BRICS Countries Advancing with a New Payment System. A Breakthrough for Global Commerce Potentially Disrupting the Dominance of the US Dollar

Recent headlines suggested that the longstanding 50-year agreement between the United States to exclusively price oil in US dollars had expired, sparking concerns that the era of the Petrodollar may end. Despite initial fears, it was later confirmed that this information was inaccurate. Nevertheless, significant developments occurred during this period as BRICS introduced a new payment system, and Saudi Arabia subsequently became a participant in this initiative.

A potentially game-changing development is on the horizon as a consortium of emerging nations, known as BRICS, prepares to unveil a new payment system, which it has been working on for years and is based on the Ethereum blockchain. This innovation, with its potential to disrupt the US dollar's dominance, could signal a long-awaited breakthrough for global commerce and provide relief to countries struggling with crippling economic sanctions and the exploitative petrodollar system.

BRICS Explained

BRICS stands for Brazil, Russia, India, China, and South Africa. The original acronym was BRIC, coined by former Goldman Sachs Economist Jim O'Neill in 2001. At that time, four countries were involved. O'Neill's forecast suggested that these countries would experience significant economic expansion by 2050 due to increasing populations, low labor costs, and abundant natural resources.

Geopolitical dynamics and fluctuations in commodity prices also played a significant role. The timing coincided with China's accession to the World Trade Organization and strong commodity demand for developing countries aligning themselves with the US. However, as a previous article on the BRICS nations noted, this dynamic began to shift following the global financial crisis. As Xi Jinping took the helm, China began to chart its course, coinciding with a sharp decline in commodity prices.

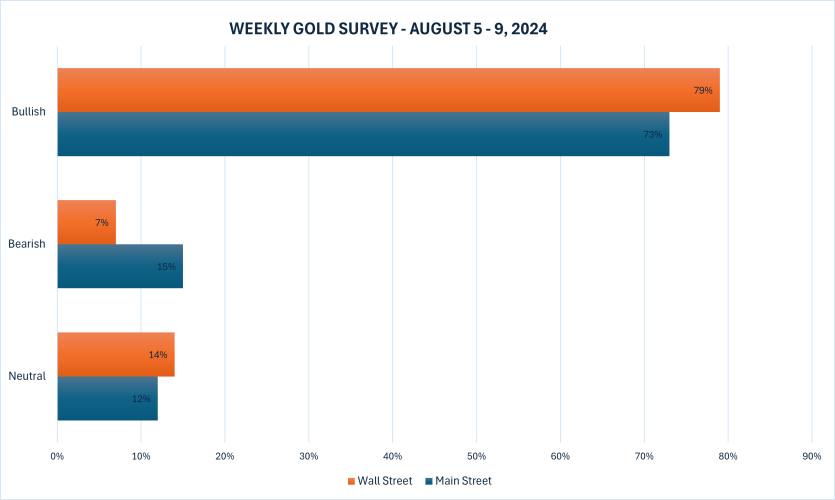

Unsurprisingly, Wall Street's sentiment regarding the BRICS shifted. Despite this shift, the article highlighted that the underlying factors that initially drove Goldman Sachs’ optimism about the BRICS remain unchanged. The BRICS countries still have growing populations, low labor costs, and commodity abundance. The only element missing in this equation was a vital commodity market. Some may have noticed that commodity prices worldwide have been rising over the last few years, increasing the geopolitical power of the BRICS.

It's also no surprise that the general public has begun to take notice, but many Western elites remain in denial about the resurgence of the BRICS nations. Despite this skepticism, the BRICS nations have continued to make significant strides, impressing with their resilience and determination.

Consequently, accessing reliable information about these countries' developments has become a challenge, especially for those living in Western societies. This scarcity of credible details makes it even more daunting to stay informed about pressing issues, and one topic that has garnered significant attention is the prospect that the bloc will launch its shared currency to rival the US dollar.

Numerous sources suggest that gold or cryptocurrency might support the proposed BRICS currency, yet no proof exists to confirm its imminent arrival. Upon examination of the origins of these reports, it becomes apparent that they mainly consist of informal remarks by officials from BRICS nations or concepts that have yet to progress beyond the initial proposal stage.

For the time being, establishing an actual BRICS currency is not a current priority. However, developing an alternative payment infrastructure is definitely under consideration. It's essential to note that a BRICS currency and a BRICS payment system are two distinct concepts. A BRICS currency would be akin to the US dollar or the euro. In contrast, a BRICS payment system refers to a network of payment channels that can facilitate transactions in any currency.

