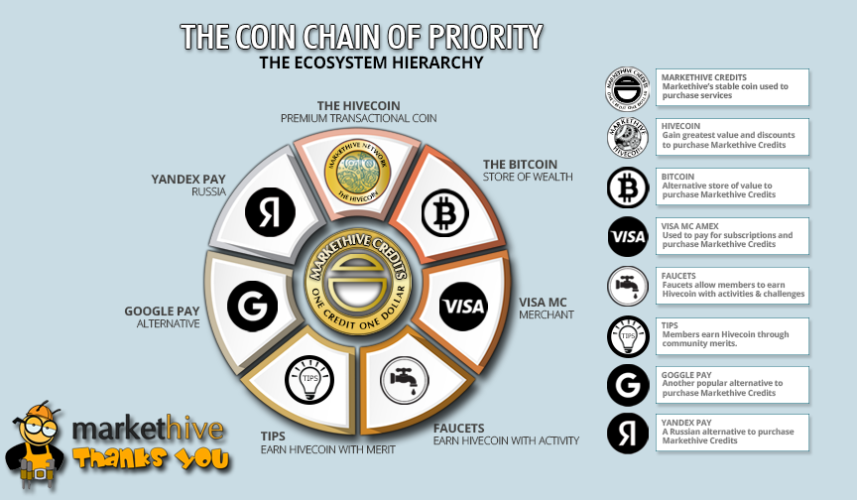

The Markethive Coin Chain Of Priority. The Ecosystem Hierarchy

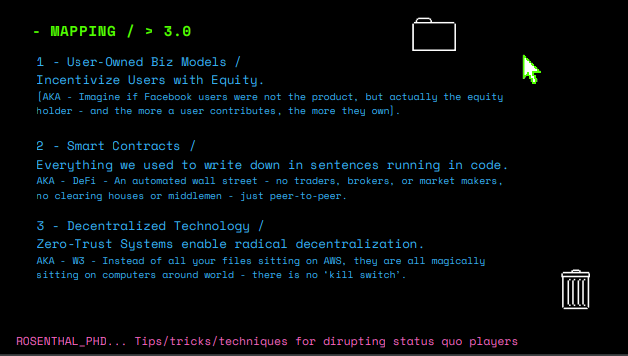

Markethive is revolutionizing the digital landscape with its innovative, decentralized platform that seamlessly integrates cryptocurrency and social networking. This dynamic platform, with its robust broadcasting capabilities, inbound marketing, and e-commerce, is not just a tool; it's a catalyst for change. By empowering entrepreneurs and challenging traditional business norms, Markethive is paving the way for a future where businesses of all sizes can thrive in a connected, decentralized, and empowered ecosystem.

This article explores the Markethive ecosystem's coin chain, emphasizing key elements and clarifying the unique roles and purposes of each token within the system. Markethive's design seeks to empower individuals to attain financial independence and self-sufficiency, rendering them essential to the platform's success and the community as a whole.

