The Big Reveal Of The Twitter Files MSM Ignores. Time To Be Awakened

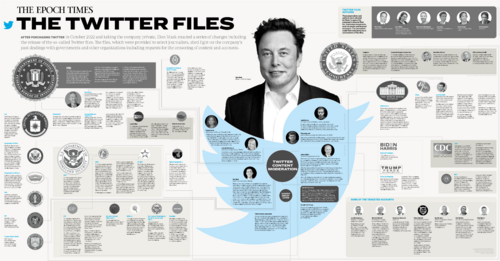

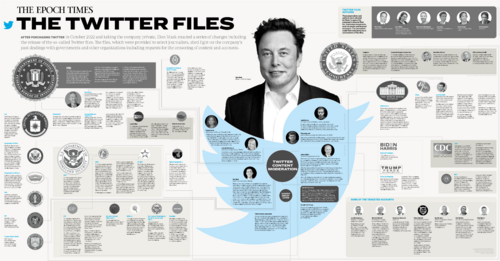

A particular comment by stalwart Elon Musk went viral after he orchestrated the first Twitter files release in December 2022. “Almost every conspiracy theory that people had about Twitter turned out to be true.” Since that time, 19 more Twitter Files have been released. They've revealed a concerning relationship between the government and big tech, which will likely evolve as online censorship laws come into force.

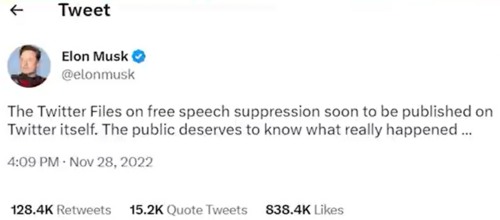

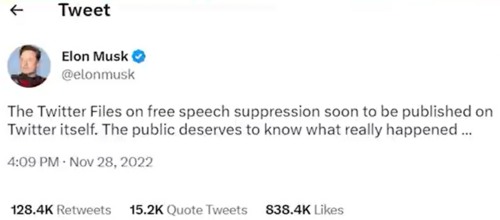

This article outlines the Twitter Files, including why they're being released, who's been publishing them, what they say, and how the powers that be will push back. As many will know, Tesla and SpaceX CEO Elon Musk finalized his acquisition of Twitter in October 2022. In the months preceding the acquisition, Elon promised to bring more transparency to the social media platform to increase trust. In November, he delivered. He tweeted,

Image source: Twitter

In December 2022, American author and journalist Matt Taibbi released the first set of Twitter files in a thread. Naturally, the first set of Twitter Files explained what they are precisely and discussed the now infamous suppression of a story about President Joe Biden's son Hunter Biden leading up to the 2020 election.

What Are The Twitter Files?

So, what are the Twitter Files, and why are they significant? In short, the Twitter Files are a collection of internal documents that prove that the US government was working closely with the social media platform to censor certain information. It’s significant because free speech is protected under the First Amendment in the United States.

To be clear, Twitter is a private company, meaning it is not obligated to abide by the First Amendment. However, the US government is obliged to comply with the First Amendment. According to some constitutional experts, its use of Twitter to suppress free speech could therefore be illegal.

Another reason the Twitter files are significant is that they suggest the US government could be censoring other social media platforms. This article explains the collaboration of 3 letter agencies with legacy social media and evidence to support this hypothesis; the Twitter Files add to the pile.

As previously mentioned, there have been 19 sets of Twitter files so far, and they've been posted as lengthy threads by multiple renowned journalists. Besides Matt Taibbi, the list includes Michael Shellenburger, Bari Weiss, Lee Fang, David Zweig, and Alex Berenson, all well respected. But of course, they've all since become substantive enemies of the state for being involved in this.

Image source: The Epoch Times

It's important to point out that the Twitter files aren't just sitting there waiting to be reported. In an interview with Kim Iverson, David Zweig revealed that even though they have unrestricted access to Twitter data, thanks to Elon, it's been challenging to dig up the information they're looking for.

This is partly because Twitter systems weren't designed to be searched. In other words, it’s like they have access to the entire internet but no search engine to search through it. The difficulty is also due to the obstruction and sabotage that the journalists faced from Twitter employees, most of whom have since been fired.

