Walmart Reports Major Shortages As Fears Of Hard Times Rising

BY EPIC ECONOMIST

The foreign supply chain is far more chaotic than most people can imagine. Not even the world's largest retailer is immune to the shortages and disruptions that have been plaguing U.S businesses in recent years, but given its market dominance in its vast network of suppliers, the fact that empty shelves can still be seen across many of its stores is quite Alarming, especially at a time when pretty much, everyone in the industry is saying that Food Supplies are going to get increasingly tighter in the months ahead, even though its Executives say that the company is actually overloaded with too much stuff. Shoppers tell a different story. Many customers have recently reported on social media what they're, seeing every time they go.

Grocery shopping at Walmart, plenty of stock outages, bare aisles, and Scattered merchandise all around the superstore, and if you notice that your local Walmart was closed during Thanksgiving well, you'll probably have to get used to it. Ceo John Furnas is that opening stores during national celebrations is a thing of the past and while he justified the temporary shutdown by saying that employees deserve to spend the day with their loved ones, we'll know that the retail Giant's workplace policies are not that amicable. Thanksgiving is typically one of the days with the highest sale volumes of the year for retailers and experts. Note that Walmart's move may actually be a strategy to ensure inventory for a long, as more shortages are expected to emerge by Christmas, the company's latest woes might be a hint of what the entire sector will be facing soon and if that's really the case, we all should Start worrying: we have a lot to discuss today, but before moving on, please support our work with a thumbs up and don't forget to subscribe after the pandemic broke the complex where the tide Supply chains together, things were never the same again, although authorities in the media Kept insisting that shortages would soon be gone they're still here, and they continue to impact our everyday lives. Even Walmart, the seemingly unshakable retail giant, is reporting growing supply, chain challenges, and customers continue to complain about not being able to find the products that they want and need if conditions are looking bad for the superstore chain.

What is the outlook for companies that are far smaller, far weaker, and have significantly fewer resources? We'll probably learn the answer to that over the next few months, with the holidays approaching Walmart continues to be a One-Stop shop for many people. Suiting customers' needs for clothing appliances, entertainment devices, and groceries. However, in many recent Reddit threads, Shoppers have been voicing concerns over growing food shortages in their Walmart stores, especially for Frozen Goods, fresh produce meats, and, more recently, many people reporting that they can't find chicken anymore. At the store, countless commentators noted that their local Walmarts had either run out of chicken or were about to perhaps due to the scale of its sales volume.

Walmart is the first major retailer to experience the impact of the bird flu pandemic on its food supply chain. One commenter asked: are people hoarding or is there a production shortage? One Restaurant owner wrote that right now it's cheaper to buy the parts than whole chickens, so owners are buying all chicken parts they can find. Meanwhile, a worker of the superstore chain said the store. I work at looks like this too we're barely getting any chicken at all, maybe a day's worth we get per truck in an email sent to Thrillist.

The company confirmed that there is a chicken shortage in their U.S stores, but they noted that Walmart is not the only one facing it. A representative for the retailer wrote. This is not just an issue isolated to Walmart it's affecting every chain. It's an industry issue.

He said with the worst outbreak of Avian Influenza, killing more than 40 million Birds, supplies of eggs, poultry and turkey have been unusually low over the past six weeks. It's safe to say that shortages were not the only disturbing thing customers have seen at the store lately. Even though the retailer is known for its cheap prices and good deals, those who were buying for Thanksgiving at Walmart were probably shocked to see the turkey prices were 109 more than they were last year, jumping from 11.18 in 2021 to 24.56 this year.

According to a Business Insider report, poultry industry, expert, Thomas Elam, said, customers should expect record prices until the end of the year. Christmas will be no different. He said that major impacts on poultry Ag and turkey production and impacts on Broiler meat production, Elam added and we've had general price inflation in wages and salaries, energy and all of those are impacting our retail food sectors. We are working hard with our suppliers to increase inventory. The Walmart spokesperson continued, but the truth is that when an industry Titan that has thrived even during the darkest moments of the pandemic, is still struggling to ramp up its inventory of everyday necessities and to keep stores shells start, then you know things are really bad.

That's what supermarket, gurus Phil Lampert noted in a recent interview. In fact, the expert argued that Walmart's decision to close all of its doors during one of the busiest shopping days of the year seems more like a strategy to hold on to its holiday inventory. For longer. Last month, CEO John Ferner announced that stores would stay closed during Thanksgiving, stating that open stores during national celebrations are a thing of the past and that all of our Associates will be able to spend time with their loved ones. This year.

