Gold weaker as U.S. Treasury yields up-tick

Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day's top stories directly to your inbox. Sign up here!

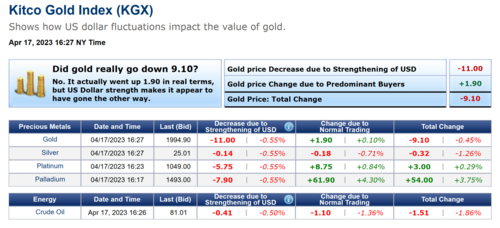

(Kitco News) – Gold prices are modestly down and silver near steady in midday U.S. dealings Wednesday. The precious metals markets are seeing buying interest limited by a rise in U.S. Treasury yields at mid-week. However, losses in metals are being limited by a weaker U.S. dollar index today. June gold was last down $7.20 at $1,997.30 and May silver was up $0.003 at $24.89.

Traders at mid-week are buzzing about First Republic Bank's quarterly earnings report on Tuesday that was worse than expected, including a huge outflow of deposits. Reports said the bank's conference call on its earnings was very brief, with no questions taken from reporters. That prompted a nearly 50% drop in the bank's share price Tuesday, including trading in the stock being halted for a while. Reports today said the U.S. government is not going to step in an assist the ailing bank.

Meantime, U.S. and/or global recession fears appear to be moving back toward the front burner of the marketplace. Diesel fuel prices in the U.S. have plunged in recent months and are about half of what they were one year ago. Such suggests a slowdown in the commercial transportation sector that could be a signal of a slowing U.S. economy. United Parcel Service (UPS) on Tuesday issued a downbeat corporate earnings report, saying “macro conditions” would likely continue to pressure its delivery volume. The metals markets appear to be taking a bearish lean from this situation, on notions of less consumer and commercial demand if the global economy weakens.

Global stock markets were mixed to weaker overnight. U.S. stock indexes are mixed at midday. Focus of stock traders this week is on the release of quarterly corporate earnings reports. So far, they have been mixed.

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

In overnight news, Sweden's central bank raised its main interest rate by 0.5%, saying inflation is still far too high.

The key outside markets today see the U.S. dollar index lower. Nymex crude oil prices are weaker and trading around $76.75 a barrel. The benchmark 10-year U.S. Treasury note yield is presently fetching 3.695%.

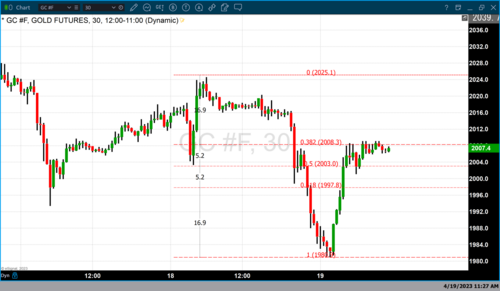

Technically, June gold futures bulls still have the firm overall near-term technical advantage. However, a six-week-old uptrend on the daily bar chart has stalled out. Bulls' next upside price objective is to produce a close above solid resistance at the April high of $2,063.40. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the April low of $1,965.90. First resistance is seen at today's high of $2,020.20 and then at $2,028.00. First support is seen at last week's low of $1,980.90 and then at $1,965.90. Wyckoff's Market Rating: 7.0

May silver futures bulls have the overall near-term technical advantage. However, a six-week-old uptrend on the daily bar chart has been negated, which is one early clue that a market top is in place. Silver bulls' next upside price objective is closing prices above solid technical resistance at the April high of $26.235. The next downside price objective for the bears is closing prices below solid support at $23.00. First resistance is seen at this week's high of $25.435 and then at $25.71. Next support is seen at this week's low of $24.53 and then at $24.25. Wyckoff's Market Rating: 7.0.

May N.Y. copper closed up 105 points at 385.85 cents today. Prices closed nearer the session low today. The copper bulls and bears are on a level overall near-term technical playing field. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 410.00 cents. The next downside price objective for the bears is closing prices below solid technical support at the March low of 382.20 cents. First resistance is seen at 390.00 cents and then at Tuesday's high of 397.00 cents. First support is seen at this week's low of 383.00 cents and then at 382.20 cents. Wyckoff's Market Rating: 5.0.

By

Jim Wyckoff

For Kitco News

Tim Moseley

.gif) Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

.png)