Gold market sees new record closing price, but the major test is next week

With gold prices pushing to within striking distance of $2,100 an ounce, seeing a new record settlement Friday, the market is setting itself up for a major week ahead, one filled with significant macroeconomic risks.

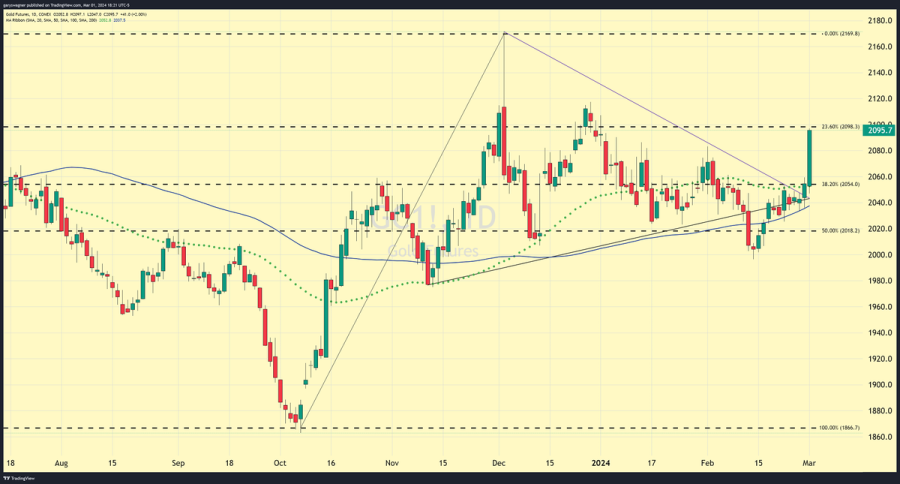

April gold futures settled Friday at $2,095.70 an ounce, a record close for the precious metal and up more than 2% from last week. The rally started Thursday as prices pushed above initial resistance above $2,050 an ounce after the Federal Reserve’s preferred inflation gauge showed a benign rise in consumer prices.

The gold market is seeing its best weekly gains since November

Meanwhile, silver managed to end the week with a 1% gain, with prices back above $23 an ounce. Although silver continues to underperform gold, some analysts have said it remains an attractive value play in a bull market.

Despite a slow start, disappointing economic data on Friday created some weakness in the U.S. dollar, giving gold and silver room to move quickly to the upside.

“Thursday's and Friday's gains reaffirm gold's ability to rise above its 50-day moving average, which it failed to do a month ago,” said Alex Kuptsikevich, senior market analyst at FxPro.

While gold has managed to break above resistance at $2,050, Kuptsikevich added that the next major resistance level to watch is $2,088. At the same time, the market can see significant upside if the momentum lasts.

“There is an even longer-term scenario. The pullback from the beginning of the year to mid-February is a classic Fibonacci retracement of 61.8% of the first growth impulse from the October lows. The realization of this scenario will be the advance to $2255,” he said.

However, not all analysts are convinced that gold is headed higher, even as it ends the week with significant momentum. In a note Thursday, Nicky Shiels, head of metals strategy at MKS PAMP, noted that gold’s outside move could be the result of its months-long consolidation. She said that momentum can push gold prices higher, but the fundamental picture remains the same, for now.

“With positioning in gold and silver running neutral & short, respectively, technically compressed price action and overall sentiment in precious metals burnt out, it really was a recipe for unexplained outsized moves. Was the PCE a game-changer? No, and not enough data to declare disinflation is about to end, and the Fed may just never cut,” she said in her note. “Can technical rallies extend? Sure. But this is not a catalyst to rope in fresh investor interest, and physical alone doesn’t chase, so it’ll come down to paper shorts and cues provided by macro. Overall, Gold remains bid-to-higher.”

Market analysts at CPM Group are also not optimistic that the gold market can hold Friday’s gains as it is caught in a well-defined trading pattern.

“Gold prices have sold off most every time they have tested resistance levels, and as prices test strong support levels, investors step back into the market, initiating new longs once more. This has kept gold prices in a wide range, mostly above $2,000,” the analysts said in a note late Friday.

“Gold prices are now testing $2,100, having firmly broken above $2,050 yesterday. The market appears to be looking for reasons to go long gold, and taking profits as technical resistance levels are tested,” the analysts added. “It is unclear if prices will continue to climb in the near term, but they already have made strong gains, suggesting the potential for a short-term pullback on profit taking. A retrenchment in prices could push gold back toward $2,075, which could potentially present a buying opportunity should the upward momentum continue.”

Some analysts have noted that gold could face a significant test next week with the release of February’s nonfarm payrolls report. At the same time, markets will be anxious to hear what Federal Reserve Chair Jerome Powell will say in his two days of testimony before Congress.

Adam Button, chief currency strategist at Forexlive.com, said that he will probably be paying more attention to labor market data next week as that could have more impact on the U.S. dollar.

He said weak labor market data could impact the U.S. dollar more than Powell’s comments.

“We basically know what Powell is going to say: interest rates will be coming down, but not anytime soon,” he said. “He will probably also say that the Federal Reserve will continue to monitor incoming data. Weak job growth could sustain gold’s rally.”

It’s not just U.S. economic data that could impact the U.S. dollar. The European Central Bank will meet to decide its monetary policy next week and a hawkish stance could support the euro in the near term.

Commodity analysts at Brown Brothers Harriman said they expect the ECB to strike a cautious tone next week as Europe’s latest inflation data came in hotter than expected.

Economic data to watch next week:

Tuesday: ISM services PMI

Wednesday: ADP employment data, Bank of Canada monetary policy decision, Powell’s testimony before the House Financial Services Committee, JOLTS job openings

Thursday; European Central Bank monetary policy meeting, weekly jobless claims; Powell’s testimony before Senate Banking Committee

Friday: Nonfarm payrolls report

Kitco Media

Neils Christensen

Tim Moseley

.png)

.png)