How To Add Hivecoin To Three Non-Custodial Software Wallets

Understanding the Role of a Crypto Software Wallet

A software or digital wallet is a powerful tool that simplifies and empowers your cryptocurrency experience. It's a handy app or site that securely stores your cryptocurrency keys, always at your fingertips, ready to be accessed anytime, anywhere with an internet connection.

This convenience puts you in the driver's seat of your digital assets, allowing you to manage them with ease and confidence. Importantly, non-custodial means you have complete control over your keys and funds, unlike custodial wallets, where a third party holds your keys.

Software wallets play a vital role in your cryptocurrency journey. They don't store your crypto; your coins are stored on the blockchain. Instead, they provide you with access to your passkeys, enabling you to transact with your digital currencies. This accessibility allows you to buy, sell, trade, or transfer crypto from your computer or mobile device without needing a physical device. Moreover, these software wallets are fortified with robust security measures, providing protection surpassing centralized exchanges.

Today, we’ll explore three non-custodial software wallets that allow you to list and transact with Hivecoin. Hivecoin is a crypto asset that is part of the Markethive community. It is instrumental in creating transactional activity within the community as we prepare to list Hivecoin (HVC) on crypto exchanges, where it will be available for free market trading.

Upon setup, each wallet prompts you to save a secret recovery phrase, a unique combination of 12 words. This phrase, best stored on paper and kept secure, not on your computer, serves as your key to access your wallet from any device. This feature ensures that even if you lose your mobile phone or access to your computer, your digital assets remain secure.

Solflare Wallet

The Solflare wallet is a comprehensive crypto wallet offering various features. It allows you to send, receive, and securely store tokens on the Solana blockchain. It also grants access to decentralized applications (dApps) on Solana, including decentralized finance (DeFi) platforms, decentralized exchanges (DEXs), and decentralized social media platforms. (DeSo) Additionally, Solflare offers a swap function that allows you to swap between tokens within your wallet.

Key Features

- Send, receive, and store tokens on the Solana blockchain

- Access to decentralized applications (dApps) on Solana

- Support for staking Solana to a validator of your choice

- Swap function for swapping between tokens within the wallet

- Compatible with hardware wallets like Ledger

- Available as a desktop and mobile browser app, as well as a mobile app on the App Store and Google Play

- User-friendly interface with easy onboarding and advanced features for experienced users

Key Benefits

- Secure and robust crypto wallet for Solana users

- Easy to use, with a user-friendly interface and advanced features for experienced users

