What Have The Bureaucrats Planned To Save Banks In The Next Financial Crisis?

The government bailed them out…Now you will bail them in

Financial freedom is often misunderstood as meaning that you have lots of money. In actuality, financial freedom means that you own your assets, and you decide how, where, and when they are spent. Another misconception is that your money in the bank belongs to you, but in truth, the banks own your money and can use it to bail them out during the next economic crisis.

The first time I heard the term “bailout” was in 2008 when the global economy was hit hard by a financial catastrophe caused by the bursting of the housing bubble. More accurately, big banks invested in bundles of bad mortgages, which crashed in value when the housing bubble burst. Initially, the big banks thought everything was fine. That was until the collapse of Lehman Brothers in September 2008.

The Lehman Brothers institution was well-respected and the fourth-largest investment bank in the United States. As such, the news of its bankruptcy sent Wall Street into a frenzy that eventually threatened the entire financial system. Ultimately, the US government had to step in to bail out Wall Street.

According to CNN, the US Treasury gave over $200 billion in loans to hundreds of financial institutions. This is less than a third of the total cost of bailing out the entire financial system, estimated to be $700 billion. Meanwhile, the regular people affected by the economic collapse got essentially nothing. Everyone knew that Wall Street speculation was to blame, but only one person went to jail; Kareem Serageldin, a former executive at Credit Suisse; however, all the other big bank executives were given bonuses.

The Securities and Exchange Commission (SEC) was supposed to investigate just how much the big banks were to blame for the 2008 GFC. However, the SEC allegedly destroyed the evidence it had been given as part of the investigation instead of exploring.

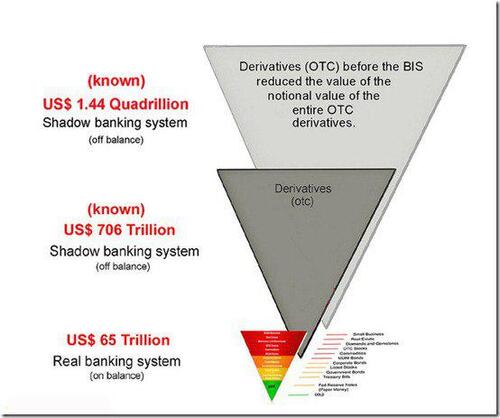

Image source: Satoshi Nakamoto Institute

Not surprisingly, the average person was not happy about how the GFC of 2008 was managed, even manipulated. And as many will know, the bank bailouts are why Satoshi Nakamoto created Bitcoin, which surfaced in 2008. However, the politicians had a different solution: passing a long list of new regulations.

One of these was the Dodd-Frank Act in the United States, passed in July 2010 and infamous for being long and vaguely worded. It contains some questionable provisions, with the Act's primary focus being the enormous derivatives market.

For those unfamiliar, a derivative is an investment that derives its value from some underlying asset. One example is Futures; when you buy a Futures Contract, you're effectively betting that the price of some asset will be higher or lower at a future date without actually buying the asset itself.

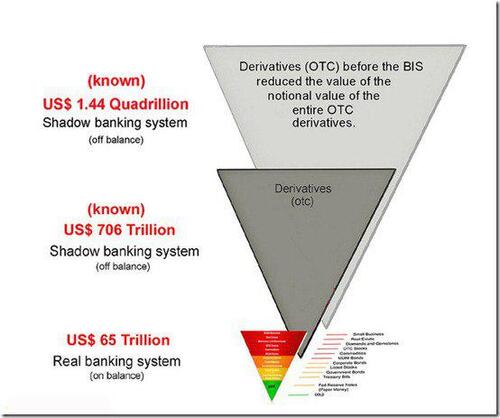

The total value of the derivative market is estimated to be as high as $1 quadrillion, or $1,000 trillion. The actual value is unknown because of poor accounting, but what is known is the 25 largest banks hold roughly $250 trillion of derivatives.

Image source: goldbroker.com

There’s no doubt that this is a substantial financial risk. That's why the Dodd-Frank Act included a provision that states that in the event of an economic collapse, derivatives claims come first. In other words, if 2008 happens again, derivatives debt owed by big banks will be paid off before anything else. The difference is that bailouts won't pay off these debts; they’ll be paid off by bail-ins.

Bailouts, Bail-ins; What’s the difference?

Whereas a bailout is when a big bank receives money from the government or institution to pay back its debts, a bail-in is when it uses its clients' money to pay back its debts. This includes people who lent money to the bank and people who have money in accounts with the bank, such as you and me.

