Will gold survive another 75 basis point hike

The gold market is ending a five-week losing streak and while sentiment appears to be shifting, some analysts say that the precious metal still faces a challenging environment next week.

August gold futures are looking to end the week with a more than 1% gain, last trading at $1,721.40 an ounce.

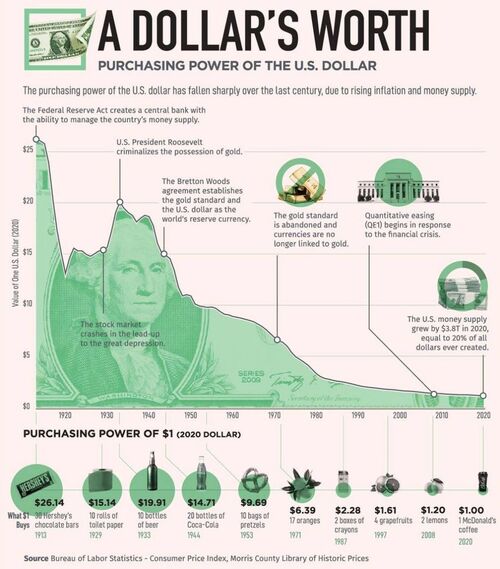

All eyes will be on the Federal Reserve next week as markets expect the U.S. central bank to raise interest rates by another 75 basis points. Some currency analysts have said that while the U.S. dollar has fallen from its recent 20-year highs, the Federal Reserve's aggressive stance will continue to support the greenback.

"Amid a backdrop of a hawkish Fed and slowing global growth, we think the dollar will resume its broad-based strength before long," said economists at Capital Economics in a report Friday.

Marc Chandler, managing director at Bannockburn Global Forex, said that while gold prices have room to move higher next week, the central bank's decision could limit gains.

"Not only will the Fed most likely hike by 75 basis points, but it will also signal it is not done with the adjustment. I imagine gold will struggle near $1750 and the 20-day moving average is just above there [$1,752]," he said.

However, some analysts see the Federal Reserve's tightening cycle as having less impact on the U.S. dollar and financial markets. Currency analysts at T.D. Securities see Wednesday's decision as more neutral for the greenback as the market has priced in a lot of hawkishness.

"This meeting carries far less weight compared to the last two and the bar seems high to drastically shift the landscape in F.X. tactically. That said, we see little reason for USD resilience to be undermined, even though we see little reason for it to surge higher from this meeting," the analysts said.

Faced with growing recession concerns, some analysts have said that the Federal Reserve could be closer to the end of its tightening cycle, which will be outright bullish for gold.

PIC

Is the bottom in? Gold could see a bullish correction, bouncing off $1,700 – Moor Analytics

"Gold prices are rising as global recession fears are resetting rate hiking expectations for all the major central banks. Gold is starting to act like a safe haven as weakening economic growth will force many central banks to abandon their aggressive tightening plans," said. "Edward Moya, senior market analyst at OANDA. "Gold might find resistance at the $1750 level, but if it doesn't, not much will get in the way until the $1800 level."

Friday, preliminary data from S&P Global Market Intelligence shows that activity in the U.S. manufacturing and service sectors dropped to their lowest level in two years. The drop in activity reflected a similar weakness in Europe.

"The market is sensing that the rate hiking cycle will end sooner because of rapidly slowing growth. Friday's U.S. services PMI was shockingly soft and means the Fed will pause around 3% and is likely to cut in 2023. When those cuts truly come into view, gold will surge on USD weakness," said Adam Button, chief currency strategist at Forexlive.com.

Thursday, markets will be anxiously waiting to see if the U.S. has fallen into a technical recession following the release of the first reading of second-quarter GDP. Many economists have dismissed first-quarter weakness as a trade imbalance; however, data from the Atlanta Federal Reserve, shows GDP contracting 1.6%, matching the decline in the first quarter. The traditional definition of a recession is two quarters of consecutive declines.

Last week Bank of America said that they see the U.S. falling into a mild recession by the end of the year.

Another European crisis

Along with the Federal Reserve's monetary policy decision, analysts have also said that they will be watching the ongoing geopolitical uncertainty that is unfolding in Europe. Thursday, Italy fell into political turmoil after Prime Minister Mario Draghi resigned following the collapse of his national unity government. The nation is expected to hold snap elections in the fall.

At the same time, economists are continuing to digest the European Central Bank's announcement of its Transmission Protection Instrument. The program will be used to buy bonds from members of the eurozone to make sure all yields are in line and avoid any fragmentation risks.

John Hathaway, Portfolio Manager of Sprott Hathaway Special Situations Strategy, said in an interview with Kitco News, that Europe could be close to a sovereign debt crisis as the central bank continues to expand its balance sheet.

"Gold prices could easily push back above record highs if there is any crisis in foreign exchange markets," he said. "The next black swan out there will be connected to unruly F.X. markets."

Christopher Vecchio, senior market analyst at DailyFX.com, said he also sees a growing risk of a sovereign debt crisis in Europe. He added that in this environment, both gold and the U.S. dollar will benefit.

"As long as there are concerns about the euro, there is room for gold and the U.S. dollar to both trend higher," he said.

"As long as there are concerns about the euro, there is room for gold and the U.S. dollar to both trend higher," he said.

Data to watch

Other economic data economists will be watching next week include consumer confidence from the U.S. Conference Board, pending home sales and personal income and spending data.

Tuesday: Consumer Confidence, New Home Sales,

Wednesday: Durable Goods Orders, Pending Home Sales, FOMC decision and statement

Thursday: Advance Q2 GDP, Weekly Jobless Claims

Friday: Personal Consumption, Person Income, PCE Inflation

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

Jim Rogers: A 'positive development' in Ukraine 'in the next few weeks' could cause a big rally, before a huge crash in stocks

Jim Rogers: A 'positive development' in Ukraine 'in the next few weeks' could cause a big rally, before a huge crash in stocks

.jpg) Investors lose more than $42 million to fake crypto apps in less than a year, says FBI

Investors lose more than $42 million to fake crypto apps in less than a year, says FBI.gif)

.gif)

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP.gif)

.gif)

The gold market has turned bearish

The gold market has turned bearish.gif)

.gif)

.gif)

.gif)