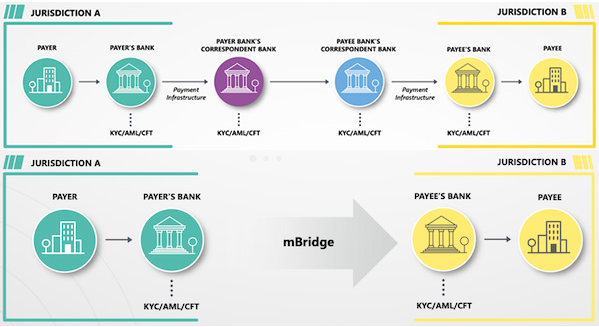

Russian companies have been engaging in trade with Chinese companies by utilizing the USDT stablecoin from Tether, which is linked to the value of the US dollar. This development is highly noteworthy as it brings attention to a significant issue. The challenge the BRICS countries face is not the US dollar itself but rather the infrastructure for carrying out financial transactions on which the US dollar relies. This significant issue is represented by SWIFT, which is recognized as the most extensive payment system globally.

Evidently, SWIFT's allegiance lies with Western nations, and it's been increasingly used as a financial weapon to exert and restrict transactions to specific entities. In reality, the SWIFT system poses a more significant challenge for the BRICS nations than the US dollar itself. Consequently, the BRICS have been actively developing a substitute for the SWIFT system.

This new payment system was unveiled during a week when the media was abuzz with speculation about the impending demise of the US-Saudi oil agreement. Interestingly, Saudi Arabia joined the BRICS payment system just before the rumored expiration date, a move that could potentially shift the balance of power in global trade.

It's tempting to suspect that the frenzy surrounding the US-Saudi oil deal was intentionally exaggerated to divert attention from the fact that BRICS had introduced a rival to SWIFT. This development has far-reaching implications, dwarfing the significance of any oil deal or BRICS currency. If the BRICS payment system gains widespread adoption, it could potentially dislodge the US dollar from its dominant position.

