Solana.com Review: A Comprehensive Analysis of the High-Performance Blockchain Platform

Solana is a fast-growing blockchain platform that has gained significant attention in the crypto space. It was created by Anatoly Yakovenko and his team at Solana Labs. Solana is designed to handle a high volume of transactions with fast processing times, making it a promising contender for decentralized applications and smart contracts.

The Solana Foundation is responsible for the development and growth of the Solana ecosystem. The foundation's mission is to support the growth of decentralized applications and create a more decentralized internet. The Solana Foundation also oversees the Solana Grants program, which provides funding for developers to build on the Solana platform.

With its impressive speed and scalability, Solana has become a popular choice for developers and investors alike. However, like any other blockchain platform, it has its strengths and weaknesses. In this article, we will review Solana.com and provide an in-depth analysis of the platform's features, benefits, and challenges. We will also discuss the future of Solana and how it could impact the blockchain industry.

Understanding Solana

What is Solana

Solana is a blockchain network that is designed to host decentralized applications (dApps). It was created by Solana Labs, which is a team of developers focused on building scalable blockchain technology. Solana uses a unique consensus mechanism called Proof of History (PoH), which is based on a sha256 hash function, to process transactions quickly and at a low cost.

Solana Blockchain Technology

Solana's blockchain technology is designed to be fast, secure, and scalable. It uses a layered approach to processing transactions, which allows it to handle a high volume of transactions per second (TPS). Solana's architecture is also energy efficient, which makes it an environmentally friendly option for blockchain technology.

Solana's Unique Features

Solana has several unique features that set it apart from other blockchain networks. One of its most notable features is its high transaction speed, which can reach up to 65,000 TPS. Solana also has low transaction fees, which makes it a cost-effective option for developers and users.

Solana's scalability is another key feature that makes it an attractive option for building decentralized applications. It uses a proof-of-history consensus mechanism, which defines the next block with a timestamp. This allows Solana to process transactions quickly and efficiently, without sacrificing security.

Additionally, Solana supports smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. This allows developers to build complex decentralized applications on the Solana network.

Conclusion

Overall, Solana is a promising blockchain network that offers fast transaction speeds, low fees, and scalability. It has several unique features that make it an attractive option for developers and users alike. With the support of a growing ecosystem of tools and services, Solana is poised to become a major player in the world of decentralized applications.

The Solana Ecosystem

Solana is a high-performance blockchain that is designed to support decentralized applications and marketplaces. The ecosystem is growing rapidly, with many key players contributing to its development.

Key Players in Solana

The Solana Foundation is a non-profit organization that is responsible for the development and promotion of the Solana ecosystem. The foundation's mission is to support the growth of the network and to foster innovation in the blockchain space.

Solana Labs is the primary development team behind the Solana blockchain. The team is led by Anatoly Yakovenko, who is the founder of Solana. The team is focused on building the core technology that powers the network, including the Solana protocol and the Solana runtime.

Solana's Community and Support

The Solana community is an active and growing group of developers, validators, and enthusiasts who are passionate about the potential of the Solana ecosystem. The community is supported by a number of resources, including the Solana Discord channel, the Solana subreddit, and the Solana blog.

Validation is an important part of the Solana ecosystem, and there are many validators who help to secure the network and validate transactions. Validators are responsible for maintaining the integrity of the network, and they are rewarded with SOL tokens for their efforts.

Overall, the Solana ecosystem is a vibrant and exciting space that is attracting a lot of attention from developers and investors alike. With its high performance and growing community, Solana is well positioned to become a major player in the blockchain space.

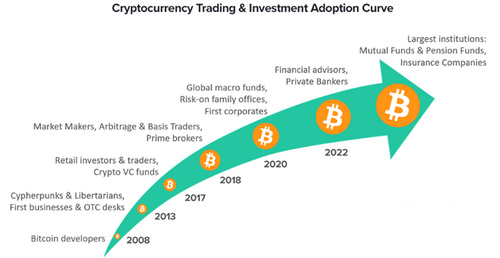

Investing in Solana

Solana is a popular cryptocurrency that has been gaining momentum in recent years. Investors looking to buy and stake Solana can do so through various exchanges and staking platforms. In this section, we will cover how to buy Solana and how to stake it for potential rewards.

How to Buy Solana

Investors looking to buy Solana can do so through various exchanges that offer the token. Some of the most popular exchanges that offer Solana include Binance, FTX, and Coinbase. Investors can purchase Solana using fiat currency or other cryptocurrencies such as Bitcoin or Ethereum.

Once an investor has purchased Solana, they can hold onto it or stake it for potential rewards. Staking Solana involves holding the token in a wallet and participating in the Solana network by validating transactions. In return, stakers can earn block rewards in the form of additional Solana tokens.

