Gold, silver punished by strong USDX that hits 20-year high

Gold and silver prices are sharply lower in midday U.S. trading Thursday, pressured in part by a very strong U.S. dollar index that today scored a 20-year high. Bearish charts are also keeping the technically based bears active on the sell side in the futures markets. June gold futures were last down $19.20 at $1,834.50. July Comex silver futures hit a 22-month low today and were last down $0.70 at $20.87 an ounce.

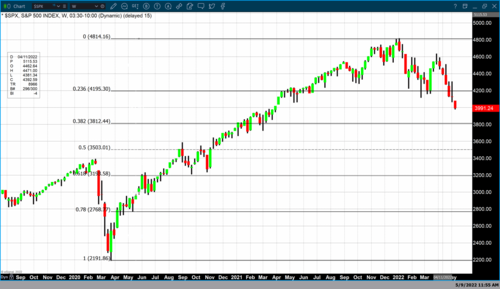

Global stock markets were mostly lower overnight. U.S. stock indexes are lower at midday and hit 12-month lows. Risk aversion remains elevated amid the Russia-Ukraine war that shows no signs of ending, Covid lockdowns in China and problematic price inflation that is gripping the globe. Traders worry the U.S. and other major economies will slip into recession in the coming months, due to the aforementioned factors.

The U.S. got another inflation reading Thursday with the producer price index for April, which came in up 11%, year-on-year. That was down just a bit from the March PPI reading of up 11.5%, but still hot nonetheless.

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke

Nothing can fix inflation now, 'economic stupidity' is underway by the Fed, Biden – Steve Hanke

In other news, the crypto currencies continue to get hammered amid the keener risk aversion in the marketplace. Bitcoin prices dropped to a 16-month low below $26,000 overnight.

The key outside markets today see Nymex crude oil futures prices up a bit and trading around $106.00 a barrel. Meantime, the U.S. dollar index is sharply higher and hit a 20-year high. The yield on the 10-year U.S. Treasury note is fetching 2.846%.

.gif)

Technically, June gold futures see a two-month-old price downtrend in place on the daily bar chart. Bears have the firm overall near-term technical advantage. Bulls' next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today’s high of $1,858.80 and then at $1,864.70. First support is seen at this week’s low of $1,830.60 and then at $1,815.00. Wyckoff's Market Rating: 3.0.

.gif)

July silver futures prices closed nearer the session low and hit a 22-month low today. A steep price downtrend is in place on the daily bar chart. The silver bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $22.50 an ounce. The next downside price objective for the bears is closing prices below solid support at $20.00. First resistance is seen at today’s high of $21.625 and then at $22.00. Next support is seen at today’s low of $20.705 and then at $20.50. Wyckoff's Market Rating: 1.0.

July N.Y. copper closed down 1,225 points at 408.75 cents today. Prices closed nearer the session high today and hit a 7.5-month low. The copper bears have the solid overall near-term technical advantage. A steep price downtrend is in place on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 435.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 400.00 cents. First resistance is seen at 415.00 cents 420.00 cents. First support is seen at today’s low of 403.70 cents and then at 400.00 cents. Wyckoff's Market Rating: 1.5.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Gold price is manipulated by the Fed, suspects mining tycoon Frank Giustra, but suppression can't last forever

Uranium price has a lot more runway left and needs to double for supply to meet demand – Sprott's Ciampaglia

Uranium price has a lot more runway left and needs to double for supply to meet demand – Sprott's Ciampaglia

Gold remains on track as Federal Reserve lays out path for 50-bps rate hikes – State Street's Milling-Stanley

Gold remains on track as Federal Reserve lays out path for 50-bps rate hikes – State Street's Milling-Stanley.gif)

.gif)

Paul Tudor Jones: 'Capital preservation is the most important thing' right now

Paul Tudor Jones: 'Capital preservation is the most important thing' right now.gif)

.gif)

(1).gif) Gold is an 'ideal' asset right now but why isn't the price higher? Fidelity weighs in

Gold is an 'ideal' asset right now but why isn't the price higher? Fidelity weighs in.gif)

.gif)