The silver lining is that it's been easy for them to know when they found something. Matt Taibbi gave an amusing example in an interview with Joe Rogan: A document containing phone numbers for a secret social media censorship group chat for big tech companies was simply and openly titled ‘Secret Phone Numbers.’ So with that information in mind, we’ll look at what they found.

Incidentally, both political parties were involved in social media censorship. As was almost every single branch of the US government, particularly the intelligence agencies. The difference is that Republican-affiliated entities sought to suppress the discussion of specific subjects, namely panic buying at grocery stores at the start of the pandemic. By contrast, Democrat-affiliated entities demanded the suppression of particular people, specific tweets, and retweets.

.png)

Image source: Running List of All Twitter Files Releases – Jordan Sather

Part One Of The Twitter Files

The first set of Twitter Files discussed the suppression of a story about Hunter Biden. The short story about Hunter Biden is that he left a laptop at a computer repair shop containing information that suggested that his dad, “the big guy,” was doing shady stuff.

The New York Post published the story in October 2020, shortly before the November 2020 election. Twitter and other social media outlets suppressed the story at the request of Democrat interests. Given the testimony of former Twitter executives, many Republicans have since argued that the 2020 election outcome would have been different were it not for the censorship of the story.

Part Two Of The Twitter Files

The second set of Twitter Files was published a few days later. The topic was Twitter's secret blacklisting policy, also known as Shadow Banning. For context, Twitter executives had denied that the platform shadowbanned users for years and would never do so for political purposes.

However, the second set of Twitter Files confirmed that Twitter had a shadowbanning system designed to limit the reach of specified users. This suppression was almost always political. It also went into overdrive during the pandemic, with users skeptical of pandemic restrictions being targeted.

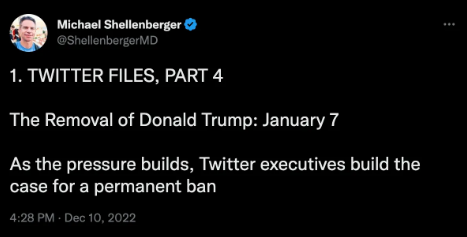

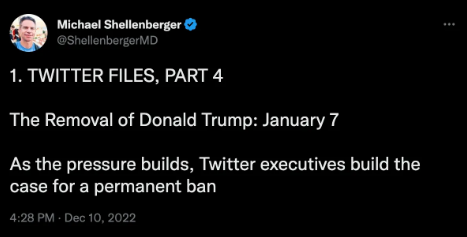

Parts 3, 4, and 5 Of The Twitter Files

The third set of Twitter Files was published the same day as the second. The topic was the controversial removal of the then-US President, Donald Trump, from the platform. This was also the topic for the fourth and fifth sets of Twitter files, all outlined here for the sake of simplicity.

To begin with, Twitter's top staff worked tirelessly to suppress Trump's reach on Twitter. Following the contentious events of January 6th, 2020, Twitter's team devised a new content policy to justify banning Trump. The files seemed to imply that they were pushed to do this by Democrat interests.

This undertaking involved axing Twitter's Public Interest policy, which stated that information should remain on the platform, no matter how controversial, so long as it's not illegal. The Public Interest policy was replaced by a new approach called the ‘Glorification of Violence' policy, with Trump as the first offender.

As explained by Matt in the interview with Joe Rogan, mentioned above, the glorification of violence policy includes an assessment of who follows a person on Twitter to determine whether that person incited violence. So, if even a single account that’s “deemed violent” follows Trump, it means that person was violating the policy.

Some may think the new policy is justified, but if you take a moment to consider that almost every account on Twitter probably has at least one follower that Twitter could consider to be violent. In other words, the policy could be applied to whichever accounts Twitter wants to eliminate, which is brutal.

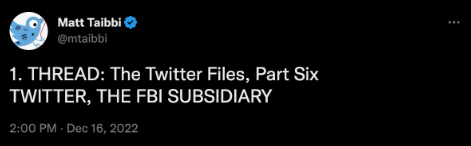

Part Six Of The Twitter Files

The sixth set of Twitter Files is even more formidable. They revealed that Twitter was in such frequent contact with the FBI that the social media company could be considered a subsidiary of the intelligence agency.