The Markethive Credit (MHC): The Markethive Token of Commerce

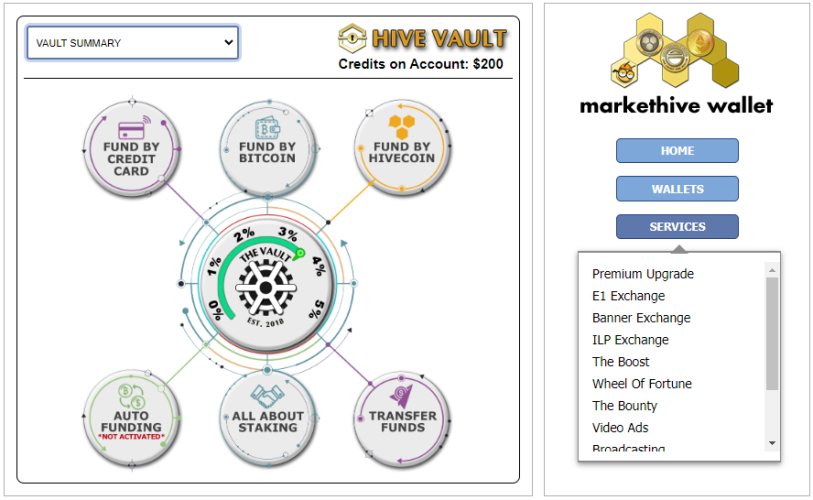

The Markethive Credit (MHC) is the cornerstone of the Markethive ecosystem, serving as its native stablecoin. With its value pegged at $1, MHC provides a secure and reliable means of purchasing a wide range of offerings within the Markethive platform. This stability ensures that users can confidently use MHC for subscriptions, digital and physical products, and services provided by the community or integrated third-party providers.

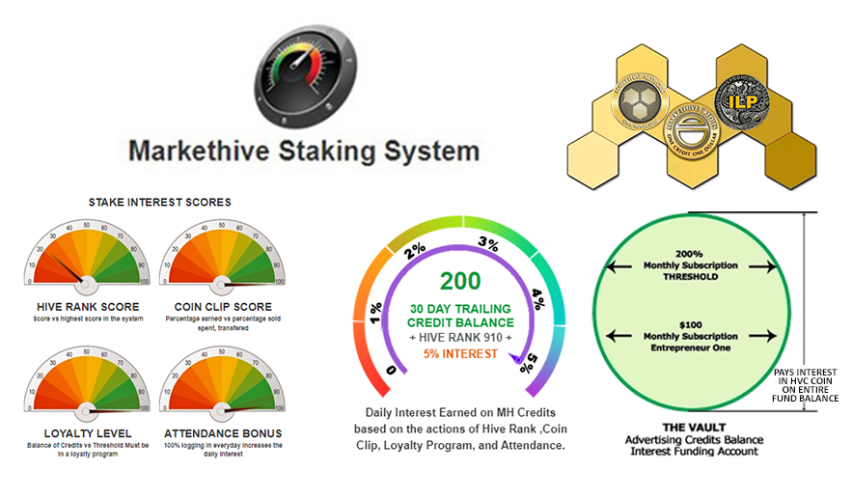

MHC's utility extends beyond its transactional capabilities. It is pivotal in the platform's staking mechanism, encouraging users to hold their MHC tokens. The quantity of MHC held in a user's wallet directly correlates with their potential daily earnings. Users with more significant MHC holdings are entitled to receive greater interest rewards. This system incentivizes long-term engagement with the platform and fosters a sense of community, as users are rewarded for their commitment and contribution to the Markethive ecosystem.

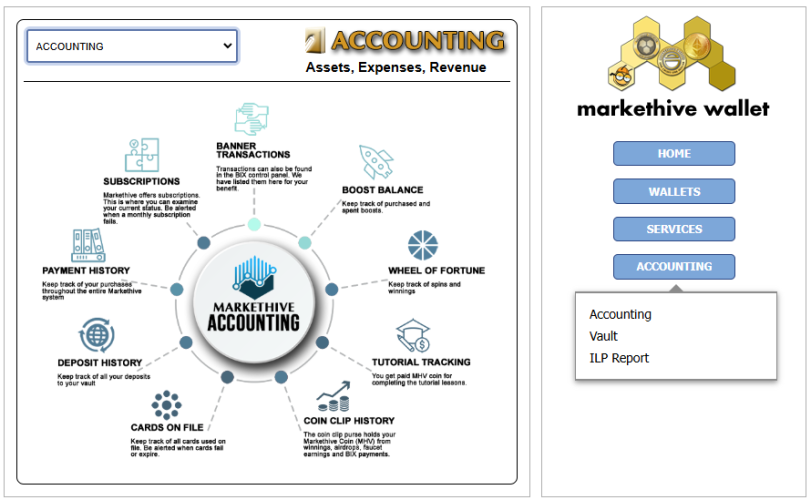

The image provided below illustrates many factors that can affect interest rates. Accrued interest is paid out in Markethive Tokens (MHV) at the start of each month; you can see your interest by tapping the coin clip that will open your wallet's Accounting section. The exchange rate between Hivecoin and MHV is 1 Hivecoin to 200 MHV (0.005 MHV = 1 HVC).

