Cryptocurrency Has Changed the Dynamics of Savings and Investment: Will Banks Survive the Storm?

Cryptocurrency has changed the dynamics of savings and investment, but the effects of this change are not yet fully understood. This article discusses the impact of cryptocurrency on the global economy and the implications for banks.

Blockchain technology is revolutionizing the banking industry. As banks continue to evolve and adopt new strategies, they may need a strong understanding and implementation of blockchain technology if they want to remain relevant in the future.

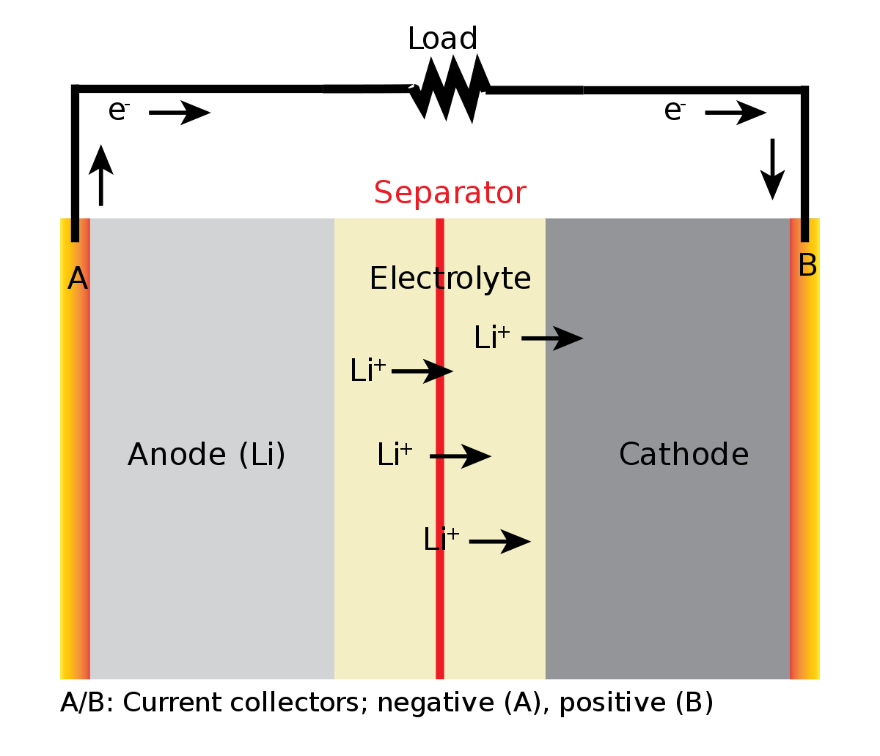

A blockchain is a public ledger that stores data without a centralized intermediary such as a bank or government agency that could become corrupted by fraudulent transactions, data loss, or malicious behavior on its part. Instead, it relies on consensus protocols that ensure trust between all users on the network when recording financial transactions on the shared ledger across multiple participants (called nodes).

Blockchain technology provides a secure way to store information and track transactions because it is not stored in any one place but dispersed across multiple networks.

Background of the Digital Currency

Cryptocurrencies are a new form of digital currency that can be used to make purchases and transfer money anonymously. These currencies have no physical form and exist only in the digital world. The emergence of cryptocurrency has affected the banking industry: will banks survive the storm?

Cryptocurrency is decentralized, meaning any government or central authority does not control it. The transactions are verified through a process called mining, which involves solving complicated math problems with powerful computers to crack cryptographic codes. Blockchain technology enables cryptocurrency users to purchase goods and services online without having to worry about fraud or identity theft because all transactions are recorded on this shared public ledger for anyone to see.

The blockchain technology industry has been developing rapidly in recent years. Some projects are being used by well-known global organizations, including JPMorgan Chase and Accenture, to streamline the supply chain process. Others have been developed specifically for cryptocurrencies such as Bitcoin and Litecoin (although they can be applied to any form of digital currency).

However, despite the widespread interest in blockchain and how it could revolutionize business processes, there remains a lack of understanding among many businesses around its actual value and potential use cases, which limits their ability to benefit from using it.

.png) Image courtesy of Vecteezy

Image courtesy of Vecteezy

Impacts of Cryptocurrency on the Global Economy

Cryptocurrency has a significant impact on the global economy. It affects the exchange of goods and services and the transfer of funds from one country to another, weakening the foreign exchange rates. As of March 2022, there are approximately 18,000 cryptocurrencies in existence. The number of cryptocurrencies is growing daily and its market capitalization is estimated to grow to $5 trillion by 2025.

Blockchain technology has already penetrated many industries, including the financial sector, government, healthcare, media, retail, etc. However, many issues with cryptocurrencies still need to be resolved before they can be used in a mainstream society like traditional currency.

