Smart Cities Equal Total Control Of Civilization. Don’t Take The Bait.

As mentioned in a previous article, power companies in Texas automatically raised the temperature of so-called smart thermostats in thousands of homes to help save energy during a heat wave in June 2021. Most people had no idea that their home temperature had been raised nor that the power company's ability to do this was outlined in the fine print of their contracts.

If what the Texas citizens experienced sounds ominous, it’s just the tip of the iceberg of what the World Economic Forum (WEF) has planned with its smart cities. In this article, we’ll explore smart cities, including who invented them, where they're being rolled out, when they will be complete, and whether or not the WEF’s plans will succeed.

What Is A Smart City?

The best definition comes from Wikipedia. It's lengthy but needs to be cited because it captures the full scope of smart cities.

“A smart city is a technologically modern urban area that uses different types of electronic methods and sensors to collect specific data. The information gained from that data is used to manage assets, resources, and services efficiently; in return, that data is used to improve operations across the city. This includes data collected from citizens, devices, buildings, and assets that are processed and analyzed to monitor and manage traffic and transportation systems, power plants, utilities, water supply networks, waste, criminal investigations, information systems, schools, libraries, hospitals, and other community services. Smart cities are defined as smart both in the ways in which their governments harness technology as well as how they monitor, analyze, plan, and govern the city. In smart cities, the sharing of data is not limited to the city itself but also includes businesses, citizens, and other third parties.”

In short, a smart city is where everything you do is tracked and managed by the government, including what you do at home. This is possible because almost every modern home appliance has internet connectivity, not just thermostats, but fridges, microwaves, TVs, cars, and even home entry systems are all connected these days. In other words, smart cities are the dictionary definition of a digital dystopia.

Now it's important to note that smart cities and 15-minute cities are different. Although the two terms are used interchangeably, they're not the same, albeit related. Whereas smart cities involve tracking and managing everything you do, 15-minute cities explicitly limit where you can go. Moreover, the primary unelected and unaccountable entity pushing 15-minute cities is the C40 Cities Climate Leadership Group, whereas the primary unelected and unaccountable entity driving smart cities is the WEF.

Who Brought Smart Cities To Light

The term smart cities had its roots in a marketing initiative called Smarter Cities by Tech Giant IBM in 2008. The enterprise has its roots in a 2008 speech by former IBM CEO Sam Palmisano titled “A Smarter Planet, The Next Leadership Agenda.” Sam's discourse on this topic can still be viewed on YouTube.

Sam says a lot of the same stuff you hear today. There's turmoil in markets, supply chain issues, accelerating climate change, political tensions arising, an energy crisis, etc. Like today's elites, Sam saw these crises as a “unique opportunity to transform the world.” He talked about how digital and physical spaces are converging, how people demand change, and how this demand should be exploited to “change the game.”

It sounds like the new normal and the great reset narratives we've heard from almost every government official worldwide since 2020. Today's difference is that the elites have the technology required to impose their will on the average person. The absence of such technology is why smart cities initially had difficulty getting off the ground.

Amsterdam was the first to pursue a smart city initiative, and it quickly became a reference point for how smart cities should be set up worldwide. Interest in smart cities started to accelerate in the following years, with the European Union announcing a smart cities initiative in 2012 and Singapore following suit in 2014.

