Gold Versus Savings Accounts: How To Safeguard From Inflation

Key takeaways:

Gold can protect investors from the devaluating effects of inflation

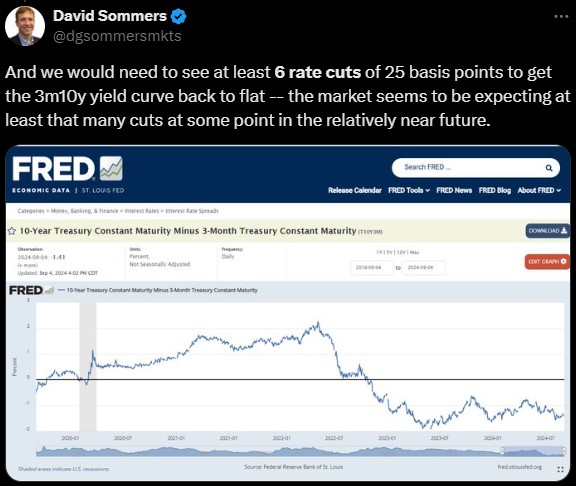

Savings accounts deliver returns only if interest rates are higher than inflation

Digital gold can offer the best of both worlds: underlying appreciation plus yield

Choosing the right investment

When choosing how to invest money, an investor may want to consider several factors including: purpose, individual goals, age, expected period of investment, attitude to risk, personal beliefs, and whether urgent access to capital may be required.

Investors who are within the middle-aged bracket may have already built significant wealth and be looking for ways to balance the risks associated with holding wealth in assets other than property or a pension. For example, those investing in higher-risk assets such as equities may want to balance or hedge those risks by holding some of their capital in safer investments such as cash, bonds, precious metals or other assets.

But even within the category of safe investments, different attributes may affect an investor’s choice.

Two obvious safe investment options are holding cash in a savings account and investing in gold, as neither of these approaches to storing value are at risk of catastrophic losses that can and do occur in higher-risk investment assets such as stock markets.

Investing in gold

There are several ways to invest in gold. Perhaps the most obvious is purchasing physical metal such as bullion-grade coins or bars and storing them in a safe location, be it domestic or via a third party. But investors can also gain exposure to gold through other forms of investment, such as exchange-traded funds (ETFs) or buying shares in gold mining companies, either directly or as part of a managed fund, for example.

Physical gold has been recognised as a store of value for thousands of years across multiple continents, and this is due to several of gold’s fundamental attributes:

Scarcity: total global above-ground supply of gold is estimated at around 212,000 tonnes, according to the World Gold Council’s report which can be found here. Gold’s available supply cannot easily be increased and unlike currency, governments cannot print more of it

Resilience: gold is near indestructible, with natural resistance to oxidation and corrosion

Beauty: gold’s unfading warmth and lustre has made it highly sought after for thousands of years as a store of wealth

Portability: gold’s high value-to-volume ratio makes it an extremely efficient and portable store of value

Flexibility: gold’s malleability and ductility, combined with its rarity, have made it ideal as a metal for jewellery, making it a symbol of wealth and status

This unique combination of attributes has made gold a reliable store of value for thousands of years, meaning the yellow metal has transcended cultural and linguistic barriers, becoming recognised as money in almost all countries.

For these reasons, gold is relevant to investors seeking to diversify their investments and to build in stability as a cornerstone of their portfolio.

What are investment savings accounts?

Investment savings accounts are accounts that allow cash to be held, earning interest over time. This can include high-yield savings accounts, which earn a higher level of interest than standard savings accounts, or money market accounts, which can offer a combination of features normally associated with savings and checking accounts.

Investment savings accounts typically provide a rate of return that is similar to or linked to the underlying base rate set by a central bank. In recent years in the UK, banks have offered rates of 0.5% to around 4% for standard savings accounts, with the higher end of the range often linked to a fixed period of investment in which the saver agrees not to withdraw funds, or may only make limited withdrawals. Individual Savings Accounts (ISAs) offer a similar product while exempting the holder from paying tax on the earnings, up to an annual deposit limit of £20,000 per person.

These accounts are therefore appropriate for experienced investors seeking low-risk, steady returns.

Comparing gold and investment savings accounts

Throughout history, gold has been very effective at holding its value, and the nominal price of gold has tended to rise as governments debase their fiat currencies by increasing the total money supply. This means that as the value of currency slowly erodes, gold maintains its purchasing power.

