U.S. Crypto Upheaval Leads to Surprising Boon for Lucky Regions

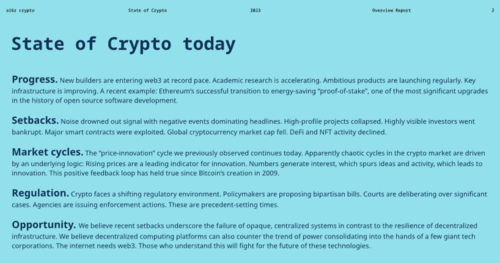

The U.S. crypto space is in chaos. In recent years, the world has witnessed a rough journey for cryptocurrencies, with their popularity surging to unprecedented heights. However, once a hotbed of crypto innovation, the United States now grapples with a clear regulatory framework. It has become hostile that necessitates a crypto exodus in the country. As the U.S. SEC hostility becomes too much to bear, which other jurisdictions are poised to attract entrepreneurs, builders, and innovators in the FinTech and crypto space?

While causing concerns within the country, this crypto fiasco has inadvertently paved the way for other regions to emerge as potential beneficiaries of the evolving crypto landscape. In this article, we will explore the regions poised to experience Crypto Bliss in the wake of the U.S. crypto fiasco.

Europe's proactive regulations, Asia's crypto-friendly environment, and the global nature of decentralized finance collectively shape a new era of innovation and adoption. As the crypto landscape continues to evolve, these regions will likely play a pivotal role in shaping the future of cryptocurrencies and blockchain technology, opening doors to a world of new possibilities.

Implications of Strict U.S. Crypto Regulations

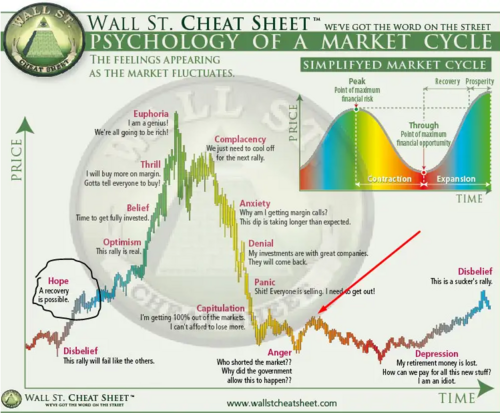

The implications of U.S. crypto regulations are far-reaching and complex. On the one hand, regulation can provide clarity and legitimacy to an industry plagued by Fear, Uncertainty, and Doubt (FUD). On the other hand, regulation can stifle innovation and limit access to new technologies.

One of the most significant implications of U.S. crypto regulations is that they have created a patchwork of laws that vary widely from state to state. This makes it difficult for companies dealing in cryptocurrency to operate across state lines. For example, New York has implemented BitLicense, which requires companies dealing in cryptocurrency to obtain a license from the state.

Alabama requires a license for selling or issuing payment instruments, stored value, or receiving money or monetary value for transmission. Arizona, Arkansas, and Connecticut have no specific cryptocurrency laws but have issued guidance on the subject. California and Colorado have a licensing requirement for businesses that engage in virtual currency activities.

The lack of uniformity in regulations hampers the growth and development of the crypto industry, as companies must navigate a maze of compliance requirements and legal frameworks. This adds complexity and costs to their operations and creates uncertainty for investors and consumers.

Moreover, U.S. crypto regulations directly impact the global crypto market. The United States is one of the largest cryptocurrency markets, and any regulatory changes or restrictions can have ripple effects worldwide. For instance, when the U.S. Securities and Exchange Commission (SEC) took a stringent stance on initial coin offerings (ICOs) and classified specific tokens as securities, it sent shockwaves through the industry and influenced regulatory decisions in other countries.

Another implication of U.S. crypto regulations is their effect on investor protection. While regulations aim to safeguard investors from scams and fraudulent activities, they can also restrict access to certain investment opportunities. For example, the SEC has imposed strict accreditation requirements for investing in certain crypto assets, which can exclude retail investors from participating in potentially lucrative ventures.

Furthermore, U.S. crypto regulations impact financial institutions and traditional banking systems. As cryptocurrencies gain mainstream acceptance, banks and financial institutions are increasingly exploring ways to integrate crypto-related services into their offerings. However, the regulatory landscape can be a significant barrier for traditional institutions looking to enter crypto. Complex compliance requirements, potential legal liabilities, and the risk of non-compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations pose challenges for banks, inhibiting their ability to embrace cryptocurrencies fully.

The U.S. crypto regulations' impact on the broader economy should not be overlooked. The crypto industry has the potential to drive economic growth, create jobs, and foster technological innovation. However, overly burdensome regulations can hinder these positive outcomes. By balancing regulation and fostering innovation, policymakers can create an environment that encourages responsible growth and positions the U.S. as a global leader in the crypto space. Still, unfortunately, the reverse is the case.

Uncertainty in the Crypto Space

It is quite notable that even before the emergence of Operation Chokepoint 2.0.pdf, the Securities and Exchange Commission (SEC) had not approved any Bitcoin Exchange-Traded Funds (ETFs). This lack of approval is significant, considering ETFs are key players in market liquidity.

Instead of approving such ETFs, regulators have chosen to drain liquidity. Crypto-friendly banks like Silvergate and Signature were the first to face repercussions. However, the circumstances surrounding their fall were viewed with suspicion, leading lawyers from Cooper & Kirk to suggest that it reflected regulatory overreach targeting the crypto industry.

Throughout 2023, the SEC has been taking aggressive action. The regulatory watchdog has filed complaints against Bittrex, Kraken, Gemini, and Paxos. Binance.US and Coinbase have also been targeted in a culmination of these actions.

By charging Coinbase as an unregistered securities exchange, the SEC has opened up a wave of legal uncertainty. It is worth noting that the SEC had previously approved Coinbase's underlying business model, a prerequisite for the company to go public under the ticker COIN in April 2021. However, as Coinbase expanded its range of crypto offerings, the SEC now views some of them as "crypto asset securities."

Simultaneously, the SEC needed to provide clear guidance when previously requested, which appears to be a deliberate strategy to establish rules through enforcement in the absence of proper legislation. While Coinbase is taking the SEC to court to seek clarification on securities, the damage has already been done.

In response to the legal uncertainty, Robinhood has announced that it will delist major cryptocurrencies like Cardano (ADA), Solana (SOL), and Polygon (MATIC) on June 27, with the possibility of more delistings based on the SEC's interpretation. Binance.US has halted all USD deposits, and Crypto.com is closing its institutional exchange.

As a result of this legal uncertainty, there has been a significant outflow of liquidity, leading to a $55 billion shrinkage in the total cryptocurrency market cap. Given the increasing fear, uncertainty, and doubt (FUD) in the U.S. crypto space, it raises the question of which crypto-friendly regions will most benefit from this situation.

%20copy.png)

European Union (EU)

Despite officially entering a recession, the Eurozone is the first major region to establish a comprehensive legal framework for digital assets. Eurostat data reveals that the Eurozone accounts for approximately 14% of global trade, putting it alongside China and the U.S. as the top three players in the market.

The E.U.'s Market in Crypto-Asset (MiCA) regulations are set to come into effect between June and December 2024. This regulatory clarity has prompted Ripple CEO Brad Garlinghouse to identify Europe as a "significant beneficiary of the confusion that has existed in the U.S." in a recent CNBC interview.

Similarly, Paul Grewal, Coinbase's chief legal officer, views the U.S. crackdown on cryptocurrencies as an "incredible opportunity" for Ireland and Europe, as stated in an interview with the Irish Independent. Years in the making, MiCA embodies a balanced and proactive approach to crypto regulation. It encourages innovation while considering financial stability and consumer protection. Here are some key highlights of the MiCA regulations:

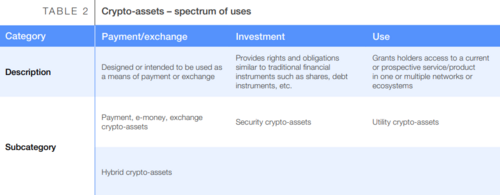

• Digital assets are categorized across a spectrum, including e-money tokens (EMT), asset-referenced tokens (ART), crypto-assets, and utility tokens.

• Requirements vary based on market capitalization. For instance, smaller-cap and utility tokens are exempt from providing a whitepaper covering liability, technology, and marketing.

• However, suppose an ART (stablecoin) or EMT exceeds certain thresholds, such as a €5 billion market cap, 10 million holders, or 2.5 million daily transactions with a volume exceeding €500 million. In that case, they are deemed "significant" gatekeepers and fall under the Digital Markets Act (DMA) regulation.

• All crypto companies are licensed as crypto-asset service providers (CASPs), with custodians and exchanges requiring a minimum liquidity threshold of €125,000 and trading platforms needing €150,000.