Accrued interest is paid out in Markethive Tokens (MHV) at the beginning of each month. You can view your interest earnings by accessing the Accounting section of your wallet through the coin clip on the dashboard or by accessing your wallet directly and navigating to the Coin Clip History.

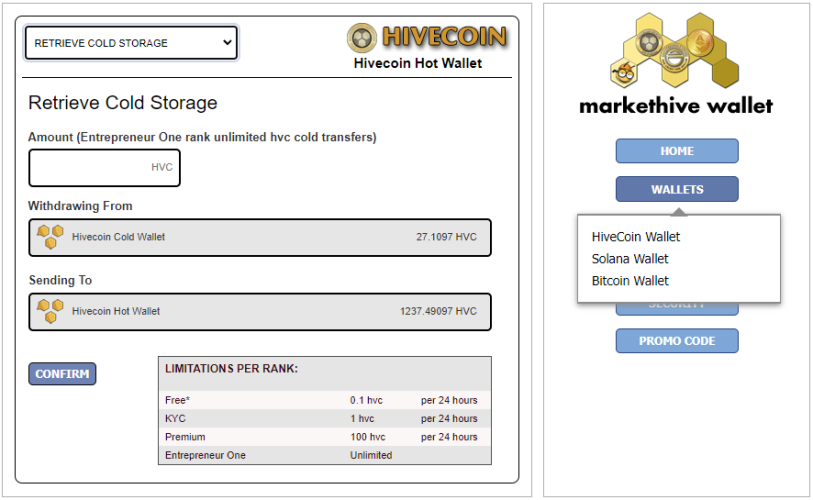

The Hivecoin (HVC): The Premium Transactional Crypto Coin

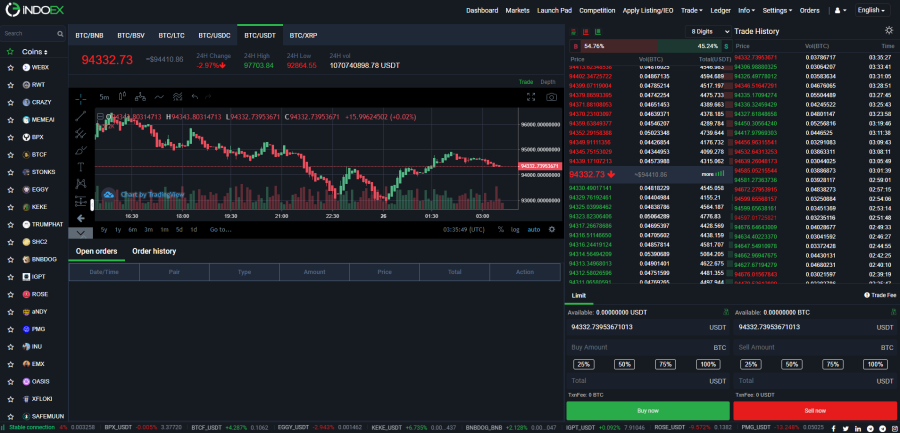

Hivecoin (HVC), Markethive's primary cryptocurrency, is a premium transactional token traded on significant cryptocurrency exchanges. HVC serves as a utility token with a wide range of uses, including payment processing, exchange transactions, smart contract execution, and commerce token integration, in addition to its primary function within the Markethive ecosystem. Users are rewarded with Markethive's coin for joining, participating, and using the platform's products and services.

Hivecoin's value is derived from its wide range of practical applications and extensive adoption rather than speculation. Its versatility and utility are evident in the diverse array of sought-after products and services it offers entrepreneurs and businesses. These offerings support a broad spectrum of use cases, including publishing, sponsored articles, press releases, broadcasts, banner ads, video ads, and digital advertising on cryptocurrency faucet sites, news sites, the Bounce, the upcoming Push, and other platforms.