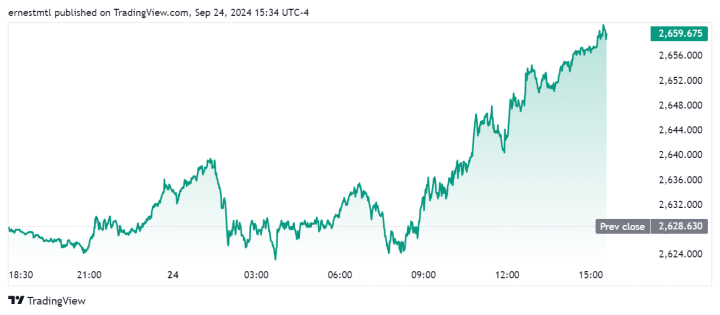

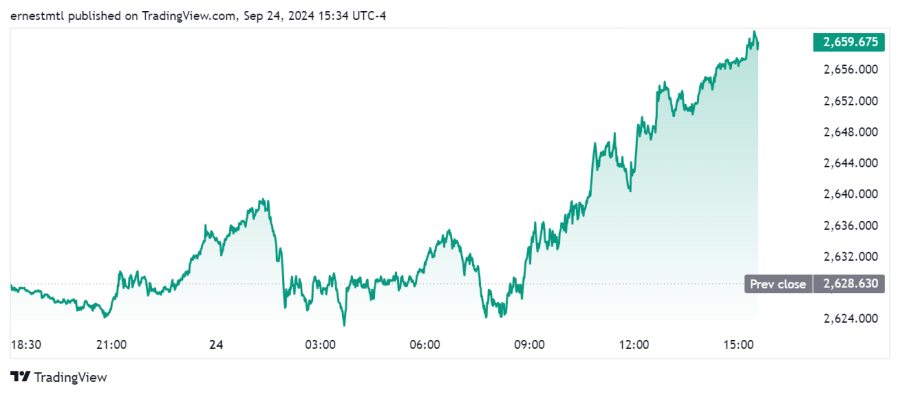

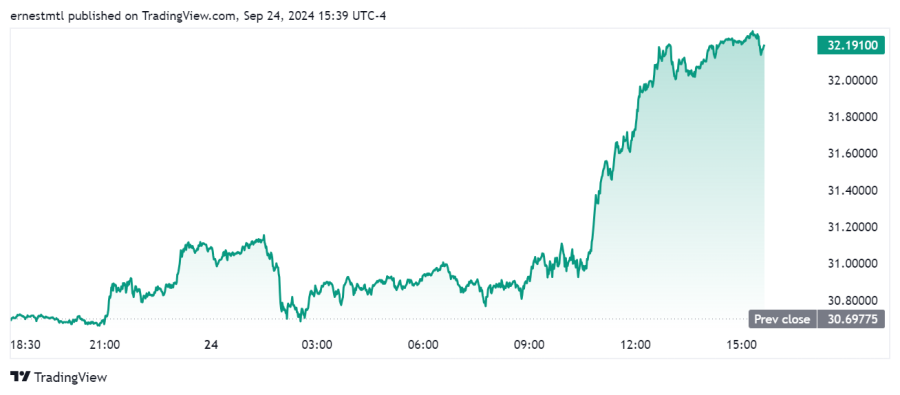

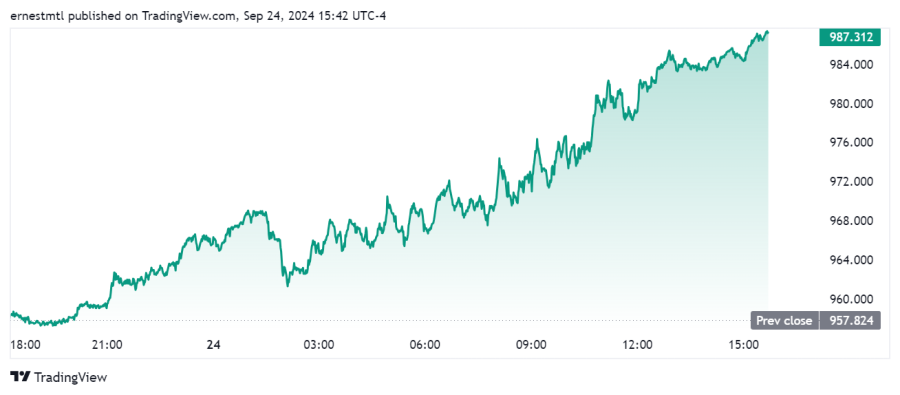

Gold traded in a range of approximately $600 to $800 an ounce in 2007. However, as governments deployed quantitative easing after the Global Financial Crisis of 2008- effectively creating money to deflate debt- gold prices began to rise, eventually reaching over $2,500 an ounce by August 2024. That’s not to say gold’s trajectory was one way: the yellow metal fell from around $1,800 an ounce in 2011 to below $1,100 an ounce in 2015. However, the long-term trend for gold has been positive as inflation continues to erode the purchasing power of currencies.