Staking in Solana

Staking Solana can be done through various platforms such as Solflare, Sollet, and Ledger. Investors can choose to stake their tokens through a centralized or decentralized platform, depending on their preference.

Staking in Solana requires a minimum amount of tokens to participate, which varies depending on the platform. Investors should also be aware of the potential risks involved in staking, such as slashing or losing their staked tokens.

In conclusion, investing in Solana can be a potentially lucrative opportunity for investors looking to capitalize on the growth of the cryptocurrency market. By buying and staking Solana, investors can potentially earn rewards and contribute to the Solana network. However, investors should be aware of the risks involved and do their due diligence before investing any capital.

Comparison with Other Blockchains

Solana vs Ethereum

When compared to Ethereum, Solana is a relatively new blockchain that has been gaining traction in the crypto world. While Ethereum is still the more popular cryptocurrency with a market cap of around $210 billion, Solana has been growing rapidly and is currently valued at around $45 billion.

One of the key advantages of Solana over Ethereum is its speed. Solana can reportedly process up to 65,000 transactions per second, while Ethereum can only handle around 15 transactions per second. Solana's high transaction speed is due to its unique consensus mechanism, which is based on Proof of History (PoH) and Proof of Stake (PoS).

However, Ethereum is more established and has a larger developer community, which means that it has a wider range of applications and use cases. Ethereum also has a more diverse ecosystem of decentralized applications (dApps) and tokens, which makes it more attractive to investors and traders.

Solana vs Bitcoin

Solana and Bitcoin are two very different blockchains that serve different purposes. Bitcoin is primarily a store of value and a means of payment, while Solana is designed to be a fast, scalable, and decentralized platform for building dApps.

Bitcoin is also much more decentralized than Solana, as it relies on a large network of nodes and miners to validate transactions. Solana, on the other hand, uses a more centralized approach to consensus, which some critics argue makes it less secure and vulnerable to attacks.

However, Solana's speed and scalability make it a more attractive option for developers who want to build high-performance dApps that can handle large volumes of transactions.

Solana vs Cardano

Solana and Cardano are both third-generation blockchains that aim to address the scalability and security issues of earlier blockchains like Bitcoin and Ethereum.

Cardano uses a unique consensus mechanism called Ouroboros, which is based on Proof of Stake (PoS) and is designed to be more energy-efficient and secure than other PoS blockchains. Solana, on the other hand, uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve high transaction speeds and scalability.

While Cardano is more established and has a larger market cap than Solana, Solana's speed and scalability make it a more attractive option for developers who want to build high-performance dApps.

Solana vs Polkadot

Polkadot is another third-generation blockchain that aims to address the scalability and interoperability issues of earlier blockchains. Like Solana, Polkadot uses a combination of Proof of Stake (PoS) and sharding to achieve high transaction speeds and scalability.

However, Polkadot is more focused on interoperability, which means that it is designed to enable different blockchains to communicate and interact with each other. Solana, on the other hand, is more focused on speed and scalability, which makes it a better option for developers who want to build high-performance dApps.

Overall, Solana is a promising blockchain that has the potential to compete with other established blockchains like Ethereum and Cardano. Its unique consensus mechanism and high transaction speeds make it an attractive option for developers who want to build fast, scalable, and decentralized applications. However, it still has a long way to go before it can become a mainstream blockchain that is widely adopted by users and developers alike.

Security and Sustainability of Solana

Solana is a high-performance blockchain that provides fast transaction processing and low fees. It is designed to be secure and sustainable, with several measures in place to ensure the safety of its users and the environment.

Security Measures

Solana uses a unique consensus algorithm called Proof of History (PoH) that combines the best features of Proof of Stake (PoS) and SHA256. This algorithm ensures that the network is secure and resistant to attacks, while also being energy efficient.

Validators play a crucial role in maintaining the security of the network. They are responsible for verifying transactions and adding them to the blockchain. Solana has a large and growing network of validators, which ensures that the network is decentralized and resilient.

Additionally, Solana has undergone several security audits to ensure that the code is secure and free from vulnerabilities. The most recent audit was conducted in 2019 and found no major issues.

Environmental Impact

Solana is committed to reducing its environmental impact and has taken several steps to achieve this goal. According to a sustainability rating by GreenCryptoResearch, Solana is one of the most sustainable cryptocurrencies at present, receiving the highest grade A in the GCR Sustainability Rating.

The Solana Foundation has also released a report on its energy usage, which shows that a transaction on Solana takes less energy than two Google searches, and 24 times less energy than charging your phone. This is due to the energy-efficient PoH consensus algorithm and the use of validators instead of miners.

In addition, Solana has plans to transition to a fully renewable energy model in the future. The network is already carbon neutral through the purchase of carbon offsets, and the Solana Foundation is working to develop renewable energy sources to power the network.

