The Causation Of Financial Nihilism Is Globalization. Is This The End Of Globalism?

For die-hard cryptocurrency enthusiasts, the drive to invest often stems from a deep-seated conviction that it's the sole path to achieving financial success. This sentiment is widespread, particularly among younger age groups. An increasing number of individuals are convinced that the only route to accumulating substantial wealth is to take bold risks with their limited financial resources, and this mindset is gaining momentum. Interestingly, this mindset has a distinct label: financial nihilism. This trend has been gaining traction over the years and experienced a sharp surge following the pandemic, primarily due to the influx of pandemic-related stimulus funds.

The underlying principles of financial nihilism have the potential to impact societal dynamics and market performance significantly. In this discussion, we'll delve into the specifics of this mindset, its origins, the consequences of holding onto it, and the benefits of resolving it. We'll also suggest strategies for coping with these challenges in the meantime.

What Is Financial Nihilism?

Financial nihilism refers to a mindset that suggests achieving financial success requires taking drastic, high-risk gambles with limited resources. This term, introduced by entrepreneur and podcaster Demitri Kofinas, has been gaining traction, especially in cryptocurrency.

Demitri's original definition of financial nihilism diverges from the abovementioned understanding. According to Demitri, financial nihilism is the belief or the realization that there is a disconnect between how much something costs and how much it's actually worth.

The housing market provides an excellent illustration; social media has been flooded with images of residences in city dwellings like Toronto, London, Sydney, and New York City that boast astronomical price tags despite their subpar condition. Conversely, other online posts have drawn attention to the fact that these properties are priced similarly to authentic, centuries-old castles, prompting many to question the value proposition.

Another notable illustration of this phenomenon is the stock market, where most shares are valued significantly higher than the earnings of their respective companies. This trend is even more pronounced in crypto. A striking example is Dogecoin, which currently boasts a market capitalization surpassing the media giant Warner Brothers.

Meanwhile, the cost of housing, stock prices, and the worth of meme coins continue to soar. Whenever it seems like this economic bubble is on the verge of collapse, governments and central banks intervene to reinflate it, ultimately widening the wealth gap between the affluent and the disadvantaged.

Source: Kirupa

This raises the issue of how the disconnect between price and value originated. According to Demitri, the root cause lies in globalization. For the context of this article, consider globalization as an economic approach that spans the world rather than individual nations. In essence, this involves relocating business operations from countries with high labor costs to those with lower costs, thereby reducing expenses and boosting profit margins.

Globalism has significantly impacted the world since the late 1980s, although it may not be immediately apparent. One critical effect is the notable drop in prices of many goods and services, which benefits the general population by allowing them to purchase more items than before. Additionally, globalism has led to increased financial gains for influential individuals. Furthermore, it has played a role in maintaining low interest rates, especially in Western countries.

This is because the nations selling goods to Western countries used the proceeds to purchase Western government debt, thereby keeping interest rates low. This situation benefited ordinary individuals by allowing them to access more borrowing opportunities. Still, it has been even more advantageous for influential individuals who can borrow significantly more.

