ENTREPRENEURS vs. POLITICIANS – SOVEREIGN KINGDOMS vs. ONE WORLD GOVERNMENT

Could it be that the tide is turning for entrepreneurs to be accepted by an overwhelming majority to the political platform? With all that is revealed recently, and many corrupt politicians and bureaucrats facing indictment, perhaps it's time to let the entrepreneurs take the helm. Think Hunter Biden & Co, Burisma and Ukrainian connection.

We all saw what an entrepreneur could do for a country for a short time that has gone down in history as triumphant by many, all to be destroyed in one year when a political puppet with his cronies seized power in what many considered as a coup d'état.

Many entrepreneurs are stepping up to thwart the dictator-driven hierarchy that is not even an elected official. Such as the World Economic Forum headed by Klaus Schwab pushing for a one-world government, one kingdom of a new world order where "you will own nothing and be happy." And where all governments across the world are answerable to it.

One entrepreneur and investor, Peter Thiel, is stepping down from the board of Meta (Facebook) with a focus on helping elect Republican candidates that support former President Trump's strategies. Candidates such as J.D. Vance and Blake Masters, also entrepreneurs, will be directly backed by Mr. Thiel for the 2022 midterm elections.

These non-politicians have all the hallmarks of entrepreneurship; they are critical thinkers and innovative individuals who focus on real people's lives and do not follow the dogmas that have manifested over the last few decades. They can empathize with their constituents on a simpler level; delivering their message the people can understand and follow through with positive action is just one example of what they would bring to the table.

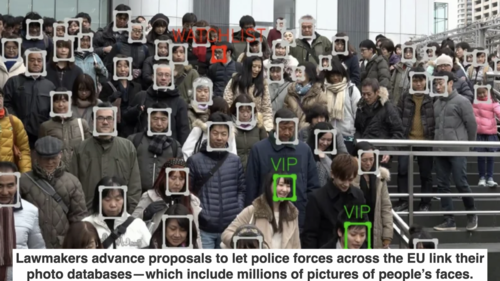

On the other hand, politicians deliver lip service with an agenda that suits them rather than society. We've seen it play out, especially in the last two years, in such a blatant fashion that it’s incredulous. Some politicians are also ignorant of emerging technologies to the point where they are apathetic and show disdain for fear of losing their grip on power.

Some Get It – Some Don’t

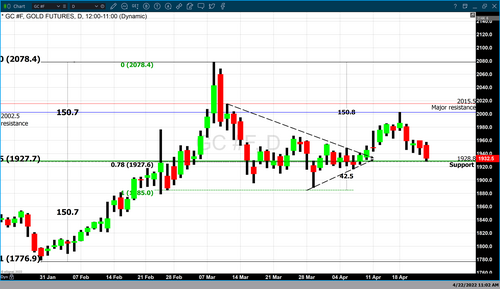

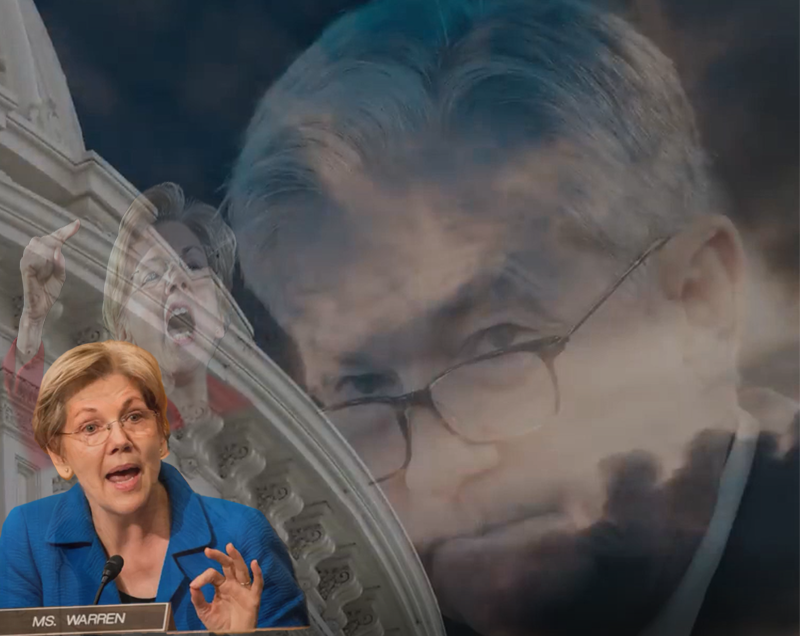

Their skewed perception of world affairs results in poor, even detrimental decisions for us ordinary folk worldwide. In a recent congressional testimony based around interest rates, Jerome Powell, Chairman of the Federal Reserve Bank, was in the hot seat where questions were asked about crypto.