Hivecoin will significantly transform Markethive's gamification strategy. Offering tangible rewards and incentives will encourage active participation and engagement on the platform. Users can earn Hivecoin through various activities, including content creation, social interactions, and referrals. This will enhance the user experience and drive the overall growth and development of the Markethive ecosystem.

Furthermore, Hivecoin's utility extends beyond its value as a digital asset. It functions as a practical token within the Markethive platform, allowing users to access premium features, buy virtual goods, and unlock exclusive content. This fosters a dynamic and self-sustaining economy in which Hivecoin is central in facilitating transactions and interactions.

Consequently, Hivecoin is not merely a speculative investment or a store of value. It has a genuine and tangible impact on the Markethive community, fostering a sense of ownership and motivating users to contribute to the platform's success. Furthermore, by aligning the interests of users and the platform through a shared stake in its success, Hivecoin will establish a virtuous cycle of growth, innovation, and community-driven development, positioning it as a leading player in the decentralized social media landscape.

Markethive's Strategic Use of Hivecoin

Markethive services can be purchased at a substantial discount using Hivecoin. The incentive is to use Hivecoin to purchase Markethive Credits. For example, $1 worth of Markethive credits can be bought for only 80 cents worth of Hivecoin. This translates to a 20% discount on any Markethive product or service purchased with Hivecoin. Effectively, a $100 product would only cost $80 in Hivecoin.

Benefits for Markethive and its Community

- Increased Hivecoin Demand: By offering discounts for Hivecoin purchases, Markethive directly increases the demand for its cryptocurrency. This heightened demand is likely to drive up the value of Hivecoin.

- Boosted Exchange Activity: As users acquire Hivecoin to take advantage of the discounts, there will be a surge in transactions on cryptocurrency exchanges. This increased activity benefits the overall Hivecoin ecosystem.

- Enhanced User Engagement: The discount system encourages users to engage more actively with Hivecoin and the Markethive platform, fostering a stronger community and potentially attracting new users.

A dynamic ticker provides real-time calculations and displays the current value of HVC, instantly converting it to the equivalent cost of a product or service. The discount is exclusively applied to transactions made using HVC, and it does not extend to other cryptocurrencies like Bitcoin or traditional payment methods such as credit, debit, or payment cards.

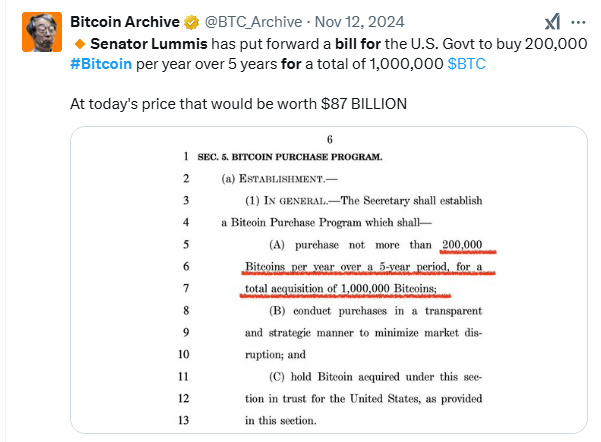

Bitcoin: Store of Wealth

Bitcoin serves as an alternative store of value for purchasing Markethive Credits (MHC) through the Vault Funding Threshold feature, which is designed to streamline the process of using Bitcoin on the platform. This innovative tool allows users to set a predetermined Bitcoin amount in a designated sub-wallet.

Once this threshold is reached, the system automatically converts Bitcoin into Markethive Credits. This automated process ensures users retain complete control and ownership of their Bitcoin until they actively initiate a conversion, striking a balance between convenience and autonomy.

The integration of Bitcoin into the Markethive ecosystem offers numerous advantages due to the inherent characteristics of this cryptocurrency and its blockchain capabilities. Furthermore, Bitcoin's pseudonymity has proven effective as a powerful tool for promoting freedom and democracy. In nations with oppressive regimes or limited financial infrastructure, Bitcoin empowers activists and individuals to secure funding and support without depending on traditional banking systems that may be susceptible to censorship or control.

