Cryptocurrencies Could Be the Answer to De-Dollarization

In today's globalized world, cross-border transactions have become a routine part of our lives. However, these transactions can be expensive and time-consuming, often requiring intermediaries such as banks and payment processors. Moreover, the dominance of the U.S. dollar in international trade has created dependencies and vulnerabilities in the global financial system. As a result, many countries are exploring alternatives to the U.S. dollar and seeking ways to facilitate cross-border transactions that are cheaper, faster, secure, and, most significantly, an alternative that would be politically neutral.

Countries and organizations are using this de-dollarisation technique more frequently to lessen their reliance on the U.S. dollar, which has been the main reserve currency since the Bretton Woods monetary system was established after World War II. In this context, cryptocurrencies have emerged as a potential solution to the challenges posed by cross-border transactions and de-dollarization. Cryptocurrencies offer a decentralized, borderless, and secure way to transfer value across borders without intermediaries.

In this article, we will explore the reasons behind de-dollarization's emergence and a possible solution to this problem. Let's get started!

Historical Overview of De-dollarization

The idea of de-dollarization is not new and has been discussed by economists and policymakers for decades. However, it gained more attention after the 2008 financial crisis, which exposed the vulnerabilities and dependencies of the global financial system on the U.S. dollar.

In the years following the financial crisis, countries such as Russia, China, and Iran began to take steps to reduce their dependence on the U.S. dollar. For instance, in 2009, Russia proposed the creation of a new global reserve currency to replace the U.S. dollar, citing concerns about the stability of the dollar and the impact of U.S. monetary policy on the global economy.

China has also been taking steps to internationalize its currency, the Yuan, and reduce its reliance on the U.S. dollar. In 2016, the International Monetary Fund (IMF) added the Yuan to its basket of reserve currencies alongside the U.S. dollar, Euro, Yen, and Pound Sterling. This move was seen as a significant step towards the internationalization of the Yuan and reducing the dominance of the U.S. dollar in the global financial system.

Countries like Venezuela and Iran have turned to cryptocurrencies to bypass U.S. sanctions and reduce their dependence on the U.S. dollar. Venezuela, for instance, launched its cryptocurrency, the Petro, in 2018, which it claimed would be backed by the country's oil reserves. Iran has also been exploring using cryptocurrencies to facilitate cross-border transactions and reduce its dependence on the U.S. dollar.

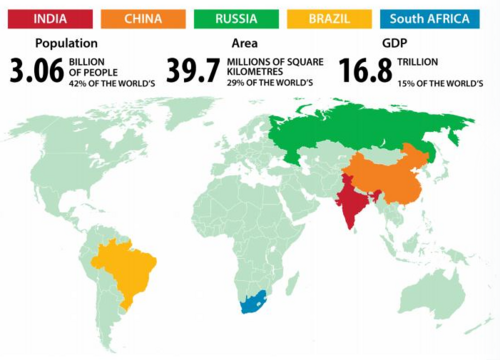

Image source: Unacademy.com

The five major emerging economies of Brazil, Russia, India, China, and South Africa (BRICS) represent nearly 42% of the world's population and have a combined GDP of over $16 trillion. They have been reducing their dependence on the U.S. dollar and promoting de-dollarization in the global financial system.

One of the critical initiatives of BRICS in promoting de-dollarization is the establishment of the New Development Bank (NDB) in 2014. The NDB is a multilateral development bank that aims to support infrastructure and sustainable development projects in BRICS and other emerging economies. It was created in response to the perceived inadequacies of existing international financial institutions, such as the World Bank and the International Monetary Fund (IMF), in addressing the needs of emerging economies.

Another initiative of BRICS in promoting de-dollarization is the establishment of the Contingent Reserve Arrangement (CRA) in 2015. The CRA is a framework that allows BRICS countries to provide each other with financial assistance in times of crisis without relying on the IMF and the U.S. dollar. The CRA has a total pool of $100 billion, which can be used to provide short-term liquidity support to member countries.

In addition to these initiatives, BRICS countries have also been exploring using their own currencies in cross-border transactions to reduce their dependence on the U.S. dollar. For instance, China and Russia have been conducting trade in their currencies since 2010, and India and Russia have also agreed to conduct trade in their currencies. Brazil and China have also signed a currency swap agreement allowing them to trade in their own currencies without using the U.S. dollar as an intermediary currency.

The BRICS countries are playing an increasingly important political game in promoting de-dollarization and reducing the dominance of the U.S. dollar in the global financial system. By establishing their multilateral institutions and exploring the use of their currencies in cross-border transactions, they are challenging the existing order and promoting a more multipolar world. Cryptocurrencies, with their borderless and decentralized nature, play an unimaginably essential role in this process, offering an alternative to traditional currencies and financial institutions.

Video source: FirstPost.com

How Would De-dollarization Impact The Rest of The World?

The new currency that replaces the U.S. dollar will significantly influence how de-dollarization affects the rest of the globe. As nations and organizations would need to adapt to the changes in their financial systems, a new reserve currency would probably result in significant volatility for the global financial system. The new reserve currency may also impact the system of international commerce since different nations may need to alter their currency exchange rates to account for it.