- Supports multiple platforms, including desktop and mobile devices

- Compatible with hardware wallets like Ledger for added security

- Offers a swap function for swapping between tokens within the wallet

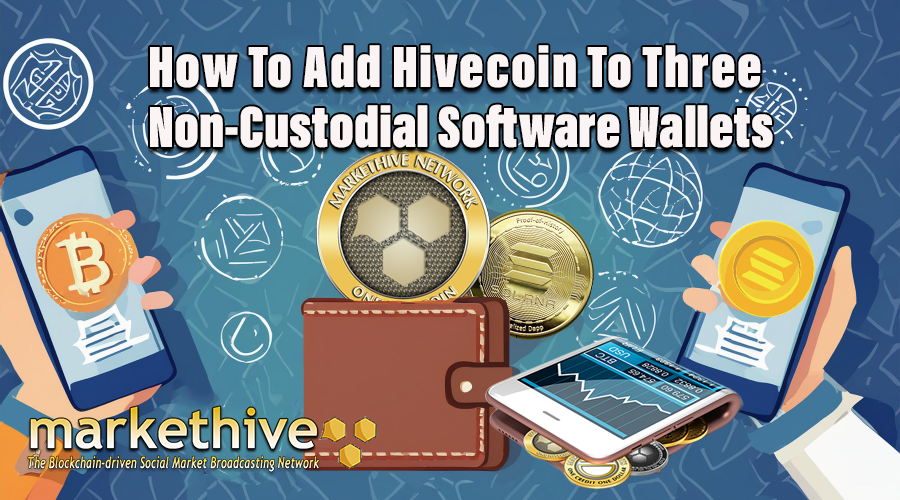

How to Add the Hivecoin Token to the Solflare Wallet

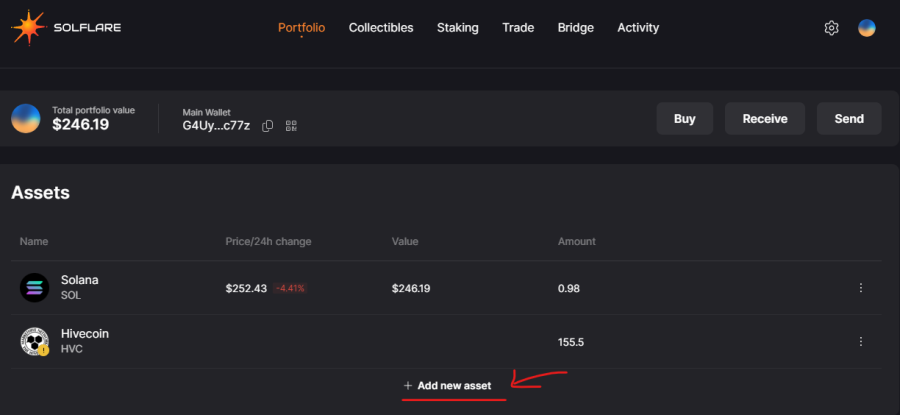

Once you’ve downloaded the Solflare wallet onto your device, which is comprehensively explained in this video, you can add the Hivecoin token (HVC) to your wallet. Adding a new asset to your wallet is a simple process.

On your Portfolio homepage, you'll find an option to "Add new asset," as shown in the image below. Clicking on this will prompt you to enter the details of the new asset, including its token address and number of decimals. Once listed, you can send and receive Hivecoin to the Markethive Wallets and associated wallets where the HVC token is listed.

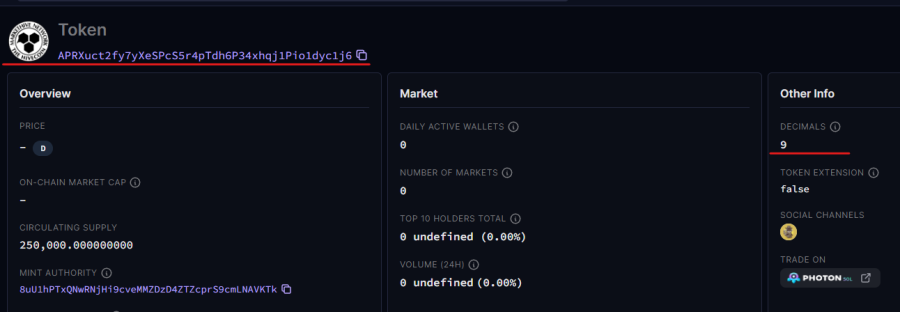

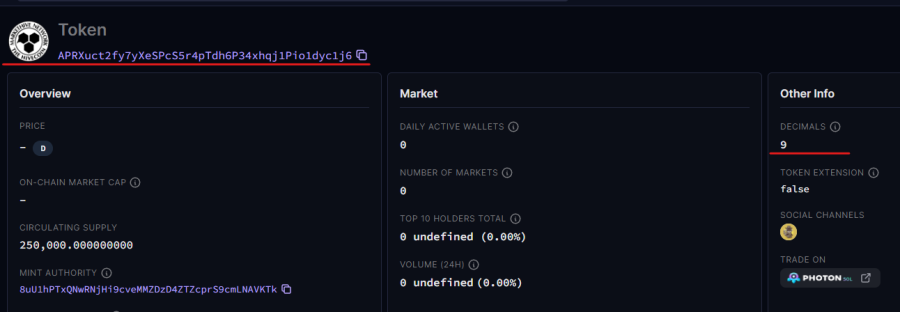

The Hivecoin mint address is APRXuct2fy7yXeSPcS5r4pTdh6P34xhqj1Pio1dyc1j6

The token's representation has nine decimal places. Below is an image of Hivecoin’s mint token address and decimal places on Solana Explorer.

Source: Solana FM Explorer

Exodus Wallet

The Exodus wallet is a popular cryptocurrency wallet with a user-friendly interface and a wide range of features for managing and securing digital assets. Here are some key points about Exodus Wallet:

Key Features

- Exodus is a non-custodial wallet, meaning users have complete control over their private keys and funds. To protect user assets, the wallet uses advanced security measures, including multi-sig technology and cold storage.

- Exodus supports over 319 cryptocurrencies and offers features like in-app swaps, staking, and NFT marketplaces. It also supports Trezor Model T and Trezor One hardware wallets for offline cryptocurrency storage.

- Exodus's user interface is designed to be easy to use, even for beginners. The wallet offers a clean and intuitive design, making navigating and managing digital assets simple.