Senator Elizabeth Warren rants about how corporations are causing inflation and how Russia is evading sanctions by using cryptocurrency in the second hearing. She even slammed cryptocurrency exchanges for refusing to sanction regular Russians; Powell stated that it was outside of his area of expertise.

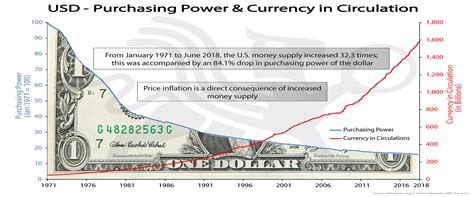

Senators Jack Reed and Kyrsten Sinema voiced their concerns regarding the global trend away from the US dollar, explicitly noting that some superpowers have accelerated their abandonment of the dollar in the wake of the Russia/Ukraine war. It’s most likely the superpowers saw that Central Bank assets are fair game for sanctions.

Kyrsten also confirmed that US politicians are becoming concerned that their sanctions against Russia are doing more harm than good to the dollar. And Jerome essentially said that the damage to the dollar depends on how long this situation lasts.

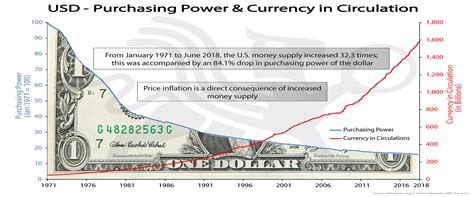

It seems the FED may have found itself backed into a corner that it can't get out of easily. As much as it's tried to stay neutral and avoid becoming politicized, politicians have been unscrupulous in using the dollar as a political weapon against International opponents.

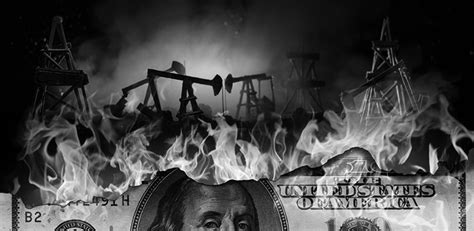

Notably, the international community has known this for some time, and many have been trying to move off the dollar for years. Many wars were started to preserve the American dollar as the reserve currency. When Moammar Gaddafi created an evaluated currency for Africa, western military power went to Libya and assassinated Gaddafi.

When Saddam Hussein announced in Iraq that he would no longer accept the US dollar for oil, two months later, the war broke out in Iraq, and Saddam Hussein was murdered. The current conflict has accelerated this process, giving the edge to crypto and its benefits because it can be used to cut through the corrupt and fragile fiat financial system that is failing in every capacity.

Some countries such as El Salvador have realized that fiat currencies are futile and have turned to adopt currencies that aren't controlled by any other nation. Currencies that maintain their value and can't be turned off for any reason.

Jerome Powell’s testimony indicates that fiat currency’s days are numbered. We are heading towards a trend of decentralizing national currencies, and for many, favorably in the form of cryptocurrencies and not a Central bank-run digital currency. (CBDC)

Below is a snippet of the essential points of the second hearing relating to crypto from Guy at Coinbureau.

To watch the full video of Guy breaking down Powell's testimony of both hearings into its most critical parts, giving you his take on what this could mean for the markets, click here. – 30mins.

The SWIFT System Weaponized

Since the sanctions on Russia by certain western countries and corporations, including the globally used SWIFT system. Founded in 1973, Belgium-based SWIFT is used by banks for cross-border financial transactions. It facilitates trillions of dollars of payments between 11,000 financial institutions in more than 200 countries making it the backbone of the international financial transfer system.

The Central Bank of Russia has since permitted its largest bank, Sberbank, to act as a cryptocurrency vendor to circumvent sanctions imposed by the U.S and E.U and a way to avoid the massive downward pressure exerted on Russia’s ruble.

The above decision, along with other contingencies such as India purchasing oil from Russia using rupees instead of dollars. And Saudi Arabia is working on selling oil to China in yuan instead of dollars.

It’s worth noting that most of the world has not joined the sanctions against Russia, including Argentina, Brazil, China, Mexico, India, Indonesia, Israel, South Africa, Saudi Arabia, United Arab Emirates, Qatar, and Pakistan.

In 2014, Russia launched the System for Transfer of Financial Messages (SPFS), a Russian alternative to SWIFT. In 2015, China launched the Cross-Border Interbank Payment System (CIPS), a Chinese alternative to SWIFT. CIPS processed around $12.68 trillion in 2021. CIPS has 1,280 financial institutions in 103 countries and regions.

Combine the Russian System for Transfer of Financial Messages (SPFS) with the Chinese Cross-Border Interbank Payment System (CIPS), and you see the foundation of a new Russian-Chinese cross-border payment system bypassing SWIFT speeding up global de-dollarization.

Interestingly, Russia has the ruble, which is fully backed by gold, unlike fiat with no intrinsic value except faith, trust, and acceptance of the people in their governments. India, China, and Russia have long had a different monetary system apart from SWIFT.