The Dodd-Frank Act opened the door to allowing big banks to use their client funds to bail themselves ‘in’ the next time there is a financial crisis. It's assumed that an issue in the derivatives market will cause the next financial crisis. And derivatives debt will, again, take precedence in the payouts.

So, who came up with this crazy idea? Two now-former key executives at Credit Suisse, Paul Calello and Wilson Ervin coined the term bail-in in an article for The Economist in January 2010. Paul died a few months later, reportedly from cancer; however, in a presentation about bail-ins, Wilson revealed that the people in power had been working on alternatives to bailouts since 2008. He explained that the desire to develop an alternative to bailouts increased after the financial crisis started to affect Europe.

In mid-2012, the International Monetary Fund (IMF) published a paper advocating bail-ins as the ideal alternative to bailouts. All the IMF needed was somewhere to test this new bail-in method.

Enter Cyprus

Cyprus was one of the European countries that were hit the hardest when the 2008 contagion spread. By the end of 2012, Cyprus was on the brink of default and begging for a bailout. In early 2013, the IMF and the European Union bailed Cyprus out for €10 billion. As with all IMF loans, the bailout came with multiple conditions.

One of the conditions was for Cypress's largest bank to execute the first-ever bail-in. Almost 50% of all bank account balances worth more than €100,000 were seized. Cyprus was also required to take 6.9% of all bank balances lower than €100 thousand and 9.9% of all bank balances higher than €100,000, regardless of the bank.

Despite the social chaos and capital controls that ensued, the IMF and its allies declared the first-ever bank bail-in a success. In 2014, the G20 countries agreed to pass bail-in laws per the Financial Stability Board’s (FSB) bail-in guidelines. The FSB's policies include issuing bail-in bonds, which should be sold to pension funds. This means your pension money could also be used to bail out banks.

The United States was the first to legalize bail-ins in 2010, with the Dodd-Frank Act mentioned above. The UK followed suit in 2013 with the Financial Services Act, and the EU legalized bail-ins in 2016 with the Bank Recovery and Resolution Directive. In my country, Australia, the Australian government's new bank bail-in laws were sneakily pushed through parliament in February 2018 with only seven senators present. So be sure to check when your country legalized bail-ins.

The specifics of bank bail-in laws vary from country to country; however, all these laws follow the same three rules, likely because of their collective conformity with the FSB.

The First Rule

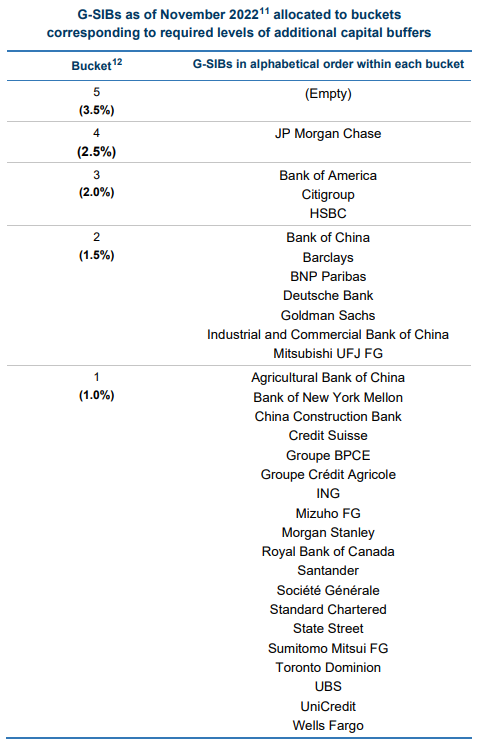

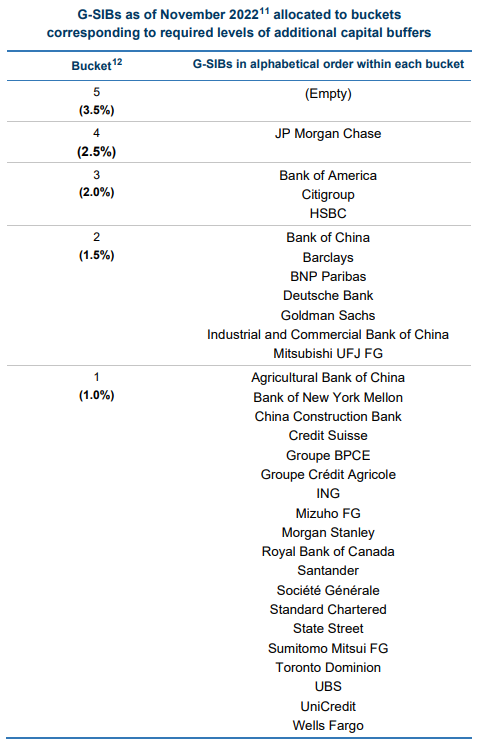

The first rule is that bank bail-ins are only allowed for banks that are deemed to be domestically or globally important. It could be more precise which banks fall into the domestically important category, but it's safe to assume that this rule pertains to those with the most assets under management.

