Fed narrative alarms traders who believe that a rate pause is imminent after the May rate hike

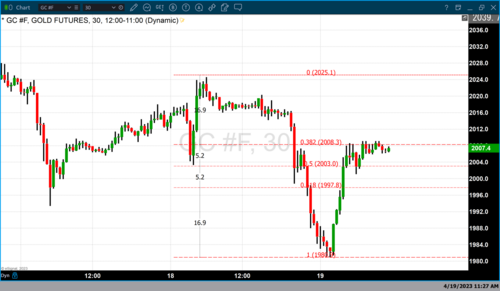

Recent volatility led to diminished bullish market sentiment for gold causing a price break and taking gold futures to $1980.90 before recovering. This morning in New York traders witnessed a quick and powerful price decline in gold breaking $20 below $2000 and recovering just as quickly as it sold off.

This was in response to Federal Reserve officials who continue to reiterate the need for taking interest rates higher. Federal Reserve officials will go silent one week before the May FOMC meeting beginning on Saturday, April 22.

Two Fed officials have been extremely vocal both suggesting the need to continue to raise interest rates even after the anticipated ¼% rate hike occurs in May.

Last week Fed Governor Christopher Waller said that the Federal Reserve needs to continue raising interest rates because of the high level of inflation. "Economic output and employment are continuing to grow at a solid pace while inflation remains much too high," Waller said, noting that investors should not expect rates to fall any time soon. "Monetary policy will need to remain tight for a substantial period of time, and longer than markets anticipate,".

Fed Governor Waller was resolute when he spoke on Friday saying, “Despite a year of aggressive rate increases U.S. central bankers "haven't made much progress" in returning inflation to their 2% target and need to move interest rates higher still.”

Addressing current inflationary pressures Waller said that inflation has "basically moved sideways with no apparent downward movement… Monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions."

James Bullard and Christopher Waller both strongly believe that the economy and inflation continue to remain stronger than expected.

Reuters posted an interview yesterday with St. Louis Federal Reserve President James Bullard who also underscored the need for higher U.S. interest rates to combat inflation. During the interview, Federal President Bullard said, “The U.S. central bank should continue raising interest rates on the back of recent data showing inflation remains persistent while the broader economy seems poised to continue growing, even if slowly.”

Both Fed officials expressed a narrative much different than many market participants assumed, which is a pause by the Federal Reserve in rate hikes to begin after one more rate hike in May. The assumption that the Federal Reserve will stop their consecutive rate hikes at every FOMC meeting since March 2022 diminished based on the most recent narrative by Waller and Bullard.

The chart above is a 30-minute Japanese candlestick chart of gold futures. It shows how quickly gold sold off during the morning trading session in New York after breaking below the support trendline at $2013. The chart also indicates that gold recovered as quickly as it sold off. As of 5:30 PM EST, the most active June 2023 futures contract is down $12.30 and fixed at $2007.40.

Gary S. Wagner

By

Gary Wagner

Contributing to kitco.com

Tim Moseley