The FBI provided hundreds of takedown requests, and Twitter always complied. Also, the number of former FBI agents working at Twitter was so large that they'd created their own Slack channel. For reference, Slack is a platform used to coordinate workplace communications.

Much of the sensitive info in the Twitter files came from these Slack discussions. These files also revealed that Twitter complied with censorship requests from NGOs. Matt concluded, “What most people think of as the Deep State is really a tangled collaboration of state agencies, private contractors, and NGOs. The lines become so blurred as to be meaningless.”

Part Seven Of The Twitter Files

The seventh set of Twitter Files returns to the topic of the suppressed Hunter Biden story. This is because the independent journalist discovered that both Twitter and the FBI were aware that the contents of the laptop were likely genuine but insisted that it was Russian disinformation.

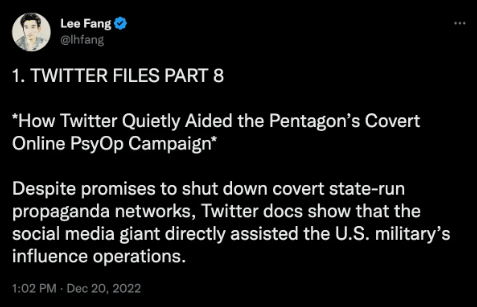

Part Eight Of The Twitter Files

The eighth set of Twitter Files was about another formidable subject, and that's how Twitter aided and abetted the US military to execute propaganda operations overseas. They shape narratives about foreign conflicts that put the US in a positive light and even use fake accounts with AI-generated deep fakes to this end.

In August 2022, a Stanford Internet Observatory report.pdf exposed a U.S. military covert propaganda network on Facebook, Telegram, Twitter & other apps using fake news portals and deep fake images and memes against U.S. foreign adversaries. The U.S. propaganda network relentlessly pushed narratives against Russia, China, and other foreign countries. They accused Iran of "threatening Iraq’s water security and flooding the country with crystal meth" and of harvesting the organs of Afghan refugees.

Part 9 Of The Twitter Files

The ninth set of Twitter Files was about Twitter's relationship with all the other US government agencies. This set of Twitter Files seems to have responded to the FBI's response to the previous set of files which the feds predictably claimed were all a “conspiracy theory to discredit the agency.”

Funnily enough, the Twitter Files found that the FBI acted as a concierge between Twitter and other US government agencies, allowing them all to submit content takedown requests. This included censorship of discussions about atrocities related to the war in Ukraine.

The long list of US Government agencies included local police departments, which had the power to search and censor users and posts. These privileges were granted by all the big tech companies involved in online censorship meetings, including Facebook, Microsoft, and even Reddit.

Part Ten Of The Twitter Files

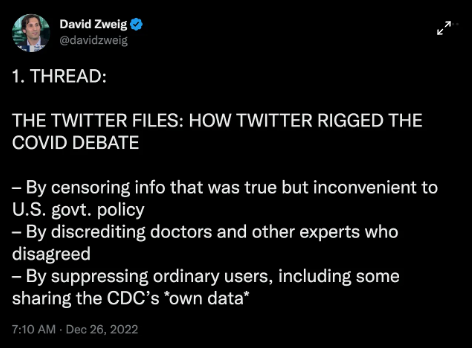

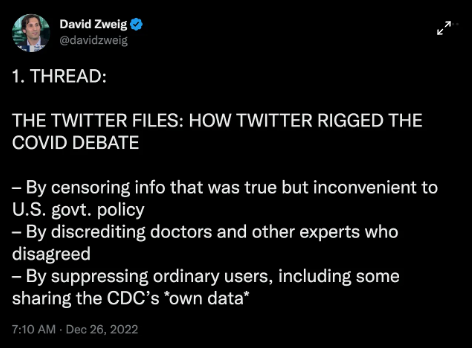

The 10th set of Twitter Files is about the very contentious topic of the pandemic. These Twitter files found that accurate information was suppressed and censored if it went against the official pandemic narrative. The instructions for this suppression came directly from the White House, both under former President Trump and current President Biden. Whereas the Trump White House was concerned about panic-buying, the Biden White House asked Twitter to censor specific people and posts.