Savings accounts, on the other hand, may not offer the same spectacular returns that gold has managed in some years, but they do provide a steady and reliable return that may suit an investor wanting predictability, a low-risk profile and instant access to their cash.

However, new systems have emerged which offer the best of both worlds: the reliable store of wealth offered by physical ownership of precious metals and the returns for holding them in a platform account. Kinesis is an online gold trading platform which offers precious metals trading and a yield on gold and silver held in an investor’s platform account. Find out how investors can access the appreciating value of precious metals and a yield on physical gold and silver here.

Future growth

Gold certainly has the potential to reach new highs in the future. Factors affecting gold’s future performance include scarcity, central bank demand, investor demand, central bank interest rates, economic conditions, stock market performance and declining faith in fiat currencies. With growth in emerging markets and an expanding world population, there is likely to be more money chasing a finite supply of gold – a factor that certainly could propel the yellow metal to as-yet-unseen highs.

Investors can access physical gold fairly easily through a specialist dealer, requiring little more than personal details and proof of identification, while access to ETFs would normally require the opening of an account with an exchange and/or a broker, and payment of fees, depending on the provider.

Digital gold

‘Digital gold’ trading, or ‘gold-backed digital currency’ options are also available, offering a simple and cost-effective way to own physical gold through an online account that includes the physical storage of an equivalent volume of gold in safe, insured and audited vaults.

Savings accounts are arguably easier to open and manage, although some accounts may include certain restrictions on how much capital can be withdrawn in a given year, or how frequently.

Gold can offer protection against inflation, as its value tends to rise as currencies become weaker. Savings accounts can also offer an effective hedge against inflation, but this is only true if the interest rate on the account is greater than the underlying rate of inflation. Inflation can therefore undermine the claims that a savings account provides a return. Once the inflation-adjusted returns are calculated, a cash account may even return a loss in terms of purchasing power.

More details on inflation-adjusted returns can be found here.

Historical Performance

Over the last 10 years, $20,000 in cash held in a savings account at an interest rate of 4% per year would have grown to $29,605, excluding any tax on those returns, and assuming the rate of interest hadn’t changed during the period. In reality, at some points during this period, savings accounts offering 4% would have been hard to find, but the value reflects products on offer at the time of publication.

Ten years ago (mid-August 2014), spot gold prices traded at around $1,310 an ounce. At the time, that same $20,000 would have purchased 15.27 troy ounces of gold. At today’s price of over $2,400 an ounce, that stack of gold would be worth $36,641 – an investment that returned $7,036 more than the same sum held in the cash account. That equates to an annual return of about 6.25% for gold, compared with the cash account at 4% per year.

This example does not prove that gold will always outperform cash, and past performance does not guarantee future returns. But it does demonstrate gold’s ability to maintain its purchasing power in the face of inflation and currency devaluation.

Pros And Cons

To summarise, let’s look at the pros and cons of each type of investment.

Gold’s benefits include its inherent scarcity: governments cannot increase the supply at the stroke of a pen. Gold can also protect an investor from the corrosive effects of inflation, which slowly eat away at the purchasing power of cash.

On the other hand, physical gold does not earn any interest or ‘yield’. Moreover, gold prices can fall in certain situations, particularly during times of high interest rates, which increase the opportunity cost of holding non-yield-bearing assets. Gold prices can also fall during times of stock market strength when equities may provide a more attractive return than physical assets. If stored at home, physical gold can also represent a security risk, while secure storage and insurance offered by a third party carry a cost.

Savings accounts meanwhile, provide a steady and reliable return on investment, and while this may be lower than the returns available from other assets, holding cash is a very low-risk way to build wealth. Setting up a savings account is also a very straightforward process, and easy access to cash is a further advantage.

On the downside, savings accounts can leave the investor exposed to central bank interest rate decisions, which tend to influence the rates offered by savings account providers. At the same time, savings accounts don’t add to the purchasing power of the sum held unless the interest rate on offer is higher than underlying inflation, which can make savings accounts less rewarding than they might appear at face value.

Frank’s experience covering the commodities markets spans 22 years, with a particular specialism in metals, carbon and energy markets. He has worked as a senior editor for S&P Global Commodity Insights (formerly Platts) and before this, at ICIS-LOR, a part of Reed Business Information (Reed Elsevier), where he covered the petrochemicals markets from 2003 to 2005.

Time to Buy Gold and Silver

Tim Moseley

.png)