- Exodus is available on multiple platforms, including desktop (Windows, macOS, and Linux), mobile (iOS and Android), and browser extensions (Chrome and Brave).

- Exodus has received positive reviews from users and critics alike, with many praising its ease of use, security, and feature set.

Key Benefits

- Easy to Use: Exodus is designed to be user-friendly, making it easy for beginners to get started with cryptocurrency.

- Security: Exodus uses advanced security measures to protect user assets, including multi-sig technology and cold storage.

- Comprehensive Support: Exodus supports over 319 cryptocurrencies, making it an excellent option for users who want to manage various digital assets.

- In-App Swaps: Exodus allows users to swap between cryptocurrencies within the wallet, making managing and diversifying their portfolios easy.

This short video explains how to download the Exodus wallet on your mobile phone, and here is a brief tutorial illustrating the desktop download. You can then synchronize both wallets.

How to Add the Hivecoin Token to the Exodus Wallet

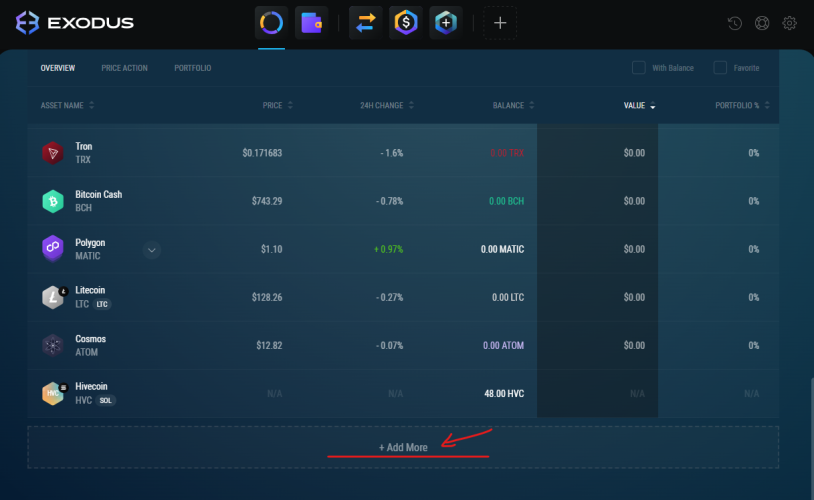

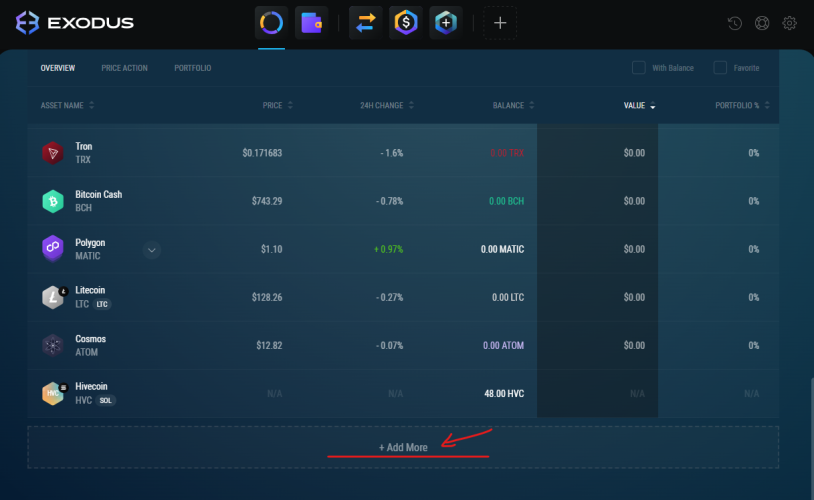

Once downloaded, you can add The Hivecoin token by scrolling down on your Portfolio page and clicking “+ Add More,” as shown above.