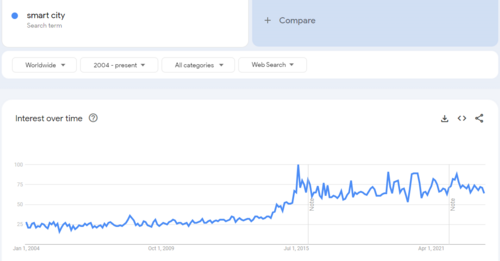

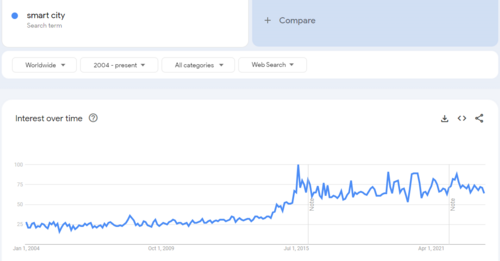

Image source: Google Trends

The search trends for smart cities peaked when the United Kingdom and India announced their initiatives in 2015. 2015 was also the year when Google incorporated a company called Sidewalk Labs, whose purpose was to facilitate the development of smart cities worldwide. There was little coordination around the creation or governance of smart cities until that point.

It all changed on January 1st, 2016, when the United Nations announced its Sustainable Development Goals (SDGs). For context, the SDGs are 17 goals that are supposed to be met by all UN members, basically the whole world, by 2030. This is why you see the date 2030 everywhere.

Image Source: un.org

The development of smart cities is part of the 11th SDG, which is to “make cities inclusive, safe, resilient and sustainable.” The Smart City Index was developed by the Singaporean University and a Swiss University in 2017 to measure how well smart cities meet these arbitrary goals. Not surprisingly, Singapore has replaced Amsterdam as the gold standard for smart cities.

Whereas Amsterdam's approach to smart cities was traffic management, Singapore's approach includes tracking whether people are littering or smoking in places they're not supposed to. Then in 2018, consulting firm McKinsey & Company published a lengthy report about smart cities. The firm found that “Cities can use Smart Technologies to improve some essential quality of life indicators by 10% – 30%. Numbers that translate into lives saved, fewer crime incidents, shorter commutes, a reduced health burden, and carbon emissions averted."

The WEF’s G20 Global Smart Cities Alliance

Most institutions that were interested in smart cities after the SDGs were announced came from the public sector. This changed in 2019 when the World Economic Forum announced the G20 Global Smart Cities Alliance on Technology Governance. As per the WEF’s initiatives website,

“The G20 Global Smart Cities Alliance unites municipal, regional, and national governments together with private-sector partners and urban residents to focus on a shared set of core guiding principles for the responsible use of smart city technologies.”

Moreover,

“The Alliance partners with international organizations and city networks to source tried-and-tested policy approaches to these technologies. Our institutional partners represent more than 200,000 cities and local governments, companies, startups, research institutions, and civil society communities. The World Economic Forum serves as the Alliance's secretariat.”

In other words, the WEF will govern smart cities being developed. Did we vote for this? It’s important to note that this announcement came within two weeks after the WEF had announced a strategic partnership with the UN to ensure the SDGs were met. The WEF and its affiliates would provide the private sector coordination and funding as part of this partnership.

The SDGs also include the development of digital IDs. Furthermore, the WEF and its affiliates used the pandemic to test digital IDs. Alongside this initiative, the WEF also began testing smart cities with the G20 Global Smart City Alliance. In November 2020, the alliance announced 36 so-called pioneer cities from 22 countries worldwide that would participate in a study to understand how the WEF can best govern smart cities.

That same year, the WEF announced it would begin developing smart cities in Japan, Latin America, and India. If you're wondering why Japan is on the list, it’s because the G20 WEF Alliance was formed during Japan's G20 presidency. Japan's interest in smart cities comes from its own Society 5.0 initiative, which was announced in 2017.

For many, the Society 5.0 initiative is a terrifying concept; as UNESCO describes it, “Japan’s new blueprint for a super-smart society, Society 5.0, is a more far-reaching concept than the Fourth Industrial Revolution, for it envisions completely transforming the Japanese way of life by blurring the frontier between cyberspace and the physical space.” Note that the Fourth Industrial Revolution is another initiative by the WEF.

The Pioneer City study concluded in July 2021, and the key findings were everything you'd expect. Almost no government accountability, almost no cybersecurity standards, and virtually no privacy. Very little accommodation for people who aren't plugged in and almost no transparency about data use.