Source: Central Banks Payment News

BRICS Payment System

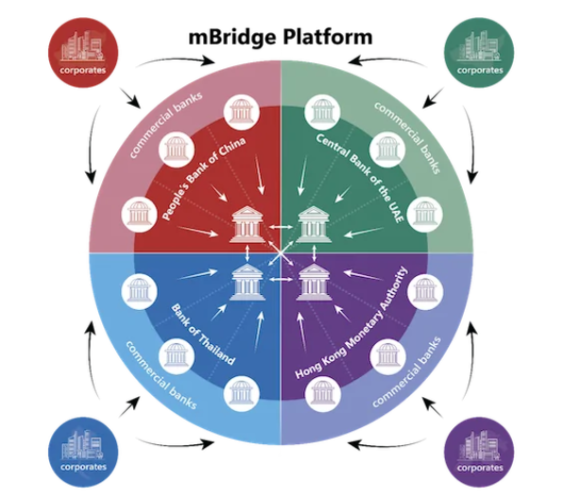

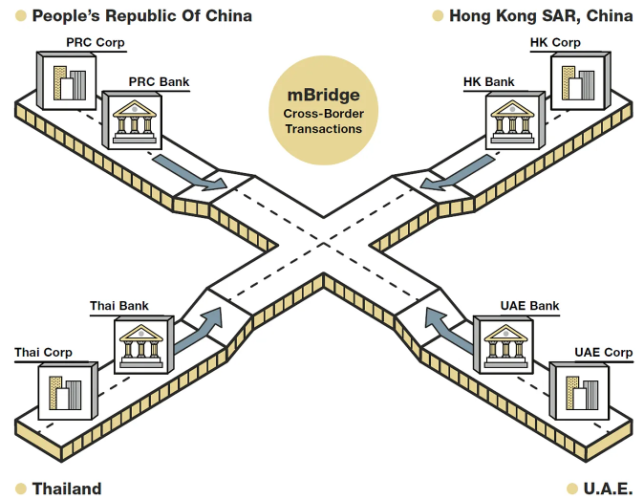

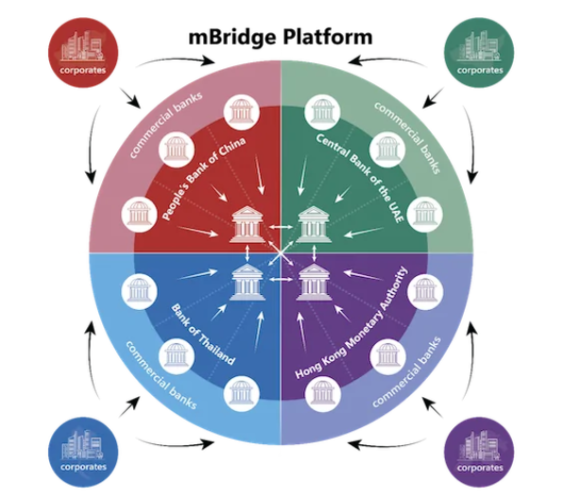

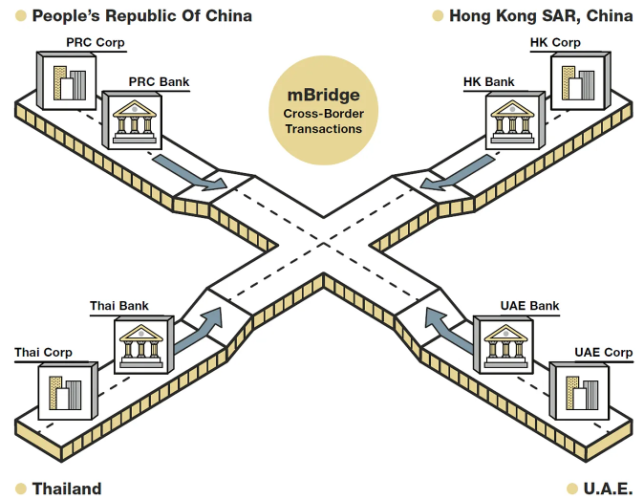

The BRICS Payment System, known as mBridge, was developed by the central banks of Thailand, Hong Kong, China, and the United Arab Emirates in collaboration with the Bank for International Settlements (BIS), often referred to as the "bank for central for central banks.” Notably, mBridge is a digital currency platform that utilizes Central Bank Digital Currencies (CBDCs). The BIS has been instrumental in supporting central banks globally in developing and implementing their respective CBDC systems.

Those familiar with CBDCs are likely aware of their unsettling implications, as they grant governments and central banks unprecedented control over individuals' financial decisions, habits, and savings limits. However, it's worth noting that CBDCs come in various forms, each with distinct characteristics and intended uses.

CBDCs have two categories: retail CBDCs, intended for public use, and wholesale CBDCs for a select group of individuals and organizations. The mBridge system falls under the latter category, designed exclusively for institutional use. As previously noted, mBridge is built on the Ethereum network, essentially replicating its architecture. It utilizes a blockchain called mBL, written in Solidity programming language, and employs the Ethereum Virtual Machine (EVM) to execute smart contracts.

A critical distinction between Ethereum and the mBL lies in the mBL's private and restricted access. Utilizing the mBL is exclusive to central and commercial banks, which also control the network's infrastructure. Specifically, participating central banks operate as de facto validators, while participating commercial banks act as de facto relays, overseeing data flow within the network.

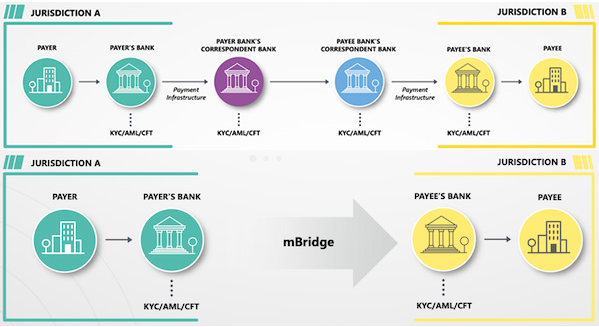

Another critical distinction between mBridge and Ethereum is their transaction speeds, with mBridge appearing much faster. This is attributed to its innovative Dashing consensus protocol, developed by Chinese researchers, which validates blocks by inspecting random segments rather than the entire block. The primary objective of mBridge is to empower users to circumvent the existing US-dominated financial infrastructure. This includes sidestepping the SWIFT system, avoiding all intermediary banks in cross-border transactions, and trading the US dollar in Forex.

The US dollar is a bridge currency, especially for large transactions. For example, if you want to swap a large amount of New Zealand dollars for Canadian dollars, you'll have to swap New Zealand dollars for US Dollars and then US dollars for Canadian dollars. That's because it's not always possible to trade large amounts of New Zealand dollars directly for Canadian dollars.

Using mBridge, you can convert New Zealand dollars to Canadian dollars in a seamless, direct transfer between New Zealand and Canadian banks. The mBridge network system bypasses the need for the US dollar as a bridge currency, eliminates the involvement of intermediary banks, and circumvents the traditional SWIFT infrastructure, marking a significant breakthrough.