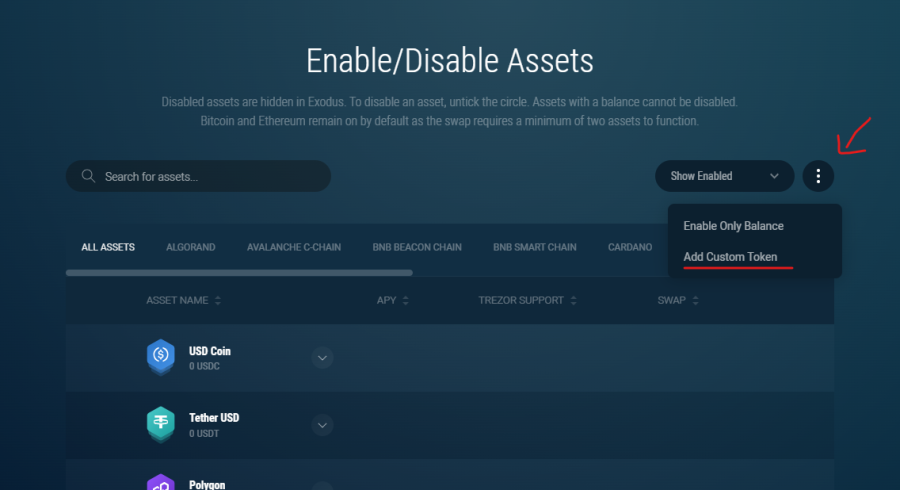

That will take you to the Assets page. Click on the three dots next to ‘show all, ' and select “Add Custom Token,” as shown below.

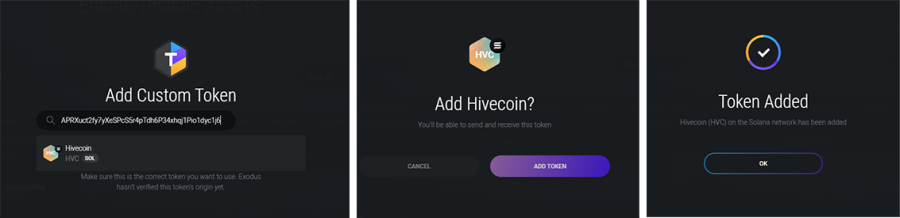

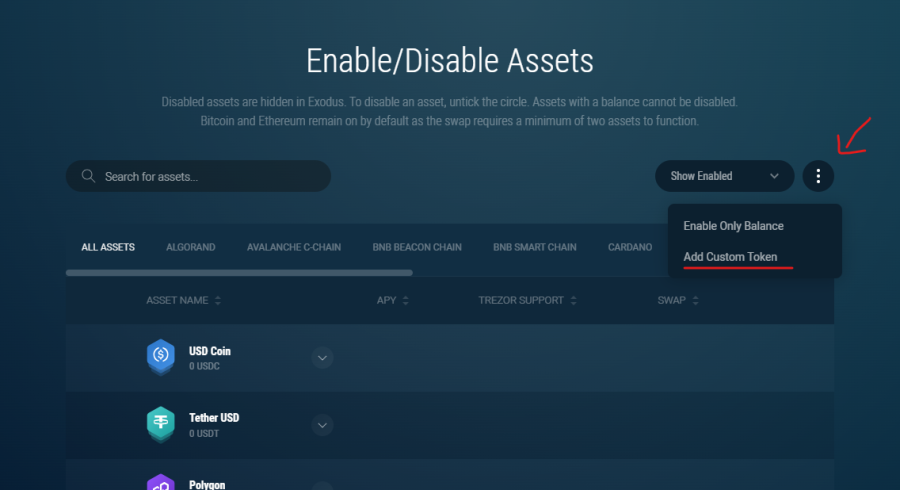

First, select the Solana Network, click Search, and paste the HVC mint token address. The Hivecoin mint address is APRXuct2fy7yXeSPcS5r4pTdh6P34xhqj1Pio1dyc1j6

Click on the Hivecoin display banner. A pop-up will appear asking to Add Hivecoin? Click on ADD TOKEN. A message appears: “You’ll be able to send and receive this token.”

Trust wallet

The Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). With over 100 million users, Trust Wallet is one of the market's most popular and trusted cryptocurrency wallets.

Key Features

- Trust Wallet supports over 100 blockchains, including Bitcoin, Ethereum, Solana, Cosmos, Optimism, and many more.

- Trust Wallet allows users complete control over their digital assets, ensuring the security and ownership of their cryptocurrencies.

- Trust Wallet provides a built-in browser for accessing and interacting with decentralized applications (dApps) on the Web3 ecosystem.

- Trust Wallet lets users store, send, and receive non-fungible tokens (NFTs).

- Trust Wallet supports various decentralized finance (DeFi) and game finance (GameFi) protocols, enabling users to participate in DeFi lending, borrowing, and gaming.

Key Benefits

- Ease of use: Trust Wallet is designed to be user-friendly, making it easy for new users to get started with cryptocurrency and Web3.