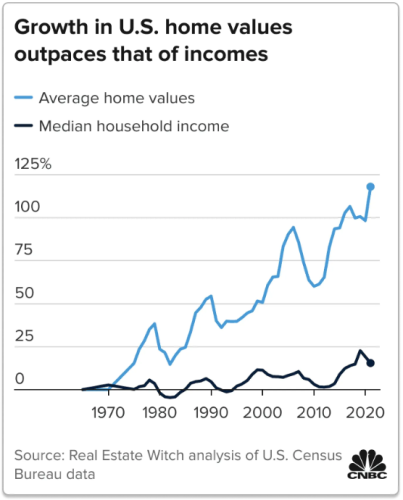

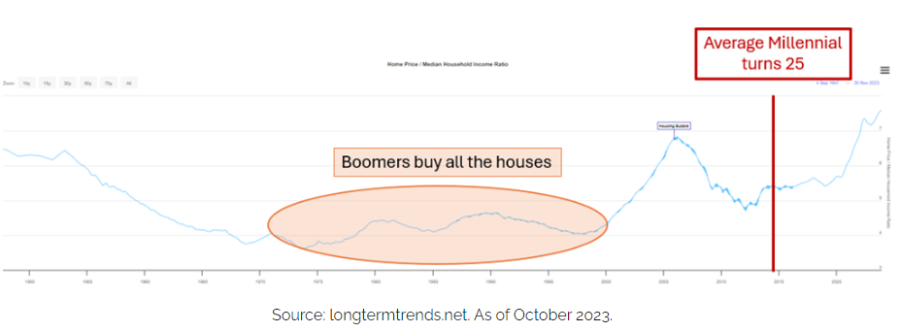

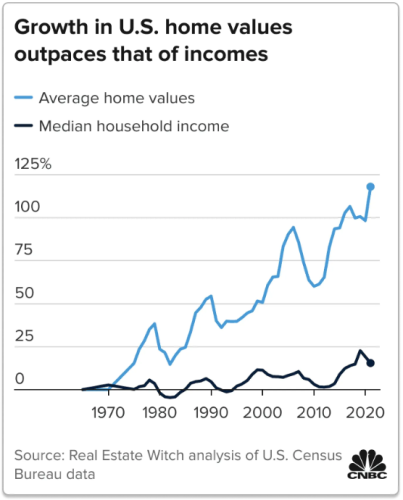

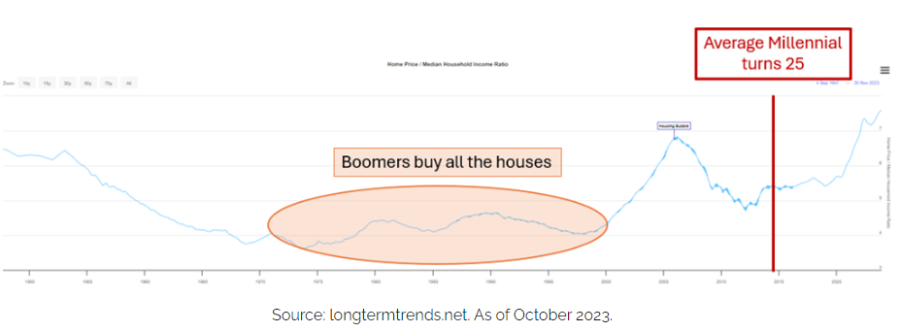

Unlike ordinary individuals who use borrowed funds to acquire consumer goods, influential individuals invest in assets, leading to two notable consequences. Firstly, the prices of essential assets, such as housing, have increased at a rate surpassing wage growth, while the costs of most consumer goods have declined due to international outsourcing. This disparity has resulted in the current disconnect between asset values and the overall economy.

Secondly, this phenomenon has led to an unusual wealth accumulation among a select few powerful individuals who have greatly benefited from globalization, earning them the label of "globalists." Unsurprisingly, many globalists hold leadership positions or have significant investments in the world's largest corporations.

In past videos, Demitri pointed out that a small group of powerful elites have accumulated vast wealth and influence, enabling them to establish parallel systems of governance that wield more power than democratically elected governments. The World Economic Forum is a prime illustration of this phenomenon, and it's just the tip of the iceberg.

By their very nature, these parallel institutions exist to promote the elite's agenda rather than serve the needs of ordinary citizens. Consequently, a significant gap has emerged between the interests of the average person and those of their governments, whose policies are ultimately shaped by the dictates of these globalist institutions.

The Effects Of Financial Nihilism On Society

Now that we've identified the roots of financial nihilism, we can delve deeper into its far-reaching consequences on society, the economy, and beyond. As highlighted in a recent article by Travis Kling, Founder and Chief Investment Officer of crypto VC firm Ikigai Asset Management, who has been instrumental in bringing the concept of financial nihilism to the forefront, he emphasizes the close relationship between financial nihilism and populism, which he defines as the perception that influential individuals are neglecting the needs and concerns of ordinary people.

This concept is closely related to global powers' influence and underlying agendas. Travis also emphasizes the importance of examining the root causes of financial nihilism. The stark disparity between housing costs and average earnings is a prime illustration. Specifically, in the US, the median home price is a staggering 7.5 times higher than the median income, a telling indicator of the issue.

Take a step back and look at the bigger picture: according to recent findings, homeownership has become an unattainable dream for 99% of Americans. Travis astutely observes that the massive financial and monetary measures implemented in response to the pandemic have exacerbated this issue, leading to a surge in financial nihilism. As a reminder, approximately $5 trillion was allocated towards pandemic relief, based on official records. Although a significant portion of this funding was distributed to individual citizens, most people went on to spend this money at the mega-corporations that belong to the globalists.

