ESG: A Woke Ideology Wreaking Havoc As Anti-ESG Rhetoric Heightens

.png)

With all the craziness happening in the world right now, you probably won’t be surprised to know that laws are being proposed that would limit food production due to ESG mandates. The EU's controversial ESG regulations came into force in January 2023, and their advocates have described them as the most ambitious yet.

These laws would severely restrict companies' ability to choose suppliers and buyers without first studying their ESG credentials, made possible through the EU’s ‘Corporate Sustainability Reporting Directive.’ The provisions in the regulations don't just apply to companies in the EU. They apply to non-EU companies, which work with EU companies, and possibly even to consumers as well.

While most EU lawmakers think these regulations will help increase the quality of life, the exact opposite is likely to occur. Not only will they crush competitiveness, but they could throw the EU into another energy and cost of living crisis that will have a knock-on effect globally. This article discusses the EU’s ESG directive, which provisions are the most disturbing, and reveals why the elites are so obsessed with ESG.

Image source: Early metrics

ESG Explained

To recap from previous articles, ESG stands for Environmental, Social, and Governance, defining an investment trend driven by financial elites since the pandemic's start. In short, ESG expresses that environmental, social, and governance issues are more important than production output or profits.

Logically, this imperative is incompatible with basic economics. Purposely pursuing more expensive energy sources, hiring people based on their personal identity rather than their abilities, and letting governmental and non-governmental organizations make business decisions is a recipe for disaster.

ESG’s incompatibility with basic economics is why it's more accurate to refer to ESG as an ideology rather than an investment methodology. Any company that complied with ESG criteria would quickly find itself out of business. This is why the ESG ideology was mostly ignored during the first 15 years of its existence.

The term ESG was coined in a 2005 report by the United Nations, the World Bank, and the Swiss government. However, the ESG criteria needed to be more consistent and clear, contributing to their lack of adoption among businesses. But in mid-January 2020, it all changed when BlackRock CEO, Larry Fink, wrote an open letter to all the shareholders of the companies the asset manager is invested in, ordering them to comply with ESG.

The Standardization Of ESG Criteria

In late January 2020, the world's elite gathered in Davos, Switzerland, for the World Economic Forum (WEF) annual conference. There, the big four accounting firms standardized ESG criteria. The ESG criteria have since become synonymous with the UN's Sustainable Development Goals (SDGs). For reference, the SDGs are a set of 17 goals that are supposed to be met by all 193 UN countries by 2030.

Image source: Weforum.org

The convergence between ESG and the SDGs comes from the strategic partnership the WEF signed with the UN in mid-2019. The announcement states that the WEF will help "accelerate the development of the SDGs.” In other words, they will provide private-sector funding and compliance. Besides developing the digital ID, SDGs mandate the development of smart cities, central bank digital currencies (CBDCs), and carbon credit scores to track and reduce an individual’s consumption.

All these technologies are being developed by companies closely affiliated with the WEF, but as mentioned above, ESG is not compatible with basic economics. This begs the question of why the private sector is on board. Well, the short answer is ‘artificial profits.’

Companies that comply with ESG get lots of investment from asset managers and better loan terms from mega banks. Companies, which refuse to comply with the ESG, see investments pulled and risk losing access to financial services altogether. Meanwhile, on the public sector side, they risk excessive regulations and bad press from governmental and non-governmental institutions working with these asset managers and mega banks.

This terrifying situation comes from the unnatural accumulation of wealth caused by a financial system where limitless amounts of money can be created. The short story is that asset managers and mega banks borrow lots of money at low-interest rates and then use it to buy assets, influence, and further push their ideologies. Understand, the ESG ideology would not exist in a sound money system; it would not be possible.

The ESG Push

Now although the ESG push has come primarily from private sector entities affiliated with the WEF, there are a few public sector exceptions. The biggest one is the European Union (EU), whose ESG initiatives are rooted in the Next Generation EU pandemic recovery plan.

Not surprisingly, the implicit and explicit purpose of Next Generation EU is to help all European countries meet the UN's SDGs by 2030. The recovery plan is expected to cost over €1.8 trillion. In other words, it provides public sector funding and compliance, complementary to the WEF’s initiatives.

Image source: commission.europa.eu

One-third of all this printed money will fund the EU's green deal, which was announced at the pandemic's start. Now, to give you an idea of just how ideological the green deal is, one of the three goals noted on its website is to ensure that “economic growth is decoupled from resource use.” This impossible goal is why it's appropriate that the EU’s ESG regulation is part of the green deal.

The Corporate Sustainability Reporting Directive

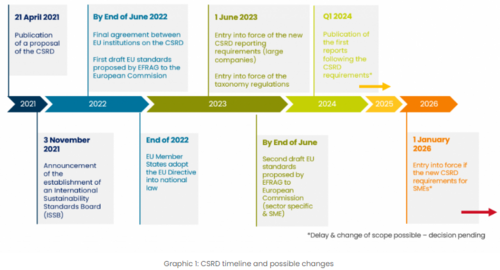

The ESG regulation in question is called the Corporate Sustainability Reporting Directive (CSRD). It was first introduced in April 2021, was passed in November 2022, and went into force this January.