- Security: Trust Wallet prioritizes security, providing a secure gateway to the Web3 ecosystem and protecting users’ digital assets.

- Community-driven: Trust Wallet has a large and active community that strongly emphasizes user support and collaboration.

Here is a step-by-step tutorial on downloading the Trust wallet on your mobile phone and using it as an extension in your browser.

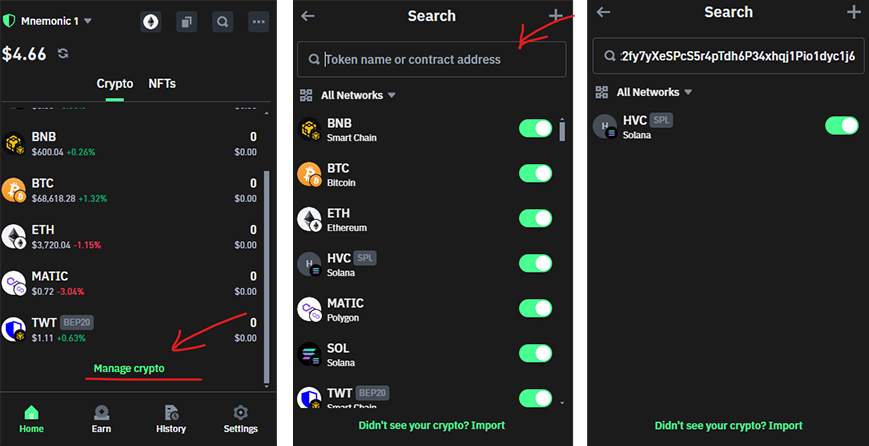

How to Add the Hivecoin Token to the Trust Wallet

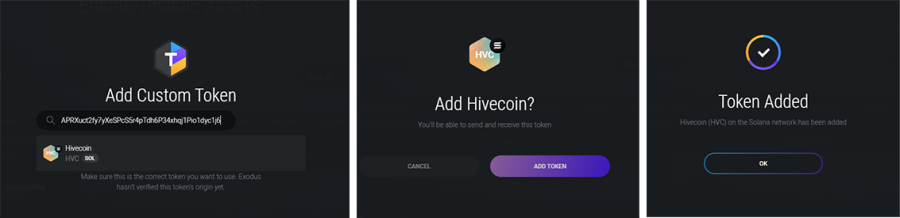

Again, it’s simple to access by clicking “Manage Crypto” at the bottom of your app extension on your browser. Enter the Hivecoin mint address, which is APRXuct2fy7yXeSPcS5r4pTdh6P34xhqj1Pio1dyc1j6. It’s also known as the contract address. It will then appear as shown in the image below.

A Message To All Markethivers

To transact using any wallet, including the Markethive wallet, you must have a small balance of Solana’s Token, SOL, for transaction fees. These fees are minuscule, so a little bit of SOL goes a long way.

Take the first step towards energizing our blockchain by acquiring one or more of these wallets, and let's work together to galvanize our Hivecoin network through frequent transactions. Every exchange of Hivecoin serves as a catalyst, stimulating community interaction and fortifying the connections that unite us.

The frequent exchange of Hivecoin within and beyond the Markethive network has a profound impact. Doing so fosters a thriving and dynamic blockchain ecosystem, bolstering its strength and adaptability. Additionally, it demonstrates Hivecoin’s real-world value and appeal among our community members, highlighting its practical uses and popularity.

This intensified participation significantly increases the token's worth and is crucial in furthering Markethive's vision. As it stimulates more activity on the blockchain, it strengthens Markethive's efforts to list Hivecoin on leading exchanges, ultimately expanding its presence and capabilities beyond the Markethive ecosystem.

Become a valued member of the Markethive Community Group and play a pivotal role in influencing Hivecoin's development within the dynamic Markethive network. Once in the group, you can send Hivecoin back and forth to other members. Enter your Hivecoin wallet address on the post with an active thread, and other members will send HVC to your wallet. You can then reciprocate by returning the HVC to the specific members. When interacting with members, quoting your HVC wallet address each time is advisable.

Additionally, To increase your Hivecoin holdings, make a habit of visiting our faucet every day at https://gotco.in. Simply input your wallet address and complete the captcha to receive a reward of 0.00001 HVC. This wallet address can belong to your Markethive wallet or any other one you own. This faucet is just one of the many that Markethive plans to introduce to support our operations and make it convenient for everyone to access.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.png)