The concept of universal basic income (UBI) is fundamentally flawed. The government's handouts would ultimately benefit wealthy elites, a point also raised by Demitri. Furthermore, the pandemic-related restrictions led to the demise of many small businesses, which were forced to shut down, while large corporations were allowed to continue operating. The policy decision to protect big business at the expense of small enterprises during the pandemic is a stark illustration of how the interests of powerful global elites often shape government policies.

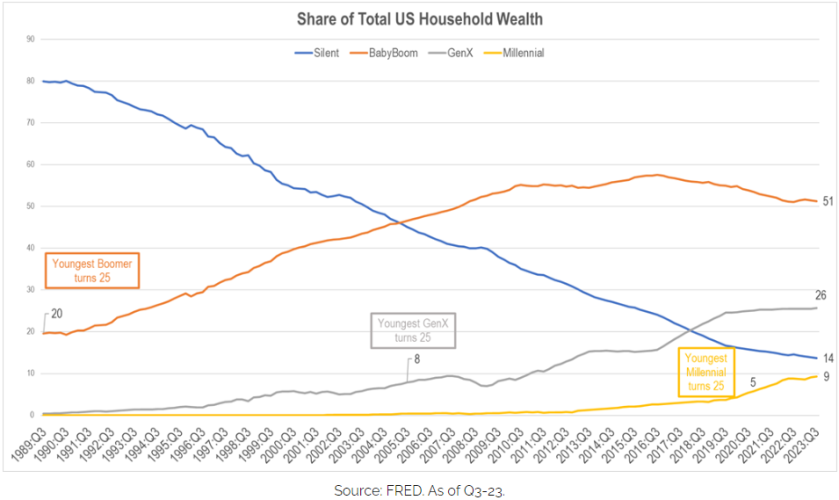

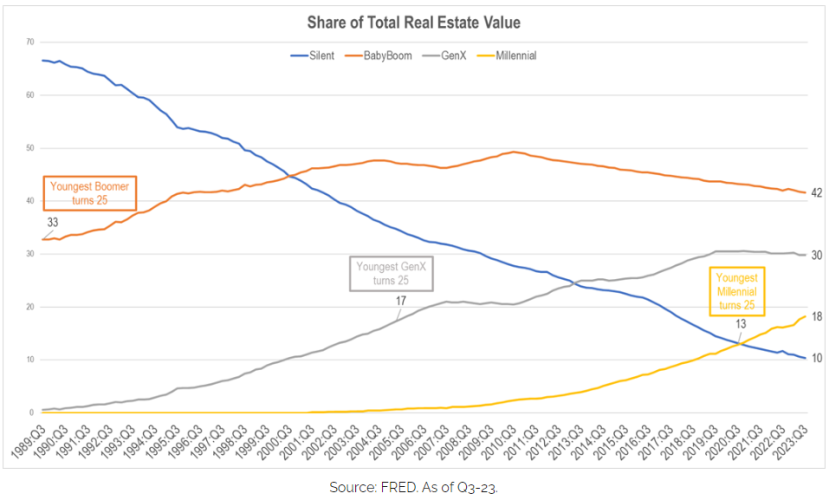

The massive monetary stimulus during the pandemic resulted in the wealthiest 1% of the population now possessing more wealth than the entire middle class combined. This growing disparity in wealth distribution has been a persistent trend since the advent of globalization in the late 1980s, although it has intensified in recent years, potentially by design.

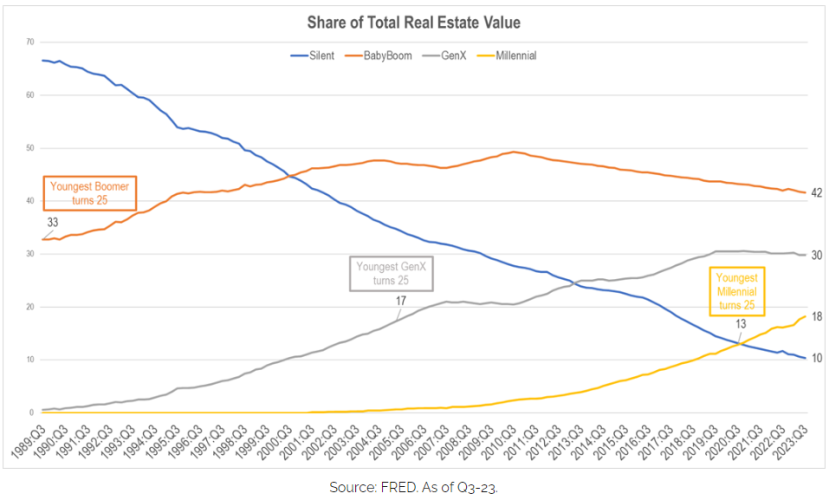

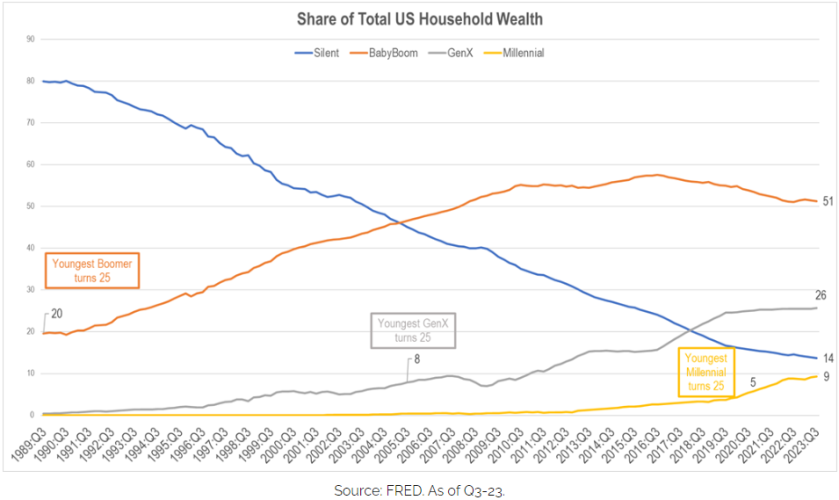

To reinforce his argument, Travis highlights two striking facts. Firstly, Millennials possess a smaller proportion of real estate value than previous generations of the same age. This means that when Baby Boomers and Gen X were Millennials' current age, they had a more significant stake in the property market. Secondly, Travis points out that total household wealth has increased sevenfold since the 1980s, yet Millennials only control a mere 9%. In contrast, Gen X holds 21%, and Boomers hold a substantial 51%, likely due to their greater advantage from globalization.

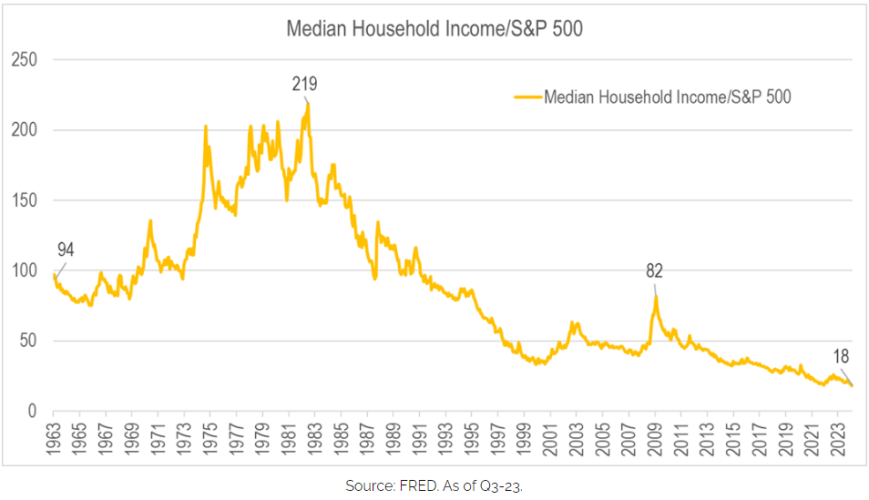

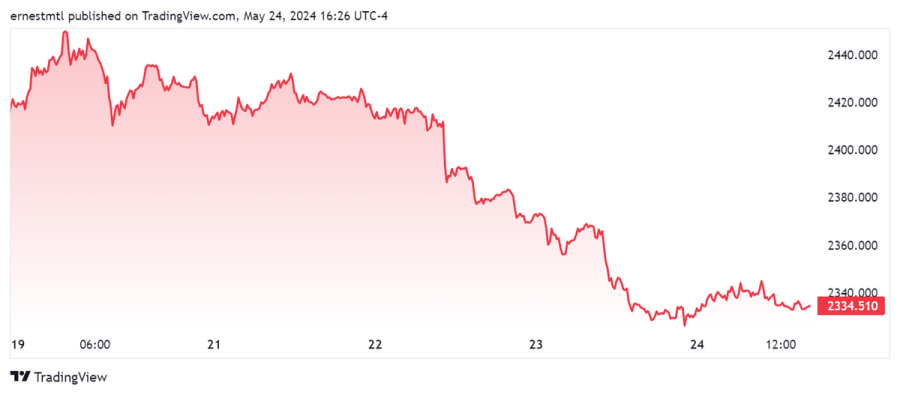

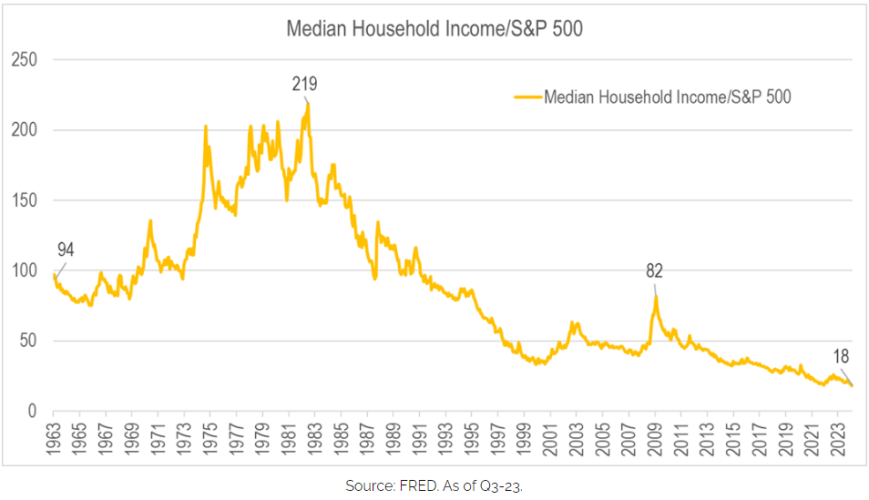

Initially, globalization positively impacted the average individual, reducing consumer goods prices and affordable asset values. However, over time, the benefits of globalization began to erode as ordinary people's wages failed to keep up with the rising cost of assets, mainly due to the outsourcing of labor and asset acquisitions by global players. This disparity is illustrated in the comparison between median income and the S&P 500, as shown in the graph below.

During the late 1980s and mid-1990s, median income remained relatively stable in relation to the S&P 500. However, it experienced a sharp decline following the dot-com bubble in 2001 and again after the 2008 financial crisis.

So What Can We Do About It?

Faced with such disheartening realities and numbers, it's only logical to wonder what steps can be taken to address the issue. According to Travis, who approaches this problem from a financial nihilist standpoint, stipulates,

“You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up expense increases) to something more tenable. More comfortable. More baller. So you gamble. You. F**king. Gamble. You look anywhere for anything that can give you a 5:1, 10:1, 50:1 type of payout. Naturally, you look to literal gambling, which is growing at a breakneck pace.”