Source: Cointelegraph Magazine

Besides facilitating international trade, removing the US dollar as the bridge currency means the demand for tens of trillions of dollars from large Forex transfers disappears. Simply put, the reduced reliance on the US dollar for international transactions substantially decreases demand, undermining the currency's value. As with any asset, the value of the US dollar is ultimately determined by the balance of supply and demand. Suppose the demand for US dollars dwindles as countries turn to alternative currencies for Forex transactions, coupled with a steady or increasing supply. In that case, it will inevitably lead to a decline in value.

To the many who believe a retail CBDC for the general populous is dystopian, including the presumptive 47th POTUS, Donald Trump, this report from the BIS CBDC survey indicates that central banks are shifting their focus away from retail CBDCs and toward wholesale CBDCs and this is likely a saving grace for us. The data reveals that 94% of central banks are more inclined to launch a wholesale CBDC than a retail one, sparking speculation that this shift may be driven by a desire to participate in the mBridge initiative.

Source: Bitcoin Magazine @ X

BRICS Endgame

The BRICS nations' financial plans have taken a significant step forward in conjunction with Saudi Arabia's recent announcement of joining the mBridge initiative. The BIS announced they would introduce the new payment platform on the same day. The BIS also reported that the number of observing members, such as central and commercial banks, who are interested in joining mBridge has increased to 26.

The significance of this development goes far beyond the adoption of mBridge. Notably, the BRICS grouping recently expanded its reach by inviting six nations to join its expanding network, now dubbed BRICS Plus. The invitees were Egypt, Ethiopia, Iran, Saudi Arabia, the UAE, and Argentina. It is worth noting that all of these countries, except Argentina, accepted the invitation. Argentina's decision to decline is interesting, particularly in light of the perceived alignment of its new president, Javier Milei, with the Western bloc.

Regardless of the circumstances, it is intriguing that Saudi Arabia's intentions regarding BRICS membership have been shrouded in ambiguity, sparking curiosity. The media has reported conflicting news, with some sources citing official statements to claim that Saudi Arabia has joined the group, while others, also referencing official sources, assert that it has not.

The proverbial expression holds that actions speak louder than words, and Saudi Arabia's decision to become a part of mBridge clearly demonstrates this. Various political analysts have highlighted that Saudi Arabia's ambiguity regarding joining the BRICS is likely a strategic move to avoid antagonizing its Western counterparts. Similarly, India has maintained a low profile regarding the BRICS, which is understandable given that the BRICS doesn't have a formalized structure.

The BRICS, or BRICS Plus, functions as a group of nations from the global South; as mentioned in an earlier publication, no headquarters, official website, or charter outlines its objectives. This could be due to the need for the BRICS countries to create a financial framework before forming an official entity.

To provide context, it is essential to note that the United Nations, dominated by Western interests, was founded after establishing the Bretton Woods system. A key factor contributing to the Bretton Woods system's dominance was the influence of institutions such as the International Monetary Fund (IMF) and the World Bank, which effectively ensnared many nations in a web of debt denominated in US dollars, often with unfavorable conditions.

If history is any guide, the BRICS should follow a comparable route. As it happens, the BRICS have already taken a significant step in this direction by establishing the New Development Bank (NDB) in 2015, a financial institution analogous to the IMF and World Bank. The NDB stands out as a tangible entity within the BRICS framework, boasting a substantial $100 billion allocated for infrastructure projects and loans. This positioning, in theory, grants the NDB the ability to exert influence similar to that of its Western counterparts, providing critical financial support to countries in need while encouraging them to adopt policies that align with the interests of the BRICS nations.

In practice, the primary challenge lies with the current payment system. If the NDB were to pursue aggressive lending practices comparable to the IMF, it could attract scrutiny from the US and its supporters, resulting in complications for the NDB and its borrowers. Moreover, providing loans to nations that are not strong allies of the US could also lead to payment difficulties. The mBridge system, however, resolves these issues.

While there is no definitive proof that the NDB will utilize mBridge, several indicators suggest a strong connection. The NDB is headquartered in China and is one of the five founding members of mBridge alongside Hong Kong. Additionally, the UAE, another key player in mBridge, holds a stake in the NDB. Furthermore, Saudi Arabia has been actively seeking to become a member of the NDB since last year, bringing the number of mBridge participants with ties to the NDB to four out of five.

The fifth is Thailand, which has reportedly expressed interest in joining the BRICS partly because of their discontent with the treatment they receive from Western countries. The governance procedure of mBridge still needs to be fully understood. Still, it is known to exist, and most participants are expected to vote to integrate the NDB if the matter arises.

Source: Blockstreet

Looking Ahead: What's Next for BRICS and mBridge?