Despite these disastrous results, the WEF continues to work on the “governance” of over 80 smart cities being developed in Japan, Latin America, and India. In May 2022, the WEF announced, "The alliance is planning to launch more networks in Asia, the Middle East, and Africa.”

One can even argue that the WEF used the pandemic to develop smart cities because the May update specifies that “The Global Smart Cities Alliance on Technology Governance is led by the Forum’s platform for Shaping the Future of Urban Transformation, established during the pandemic.

Which Cities Will Convert?

Now, if you're wondering which cities will be converted into smart cities and controlled by the WEF, the short answer is all of them. This is simply because the UN's SDGs require all 193 member countries to introduce smart cities by 2030. As such, the only question is when cities will be under the WEF’s control. The goal is to turn every city into a smart city by 2030, but it looks like the WEF and its UN affiliates are rolling out smart cities, one region at a time.

So right now, the WEF is working on Japan, Latin America, and India and will soon be working on Asia, the Middle East, and Africa. More to the point, except for Japan, the WEF is currently focused on building smart cities in developing countries. This is probably because populations in poorer countries are easier to control and because these populations are begging for some usable infrastructure.

The most prominent smart cities initiative in a developing country appears to be the one from India mentioned earlier. The smart cities mission of 2015 sought to turn 100 cities across India into smart cities. An August 2021 update notes that Delhi and Nagaland have completed over 70% of their projects, making them the smartest cities to date. While another seven states – Rajasthan, Gujarat, Karnataka, Madhya Pradesh, Goa, Tripura, and Andhra Pradesh – have finished 50-60%. However, many other states/UTs are not performing well. Meghalaya has not completed even a single project.

It makes one wonder when the WEF will shift its smart cities focus to developed countries in places like North America and Europe. It will probably happen once the WEF has experimented enough on developing countries to know how to roll out smart cities without causing a full-scale revolution. That said, some countries in developed regions are not so subtly working with the WEF already.

The largest smart cities initiative in a developed country comes from the European Union (EU). In September 2021, the EU announced its 100 climate-neutral and smart cities by 2013 mission. In April 2022, the complete list of participating cities was revealed. It’s worth mentioning that the EU’s list doesn't only include major cities; it also includes smaller towns and regions of only 100,000 people. It raises the argument that many may have only signed on because the EU will give €360 million to participants.

According to the McKinsey report, the smartest cities in Europe in 2018 were Stockholm, Amsterdam, and Copenhagen. The same report notes that New York City, San Francisco, and Chicago were the smartest cities in the United States in 2018.

Screenshot source: McKinsey report

According to the Smart Cities Index, the smartest cities in 2021 were Singapore, Oslo, and Zurich. The only issue they had was housing. However, this is not the only issue associated with smart cities, and the evidence so far suggests the WEF’s mission will fail.

A WEF Victory Hangs In The Balance

Believe it or not, the most significant pushback to the WEF smart cities has come from individuals and institutions aligned with the WEF on most other issues. This is because of the use of smart city data for criminal investigations, which you'll recall was highlighted in the Wikipedia definition above.

These critics have pointed out that smart city data tends to result in the over-policing of specific groups, which goes against the equitable principles of the smart cities concept. This is a bigger deal than you think because the primary benefit of smart cities is crime reduction, at least according to McKinsey. The 2018 smart cities report states, “Incidents of assault, robbery, burglary, and auto theft could be lowered by 30% to 40%.”

On top of these metrics are the invaluable benefits of giving residents freedom of movement and peace of mind. This is the largest chunk of the overall benefit. Otherwise, pro-WEF critics are also concerned about sharing personally identifiable data. Remember Google's smart city subsidiary, Sidewalk Labs? Their first project was a smart city in Toronto, Canada. The project was shut down in early 2020 after the privacy commissioner resigned in protest. It happened around the time that the average Indian citizen started to become skeptical of the country's smart cities mission.