As for globally essential banks, the FSB publishes a list of them yearly, along with their de facto risk of default due to derivatives debt. There are currently 30 globally systemically important banks, with JPMorgan being noted as the highest risk. JPMorgan reportedly has $60 to $70 trillion of derivatives debt.

Image source: FSB.org

What happens when a non-systemically important bank goes under? The answer is that they are acquired by a domestically or globally important bank.

The Second Rule

The second rule of bank bail-ins is that they do not apply to bank balances below the deposit insurance threshold. In the US, the FDIC covers $250 thousand in deposits. In the UK, the FSCS covers £85,000; in the EU, it's €100,000 with various insurers involved. If you think this means your money is safe, think again.

As pointed out by The Huffington Post, “deposit insurance funds in both the US and Europe are woefully underfunded, particularly when derivative claims are factored in." In short, insurers don't have enough money to cover all bank deposits.

In the case of the FDIC, its 2021 annual report suggests that it only has around $120 billion in its Insurance Fund. This is chicken feed compared to the $19 trillion of bank deposits in the US and a drop in the ocean of the derivatives market, which could be in the $quadrillions.

The Third Rule

However, a third rule of bank bail-ins states that you will be given some alternative asset in exchange for your lost deposits. Believe it or not, these alternative assets are typically shares in the bank you bailed out. I don’t think I would favor the bank taking my money and replacing it with its worthless stock in return.

To compound matters, if governments passed laws to make Central Bank Digital Currencies (CBDCs) legal tender, you could be paid back in CBDC instead of cash. Incidentally, bank bail-ins would be the perfect way to force people to adopt CBDCs; perhaps that's the plan.

Speculation aside, it's important to note that we could temporarily lose access to our funds during a bank bail-in. As we've seen with Cypress, banks could put limits on their hours of operations, limits on payments, transfers, and limitations on cash withdrawals until the bail-in process is complete. Can you imagine the social turmoil it would trigger if banks worldwide simultaneously imposed these bail-in restrictions on their depositors?

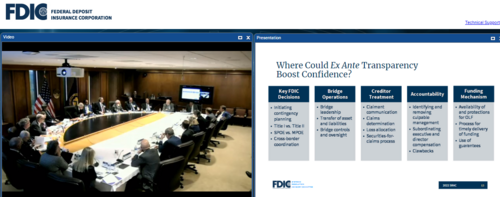

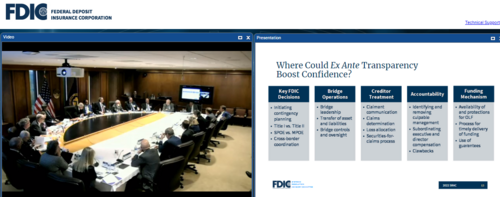

Image source: Federal Deposit Insurance Corp.

Bail-In Simulation Phase

The ‘powers that be’ are hyper-aware of the looming unrest of ‘we the people’ because they've been coordinating bank bail-in simulations for years. The FDIC held the most recent high-profile bank simulation in November 2022. Several panelists from prominent financial institutions and regulators participated in the session, including Wilson Ervin, Chief Architect of the bank bail-in process.

It was a tedious, lengthy discourse containing much financial jargon; the most exciting stuff began around the 1-hour mark, and snippets from this section went viral. At around 1:18 minutes into the video, one of the panelists speculates how the FDIC and its secret allies should maintain the public's confidence in the financial system when the bail-ins inevitably happen. She argues that transparency is the answer but that some entities should get more transparency than others.

This panelist also commented on ensuring the public understands that “prior compensation could be clawed back.” That sounds very much like the banks can take your money long after the bail-in process has been completed. She even asked the other panelists how they could “address excess cash use in such a crisis.”

This suggests governments are planning on introducing a CBDC using bank bail-ins. Then again, it could reference the freeze on cash withdrawals mentioned above. The panelists also said they should “make the announcement on a Friday, ideally a Friday night.” For context, Fridays are famous for being one of the days when nobody pays attention to the news. Hence why bad news often comes out on Fridays.