• CASPs must report user transactions to maintain licenses with the European Securities and Markets Authority (ESMA). This reporting includes transfers between CASPs and self-custodial wallets if the transactions exceed €1,000. CASPs must also record the senders and recipients for hosted wallets, following the "Travel Rule."

While the increased tracking may not be ideal, it represents a significant step towards legitimizing the crypto industry. In contrast, the U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler recently made blanket statements referring to crypto investors as "hucksters, fraudsters, scam artists."

It is also worth noting that Switzerland maintains its position as an innovation sandbox while interacting with the Eurozone. This is why many prominent crypto foundations, such as Tezos and Ethereum, are in Switzerland.

Within the E.U. itself, numerous crypto companies have gained global recognition. Notable examples include the Netherlands-based options trading platform Deribit, Finland's LocalBitcoins, Lithuania's DappRadar, and Ledger, a hardware wallet provider headquartered in France.

Switzerland

Switzerland, famous for its breathtaking landscapes and precision timepieces, is quickly establishing itself as a worldwide center for cryptocurrency businesses. What sets Switzerland apart is its regulatory environment, which plays a crucial role in fueling the growth of crypto enterprises.

The Swiss Financial Market Supervisory Authority (FINMA) has taken proactive steps to establish clear guidelines for crypto companies, offering them the legal certainty they need to operate. A prime example of this progressive mindset is the "Crypto Valley" in Zug, where numerous blockchain and cryptocurrency startups have found a home.

In 2020, Switzerland solidified its reputation as a crypto-friendly nation by passing the Blockchain Act. This legislation provides a comprehensive legal framework for distributed ledger technology (DLT) and blockchain, ensuring businesses clearly understand their legal obligations and rights.

Another key factor contributing to the success of crypto businesses in Switzerland is the country's robust financial infrastructure. With some of the world's largest banks and financial institutions, Switzerland offers crypto enterprises access to a sophisticated and mature financial ecosystem. This infrastructure, combined with Switzerland's stable economy, makes it an ideal location for businesses operating in the volatile realm of cryptocurrencies.

Switzerland's dedication to innovation and education is also vital in driving the growth of crypto businesses. Swiss universities rank among the world's leaders in blockchain research, consistently producing talented individuals for the rapidly expanding industry. Prominent institutions such as the Swiss Federal Institute of Technology in Zurich (ETH Zurich) and the University of Zurich offer courses specifically focused on blockchain and cryptocurrency, equipping students with the necessary skills to propel the industry forward.

The future appears bright for crypto businesses in Switzerland. The country's forward-thinking regulatory environment, robust financial infrastructure, and commitment to innovation will continue to foster growth in the sector. Furthermore, the Swiss government's openness to new technologies and willingness to engage in dialogue with crypto businesses indicate that Switzerland will maintain its status as a global hub for cryptocurrency innovation.

Dubai

Dubai's government has been actively working to create a welcoming environment for crypto businesses. They understand the importance of regulation and have proposed a comprehensive framework through the Dubai Financial Services Authority (DFSA). They aim to balance addressing concerns like money laundering and terrorist financing while encouraging innovation and healthy competition in the crypto industry.

The Dubai International Financial Centre (DIFC) has also taken steps to foster a crypto-friendly atmosphere. They introduced the Innovation Testing License initiative, allowing fintech firms to test their ideas in a controlled environment before launching them to the public. This approach promotes a safer and more secure environment for businesses and consumers.

Dubai's commitment to technological advancement and its Smart Dubai initiative further enhance its appeal to crypto businesses. They have recognized blockchain technology's potential and implemented it in various sectors, such as real estate, healthcare, and transportation. This integration of blockchain applications demonstrates their dedication to creating an innovative and progressive city.

Furthermore, Dubai's solid internet infrastructure, widespread mobile usage, and extensive data centers provide a strong foundation for crypto businesses to flourish. These resources are essential for the seamless operation of crypto-related activities and ensure businesses can operate efficiently and effectively.

Dubai's strategic location as a bridge between the East and the West adds to its allure as a global crypto hub. It has attracted significant crypto industry players, including renowned exchanges like Binance and blockchain startups like ConsenSys. These companies contribute to the local economy and foster Dubai's vibrant and dynamic crypto ecosystem.

Looking ahead, the future of crypto businesses in Dubai appears promising. The government's commitment to embracing blockchain technology, a favorable regulatory environment, and advanced infrastructure establish a strong foundation for sustained growth in the crypto sector. Moreover, Dubai's status as a global financial hub and its strategic location continue to attract international crypto businesses. As more companies establish their presence in Dubai, the city is on track to becoming a renowned global crypto destination.

