Opportunity with Godesana.com: A Detailed Description

%20(Facebook%20Post).png)

GoDesana.com is a company that offers an income opportunity for those interested in the wellness industry. The company claims to provide pure, organic, and wild-crafted essential oils and other wellness products. GoDesana.com has eliminated the hurdles to getting started with no sign-up fees, no auto-delivery requirement, no investment, and no personal purchase requirements to earn.

The company's compensation plan is designed to reward affiliates for their efforts in building their business. According to the company's website, affiliates can earn money through retail sales, team commissions, bonuses, and incentives. GoDesana.com claims that their compensation plan is one of the most lucrative in the industry, paying out every day of the week.

Key Takeaways

- GoDesana.com offers an income opportunity for those interested in the wellness industry.

- The company provides pure, organic, and wild-crafted essential oils and other wellness products.

- The compensation plan is designed to reward affiliates for their efforts in building their business.

About GoDesana

GoDesana is a company that offers essential oils, personal care, weight loss, nutrition, and home products. The company was founded by Paula Scarcella and Alexandria Brighton in 2007, and its headquarters is located in Chandler, Arizona, USA.

Founders and History

Paula Scarcella and Alexandria Brighton are the founders of GoDesana. Scarcella has over 30 years of experience in the network marketing industry, while Brighton is a certified aromatherapist with over 30 years of experience in the field of natural health. Together, they created GoDesana with a mission to provide pure, natural, and organic products to people around the world.

GoDesana has been in business for over a decade and has built a reputation for providing high-quality products to its customers. The company has received positive reviews from customers who appreciate the quality and effectiveness of its products.

Affiliation with Green Organics International

GoDesana is affiliated with Green Organics International, a company that specializes in organic and natural products. Green Organics International is a network marketing company that offers a variety of products, including health and wellness, personal care, and home care products.

As an affiliate of Green Organics International, GoDesana offers its products through a network of independent distributors. This allows customers to purchase GoDesana products directly from distributors and also provides an opportunity for individuals to earn income by selling GoDesana products.

Overall, GoDesana is a reputable company that offers high-quality products and an opportunity for individuals to earn income through its network marketing program.

Product Overview

GoDesana.com offers a wide range of products that are designed to cater to different aspects of health and wellness. Their product line includes essential oils, aromatherapy, tea and herbal products, nutrition and supplements, personal care, and weight loss products.

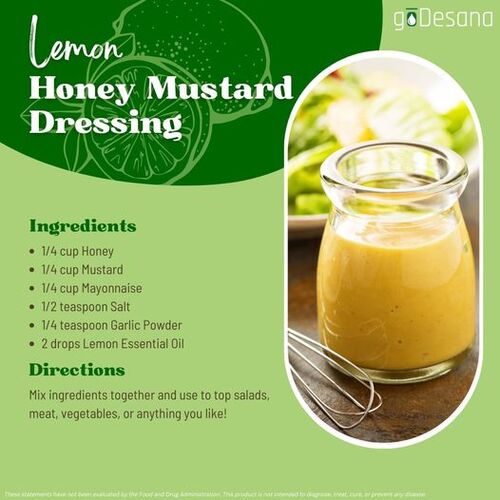

Essential Oils and Aromatherapy

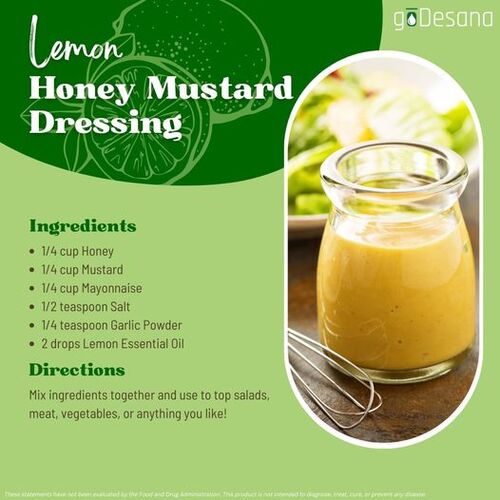

GoDesana.com offers a variety of essential oils that are 100% pure, organic, and wild-crafted. Essential oils are derived from plants and are used for aromatherapy, massage, and other therapeutic purposes. They are known for their calming and soothing effects and can help relieve stress, anxiety, and other emotional issues.

Tea and Herbal Products

GoDesana.com offers a range of tea and herbal products that are designed to promote health and wellness. Their tea blends are made from organic and wild-crafted herbs and are designed to support different aspects of health, such as digestion, immune system, and relaxation.

Nutrition and Supplements

GoDesana.com offers a range of nutrition and supplement products that are designed to support overall health and wellness. Their products are made from high-quality ingredients and are designed to provide essential nutrients that may be missing from the diet.

Personal Care and Weight Loss Products

GoDesana.com offers a range of personal care and weight loss products that are designed to support overall health and wellness. Their personal care products are made from natural and organic ingredients and are designed to be gentle on the skin. Their weight loss products are designed to support weight loss goals and are made from natural and organic ingredients.

Overall, GoDesana.com offers a wide range of products that are designed to support overall health and wellness. Their products are made from high-quality ingredients and are designed to be safe and effective.

Compensation Plan

GoDésana offers a generous and fair compensation plan that provides its product consultants with multiple ways to earn. The plan is based on a unilevel compensation structure that allows consultants to earn commissions on their personal sales as well as the sales of their downline.

Unilevel Compensation Structure

The GoDésana compensation plan is based on a unilevel structure that allows product consultants to earn commissions on up to 10 levels of their downline. This means that consultants earn a percentage of the sales volume generated by their downline, with the percentage increasing as they move up in rank.