That list of people included former New York Times journalist Alex Berenson and Dr. Martin Kulldorff, an epidemiologist at Harvard Medical School. The posts included those that cited official government statistics or statements about the pandemic, which discredited the official narrative, what they call ‘the science.’

Part 11 Of The Twitter Files

The 11th set of Twitter Files explains the history of the social media platform’s partnership with intelligence agencies. This set of files suggests this collusion only began in 2017 when Democrat interests insisted that Trump had won the 2016 election due to Russian interference.

According to the Twitter files, there appears to be no evidence of significant Russian interference in the 2016 election. On the contrary, Russian interference was used by US government agencies as an excuse to infiltrate big tech companies further and dictate how information is shared online.

Part 12 Of The Twitter Files

This ties into the 12th set of Twitter Files, suggesting that Twitter was coerced into complying with the US government. Twitter was struggling with the problem of public and private agencies bypassing them and going straight to the media with lists of so-called suspicious accounts. They would have politicians push for anti-big tech legislation and leak information to the press whenever Twitter refused to comply with their censorship requests.

This combination of private and public pressure intensified when the pandemic began. US government agencies pressured Twitter to suppress information about the pandemic's origins. The US government has since pulled a complete 180° with the FBI confirming original suspicions were indeed correct.

Part 13 Of The Twitter Files

The 13th set of Twitter Files conducted by Alex Berenson discusses how Twitter suppressed the debate about treatments for Covid, particularly the tweet from Dr. Brett Giroir claiming that natural immunity was superior to vaccine immunity was "corrosive" and might "go viral." After being pressured by a top Pfizer board member, Dr. Scott Gottlieb, Twitter censored content challenging the narrative, saying it might hurt sales of Pfizer’s mRNA vaccines which his company directly benefits from.

He also went after another tweet about Covid’s low risk to children. Pfizer would soon win the okay for its mRNA shots for children, so keeping parents scared was crucial. Gottlieb claimed on Twitter and CNBC that he was not trying to suppress debate on mRNA jabs. These files prove that Gottlieb, a board member at a company that has made $70 billion on the shots, did just that.

Part 14 Of The Twitter Files

The 14th set of Twitter Files was released in mid-January. They reveal how trending hashtags on Twitter that went against popular narratives were attributed to Russian bots and suppressed despite Twitter having zero internal evidence of Russian involvement. Twitter warned politicians and media they not only lacked evidence but had evidence the accounts weren’t Russian but were roundly ignored.

You may remember that Russian bots were blamed for almost everything a few years ago. These Twitter Files recount how this baseless claim became overblown to the point that mainstream media alleged Russian bots controlled both sides of the narrative.

The Russians were also blamed for #ReleaseThe Memo, #Schumer Shutdown, #Parkland Shooting, and even #Gun Control Now to “widen the divide,” according to the New York

Times. The Russiagate scandal was built on the cowardly dishonesty of politicians and reporters, who ignored the absence of data to fictional scare headlines for years.

Part 15 & 16 Of The Twitter Files

This relates to the 15th set of Twitter Files, which reveals that intelligence agencies started alleging Russian bots were running large republican-leaning accounts. These allegations were so extreme that even Twitter's censorship policy teams pushed back against suppression requests.

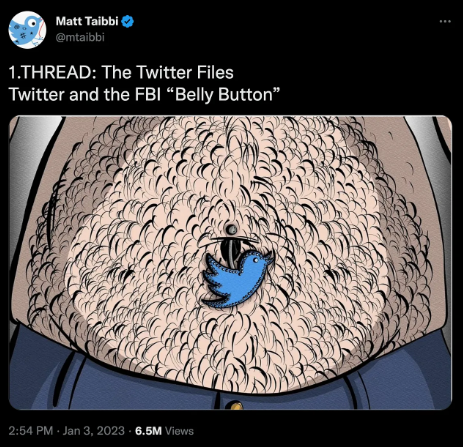

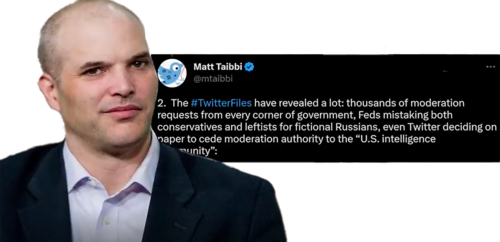

In mid-February, Matt Taibbi published the 16th set of Twitter Files and provided an excellent summary of the previous 15 files.