By 2020 all the 100 cities selected were supposed to be smart cities. However, only a handful have met the necessary criteria, and there continued to be headlines about delays and corruption. In 2021, some public sector institutions started to oppose smart cities, with Yale University publishing an article titled “Why the Luster on Once Vaunted Smart Cities Is Fading.” The article explains how cities built from scratch to be smart have failed and have been a waste of time and money.

At the same time, other public sector institutions started to study why smart cities were failing so miserably. Lo and behold, most of these studies focused on the fact that smart cities are at odds with the ambitious social justice goals many smart city types support even more.

It's not just the public sector either; institutions in the private sector are starting to realize that the cost of rolling out the surveillance infrastructure required is not worth the estimated gains, especially if personally identifiable data can't be sold. Without the private sector on board, smart cities will fail.

Source: Youtube

One of the best articles yet about the failure of smart cities is titled “Why smart cities aren't the future.” It was published in December 2022 by journalist David Sax, who wrote a book about why smart cities suck, citing, “As many smart city solutions fail to live up to the hype, here’s why the future could rest in analog innovations, not technological ones.”

David refers to Burcu Baykurt, who teaches urban futures and communications at the University of Massachusetts and is the author of the forthcoming book titled “The City as Data Machine,” which is currently under embargo till April 2024.

She looks at the legacy of a smart city project Google and Cisco attempted in Kansas City, starting back in 2016, stating that the plan was to attempt a test bed downtown, using sensors, advanced cameras, public Wi-Fi networks, and digital kiosks to connect all sorts of city services and improve them for the mostly poorer Black and Latino residents of the area. The data would reveal gaps in parking, transportation, and policing, which would lead to quicker and better solutions by city staff.

In other words, it was supposed to be the textbook smart city, but here's what actually happened; Burku Baykurt concluded,

”To be honest, it doesn't change much. The hype mobilizes a lot of people. There seems to be change going on. Breathless proclamations are made. Articles are written. Politicians take photos with executives. But in the end, the data is just that: lots of data. And in the Kansas City case, the solutions proposed from that data were so impractical and disconnected from reality (driverless cars and drones rather than buses and more police patrols) that the project quietly died after a few years.”

David ends his article with a fantastic quote, which just so happens to touch on the primary issues that continue to plague the smartest of smart cities,

“The future of cities lies not in making cities obsolete by upending them through digital utopianism but in doubling down on the analog things that have always made cities great: housing opportunities, economic and cultural diversity, vibrant public spaces, a mishmash of humanity.”

Why Smart Cities Will Fail

In sum, the WEF’s smart cities will fail because they can't appease their ideological allies and cannot coordinate the creation of smart cities from the top down. Never mind that the average person doesn't want to live in a dystopian smart city that the WEF governs. However, this doesn't mean that the folk at the WEF aren't going to try.

This article about how to resist the great reset explains that the WEF is trying to take control of cities, states, and governments using its network of 10,000 young global leaders and shapers who are being maneuvered into positions of power.

So be on the lookout for these individuals, as well as any institutions they are associated with. They'll be easy to spot because they will be the ones pushing for digital ID, CBDCs, online censorship, carbon credit scores, smart cities, and all the other UN SDGs the WEF is trying to implement. Also, note that ESG criteria are synonymous with SDG criteria.

All this information can be overwhelming, so here’s a short video to lighten the mood and have a bit of a laugh.

As the old saying goes, “Don't be scared, be prepared.” What prepared means varies from person to person, but an excellent first step is being informed. A good second step is telling others who are willing to listen. After that, the rest is up to you.

(29).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

(1).jpg) Gold prices can still push to record highs at $2,100 an ounce by the end of the year – MKS' Shiels

Gold prices can still push to record highs at $2,100 an ounce by the end of the year – MKS' Shiels

(29).gif)

.jpg)