Visa, MC. Amex Traditional Credit/Debit Cards

While other payment methods may be introduced or become preferable for certain transactions, Markethive is committed to providing a consistent user payment experience. The current payment method for purchasing Markethive Credits and paying for Markethive subscriptions will always be accepted. This unwavering commitment ensures that users can access a familiar and dependable payment process for managing their Markethive accounts and utilizing the platform's full range of features.

This commitment to a consistent payment option is essential in a dynamic online environment where payment trends and technologies can change rapidly. By upholding this steadfast approach, Markethive offers its users a sense of stability and reliability, removing any uncertainty or inconvenience that could arise from changes in payment preferences or the implementation of new payment technologies.

Furthermore, this commitment highlights Markethive's user-centric philosophy, prioritizing the needs and preferences of its users by ensuring a seamless, hassle-free payment experience. By maintaining this consistent payment option, Markethive shows its dedication to providing a reliable, user-friendly platform that serves the diverse needs of its community.

Alternative Payment Systems. Google and Yandex Pay

The Markethive community is diverse and geographically dispersed, with members residing in many countries worldwide. Many of our members live in regions where traditional payment systems, such as banks and credit card networks, are not easily accessible or reliable. This can create barriers to participation in the Markethive ecosystem and limit opportunities for financial inclusion.

Cryptocurrency offers a potential solution to these geopolitical and financial access issues. By leveraging decentralized digital currencies, Markethive members can bypass traditional financial institutions and transact directly with each other, regardless of their location or the restrictions imposed by their local governments. This can empower individuals in underserved regions and promote greater economic freedom.

However, navigating the complexities of digital wallets, exchanges, and blockchain technology can be challenging for those new to the cryptocurrency industry. This is where payment platforms like Google Pay and Yandex Pay can be crucial in expanding access to the Markethive community. By integrating these familiar and user-friendly payment methods, Markethive can lower the barriers to entry for newcomers and facilitate a smoother onboarding experience.

Furthermore, these payment platforms can help bridge the gap between traditional fiat currencies and the cryptocurrency ecosystem. By enabling users to fund their Markethive accounts using their existing bank accounts or credit cards, Google Pay and Yandex Pay can simplify the process of acquiring and using cryptocurrency, making it more accessible to a broader audience.

.png)

Faucets. The Income and Rewards Mechanism

There are numerous avenues to acquire Markethive's Hivecoin cryptocurrency with minimal effort. Two primary examples of these methods include micropayments and faucets. These mechanisms enable you to garner small quantities of Hivecoin as a reward for your activities and engagement within the Markethive platform.

Upon completing the KEY qualification and subsequent approval, you will gain access to the micropayments system. Your chosen KEY qualification level will directly influence the amount you receive in micropayments. The specific quantity of Hivecoin you receive will be contingent upon the intricacy of the task and your degree of engagement.

By maintaining an active presence within the Markethive ecosystem and capitalizing on the diverse earning opportunities, you can steadily amass Hivecoin over time. Integrating microtasks and faucet claims into your daily routine can achieve this with minimal effort. Pursuing and completing the KEY qualification process is essential to unlocking your full earning potential.

Other methods to earn Hivecoin include:

- Hivecoin Faucet website: Visit the Hivecoin Faucet website daily to claim HVC by entering your Hivecoin address and capturing the symbol.

- Social media engagement: Markethive offers rewards for sharing content, following their social media accounts, or participating in online discussions.

- Earn while you learn: By taking the Markethive tutorials, you gain knowledge about Markethive and receive micropayments as a reward.

- Referral programs: Earn Hivecoin by inviting friends and family to join the Markethive platform.

- Content creation: Contributing valuable content to the Markethive community, such as blog posts or videos, is incentivized with Hivecoin.