The future of the BRICS nations and the mBridge payment system is multifaceted. It's essential to note that mBridge is still in its infancy, having only recently launched as a minimum viable product (MVP), which, as the name suggests, is its initial public release. However, it is evident that BRICS primarily serves as an economic endeavor. Furthermore, the increasing number of countries joining the initiative highlights their interest in the financial advantages of affiliating with major commodity producers, underscoring the profound importance of mBridge.

The primary factor behind the substantial value of the US dollar is its necessity in global trade, particularly for purchasing essential commodities such as oil that are denominated in dollars. This raises a significant question: As a nation, do you require the commodities themselves more, or do you need the dollars to acquire them?

The degree to which a country relies on US dollars is primarily determined by its natural resources. Nations with an abundance of exports, such as oil or minerals, tend to be less dependent on the US dollar, whereas those with limited resources often rely heavily on it. This dynamic significantly impacts global politics, leading to a predictable pattern of geopolitical alignments. Nations with solid commodity reserves wield greater independence and are more likely to challenge the US and its allies, whereas those without must form alliances with the US to ensure access to the dollar.

However, it's important to note that the focus is not solely on the US dollar per se; it's the rails on which it runs. The primary purpose of mBridge is to provide nations lacking in commodities the ability to buy these goods directly from producers, bypassing the need for US-dominated infrastructure. In other words, this platform grants them liberation from American influence, empowering them to act with greater autonomy.

This value proposition is quite appealing because, like most individuals, most nations desire to be independent and avoid getting involved in conflicts between major powers. They aim to exist peacefully, and mBridge offers them the means to maintain neutrality. However, implementing this may pose challenges, leading to intriguing situations. A notable instance is the extensive financial sanctions imposed on Russia, hindering its ability to utilize US dollars in trade and forcing it to rely on the currencies of other trading partners.

In the previous year, a Russian official disclosed that Russia had collected a substantial amount of Indian rupees from selling oil to India. Typically, Russia would exchange these rupees for US dollars, which could then be spent on goods from other nations. However, this is no longer an option. As a result, Russia is limited to using these rupees solely to buy goods from India, despite already having most of the products India offers.

India's major export is petroleum products, which Russia already has in abundance. India's other export offerings, such as rice and textiles, are limited in their appeal to Russia, which already meets most of its needs in these areas. It's akin to having an open-ended line of credit that can only be used at a single store that predominantly sells items you already possess in abundance.

A critical challenge comes to the forefront as the mBridge system expands to include more currencies. This will lead to the necessity of introducing a bridge currency similar to the US dollar. This is where the conflicting information regarding the BRICS currency begins to clarify.

While there has been a widespread belief that the BRICS currency would be accessible to the general public and function as a standard retail currency, it is more probable that it will be utilized on a wholesale level within the confines of the mBridge system, exclusively by the central banks and commercial banks involved in the system.

Source: Rich Turrin Substack

The primary function of the BRICS currency is likely to prevent countries from accumulating large amounts of any given currency. The concept of a commodity-backed BRICS currency becomes more plausible when viewed as a bridge currency within the mBridge platform. Moreover, establishing this currency will enable smaller nations with more minor currencies to participate in the mBridge system.

Overall, introducing mBridge may signal the beginning of the end of the US dollar's supremacy and potentially a shift away from the increasingly fragmented global trade landscape. Progress in this direction will be gradual, with various obstacles to overcome. The existing US powers will unlikely relinquish their grip on the financial system without a fight and will likely employ all available means to preserve their control.

What Else Could Be On The Horizon?

A lot is happening behind the scenes, and a significant development is unfolding. Speculation is mounting that a coalition is forming between influential leaders, including former US President Trump, Russia's Vladimir Putin, China's Xi Jinping, India's Narendra Modi, tech mogul Elon Musk, and Prince Mohammed bin Salman of Saudi Arabia.

This alliance is becoming increasingly apparent as the year advances with widespread optimism, fueled by the belief that a golden age is on the horizon, where nations can peacefully coexist, united in mutual understanding and cooperation.

Just recently, the presumptive President Trump vowed to fully support cryptocurrency and make Bitcoin a crypto powerhouse. This includes setting up crypto mining operations in the US, implementing transparent regulatory guidance to benefit the crypto industry, and ‘cleaning up’ the corrupt banking system.

This initiative will create an extensive new banking system linked to the BRICS system in the Americas, paving the way for a global trading network based on blockchain technology that can monitor illicit activities like money laundering and human trafficking and ensure full financial transparency.

As Trump said at the 2024 Bitcoin Conference,

“Bitcoin is not threatening the dollar; the behavior of the current US Government is threatening the dollar. The danger to our financial future does not come from crypto; it comes from Washington, DC.”

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley