Fed hikes may have concluded, as central banks purchase gold at a record level

Gold had tremendously strong gains today of just over $20 per ounce in both physical gold as well as futures. As of 4:00 PM EST gold futures basis the December contract is currently up $20.80 or + 1.05%, and fixed at $2001. On its first day as the most active Comex contract, February gold (GC G24) gained $20.60 or + 1.03% and is currently fixed at $2021.10. Physical or spot gold is up $20.80 trading at $1998.40.

Today’s solid gains are the result of multiple factors. First, the release of economic reports indicates that the economy in the United States has been contracting as a result of recent rate hikes by the Federal Reserve. Secondly, the Federal Reserve released its minutes from the last FOMC meeting in which the Fed continued to maintain its current interest rate level.

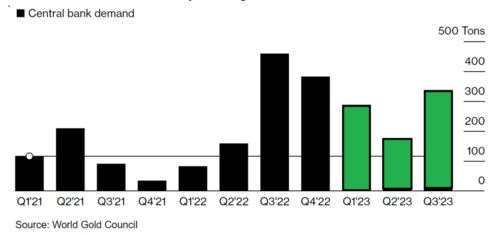

Third, a report by the World Gold Council revealed intensified buying by central banks around the world resulting in a new record for purchases in the first nine months of the year. Lastly, except for the Federal Reserve, global central banks are beginning to cut interest rates.

It was a combination of all the events cited above that propelled gold futures above $2000 per ounce.

The World Gold Council has updated its list of gold reserves by countries revealing that many central banks aggressively added to their gold reserves. Collectively these purchases by global central banks are at a record pace for the first three quarters of 2023 which totals 800 tons, with China Poland, and Singapore being the primary buyers. This pace is well above the total purchases for the same period in 2022.

Will the Fed follow the pack and cut rates sooner than anticipated?

Today the Federal Reserve released its minutes for the most recent FOMC meeting. The minutes supported current expectations that the Federal Reserve’s pause not only will continue, but more importantly signals that the Fed might have concluded its aggressive interest rate hikes that began in March 2022. These hikes have effectively raised the Fed funds rate from between 0 and ¼% to between 5 ¼% and 5 ½%. Expectations by the CME’s FedWatch tool indicate the probability of a rate hike pause is 94.8% down from the probability of 99.8% a week ago.

Adding to these bullish developments that took gold futures above $2000 per ounce is the fact that multiple central banks have begun interest rate cuts.

In fact, for the first time since January 2021, the number of central banks that are cutting interest rates is greater than the number of central banks implementing rate hikes.

While the Federal Reserve’s monetary policy has not mentioned any imminent rate cuts the fact that many other central banks are cutting rates is positive. Although the ECB has not begun to cut its interest rate level, expectations are high that they have ended their cycle of rate hikes and could begin rate cuts as early as the second quarter of 2024.

Gary S. Wagner

By

Gary Wagner

Contributing to kitco.com

Tim Moseley