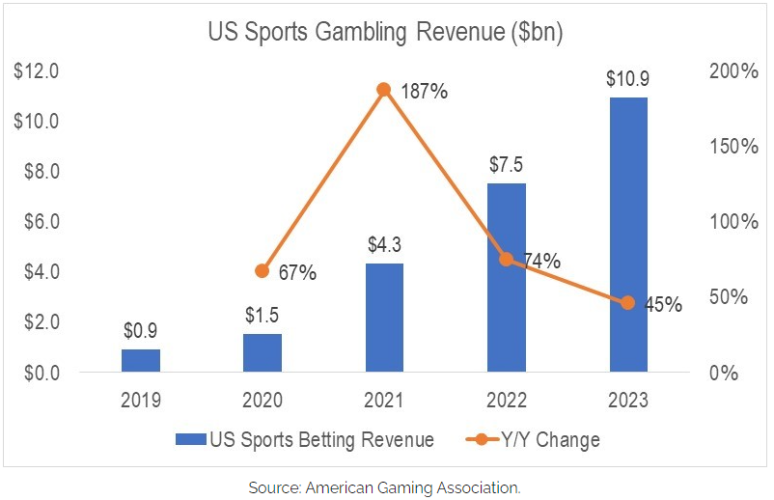

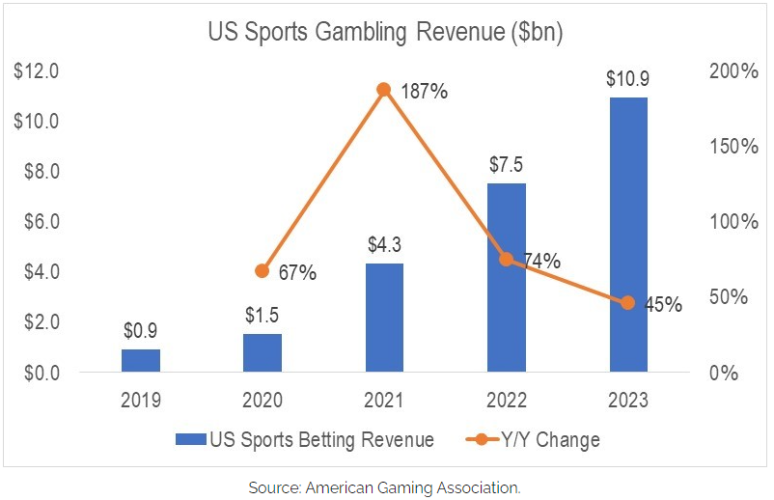

Travis cites a surge in gambling revenue to bolster his argument, which is experiencing an even more dramatic upward trend than Nvidia's stock performance. Notably, US casinos reached unprecedented revenue highs in 2023. Travis further supports his claim with detailed statistics, including the volume of wagers on specific events such as the Super Bowl and data on zero-day-to-expiry options.

For those new to the concept, zero-day-to-expiry options enable wagering on a stock's direction by the day's close. These options have seen a meteoric rise, now accounting for 43% of S&P options trading volume, a surge that began during the pandemic. Travis suggests that a subconscious awareness of the drastic instability in current fiscal and monetary policies drives the typical individual to engage in this behavior. What's intriguing is that this average person may not even realize the underlying macroeconomic factors at play but instead is guided by a gut feeling that something is amiss.

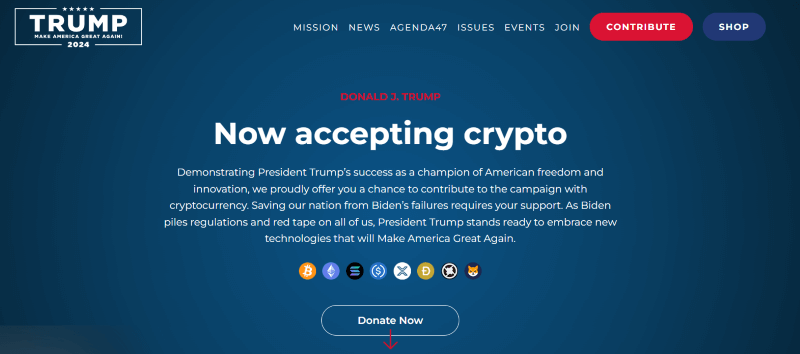

Travis injects cryptocurrency into the discussion, calling it "The Roman Colosseum for asset price and risk-taking distortions.” He notes that specific cryptocurrencies have yielded returns far surpass those of any zero-day-to-expiry option or meme stock. To drive his point home, Travis cites several examples. He then declares that crypto is, at its core, “ A populist movement. A countercultural movement. A YOUNG PERSON’s movement. Boomers don’t get it. It’s “our” thing. It’s the one thing we can actually beat Boomers at (so far).”

He anticipates that Millennials will inherit the $53 trillion wealth held by Boomers and invest a significant portion of it in cryptocurrency. In the near future, he foresees that this cryptocurrency trend will reveal unprecedented reckless actions. This projection is unfolding as anticipated, as various meme coins with little value are reaching market capitalizations in the billions of dollars.

The prospect of this scenario defining most of the crypto bull market is unsettling. Travis advises giving in and embracing it rather than fighting it. “You can wish that weren’t the case. You can wish the crypto market would be more sound-minded. More sober. More focused on providing solutions to real problems. More rooted in reasonable valuation methodologies. Less bubble-ish. But I believe those wishes will be left ungranted.”

