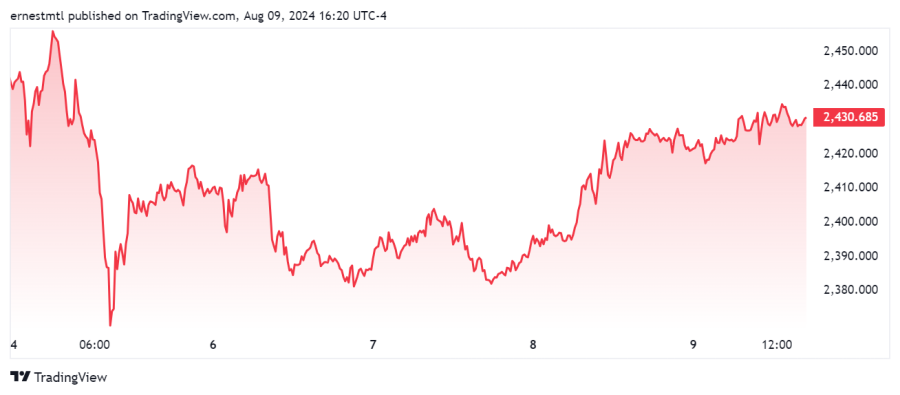

Markets began this week with one of the most profound shocks in recent years after the unwind of the yen carry trade and fears of a U.S. recession combined to drive risk assets sharply lower, dragging gold prices down along with them.

After opening the week trading close to $2,440 per ounce, spot gold saw a double bounce at $2,420 as news of the collapse of Japanese equities hit the wires, causing crypto and other risk assets to drop sharply during overnight trading. Gold initially saw a rally off their lows, with the spot price rising to a session high just shy of $2,460 per ounce shortly after midnight EDT as investors fled to safety.

But as the panic spread through the Asian and European sessions, gold was dragged lower once again, and after failing to hold support at $2,420 per ounce, spot gold began its own collapse shortly after 6:30 a.m., falling $60 in two hours.

After bouncing twice at the session low of $2,365 per ounce just after 8:30 a.m. on Monday, spot gold shot higher over the next couple of hours, eliminating nearly half of its losses by 11:00 a.m. EDT.

From there, gold prices stabilized along with equities, and the yellow metal established a range between $2,380 and $2,415 per ounce which it maintained throughout the middle of the week.

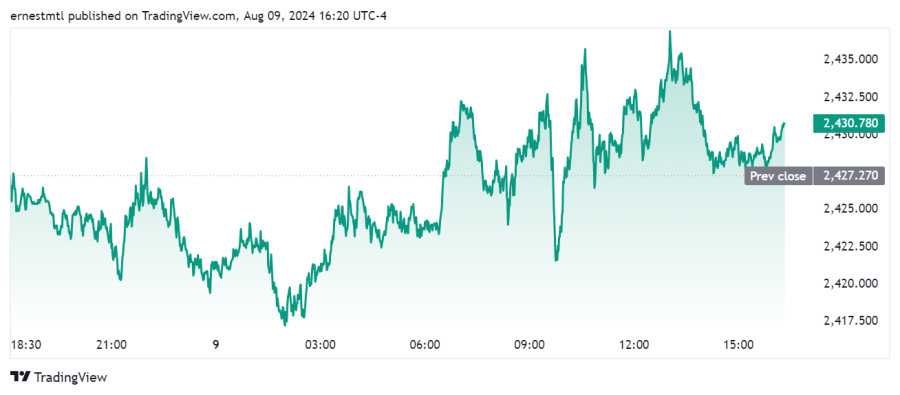

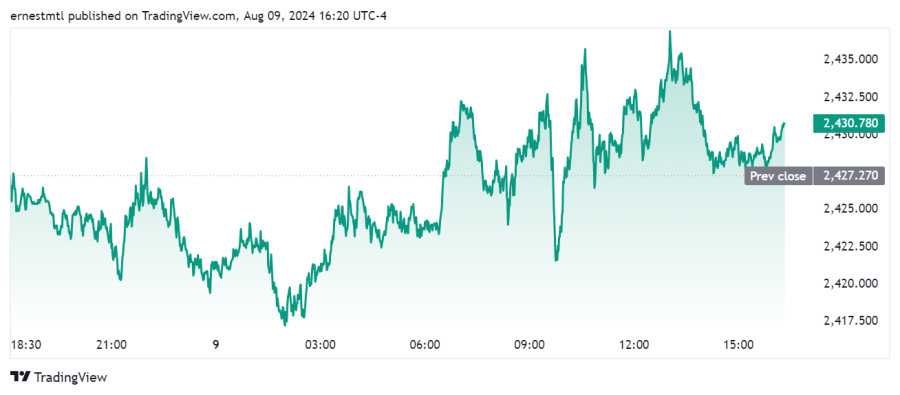

Thursday morning's better-than-expected weekly jobless claims report brought renewed optimism to both equities and precious metals markets, and drove spot gold to the edge of $2,430 throughout Thursday and Friday, but the yellow metal was rebuffed after every attempt to break through this resistance level. Still, the spot price never fell more than $2 below $2,420 per ounce for the duration of the week.

The latest Kitco News Weekly Gold Survey shows most industry experts predicting sideways price action next week, while the majority of retail traders expect the yellow metal to post gains.

“I am neutral on gold for the coming week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “I just have the feeling that coming off a volatile ten days, markets may settle down a bit next week before the Democratic convention starts the following week.”

Marc Chandler, Managing Director at Bannockburn Global Forex, also expects gold to trend sideways, at least at the beginning.

“I suspect continued consolidation is likely through at least the early part of next week,” he said. “I think the market may have exaggerated the likelihood of a 50 bp cut, let alone an emergency inter-meeting Fed cut. US coupon yields have firmed.”

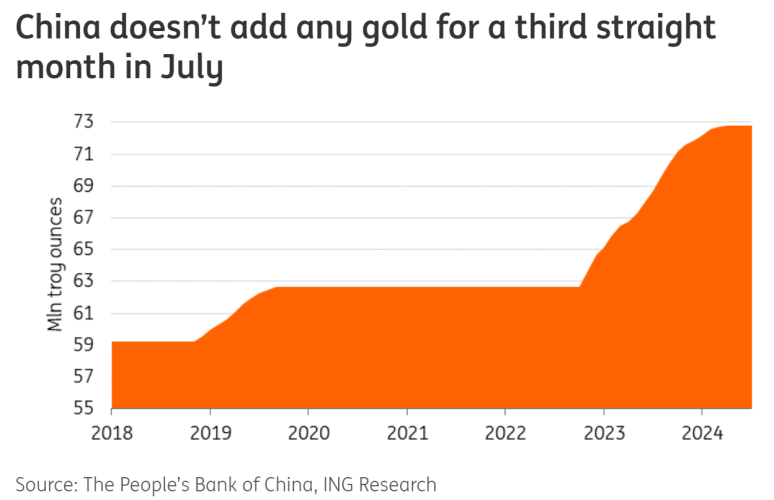

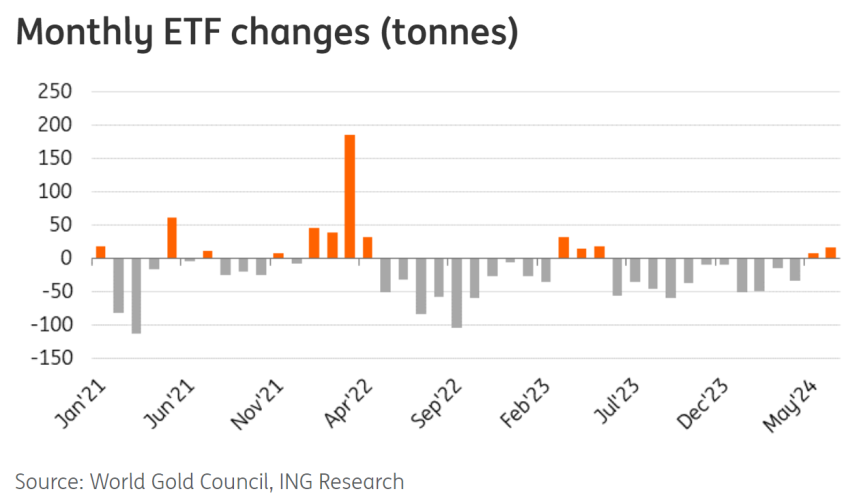

Chandler said next week’s highlight will be the CPI report. “It is likely to be unchanged on year-over-year basis, which will meet the low bar of a Fed Sept cut (25 bp),” he said. “Note that China’s PBOC did not buy gold for the 3rd month in July after an 18-month buying spree.”

“Still to come: Middle East tensions, and many still expect Iran to strike Israel, which would, at least initially, be supportive of gold,” he added.

Adrian Day, President of Adrian Day Asset Management, expects gold prices to move higher. “Market expectations for an interest rate cut by the Federal Reserve keep changing, and with them so does the gold price,” he observed. “But there is little doubt that there will be at least an initial rate cut in the near term, and that will be the signal for North American investors to become more interested in gold, especially as the U.S. economy shows signs of slipping into a recession.”

“Until now, the gold price has been driven with very little interest from Western investors,” Day said, “but a cut from the Fed and ongoing cuts from other central banks will change that.”

Adam Button, head of currency strategy at Forexlive.com, is neutral on gold’s near-term prospects. “A double top at $2475 is competing with a series of higher lows,” he said. “We’ve also seen a speculative wash-out. I think that sets the stage for a week of calming and consolidation, but watch Wednesday’s CPI report closely as it’s likely to put the nail in the coffin of the inflation story.”