On the other hand, lemput noted that the company is trying to reduce costs wherever they can and by shuddering stores, temporarily. They wouldn't have to pay their employees any extra money for working on the holiday with customers paying more for groceries and fuel. The department store saw a decrease in sales of general merchandise this year right now, the retailer is dealing with a massive inventory: glut of Home Goods, appliances, electronics, and other big-ticket items, while the grocery section, which accounts for 60 percent of its sales, is seeing major Inventory holes, the excess supply of products that aren't selling and the shortfall of products that are in high demand, let the company's profit to Collapse by 24. In the first quarter alone and after a disappointing earnings report, its stock shares plunged by 10 percent in a single day. The imbalances in Walmart's supply chain will take several quarters to be sorted out, says president Doug McMillan in September.

He said that supply chain problems and inventory shortages are as Stark as he can remember in his 30 years in retail. He also expressed concern about the impact of rising prices on U S, households, I'm concerned about the inflation rate, and should it stay at this level or go up and be there for a sustained period of time? I think that has a negative impact on too many families. Mcmillan said, at the end of the day, inflation needs to come down stress Prime Yara, a retail analyst with the financial services firm, Edward Jones, with inflation as high as it is lower-income families can't afford the general merchandise. Moreover, the USDA says food prices are about to get even higher, so the retailers, sales, and profit Outlook is being hit on all fronts.

During last year's holiday season, Walmart reported a record-breaking sales growth of 15.1 percent. That's why this year's forecast of a mere four percent growth in holiday sales highlights the chain's latest struggles. Moreover, MacMillan noted that 2022 supply chain costs were more than 400 million dollars higher than anticipated. The company also took a one billion dollar hit on its operating income, and now executives are scrambling to stabilize the business.

However, the problems Walmart is facing in 2022 are not new. Last year, former Walmart president and CEO Bill Simon, said that the supply chain was a mess from start to finish. I've never seen it like this, and I don't really think anybody living in this country has. I mean this is really unprecedented. There's a shortage of Labor in our distribution system and there's a shortage of people to put items on the Shelf.

Simon told Fox Business according to a new story in Bloomberg, the company's Inventory management practices actually have a lot of room for improvement. Not only are its sales dramatically slowing but they're having to hire Consultants to figure out why they're stocking up so many of the wrong products. Many products run out quickly and the new stuff doesn't come in Simon, Says, adding that self-inflicted wounds were Walmart's biggest risk. A representative tried to hush the story about an anonymous source who noted that, after a meeting with Executives, they all seemed worried about the ongoing disruptions in the process of replenishing merchandise, to keep up with the cost of demand and changing season. One Californian Walmart, Supercenter manager, who preferred not to reveal their name, said that Simon's comments were dead on.

There are gaps where merchandise is missing, we're not talking about a couple of empty shells. This is throughout the store in every store. Some places. Look like they're going out of business. The manager who's worked at Walmart for nine years highlighted my camera bar hasn't had cameras since early January.

They let the merchandise phase out, but nothing new comes in to replace them. We're supposed to have 72 cameras, but we maybe have 12 What is a customer supposed to buy the soul set at this point, it's clear that cameras are the least of their problems, the deeper we look, the more Walmart's issues rise to the surface from the elephant in the room that nobody really wants to talk about is the fact that our supply chains will never fully return to the way they were in 2019, too much has changed and if the retail giant is in travel, that means everyone else is also experiencing volatility in the supply chain. These Trends will continue to accelerate in the near future, and many other retailers will be facing similar challenges or worse. A consumer recession is now Brewing, financially squeezed U.S families can't afford to spend at the same pace they've been doing over the past couple of years, given that they're grappling with the most painful cost of living crisis in a generation and as consumers deal with the impact of Higher prices, retailers continue to see their sales dropping and those that are on the edge may fall off of it way before people notice.

Tim Moseley

.gif)

.gif)

.png)

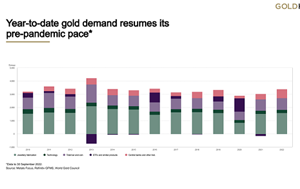

.gif) World Bank sees gold prices falling another 4% in 2023

World Bank sees gold prices falling another 4% in 2023