“The Twitter files have revealed a lot: thousands of moderation requests from every corner of government, Feds mistaking both conservatives and leftists for fictional Russians, even Twitter deciding on paper to cede moderation authority to the US intelligence community.”

Matt also laments that there's been next to no mainstream media coverage of the Twitter Files except that Donald Trump had requested Twitter take down a spiteful tweet. Matt then highlighted a few more egregious cases of such requests to see if the media would cover them. All he got was crickets.

Part 17 Of The Twitter Files

The 17th set of Twitter files was published in early February 2023 and is relative to a US Government agency, The Global Engagement Center (GEC), created in Obama’s last year of presidency. The GEC is an interagency group whose initial partners include the FBI, DHS, NSA, CIA, DARPA, and Special Operations Command (SOCOM), et al.

They reveal that it used Twitter for geo-political purposes, with agencies instructing the social media platform to suppress and censor posts and accounts assumed to be affiliated with foreign intelligence. Similarly to the obsession with Russian bots, hundreds, if not thousands, of Twitter accounts were incorrectly labeled as associated with Indian or Chinese intelligence.

The Twitter Files thread reveals that the bombshell reports have managed to attract the attention of US politicians, who summoned two journalists, Matt Taibi and Michael Shellenburger, to a hearing on March 9th, 2023.

Part 18 Of The Twitter Files

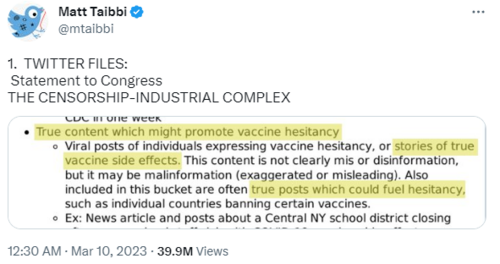

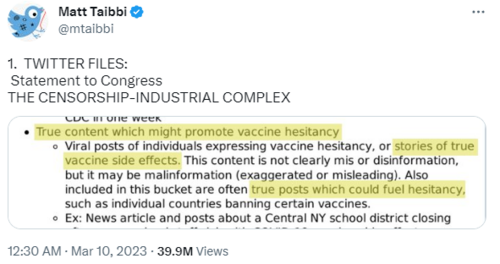

The 18th set of Twitter Files relates to the Censorship Industrial Complex, which demonstrates that Twitter was a partner to the government. Along with other tech firms, it held a regular “industry meeting” with the FBI and DHS. It developed a formal system for receiving thousands of content reports from every corner of government: HHS, Treasury, NSA, and even local police.

At its essence, the Censorship-Industrial Complex is a bureaucracy willing to sacrifice factual truth to serve broader narrative objectives. It’s the opposite of what a free press does. The Twitter Files show the principles of this incestuous self-appointed truth squad. It’s moving from law enforcement/intelligence to the private sector and back, claiming a special right to do what they say is bad practice for everyone else: be fact-checked only by themselves.

Part 19 Of The Twitter Files

Since then, new information released on the Twitter Files on March 17th, 2022, revealed that the US government and major social media companies worked hand-in-hand with Stanford University to censor or limit accurate information about COVID-19.

Independent Journalist Matt Taibbi tweeted,

"The Virality Project in 2021 worked with government to launch a pan-industry monitoring plan for Covid-related content. At least six major Internet platforms were 'onboarded' … daily sending millions of items for review."

For reference, the Virality Project is a ‘coalition of research entities focused on supporting real-time information exchange between the research community, public health officials, government agencies, civil society organizations, and social media platforms,’ per their website.

The goal of the project, created by Stanford University, was to identify people on social media who said things about COVID-19 that the government did not want them to say. Perhaps the most glaring issue Matt Taibbi highlighted in the Twitter Files drop was that the Virality Project was “repeatedly, extravagantly wrong.”