“Sideways,” said Darin Newsom, Senior Market Analyst at Barchart.com. “While I still see Dec gold in an intermediate-term downtrend on its weekly chart, it remains range bound heading Into Friday's session.”

“Heading into next week, resistance is at the previous 4-week high of $2,537.70 with support at the previous 4-week low of $2,398.20,” he said. “Granted that’s a wide $139.50 range, but that sometimes happens. The contract’s daily chart is providing little guidance, also indicating a sideways short-term trend early Friday morning.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, said the gold market is changing so quickly these days that it’s difficult for traders to choose a direction.

“You're living day to day, not week to week with this stuff,” Lusk said. “These gyrations, the swings in the market… check your position in another four hours and see what your opinion is, because it may change big time.”

Lusk said that since recession fears first flared up last week, they sent everything tumbling, and he still believes the U.S. employment situation is worse than the headline numbers. “The market is contracting in the private sector,” he said. “The job growth is pretty contained in government hiring, so that's not really sustainable. Longer term, that's the fear, but the emotion sometimes is out of whack versus reality.”

Lusk said Monday’s apocalyptic pessimism was just as overdone as the equity market’s irrational optimism that preceded it.

“There were people screaming Monday morning that the Fed had to do a 75-point emergency cut,” he said. “It's just nonsense. For what? Where were we in January in the S&P 500? We closed last year at 4820, and we're 5359 currently. We have to have a crash in the market. You have to go negative, and this did not happen in the Dow or S&P. NASDAQ, different animal, but nothing goes up forever.”

Turning to gold’s price action, Lusk said he expects the yellow metal to remain strong, and while he doesn’t see another big move higher in the near term, he believes gold will run higher by year-end.

“We hit $2,485, that was our target,” he said. “Now we're at $2,468 [in the December contract], and last Friday it was over twenty-five-hundred dollars, $2,522. Last Friday was the all-time high. Now you're only $50 away from there, which these days is nothing. But the next target up is going to be that $2,580 to $2,585 area, that's 25% higher on the year.”

“They'll act in five percent increments,” Lusk added. “That's all they've done on this rally, by the way: take it up five, ten, fifteen, twenty percent higher on the year, get a little above it, pause, correction, break a hundred dollars, right back up, make new highs, repeat, consolidate, blah, blah, blah. New story comes in, run it up.”

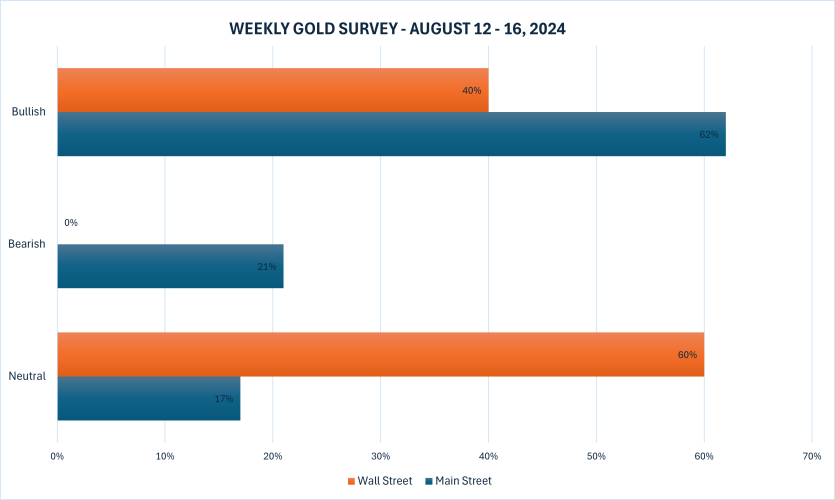

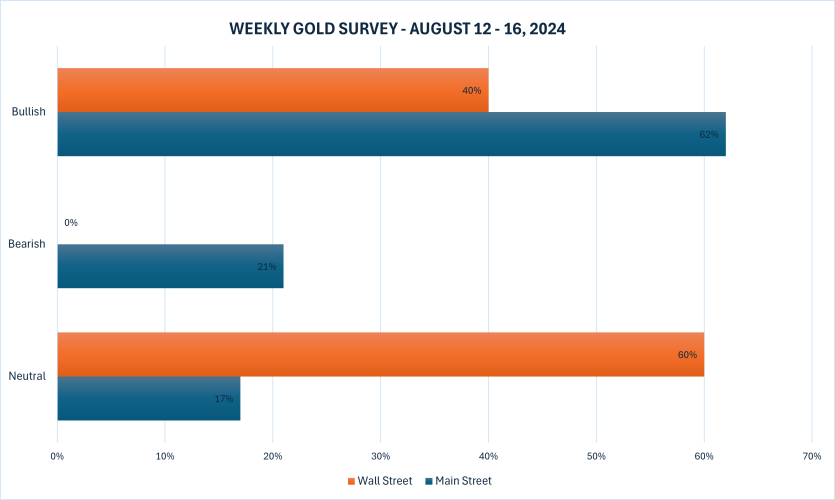

This week, 10 analysts participated in the Kitco News Gold Survey, with the majority of Wall Street now expecting gold to settle into a consolidation pattern as bearish sentiment has completely evaporated. Six experts, or 60%, expect to see gold prices trending sideways during the week ahead, while the remaining 40% believe gold will post further gains next week. None predicted a decline in price for the precious metal.