As recently as November 16, 2019, Vladimir Putin said,

“The Dollar enjoyed great trust around the world. But, for some reason, it is now being used as a political weapon to impose restrictions. They’ll collapse soon. Many countries are now turning away from the Dollar as a Reserve Currency.”

What is happening here is that some misinformed or even corrupt self-serving decisions are giving rise to a multi-polar world, which is quite the opposite of a one-world government. In effect, the countries that have sold out to the United Nations supporting their Agenda 21/30 are creating their own demise.

Are You Ready For Some Truth Bombs?

An award-winning journalist, and former newscaster, Lara Logan, drops a few truth bombs in this interview that rocks the world. The alternative media exposes the NWO, EU, US, NATO, the UN, CERN, the WHO, the CIA, the MOSSAD as all one big snake pit connected up the dark evil pyramid of the elite.

You are not hearing this on mainstream media as they are facilitating the agenda and narrative of corrupt politicians whose thoughts and strategies are a polar opposite to entrepreneurs with life experience and a humanitarian approach.

"If a nation expects to be ignorant and free, it expects what never was and never will be . . . The People cannot be safe without information. When the press is free, and every man is able to read, all is safe."

Thomas Jefferson

The Crypto Industry Takes A Firm Stand. More Entrepreneurs Stepping Up

The dollar as the Reserve currency all countries align is diminishing rapidly. The cry for regulation of cryptocurrencies by corrupt governments shows the corruption and mutiny within organized financial system bodies like the SEC, revealing how protected Bitcoin and Ethereum are.

Some governments asked entrepreneur and SpaceX CEO Elon Musk to block Russian media outlets from its Starlink satellite broadband service. In a tweet he sent out on March 5th, Musk declared the company would not comply with the request "unless at gunpoint." According to Musk, the demand hadn't come from Ukrain, and he added, "Sorry to be a free speech absolutist."

The sanctions to squeeze Russia's economy and sever the country from the global financial system have forced companies and financial firms to halt business. But many of the world's largest crypto exchanges – including Binance and US-based Kraken and Coinbase refused to ban Russian clients, despite a plea from the Ukrainian government.

They said they would screen users and block anyone targeted by sanctions. The standoff illustrates the ideological difference between the traditional financial sector and the world of cryptocurrencies, whose origin lies in the ideal of liberty and distrust of governments. The crypto exchanges argued that cutting off a whole nation would counter Bitcoin's ethos of offering access to payments free of government oversight.

A Turning Point In History And The Rise Of Kingdoms

The world’s state of affairs may look bad to some, but it's a turning point in history, with Russia now seeming to lead the way out of the Matrix, leaving behind the corrupt financial system and mainstream media. This is perhaps the start to implementing a free world outside of the matrix of the cabal that we have been trapped in for centuries.

We now have what can be considered separate kingdoms of sovereignty emerging that are all fundamentally on the same page and supporting each other. It includes social media marketing cryptocurrency ecosystems that can help an expanding community in times like these where the world has reached a level of volatility unprecedented.

Unlike the tech giants, Markethive will not be or will ever be involved in sanctions that hurt people at the very core. Every individual from every country is welcome to the sovereign kingdom of Markethive and escape the tyranny that surrounds it but will not penetrate it.

Aptly recognized as the Ecosystem for Entrepreneurs, Markethive stands for freedom of speech, critical thinking, self-expression, and liberty, cultivating the entrepreneurial spirit to keep it alive. Perhaps it’s time to get the entrepreneurs back into government—empaths with substance and have no agenda except to help humanity thrive.

An Individual Thinker – An Entrepreneur Of Medieval Times

I will finish off with a quote from Roger Bacon, who was born in 1220 and died in 1294. A scholar with a background in experimental science, philosopher, educational reformer, he later became a friar and was subsequently condemned to prison for daring to speak his mind and his penchant for millenarianism.

He also predicted the hot air balloon, the flying machine, and the magnifying glass. He was the first person in the West to give exact directions for making gunpowder.

Bacon displayed prodigious energy and zeal in the pursuit of experimental science. His studies were talked about everywhere and eventually won him a place in popular literature as a kind of wonder-worker. Bacon, therefore, represents a historically precocious expression of the empirical spirit of experimental science. He is what I would call an entrepreneur of medieval times.

“True knowledge stems not from the authority of others, nor from a blind allegiance to antiquated dogmas, but instead is a highly personal experience. A light that is communicated only to the innermost privacy of the individual, through the impartial channels of all knowledge and of all thought.”

Note from Editor; This article is an alternative view to the mainstream narrative. After much research, I felt the need to put it out there. After all, there are two sides to every story.

Also published @ BeforeIt’sNews.com https://beforeitsnews.com/economics-and-politics/2022/03/entrepreneurs-vs-politicians-sovereign-kingdoms-vs-one-world-government-2529469.html

Tim Moseley

.jpg)