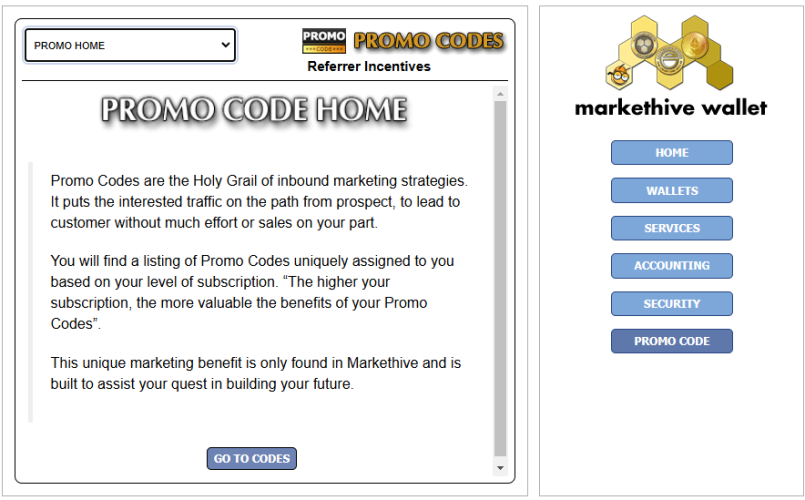

- Airdrops and giveaways: Markethive distributes Hivecoin to users through airdrops or Promo Code giveaways.

Completing the KEY qualification will activate micropayments and allow you to earn MHV, which is automatically converted to HVC in your Markethive wallet.

Tips. Earn Hivecoin With Merit

Within the Markethive ecosystem, the accumulation of HVC is intrinsically tied to the concept of merit. This means that your efforts and contributions are directly rewarded with HVC through members tipping you for your valuable content. Markethive is creating a system where active participation and value creation are incentivized.

Ways to Earn HVC through Tipping

- Content Creation and Curation: Creating high-quality, engaging content that resonates with the Markethive community is a primary way to earn HVC. This could include blog posts, articles, videos, infographics, or other forms of media that contribute to the overall knowledge and value of the ecosystem. Additionally, curating and sharing valuable content from others can also earn you HVC.

- Social Engagement: Actively participating in the Markethive social network provides another way to earn HVC. This includes commenting on posts, sharing content, engaging in discussions, and building relationships with other community members. If they appreciate you and your content, they may tip you.

Key Points to Remember:

- Quality Over Quantity: While consistent activity is essential, the quality of your contributions is paramount. Focus on creating valuable content, engaging with the community meaningfully, and providing genuine value to the ecosystem.

- Community Building: The Markethive ecosystem thrives on collaboration and community. Building relationships with other members, supporting each other's efforts, and contributing to the community's growth can lead to greater HVC rewards and a more fulfilling experience.

- Long-Term Vision: Earning HVC with merit is not a get-rich-quick scheme. It requires a long-term vision, consistent effort, and a commitment to the values and goals of the Markethive community.

By actively participating in the Markethive ecosystem and contributing your skills and talents, you can earn HVC with merit and become a valued community member. Remember that your success is intertwined with the success of the overall ecosystem, so focus on creating value, building relationships, and contributing to the collective growth of Markethive.

Harness the Power of Markethive to Grow Your Brand and Presence

Markethive is more than just another social media platform; it's a dynamic ecosystem that integrates social networking, inbound marketing tools, and a rewards system to foster your business's growth. By joining Markethive, you establish an online presence and become part of a vibrant community that actively supports and promotes your business.

Markethive provides the tools and resources you need to connect with your target audience, build brand awareness, and drive sales. Through our innovative platform, you can create engaging content, launch effective marketing campaigns, and track your results in real-time. With Markethive, unlock your business's full potential and achieve success beyond your expectations.

Unlike traditional social media platforms, Markethive rewards users for their online activities. By engaging with the community, sharing content, and promoting your business, you can earn rewards that align with your business goals. With Markethive, your online activity is not just valuable; it's also profitable. Markethive embodies the future of social media and marketing. We're not simply providing a platform but offering a comprehensive solution.

.png)

Tim Moseley

.png)

.png)

.png)

%20copy.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)