Overall, Solana is a secure and sustainable blockchain that is committed to reducing its environmental impact. Its unique consensus algorithm and large network of validators ensure that the network is secure and decentralized, while its commitment to renewable energy and carbon neutrality demonstrates its dedication to sustainability.

Future of Solana

Solana has been making waves in the cryptocurrency world, and many investors are curious about the future of this blockchain platform. While it is impossible to predict the future with certainty, there are some upcoming developments and potential challenges that may impact Solana's future.

Upcoming Developments

One of the most significant upcoming developments for Solana is the upcoming launch of Wormhole, a cross-chain bridge that will allow Solana to connect with other blockchain networks. This will increase the interoperability of Solana and make it easier for developers to build decentralized applications that can interact with other networks.

Another development to watch is the adoption of Solana by more mainstream companies. Solana has already seen some adoption by companies such as FTX and Serum, but more adoption could lead to increased innovation and funding rounds for the platform.

Potential Challenges

One potential challenge for Solana is the competition from other blockchain platforms. While Solana has unique features such as its high speed and low transaction fees, other platforms such as Ethereum and Binance Smart Chain are also popular among developers and investors.

Another potential challenge is the impact of 5G technology on the blockchain industry. While 5G could lead to increased adoption of blockchain technology, it could also lead to increased competition from centralized platforms that offer similar features.

Finally, Solana's reliance on Twitter for communication could be a potential weakness. While Twitter has been a useful tool for Solana to communicate with its community, it is also vulnerable to censorship and other issues that could impact Solana's reputation and adoption.

Overall, the future of Solana is uncertain, but there are several upcoming developments and potential challenges that could impact the platform. Investors and developers should keep a close eye on these factors as they consider the potential of Solana as a long-term investment.

Conclusion

In conclusion, Solana is a decentralized, high-performance blockchain network that has been gaining popularity in recent times. It is known for its scalability, energy efficiency, and fast transaction processing speed of up to 65,000 transactions per second. Its innovative Proof of History consensus mechanism and single chain protocol make it a unique player in the blockchain space.

The Solana network is designed to be scalable, which means it can handle a large number of transactions without slowing down or compromising on security. This makes it an attractive option for developers and businesses looking to build decentralized applications that require high throughput and low latency.

The Solana protocol is also highly decentralized, which means that no single entity controls the network. This ensures that the network is secure, transparent, and resistant to censorship. The Sol token is used for validation and governance on the network, and it is an essential component of the Solana ecosystem.

Overall, Solana is an exciting technology that has the potential to revolutionize the way we think about blockchain and cryptocurrency. Its focus on performance, scalability, and decentralization make it an attractive option for developers and businesses looking to build innovative applications that require fast and secure transactions. As the blockchain space continues to evolve, it will be interesting to see how Solana continues to innovate and grow.

Frequently Asked Questions

Is Solana.com a reputable platform?

Solana.com is a reputable platform that has been operating since 2017. It is known for its high-performance blockchain with a focus on decentralization and security. The platform has received positive reviews from users on Trustpilot, with many praising its user-friendly interface and fast transaction speeds.

How does Solana.com compare to other cryptocurrency exchanges?

Compared to other cryptocurrency exchanges, Solana.com stands out for its fast transaction speeds and low fees. It uses proof-of-history consensus to define the next block with a timestamp, making it a scalable and efficient blockchain. Additionally, Solana.com offers an NFT marketplace called Solanart, which is fast and has low fees.

What are the fees for using Solana.com?

Solana.com has low fees, with users paying less than $0.025 per transaction. Additionally, users can stake Solana (SOL) for rewards.

Can I trust Solana.com with my personal information?

Solana.com takes security seriously and uses multiple layers of protection to keep user information safe. However, as with any online platform, there is always a risk of hacking or data breaches. It is recommended that users take precautions such as using strong passwords and enabling two-factor authentication.

What is the user experience like on Solana.com?

Users generally have a positive experience on Solana.com, with many praising its user-friendly interface and fast transaction speeds. However, some users have reported issues with the platform's network getting slow during high traffic periods.

Are there any security concerns with using Solana.com?

While Solana.com takes security seriously and uses multiple layers of protection, there is always a risk of hacking or data breaches. Additionally, some users have reported issues with the platform's network getting slow during high traffic periods. It is recommended that users take precautions such as using strong passwords and enabling two-factor authentication.

Tim Moseley

Gold price is stuck in neutral, but that is its strength now

Gold price is stuck in neutral, but that is its strength now

The green hydrogen economy is real, but it might not define platinum's role in the global green energy transition

The green hydrogen economy is real, but it might not define platinum's role in the global green energy transition

.png)

.jpg) analysis.

analysis.

.jpg)