Meanwhile, 210 votes were cast in Kitco’s online poll, with most Main Street investors maintaining their bullish outlook. 130 retail traders, or 62%, looked for gold prices to rise next week. Another 45, or 21%, expected the yellow metal to trade lower, while 35 respondents, representing the remaining 17%, saw prices consolidating during the week ahead.

After this week's virtually empty data calendar, market-moving news picks up once again. Next week's highlights include Tuesday's release of U.S. PPI for July, followed by U.S. CPI for July on Wednesday, July retail sales and weekly jobless claims on Thursday, and U.S. housing starts and building permits for July on Friday morning, followed by the preliminary University of Michigan consumer sentiment survey for August.

Markets will also pay attention to the Empire State and Philly Fed manufacturing indexes for August scheduled for release on Thursday morning.

And with attention now squarely focused on the prospect of a September rate cut from the Federal Reserve, precious metals investors will also be paying close attention to next week's slate of Fed speakers, including Bostic on Tuesday, Musalem and Harker on Thursday, and Goolsbee on Friday afternoon.

James Stanley, senior market strategist at Forex.com, expects to see gold prices rise next week. “Bulls are still in control and they illustrated that well over the past week,” he said. “The Monday spike-low led into a higher-low on Tuesday and buyers came back in a big way in the latter part of the week.”

“In my view they have an open door to re-test highs but there still hasn’t been any clear evidence that they’re ready to take out $2500 yet,” Stanley said. “If they can break the pattern of lower-highs in spot Gold on the daily chart, that door for the $2500 test widens significantly. The risk to this scenario would be Treasury yields around the CPI report next week as a rush for yield can see capital flee gold to chase yield.”

Everett Millman, Chief Market Analyst at Gainesville Coins, said that he expects August’s seasonal favorability to support gold despite the geopolitical and market turmoil.

Millman said gold’s sharp drop was expected during Monday’s market decline. “Somewhat counterintuitively, it's actually the standard response that we see from the precious metals when other markets are selling off,” he said. “It's just that gold is very liquid, it's easy to sell and it's the first thing to go when risk assets are selling off the first move tends to be lower for gold. That's why it didn't surprise me because hedge funds and wealth management firms have to sell something to recoup their losses.”

Millman said that seasonally, August is one of the best months for gold, and markets are now looking ahead to a September rate cut from the Fed.

“It seems to be set in stone that everyone's expecting it,” he said. “They may not cut rates as much as some people are howling for right now, but it seems the Fed is going to start cutting in September, and that's good for gold.”

While Millman expects a fair amount of front running of the rate cut throughout the month of August, he doesn’t see a big price increase. “I don't expect any major moves higher,” he said. “I would expect gold to continue sideways with a bit of a bias toward trading higher.”

“Really, anything holding above support at $2,400 should be cheered massively by the bulls,” he added. “Gold still is up a ton this year, so they can only be happy with where we're already at. $2,500, up to $2,700, I wouldn't expect to see any of that until at least September.”

The one thing that Millman believes could drive gold to new highs ahead of schedule is an escalation in the Middle East. “The biggest thing would be if Iran finally retaliates,” he said. “The biggest concern is that if the conflict spreads, that more countries are roped into it, and then you get a wider war, and everyone has to line up and pick sides.”

“I think that's definitely a risk that would drive gold higher,” he concluded.

“This is now bullish,” said Michael Moor, Founder of Moor Analytics. “Decent trade back above 24979 (+3.5 tics per/hour starting at 7:00am) should bring in decent strength. Decent trade above 25123 (-.6 of a tic per/hour starting at 7:00am) will project this upward $110 (+). A maintained gap higher will leave a minor bullish reversal below. Decent trade below 24316 (+3 tics per/hour) will project this downward $40 (+).”

And Kitco Senior Analyst Jim Wyckoff sees technical and fundamental drivers favoring price gains next week. “Steady-higher as charts remain bullish and geopolitics simmering,” he said.

At the time of writing, spot gold last traded at $2,423.78 per ounce for a gain of 0.14% on the day, but a loss of 0.46% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.jpeg)

.jpeg)

.png)