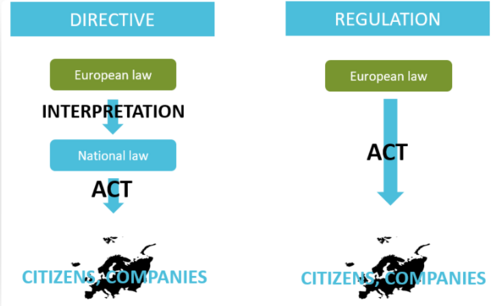

However, there are two caveats here. The first is that the CSRD is technically a directive, not a regulation. Whereas an EU regulation requires all EU countries to comply with the EU law as it's written, an EU directive allows EU countries to adjust the EU law and can take their time rolling it out.

Image source: Kvalito.ch

This ties into the second caveat: going into force and being enforced are two different things. While the CSRD went into force this January, it won't be enforced until 2025. To clarify, ESG reporting standards will be published in June. In 2024, EU companies will start collecting data using these standards. In 2025, this data will be reported.

Image Source: DFGE.de

A spokesperson for the agency tasked with setting these standards specified that over 1,000 ESG data points must be reported. In a December 2021 interview, one of the architects of the CSRD revealed that the directive's purpose is to “bring sustainability reporting to the same level as financial reporting.” He also indicated that all the reported data would have to be digitized and that this won't be easy or cheap.

Failure to comply with the EU ESG disclosures will result in sanctions that should be “effective, proportionate, and dissuasive.” The CSRD will require governments to publicly shame the companies that didn't comply, order them to stop violating ESG criteria, and fine them. The CSRD is expected to apply to around 50,000 companies operating in the EU, but because of the absurdly low bar for what counts as a large company, the actual figure will probably be much higher.

An EU company is considered a large company if it meets two of the following three criteria; it has a revenue of more than €40 million per year, has more than €20 million in assets, or has more than 250 employees. Publicly listed EU companies will also be required to comply with the CSRD regardless of their size.

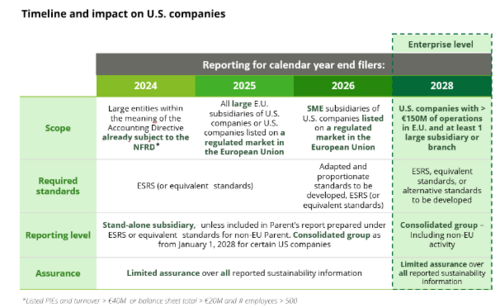

Moreover, the CSRD will also apply to non-EU companies which meet the following criteria; it returns more than €150 million each year for two consecutive years and has a subsidiary in the EU or a branch that takes in more than €40 million each year.

Another big reason the CSRD will apply to more than 50,000 companies is because of highly concerning provisions in the CSRD, which, as mentioned above, could apply to small and medium-sized businesses inside and outside of the EU and possibly even to consumers.

Image source: WSJ/Deloitte

The Double Materiality Provision

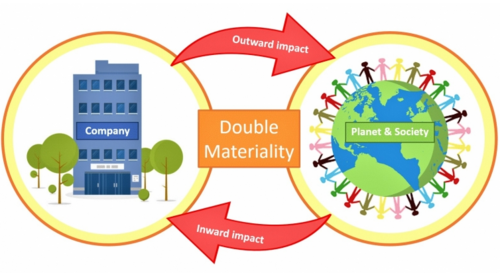

The most problematic provision is called Double Materiality. As stated by KPMG, the third largest accounting firm and one of the big four auditors, "double materiality requires companies to identify both their impacts on people and environment – Impact Materiality, as well as the sustainability matters that financially impact the undertaking – Financial Materiality.”

Double materiality sounds like yet another bureaucratic buzzword. However, these two insignificant words open the door to forcing small and medium-sized companies and possibly even consumers to comply with the CSRD’s ESG reporting requirements.

This is simply because double materiality requires companies directly affected by the CSRD to collect ESG-related data from individuals and institutions which lie upstream and downstream from their actual business operations.

In other words, in addition to the company’s own data, it would have to collect and report extensive ESG-related data from all suppliers they buy raw materials from – Upstream part of the provision. Then the company would need to chase up its largest consumers who have purchased its product and ask them to provide their ESG data for its reporting purposes. This is the downstream part of the provision.

In a real-world scenario, the company may have trouble collecting the data due to non-compliance, or the supplier may fall short in their ESG ratings. In this case, they would have to switch to ESG-aligned suppliers to meet the CSRD criteria to avoid a low ESG score and being fined. In such circumstances, the company could quickly end up in bankruptcy.

However, BlackRock comes to the rescue with investment, and the bank gives the company a loan. It stays afloat and finally gets all its most significant suppliers and consumers to provide detailed ESG data. There's just one problem: they all scored poorly on ESG, they need to use more renewable energy, their workforces need to be more diverse, and they are not members of the WEF. (Remember, ESG stands for environmental, social, and governance.)