Affiliate Ranks

GoDésana has ten affiliate ranks, each with its own set of requirements. The ranks, in ascending order, are: Product Consultant, Silver, Gold, Jasper, Amber, Ruby, Emerald, Diamond, Double Diamond, and Platinum Diamond.

To move up in rank, consultants must meet certain requirements, such as achieving a certain amount of personal volume (PV) and group volume (GV), and sponsoring new consultants. As consultants move up in rank, they become eligible for higher commissions and bonuses.

Commissions and Bonuses

GoDésana pays its product consultants in eight different ways, including retail profits, preferred customer bonuses, and cycle bonuses. The cycle bonus is a unique feature of the GoDésana compensation plan and provides consultants with a proven formula to quickly earn $750.00 or more on a daily basis.

In addition to the cycle bonus, GoDésana offers other bonuses, such as the rank advancement bonus, which rewards consultants for achieving higher ranks, and the leadership bonus, which rewards top leaders for their efforts in building and supporting their downline.

Overall, the GoDésana compensation plan is designed to provide its product consultants with a fair and equitable way to earn income while promoting the company's high-quality, organic products.

Opportunities for Success

Building a 6-Figure Business

At goDésana, there is an opportunity to build a successful business and achieve financial freedom. With the right mindset and dedication, it is possible to create a 6-figure business. The company's compensation plan offers several ways to earn income, including retail sales, team commissions, and bonuses.

One way to grow a successful business is by building a team of like-minded individuals who share your passion for wellness and natural products. By mentoring and supporting your team members, you can help them achieve their goals while also growing your own business.

Another key to success is staying up-to-date with the latest products and industry trends. goDésana provides ongoing training and resources to help consultants stay informed and grow their business.

Partnering with Local Businesses

goDésana also offers opportunities to partner with local businesses and expand your reach in the community. By collaborating with spas, fitness centers, and other wellness-focused businesses, you can introduce your products to a wider audience and build valuable relationships.

Partnering with local businesses can also lead to new opportunities for growth and expansion. For example, you may be able to co-host events or workshops to promote your products and services. This can help you connect with potential customers and build a loyal following.

Overall, goDésana provides a range of opportunities for success, whether you are looking to build a 6-figure business or partner with local businesses. With the right mindset, dedication, and support, you can achieve your goals and create a thriving business in the wellness industry.

Educational Resources

goDesana provides its members with a wealth of educational resources that can help them grow their business and improve their knowledge of essential oils.

One of the key educational resources available to goDesana members is Alexandria Brighton, the company's exclusive formulator. With over 30 years of experience in the Ayurvedic Medicine, Aromatherapy, herbal, and natural remedy world, Alexandria Brighton is a deeply intuitive and knowledgeable educator who can help members learn more about the benefits of essential oils and how they can be used to improve health and wellbeing.

In addition to Alexandria Brighton, goDesana also offers a range of training materials to help members learn more about the company's products and compensation plan. These materials include webinars, training videos, and other resources that can be accessed through the goDesana website.

Finally, goDesana members can also benefit from the resources available through the Brighton Institute of Botanical Studies. Founded by Alexandria Brighton, the institute offers a range of courses and programs in aromatherapy, herbalism, and other related fields. By taking advantage of these resources, goDesana members can deepen their knowledge of essential oils and related topics, and gain the skills they need to succeed in the essential oils industry.

Is GoDesana a Scam or Legitimate?

When it comes to MLM companies, there is always a concern about whether the company is legitimate or just a scam. With GoDesana, there are mixed opinions on the matter.

On one hand, GoDesana has been around since 2014 and has a variety of products, including essential oils, personal care, weight loss, nutrition, and home products. They also have a compensation plan that claims to offer many earning opportunities for their affiliates.

On the other hand, there are some concerns about the company's practices. For example, some people have reported that GoDesana heavily incentivizes 31-day affiliate purchases, which could be seen as a red flag. Additionally, there have been accusations of GoDesana being a pyramid scheme, which is illegal in many countries.

Despite these concerns, it's important to note that GoDesana is still in business and has many satisfied customers and affiliates. It's up to each individual to do their own research and decide whether they want to get involved with the company.

Overall, while there are some concerns about GoDesana, it's not fair to label the company as a scam without further evidence. However, it's important to approach any MLM opportunity with caution and do thorough research before investing time and money.

Tim Moseley

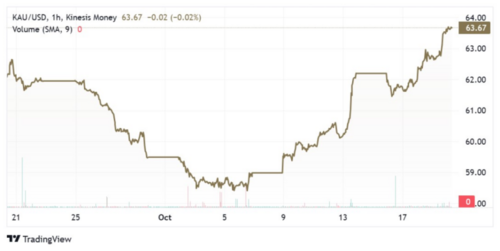

Gold prices consolidating just below $2,000, caught between opposing forces

Gold prices consolidating just below $2,000, caught between opposing forces

Gold prices ending the week around $2,000 as geopolitical uncertainty overshadows rising bond yields

Gold prices ending the week around $2,000 as geopolitical uncertainty overshadows rising bond yields

.jpg) The monetary system today: 'Council of elders deciding the price of money' – Lyn Alden

The monetary system today: 'Council of elders deciding the price of money' – Lyn Alden%20(Facebook%20Post).png)

.jpg) Time to increase allocation to gold – JPMorgan's Kolanovic

Time to increase allocation to gold – JPMorgan's Kolanovic

(1).gif)