This assumes that the situation will persist if the root causes of financial nihilism are not dealt with. Yet, there is a growing public awareness regarding the WEF's questionable motives and associated institutions’ less-than-favorable agendas and virtue signaling, leading to a rapid understanding of these underlying issues.

So, When Will The Causes Of Financial Nihilism Be Addressed?

Acknowledging that economic globalization is the primary culprit behind this crisis is essential. Given that nationalism is the antithesis of globalization, it's logical to conclude that the antidote lies in economic nationalism. While this notion may initially seem radical, it's already gaining traction. The recent trends of onshoring and friendshoring, often mentioned in economic discourse, are, in fact, manifestations of economic nationalism. This approach involves reintegrating most outsourced operations, regardless of the expenses involved. This is where the first major hurdle arises – the significant costs that come with it.

It is often overlooked how globalism has positively impacted the everyday individual. Due to outsourcing manufacturing operations, the average person has benefited from lower costs of goods and certain services. Reversing this trend and bringing production back onshore would likely result in price increases for goods, especially when asset prices are already high, creating a challenging situation for the average person. This scenario is the opposite of when globalization began taking shape.

In stark contrast to the favorable economic climate of the 1990s, when commodity prices declined and assets were reasonably priced, the shift towards nationalist policies will bring about a period of financial strain, marked by rapid inflation and persistently high asset values that remain out of reach for many.

A promising trend is the potential for a surge in average salaries, with some indications that this upward shift is underway. As a natural consequence, the exorbitant earnings of the wealthy elite are likely to decrease in tandem. It's implicit that this prospect is unappealing to those at the top, who may even view it as an existential threat, given the staggering levels of debt they've accrued and cannot repay.

In other words, those with power are vested in suppressing wage growth for the general population, as increased earnings would erode their wealth and profits. Similarly, they cannot permit interest rates to climb, lest they face insurmountable debt repayment challenges resulting from the excessive borrowing they engaged in during the era of inexpensive credit that characterized globalization.

This shows why globalists are fixated on innovations like artificial intelligence. It enables them to maintain low wages and profit in an economically nationalist setting. Similarly, their enthusiasm for central bank digital currencies (CBDCs) can be seen as a means to manipulate interest rates and debt levels. Furthermore, it's notable that many nationalist-leaning leaders elected globally have ties to the World Economic Forum, suggesting that their allegiance may not be to national sovereignty but to the globalist ideology that aligns with the WEF's agenda.

Notably, ordinary individuals increasingly recognize this situation, leading to a decline in trust in established organizations. Demitri has consistently emphasized this point in his discussions. The main challenge in combating financial nihilism lies in losing confidence in the institutions responsible for implementing solutions, as global interests have influenced these institutions and have become corrupted.

The only viable remedy for the crippling effects of financial nihilism lies in establishing new organizations prioritizing ordinary individuals' needs over those of the powerful elites. This transformation is still in its infancy and may require several decades to reach fruition, much like the gradual rise of globalization in its formative years.

Navigating Turbulent Times Ahead

The main question is how to address the changing dynamics during this period. More specifically, how can individuals cope with the impending peak in asset values and the rapid surge in goods prices? Both the timing and location factors influence the solution. Looking at the timing perspective, Travis's forecast about this being an exceedingly speculative crypto market cycle is accurate and is expected to persist. Additionally, his assertion that the crypto market will present the most outstanding returns among speculative asset classes also holds true.

When considering the increasing participation of globalist investors such as BlackRock in cryptocurrency, it becomes evident that investing in crypto presents a significant opportunity to enhance one's financial position in the near future. To prosper financially within a globalist context, it is essential to emulate the strategies of global investors. Many are now mimicking the investment decisions of influential figures like Nancy Pelosi. However, the challenge lies in exiting these investments at the right moment or, preferably, beforehand. Achieving this task is more complex than it may seem.

One of cryptocurrency's most exciting aspects is its transparency, allowing all transactions to be publicly visible. This unique feature enables individuals to monitor and track the investment strategies of experienced traders in real time, often providing valuable insights. By doing so, many people have successfully identified emerging trends, including the rapid growth of memecoins, before they surge in value.