Hong Kong

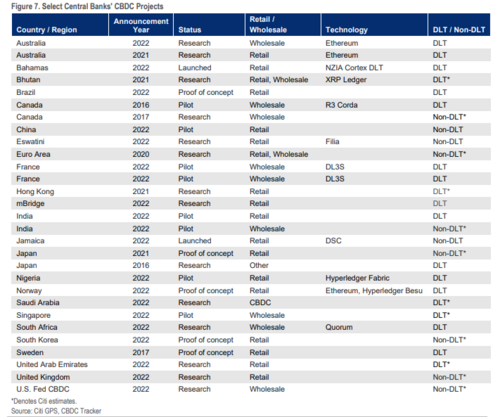

A semi-autonomous region of China has come back into the world of cryptocurrencies. Despite mainland China's ban on cryptocurrencies to ensure the smooth implementation of the digital yuan, Hong Kong has been given the green light for retail crypto trading since June 1.

However, certain restrictions exist for Virtual Asset Service Providers (VASPs) in Hong Kong. They are required to block retail traders from mainland China, and the tokens they list must possess high liquidity, be included in two major indices, and have at least one year of trading history. VASPs must also adhere to various regulations, including segregating customer assets, setting exposure limits, following cybersecurity standards, and avoiding conflicts of interest.

The decentralized finance (DeFi) sector can also flourish in Hong Kong under the Securities and Futures Ordinance, specifically the Type 7 license, with their tokens classified as either futures or securities. As a result of the new regulatory framework, several exchanges, such as CoinEx, Huobi, OKX, Gate.io, and BitMEX, have hurried to obtain VASP licenses in Hong Kong.

Interestingly, Z.A. Bank, a subsidiary of the Chinese state-owned company Greenland and the most prominent digital bank in Hong Kong, has also participated in Hong Kong's e-HKD Pilot Programme initiative. This demonstrates China's full endorsement of Hong Kong's adoption of digital assets for the foreseeable future.

Moreover, Hong Kong's tax regulations on businesses are quite favorable. While individual taxpayers are exempted from the capital gains tax, companies are subject to a single-tier tax system where corporations are taxed at 16.5% on assessable profits.

Singapore

Singapore, a highly developed city-state, has emerged as a major cryptocurrency hub in the Asia-Pacific region. One of the key reasons for this is the absence of capital gains tax, which means that individuals trading or selling cryptocurrencies are not burdened with tax liabilities.

The Monetary Authority of Singapore (MAS) classifies cryptocurrencies as "intangible property" and allows their use as a medium of exchange for goods and services. This is facilitated by homegrown payment provider Alchemy Pay, making crypto transactions relatively easy in the country.

However, it's important to note that businesses in Singapore are subject to a flat corporate tax rate of 17%. Nonetheless, Singapore offers a three-year tax exemption for start-up firms, providing them with a favorable environment to establish themselves and build credit, especially when traditional funding opportunities are limited.

Singapore has attracted major cryptocurrency players thanks to its financial stability and favorable regulations. For example, OKCoin, Coinbase, Binance, and Crypto.com have all set up offices in Singapore. Crypto.com has obtained a Major Payment Institution (MPI) license from the MAS, freeing it from certain thresholds related to its Digital Payment Token (DPT) services. This strategic move safeguards the exchange's operations amidst the SEC's tough stance on similar platforms.

In addition to its crypto-friendly environment, Singapore has been proactive in integrating artificial intelligence (A.I.) and machine learning technologies. The Ministry of Education has already developed AI-powered student learning systems, demonstrating the country's commitment to leveraging game-changing technologies.

As A.I. continues to advance and intertwine with the crypto industry, Singapore is well-positioned to become a hotspot for innovative crypto projects. Singapore's favorable tax regime, supportive regulations, and embrace of transformative technologies like A.I. make it an attractive destination for the cryptocurrency industry, drawing major players and paving the way for future developments.

As the U.S. crypto fiasco unfolds, these favorable regions offer promising prospects for the crypto industry. These regions provide supportive regulatory frameworks, fair tax policies, and a commitment to embracing emerging technologies. By capitalizing on these opportunities, crypto enthusiasts, entrepreneurs, innovators, and businesses can find their version of Crypto Bliss in these forward-thinking destinations.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.png)

(27).gif)

.png)

.png)