Common Questions heard from Affiliate Marketers and some solid trusted realistic advice to increase your promotion results

Introduction

You've probably heard these questions before. You might have even asked them yourself. But if you're new to the world of affiliate marketing, then this article will provide you with a few answers and shed light on some common mistakes that other marketers are making — information that can help you start getting results faster!

How Can I Do Better With My Affiliate Marketing?

How Can I Do Better With My Affiliate Marketing?

> Make sure your website is good: You should have a landing page with your affiliate link that converts.

> Make sure you have a good product to promote: If it does not convert, then it will be difficult for you to make money from it.

> Make sure your landing page is mobile friendly so people can see the offer clearly on their phones or tablets and click through to buy the product or service faster than ever before!

What Are Some Things That Will Happen After I Start Doing Affiliate Marketing?

-

You will make money.

-

You will have more time on your hands.

-

You will learn new skills and increase your knowledge base of the world in general.

How Can I Marry Together My Two Affiliate Marketing Niches?

You are probably thinking: “How can I marry together my two affiliate marketing niches?”

You can do this by making sure that you're promoting a product or service that is relevant to both niches. If you have an online business selling products for people who love animals, for instance, then make sure that your internet marketing campaigns are targeted at pet lovers who also love animals. This way, when they search for information on how to care for their pets online, they will see your ads and be interested in clicking through them.

What Keywords Should I Use For My Affiliate Marketing Sites?

There are a lot of people that think that keywords are the most important thing when it comes to affiliate marketing. While keywords are important, they’re not everything. You can have great content, but if your site doesn’t rank well in Google then you won’t get any traffic and the only way you can make money is if people buy your products or services through your affiliate links.

The best way to find out which keywords would work best for your site is by using a tool called SEMrush or Ahrefs (or another one) as these tools will show you exactly how much traffic each keyword gets and what websites rank for those terms. If there isn't much traffic going towards the keyword then chances are no one cares about it so don't waste time trying to rank there because there isn't any money in it anyways!

Another thing I like doing is finding out what questions people have asked before so I can create content around those topics which usually brings back more visitors than just writing articles about things nobody cares about anymore such as "What color shoes should I wear" (which nobody cares because we already know how).

How Long Does It Take To See Results From Affiliate Marketing?

You will never see results from your affiliate marketing efforts if you are not putting in the work. It takes a lot of time and effort to get results, so if you're not seeing any then it's likely that something needs to change.

If after 6 months of working hard at promoting products and services, you still don't have any sales or commissions then it might be time to move on and find something else that works better for you.

What Makes A Good Affiliate Website?

There are a number of different things that can make or break your affiliate website. The first and most obvious thing to consider is the design. A good design should be easy to use, look professional, and make a good first impression on visitors.

A good site layout is another important factor in creating an effective website that converts well. Remember that people are more likely to buy products if they find them quickly and easily — if your website doesn’t have this feature, then your conversion rates will suffer as a result.

The content of your site is also important because it helps you establish credibility in the eyes of potential customers by providing them with relevant information about the niche you sell in. If people don’t trust what they read on your page, then they may not feel comfortable buying from there either!

Is Wealthy Affiliate Legit Or A Scam?

Wealthy Affiliate is a legit company. They have been around for over 15 years, they have a great reputation and they are accredited by the BBB.

They also have an awesome support team that is always willing to help you out with any issues or problems that you may experience along the way.

They also have a great community of users who are always willing to help each other out as well.

How Can I Tell If An Email Is From Amazon Or Just Someone Trying To Commit Fraud?

There are a few key questions you can ask yourself whenever you get an email from Amazon:

-

Does this email address look like it's coming from Amazon? If there are some random letters after the "@" sign, then it may be another domain name altogether. For example, if you receive an email from "info@amazon.com" or "sales@amazon.com", then this is likely not coming from Amazon but rather someone who is trying to commit fraud.

-

Is there any wording that doesn't sound right for what we would expect an Amazon representative to say? For example, if they were asking for your credit card information or password, then this should send up some red flags immediately! If they were asking you to click on links in their emails or access confidential files on their website (which has never happened before), then those are also signs of fraud.

How Do Affiliate Links Work On Facebook?

Now that you have your affiliate links, you can use them to promote your products and services.

To add an affiliate link to Facebook:

-

Go to the page you want to post it on (or create one if you don't already have one).

-

Click on "Create Post" at the top left corner of the screen and select "Link." You should now see a box where you can enter a URL or embed a video from YouTube, Vimeo or another site. If you're adding a URL, make sure it has tracking parameters so that Analytics will pick up traffic from this link!

-

Click on "Use Link" at the bottom of this box; this will take us back into our text editor so we can start writing down what we want our audience members' eyes to see when they click through from Facebook onto our website or landing page (website).

If you follow some basic principles and apply them to your own affiliate marketing campaigns and learn from the successes of others, then you will be well on your way to getting the results that you want.

If you follow some basic principles and apply them to your own affiliate marketing campaigns, then you will be well on your way to getting the results that you want.

-

Be sure that the site has high quality content and a good reputation for providing value. If it does not, then there is no point in promoting it because people will not visit or trust what they find there.

-

Make sure that the product that you are promoting is one that provides value for people who are interested in buying it. You can only make money if someone buys something from your link, so do not waste time promoting products or services that do not provide any real value or solve a problem for the customer using them (or are even seen as harmful).

-

Make sure that the website where customers can buy these products has trust signals such as SSL certificates installed properly on their servers; otherwise customers may hesitate before making a purchase decision based on perceived risk factors like poor security controls being placed at risk due to lack of proper research into how reputable companies manage their e-commerce websites – especially when considering sensitive financial information such as credit card details being transmitted across insecure networks without encryption applied beforehand by using HTTPS protocol instead of HTTP protocol whenever possible; this would increase costs significantly but could save thousands (or even millions) over time by preventing breaches due to hacking attempts – especially since hackers tend not to target small businesses which have less resources available than larger corporations with teams dedicated specifically towards cybersecurity

Conclusion

I hope that this post has helped answer some of the questions you have about affiliate marketing and how it can help you achieve your goals. If there’s anything else you would like to know about this topic or if there are any other questions that I haven’t covered in this post, please leave them in the comments below so we can discuss them!

Tim Moseley

.jpg)

.png)

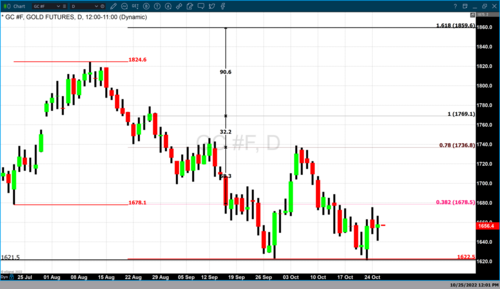

LBMA delegates see silver prices rallying 54% in the next 12 months

LBMA delegates see silver prices rallying 54% in the next 12 months