BlackRock and the bank see the company’s annual ESG report and inform them that they won't be able to provide any more financial support unless they force its suppliers and consumers to improve their ESG scores. The company tries to jump a few more hurdles, but after trying so hard to comply, the company ultimately goes bankrupt.

Image source: contextsustainability.com

The Harsh Reality

The reality is the CSRD has the potential to impact individuals and institutions worldwide. Large companies in the EU will bear the brunt of the burden. The time and money they will take to report ESG criteria will be a massive expense.

Any small or medium-sized businesses, which lie upstream or downstream from these large companies, will likewise be required to report, and their expenses will be even greater in percentage terms. Never mind the costs and the surveillance that will come with digitizing all this sensitive ESG data.

In the 2022 conference held by the WEF in Davos, the ESG panelists agreed that small and medium-sized businesses would eventually have to comply with ESG to get investments and loans from financial institutions. One of the panelists gave an example of compliance with the ‘social’ criteria of ESG, stating that small and medium-sized businesses must pay their employees a “fair wage.”

Some argue this is code for paying their employees as much as a big enterprise can, which small and medium-sized companies often cannot do. With the CSRD applying pressure from the public sector and ESG investing applying pressure from the private sector, it's more than likely that many small and medium-sized businesses affected will go bankrupt.

As far as the elites are concerned big business taking over everything was always inevitable. The only things that will protect small and medium-sized businesses from going under will be investments from asset managers, loans from megabanks, and grants from governmental authorities.

This will give them the power to pick winners and losers based on their compliance with the ESG ideology, not on output. Assuming this ESG ideology continues to grow, we could see a scenario where businesses are occasionally prevented from providing goods and services to consumers on ESG grounds.

Excuses could include climate change, social inequality, and the inability to track what's been purchased. Again, basic economics says this would not be sustainable, but printed and borrowed money would make it so.

The EU could achieve its goal of having an economic output with zero input. It would just be rising numbers on a screen, with inflation kept in check by capital controls on digital currencies. Quality of life would quickly diminish as no actual inputs means no tangible outputs. There would be frequent and chronic shortages of critical goods and services, which the elites will blame on the same crises that ESG claims to solve. If it's allowed to be discussed at all, ‘real’ inflation will be off the charts.

.png)

Image source: cryptonews.com

The Elite’s ESG Obsession

So why are the elites so obsessed with ESG? The answer is ‘inflation.’ The byproduct of ESG policies creates inflation. The fact is, the wealthiest individuals and institutions have trillions of dollars of debt that they can't ever hope to pay back. And as mentioned above, most of this debt was used to buy assets and influence, all to push dystopian ideologies which go against the natural laws of economics.

In theory, most of the issues ESG seeks to fix could be more easily fixed with a sound monetary system. Saving is incentivized, wealth accumulation is arduous, and harmful ideologies are more difficult to finance. In practice, the elites default on their debts and lose all their assets and influence.

That's why there's only one solution in their eyes: to centralize control so intensely that it becomes impossible for them to default. This requires controlling where you go, what you say, and how you spend. If you look at the bigger picture, you'll realize that this is the true purpose of the SDGs and ESG.

.png)

Image source: US Debt Clock

The Silver Lining

The silver lining is that the elites will likely fail in implementing ESG policies. Evidence of this was in mid-2022 when energy prices soared, and we saw a rise in anti-ESG rhetoric because people knew ESG was the ultimate cause.

Although ESG saw a comeback after energy prices fell, this won’t last long. That's because the energy market fundamentals still need to be addressed. There needs to be more supply relative to demand, and energy companies are reluctant to expand in the face of ESG opposition.

When energy-driven inflation comes back, and it will, ESG will become Public Enemy #1 again, and rightfully so. When energy prices spike, you'll see governments declare oil, natural gas, and nuclear energy as green and spend $500 billion to burn so-called ‘dirty’ coal to keep the lights on as Europe and the UK have already done, and that's just what will happen in the developed world.

In the developing world, entire countries will go under; revolutions will arise, along with mass migrations, and all those angry people will know that ESG is ultimately to blame. This will lead to global instability, which will thwart the UN and the WEF’s plans.

Recently, Vanguard, the world’s second-largest asset manager, resigned from the Net Zero Asset Managers initiative, stating they were “not in the game of politics.” Moreover, Vanguard doesn’t believe it should dictate company strategy, saying it would be arrogant to presume that the firm knows the right strategy for the thousands of companies that Vanguard invests with.

Vanguard’s decision to withdraw, citing a need for independence, has perpetuated the anger of climate extremists since the Pennsylvania-based asset manager refused to rule out new investments in fossil fuels in May 2022.

Now, the elites are hyper-aware of this, so they're trying to move quickly to take control of everything before the purchasing power of their fiat currencies goes entirely to zero. They will fail because people will opt out of the current system when they see it closing in on them.

They’ll opt out by participating and supporting parallel ecosystems and adopting alternative technologies like cryptocurrency, which have been in development for years in preparation for this exact transition. As fiat currencies implode, the current system will collapse, and an alternative system will emerge.

Tim Moseley

(23).gif)

.gif) Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion

.jpg)

(4).gif)