Its significant benefits of being fast, easy, cheap, and secure have been widely accepted and embraced by people worldwide for years despite some shortcomings such as volatility, lack of regulation, etc. The digital currency has been used in various ways so far, most notably for online gambling, but also as an alternative to fiat currencies in some countries where they offer a better exchange rate (and are sometimes even preferred).

The use case of cryptocurrencies is also evolving; while many people will continue to use them as a form of money or payment systems, many others might use them for trading, which includes buying goods and services; using cryptocurrency instead of fiat currency.

Cryptocurrency and the Banking Industry

Bitcoin, the first and most popular cryptocurrency, was created in 2009. It was created as a decentralized form of currency that is not controlled by any one country. It functions as a peer-to-peer payment system that does not require any middlemen, and a network of nodes verifies transactions.

Bitcoin and other cryptocurrencies have gained traction in recent years, but the regulatory environment for cryptocurrencies is still unclear. There are advantages to using cryptocurrencies, such as security, transparency, and no central control.

However, there are also disadvantages to using cryptocurrencies, such as price volatility, potential hacking, and lack of regulatory oversight. There are two sides to the cryptocurrency debate. One side argues that cryptocurrencies are the future of money and will replace cash, credit cards, and other payment methods. The other side argues that cryptocurrencies are a speculative bubble that will soon burst.

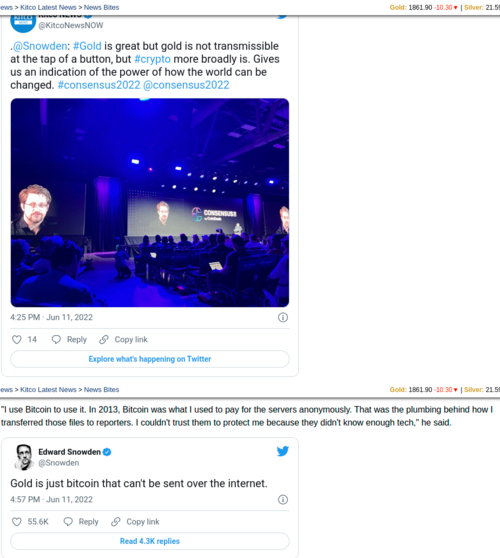

Some say that the implications of cryptocurrency on the global economy are not yet fully understood, but there are some apparent effects. For example, cryptocurrency has allowed individuals to transfer money internationally without banks or a third-party service. Cryptocurrency has also led to a decrease in demand for gold and other precious metals, as well as a reduction in cash usage.

The effects of cryptocurrency on banks are unclear. Some argue that banks will be irrelevant shortly, while others argue that banks will survive the storm. Cryptocurrency has caused a decrease in demand for banks' services and has led to an increase in financial risk. Banks may likely weather the storm by embracing cryptocurrencies and exploring new technologies like Blockchain. But will this ever happen? Who knows!

Roles of the Banking Sector in an Economy

In an economy, the banking sector plays a crucial role in facilitating the flow of money and providing loans to businesses and individuals. They have the power to regulate the money supply, which means they can determine how much money is in circulation.

This gives them control over inflation and deflation in the economy, so their actions must be responsible and transparent to avoid economic instability and financial crises such as the Great Recession from December 2007 to June 2009 and the recent financial crisis.

The central banks also determine whether the banks charge interest on loans and, if so, what the interest rate will be (known as the "prime rate" in the United States). Since banks can lend funds out of their reserves, there is a limit to the amount of capital they must hold; therefore, banks should borrow from other banks when necessary rather than from the public.

According to the conventional wisdom of financial economics, financial crises are inevitable in any economy that runs on fiat money because they occur when banks borrow more than they have and then fail to repay what they owe (Minsky, 1973).

The Federal Reserve System has attempted to prevent financial panics by keeping the supply of money constant and increasing it through open-market operations whenever the volume of outstanding debt increases by an amount greater than or equal to the Fed’s target for M1, which represents currency plus demand deposits at commercial banks. This method is commonly referred to as “monetizing the deficit.”

Why Are the Banks Cautious of Cryptocurrencies?

Undoubtedly, cryptocurrency has given rise to new, disruptive technology for money transfers and payment systems at large. Still, the central banking industry remains skeptical about its potential for displacing fiat currency as a medium of exchange or store of value, particularly when considering the risks associated with digital currencies like Bitcoin.

The cryptocurrency pioneer relies on decentralized networks and cryptography for security purposes instead of traditional regulation and oversight methods employed by central bank regulators worldwide and their regulatory bodies (the Financial Services Authority in the UK is an example).

According to research conducted by the Association of Certified Anti-Money Laundering Specialists (ACAMS) and the U.K.’s Royal United Services Institute (RUSI), nearly 63% of survey respondents who work in the banking sector view cryptocurrency as a potential risk rather than an opportunity.