This approach may only be viable in the short term. Beyond that, we may witness a widespread asset selloff as heavily indebted global powers attempt to settle their debts. This scenario presupposes that their efforts to manipulate wages and interest rates will ultimately fail, which appears probable. Those familiar with the CBDC narrative will understand that developing and launching such technologies is complex. Moreover, coercing people to adopt these technologies and actually getting them to use them are two distinct challenges, with the former being relatively easier to achieve than the latter.

If globalization efforts stagnate, the value of assets will decline, while the cost of goods and wages will increase. To thrive in this scenario, it's essential to adopt a diligent work ethic, particularly in sectors experiencing a resurgence of domestic production. Reestablishing local operations will necessitate massive investments of energy and resources. Strategically placing yourself near these industrial centers can provide indirect benefits, even if you're not directly employed in these fields.

This pertains to the second aspect of addressing the consequences of globalism, which is location. Assuming that globalists can establish CBDCs and similar systems, there will likely be certain countries and regions where their influence will be limited. These technologies may be less widespread or may not be present. It needs to be determined which countries and areas these may be, but this should become clearer over time.

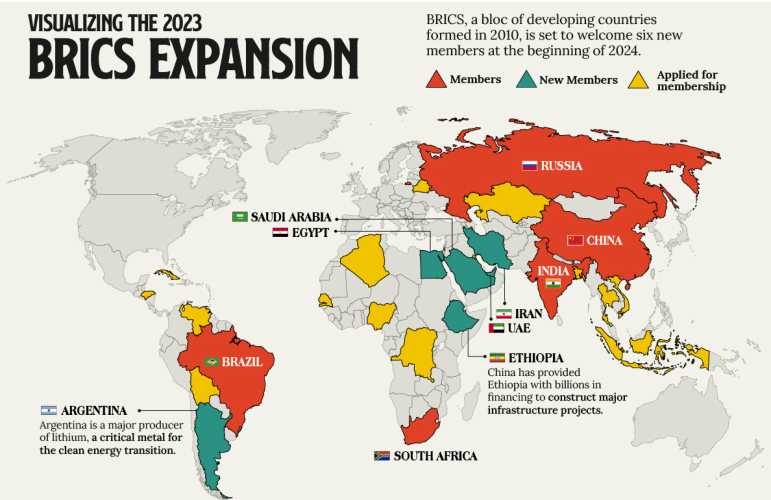

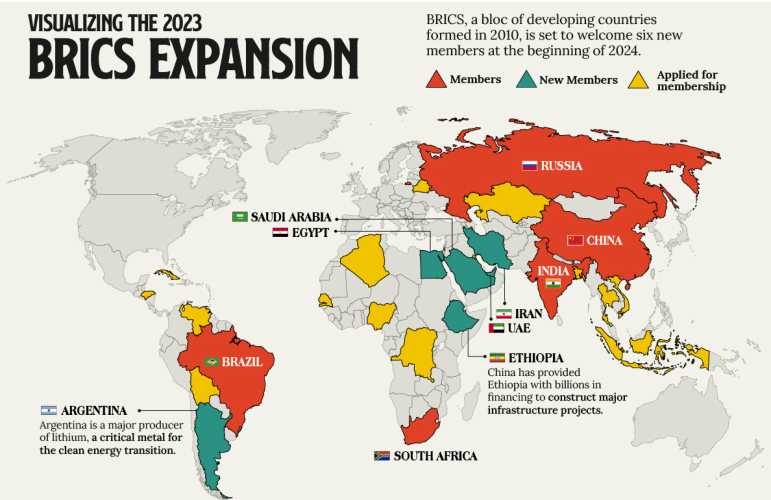

Source: Visual Capitalist

Countries less inclined to adhere to globalist principles, like the BRICS nations and their allies, often face the most adverse impacts from them. Even if the globalists do not succeed in introducing their dystopian technology, it may still be wise to consider moving, as certain countries may struggle to bring operations back onshore efficiently due to limitations in resources or workforce. Europe and the UK are especially vulnerable to this scenario.

In essence, navigating the challenges of globalism and its eventual downfall will require flexibility in managing one's finances, career, and home. We're operating in a globalized system, so it's crucial to mirror the investment strategies of globalists and be prepared to move to avoid their control. As we transition towards a more nation-centric environment, your ability to find meaningful employment will become more vital to your survival than your investment savvy, which may also require relocating to a new country. However, choose a nation that won't likely end up in a kinetic war because of its nationalism.

.gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.jpeg)

.gif)