The second panelist agreed with the first about being selective with transparency about the bail-in and specified that they should tell the banks and big investors first. He said they shouldn't tell the public until later because they would panic. The third panelist agreed with the second and said something sinister, akin to the public having more faith in the banking system than we do, let's keep it that way. The other panelists laughed.

He continued to repeat that only institutional investors should know what's going on, and they should “be careful with what we tell the public.” But wait, there's more; a fourth panelist then said something even more sinister. The timestamp is around 1:27 minutes. She literally says, “the information should go out once we're moving out of the recession.”

This fourth panelist explained that non-bank entities, including cryptocurrency exchanges, should be included in the bail-in process. This statement could mean that she wants them to be subject to acquisition by big banks or that she wants to use the crypto you hold on exchanges to bail them in.

A little later, Wilson said they must ensure that disinformation about bank bail-ins doesn't get out before the fact-check-approved version of events. He even suggested that this online censorship should happen in advance so that people don't talk about their money being taken. Governments worldwide are rolling out precisely these kinds of online censorship laws, most of which will be going into force later this year or next year, as documented in this article.

If you’re interested, the video of the entire simulation can be found on the FDIC website, but they haven't made it easy to find. Click on Archive, as shown in the image below, and scroll down to the video dated 2022-11-09, Systemic Resolution Advisory Committee.

Image sourced at: https://fdic.windrosemedia.com/

What Can We Do To Protect Our Money?

So the big question is what we can do to protect our money from being taken by the big banks when the next financial crisis hits us. You can do many things, and they all fall under one umbrella: keep your money out of globally and domestically important banks. Check the details of bank bail-in laws in your country or region first.

The first hedge against bank bail-ins is to move your money to smaller banks that are not globally or domestically important and have minimal exposure. Or even diversify savings across banks and in different countries. Monitor banks’ and institutions’ financial stability and avoid banks with large derivative and mortgage books.

Financial institutions should be chosen based on the strength of the institution. Jurisdictions should be selected based on political and economic stability. Culture and tradition of respecting private property and property rights are also significant.

The second hedge is to keep enough cash on hand to pay for at least a few months of expenses, depending on your personal circumstances, although this may be challenging or even possible. However, remember that fiat currencies are losing value by the day due to inflation and will continue to do.

The third hedge against bank bail-ins is to have physical gold in allocated accounts with outright legal ownership. Have some physical gold and silver in denominations that could be used for payment if necessary. If you are in the United States, gold and silver eagles are technically legal; however, there’s a catch. Their face value is much lower than their actual value. You can thank the government for that.

The fourth hedge against bank bail-ins, and one which is increasingly becoming more popular, is to hold cryptocurrency. To be clear, this means decentralized cryptocurrencies, not centralized ones like stablecoins. Ideally, these cryptos will be kept in your own personal crypto wallet.

In Closing

If the deliberations at the FDIC simulation are anything to go by, the people in power will start doing bank bail-ins after the next recession. It’s all speculation about when the next recession will be official. Still, it doesn't seem to matter because they don't plan on telling us that our money has been used to bail in the bank until all the institutional investors have gotten out.

At least we know the announcement will be made on a Friday when nobody's paying attention, as per the FDIC panelist. The unpredictable factor is what happens after the bank bail-ins are announced. Again, the social unrest will be unprecedented. This could create another crisis that the people in power could use as an excuse to exercise even more control and bear in mind the possibility of CBDC-based insurance payouts.

The silver lining to this situation is that people are becoming increasingly aware of what's happening and what the elites are planning. With all this upheaval society worldwide is experiencing, many are preparing to protect themselves and participating in parallel communities and economies to counter bureaucrats and their inept, self-serving policies.

By the Grace of God, we will prevail while the powers that be fall on their swords. Our increasing knowledge made available to us via decentralized media gives us the wisdom to remain calm and optimistic that the ignorant and arrogant decision-makers are very close to their complete demise in this time of tribulation. May God bless us all.

This information is provided for informational purposes only. Nothing herein shall be construed as financial, legal, or tax advice.

(21).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

(21).gif)

Frank Giustra warns that the dollar will be dethroned in 'bifurcated' global monetary system, CBDCs and AI could usher in a 'terrifying' world with mass joblessness and digital 'control'

Frank Giustra warns that the dollar will be dethroned in 'bifurcated' global monetary system, CBDCs and AI could usher in a 'terrifying' world with mass joblessness and digital 'control'

Gold price is going to $2,200 as central banks break the global economy – Degussa's Thorsten Polleit

Gold price is going to $2,200 as central banks break the global economy – Degussa's Thorsten Polleit