Bitcoin has been around for over a decade and is the most well-known cryptocurrency. But as more and more digital currencies come into the marketplace, banks are starting to get cautious. They are concerned about potential losses resulting from transactions on these platforms. They don’t know what regulations governments will put in place to ensure these cryptocurrencies are not used for illicit purposes such as money laundering or terrorism financing.

One of the world’s largest bitcoin exchanges, Bitfinex, was hacked in August 2016 and had millions of dollars worth of bitcoins stolen from its customer's wallets and accounts. This has raised many valid questions about why the banks are concerned about the emergence of cryptocurrency.

Cryptocurrencies can also circumvent government-imposed capital controls, and it is now increasingly being used by international companies to avoid or evade taxes in various countries around the world.

This is due to the use of cryptography, allowing people worldwide to send funds to each other with complete anonymity and in a decentralized manner, using a peer-to-peer network of computers rather than a central server as traditional financial institutions do today.

However, because of its decentralized nature, bitcoin poses a risk of anonymous money laundering and terrorism financing, especially when combined with other forms of digital anonymity, such as “mixers” and other privacy-enhancing technology like Tor (The Onion Router) and VPNs (virtual private networks), which are used to mask IP addresses.

Can Cryptocurrency Eliminate the Banking Sector?

âââââ Image Courtesy of Medium

âââââ Image Courtesy of Medium

The latest trend in the financial sector is the rise of cryptocurrency. In 2009, a person or group under the pseudonym Satoshi Nakamoto published a paper describing digital currency. The paper introduced bitcoin, which became the first decentralized cryptocurrency in the world. Bitcoin and other cryptocurrencies have since become increasingly popular but also volatile.

For example, the price of Bitcoin rose from $2,500 in January 2017 to $19,000 in December 2017. Cryptocurrency is decentralized and relies on blockchain technology, and a central bank or government does not regulate Bitcoin and other cryptocurrencies. This makes cryptocurrency appealing to those weary of the unpredictable monetary policies of central banks and governments.

Many advantages come with cryptocurrency, such as its decentralized nature and independence from government interference, making it a great alternative to fiat currency systems (e.g the $USD).

However, it is essential to note that not all currencies have the same benefits as Bitcoin or other cryptocurrencies. It is also safe to say there is no guarantee that Bitcoin will be successful in the long run when compared to fiat currency, which has been around for thousands of years and has proven itself over time to be a stable medium of exchange for both individuals and businesses alike.

Nevertheless, if you look at the current state of cryptocurrency and the new development of blockchain technology today, many believe that it could be the future of money in this century. So they are trying to create more decentralized systems like Bitcoin or Ethereum, etc., but these systems are still in the early stages of development. We need more time before we can see what will happen with these currencies and applications.

So, for now, we need to find ways to secure our money from banks and other traditional financial institutions because as long as we have centralized systems that control how much currency and transactions are allowed, it is very easy for them to steal your funds or freeze your account whenever they deem it necessary.

In Summary

The Central Banks are at the heart of the modern global financial infrastructure in the current economic system, and as such, they have become a powerful force in society. In many cases dominating the economic life of nations to the extent that can be likened to that of feudal rulers controlling their kingdoms and duchies during times past.

Today we have what amounts to the equivalent of the Royal Family controlling central banks worldwide! In recent years, with the onset of a global economic collapse and with the Federal Reserve’s power over the American economy and the global economy increases, the Federal Reserve has become ever more influential over the entire planet.

Blockchain technology depends on algorithmic confidence, and its decentralized system offers an option to the current system. But the cryptocurrency has little adoption rates, and its legal reputation is still under the cloud. Cryptocurrencies are a new digital asset class with no central authority or bank behind them.

Instead, it relies on a distributed network of computers and users to maintain order and security in exchange for incentives and rewards, which is why they are often called “digital cash” as opposed to more traditional means of storing value like paper currency and gold. Many different cryptocurrencies are available today: Bitcoin Cash, Litecoin, Ethereum, Ripple, Dash, Zcash, Monero, Dogecoin, and so on.

There are possibilities at this point that Central Banks will start to introduce their own central bank digital currencies (CBDC). The problem is that nobody has yet been able to provide a solution for what happens when CBDCs across international borders fail. The associated costs and risks become more challenging to manage than they currently are today for national fiat currency systems.

The global financial system remains reliant on national monetary policymakers being willing to let the exchange rate of their respective countries weaken over time as part of ‘internal devaluation to encourage domestic consumption and investment spending via the money multiplier mechanism – something that can only be achieved if there are sufficient savings available.

References:

Tim Moseley

.gif)

.gif)

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov.gif)

.gif)