Autocrats Push Back

How will the ‘powers that be’ push back against the Twitter Files? The thing is, they’ve been pushing back Elon Musk for the entire time. One of the main ways they've been doing this is by going after Elon's other enterprises. Tesla has been hit with a barrage of baseless lawsuits and regulatory threats.

Twitter has also been the target of a relentless propaganda campaign, claiming its fresh free-speech approach is destroying the world in every possible way. Many would say that’s unfair, considering that Twitter and other mainstream social media platforms had made the world a nastier place long before Elon got involved.

Most of this propaganda came from the European Union, which will begin enforcing its online censorship laws mid-year. Conceivably, the pressure on Elon and Twitter will only increase as we get closer to the 2024 election in the United States. It's clear that Twitter significantly influences political discourse in the USA. What's said on the platform could affect the next election's outcome, which gives Elon lots of power.

Considering that he voted Republican for the first time last year, it's likely that he will be promoting whichever conservative candidate is selected to run. Bearing in mind that most US agencies seem to be aligned with the Democrats, it's likely they will do everything they can to prevent a Republican victory.

This begs the question of how exactly they will take down Twitter. After all, Elon is a formidable foe; he's one of the wealthiest men in the world, has many connections, and has a massive loyal following. He can access advanced technologies thanks to all the companies he owns and operates. And therein lies the answer; cutting-edge technologies.

Putting on the ‘tin foil hat’ for a moment, it's plausible that US Agencies could attempt to take down Twitter by flooding it with deep fakes or images related to elections. This could give them the perfect excuse to return to Twitter, saying they're not taking content moderation seriously. US Agencies already have a history of doing this. (recall the eighth set of Twitter files above.)

Luckily Elon is a smart guy and probably saw this coming from a million miles away, and arguably one of the reasons why the paid verification badges were introduced. It makes it easy to identify which accounts are malicious. A digital forensics technique can also identify deep fakes, providing it stays vigilant of fast-paced emerging technology. This will make it easy for Twitter to scrub most, if not all, deep fake content before the 2024 election. The caveat is that it could simultaneously require everyone using Twitter to complete KYC to use the platform.

At that point, the US government agencies would need to find a way to remove Elon from Twitter and install someone who will use this information for their own agenda. This takeover could happen to all legacy social media.

In politics, deepfakes are the inevitable next step in the attack on truth. In addition, deepfakes weaponize information to maximize the dynamics of a social media ecosystem that prizes traffic above nearly all else.

The Panacea For This Coup d'etat

The only solution to this takeover is decentralized alternatives. Many platforms are popping up to combat government agencies' perverse centralization and infiltration. Former Twitter CEO Jack Dorsey has backed the development of an alternative micro-blogging platform like Twitter called Bluesky. Dorsey described it as “an open decentralized standard for social media.”

Markethive has gone one step further by incorporating an inbound marketing, social network, and content broadcasting platform for entrepreneurs. The ecosystem is a conceptual cottage industry, including a merchant accounting system and cryptocurrency. It has adopted the necessary measures to thwart any power plays by autocrats and heading toward total decentralization. CEO of Markethive, Tom Prendergast, says,

"Now more than ever, we rely on Web3 technology, so the safest and most logical way to go to achieve financial freedom, peace of mind, and self-sovereignty is online with a Blockchain-driven Market Network that is divinely inspired and will withstand and survive the perils, the world is now facing. We are in a time of biblical proportions Markethive is building the proverbial ark."

The transition from centralization to decentralization would be highly bullish for the cryptocurrency blockchains that support decentralized social media platforms. Given the calamity of the geopolitical corruptness and failing monetary system, an alternative crypto economy is making more sense than ever.

(24).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.jpg) Gold bulls are in the driver's seat; market sentiment looking for prices to hold around $2,000

Gold bulls are in the driver's seat; market sentiment looking for prices to hold around $2,000

.png)

(24).gif)

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

.gif) Once $2,000 breaks, gold is off to the races – Willem Middelkoop

Once $2,000 breaks, gold is off to the races – Willem Middelkoop