There will be an increased rivalry between the BRICS nations and the other countries which utilizes the SWIFT system. The BRICS partners are working to create international alternatives to SWIFT and other U.S.-dominated payment systems. The BRICS is motivated by the growth of international commerce and a need to create an alternative global payment network that can't be susceptible to U.S. government sanctions.

As international banking transactions involving multiple currencies require conversion into U.S. dollars, banks participating in the potentially sanctions-busting alternative to SWIFT risk retaliation from the U.S., which could use its power to exclude sanctioned banks and corporations from the global banking infrastructure. This calls for using intermediate banks with U.S. roots and SWIFT, which, according to nations like China, Russia, Iran, and Turkey, allows countries targeted by the most recent U.S. foreign policy to be cut off from global trade.

China, the world's second-largest economy in nominal terms of GDP, is attempting to promote the Yuan as a trade alternative to the U.S. dollar. An increasing de-dollarization trend has sparked trade agreements involving Brazil, Russia, India, China, and South Africa. This agreement has captured the interest of 19 countries that recently declared their intentions to join the BRICS.

Apart from the U.S. faltering economy, the government is notorious for its debt trap policies. For countries to maintain the U.S. dollar as the world's reserve currency, the U.S. government must keep it politically neutral and not use it as a weaponized tool against any nation through sanctions.

The Rise of Cryptocurrencies

Cryptocurrencies have significantly increased in popularity and adoption over the past decade. Bitcoin, the first and most well-known cryptocurrency, was created in 2009, and since then, thousands of other cryptocurrencies have been developed.

One of the main drivers of the rise of cryptocurrencies has been the increasing use of blockchain technology, which underpins most cryptocurrencies. Another factor contributing to the rise of cryptocurrencies has been the growing distrust of traditional financial institutions and government-backed currencies. Many people see cryptocurrencies as a way to bypass traditional financial systems and gain more control over their money with a high degree of privacy and anonymity.

The rise of cryptocurrencies offers a potential solution to the problem of de-dollarization, although more is needed. Cryptocurrencies can help countries reduce their dependence on the U.S. dollar and mitigate the impact of U.S. economic policies and sanctions by providing a stable and reliable means of exchange that operates independently of governments and central banks.

Countries that rely heavily on the U.S. dollar for trade and finance are vulnerable to U.S. policy decisions, which can have significant economic consequences. By diversifying away from the U.S. dollar, countries can reduce this risk and mitigate the impact of U.S. policies.

Cryptocurrencies, such as Bitcoin, offer several potential advantages for countries looking to reduce their reliance on the U.S. dollar. For example, Bitcoin is not subject to the same geopolitical pressures as traditional fiat currencies, offering high transparency and security. Bitcoin can provide a more stable store of value than fiat currencies, which can be subject to inflation and other economic pressures.

However, significant challenges are associated with using cryptocurrency as a solution to de-dollarization. For example, the value of cryptocurrencies can be highly volatile, making them an unreliable store of value. The regulatory landscape surrounding cryptocurrencies is complex and can change rapidly, making it difficult for countries to incorporate them into their monetary systems.

Despite these risks, the rise of cryptocurrencies shows no signs of slowing down, and they will likely continue to play an increasingly important role in the global financial system in the years to come.

Image by Markethive.com

Cryptocurrencies Offer Freedom In A World Of Financial Slavery By Design

Although cryptocurrencies have long been debated and studied, they are only recently beginning to gain acceptance as financial instruments that may be useful to those who aren't die-hard crypto enthusiasts. Cryptocurrencies have the potential to enable social and economic improvement worldwide, particularly in developing countries, by facilitating access to finance and financial services.

Although there are many advantages that users of cryptocurrencies can take advantage of, the most important one is an unmatched degree of freedom, such as mental and financial independence from controlling one's resources.

Early adopters who became rich overnight and discovered opportunities for financial growth had witnessed the incredible rate at which the crypto sector is evolving. The most well-known cryptocurrency, Bitcoin, has already enabled many people and businesses to prosper. The economy is gradually adapting to fulfill these expectations, and cryptocurrencies can assist.

Over one-third of the world's population lacks access to essential banking services like loans and account opening that might help them during personal financial crises. Even within India, banks charge interest rates significantly over what is fair, making consumers who sought loans feel even more uneasy. Cryptocurrencies can help with this because of their high volatility and straightforward usage.

Using cryptocurrency is made simpler and more accessible by several programs and tools. Massive crypto adoption will usher in an era of economic transformation where everyone will have greater control and empowerment over their finances.

Final Thoughts

De-dollarization is a significant trend to watch because it will significantly impact the U.S. dollar, the U.S. economy, and the rest of the world. It's still being determined how this will play out, but it seems possible that cryptocurrencies will play an essential role in de-dollarization. In the meantime, it's worth watching how countries are moving away from the U.S. dollar and how this affects their economies.

Cryptocurrencies offer several potential solutions to the challenges of cross-border transactions, bypassing U.S. sanctions and reducing reliance on the U.S. financial system. Increased adoption of cryptocurrencies could significantly impact the global financial system. It could reduce the dominance of traditional financial institutions and provide more opportunities for peer-to-peer transactions.

However, there are potential challenges to adopting cryptocurrencies, including regulatory and security concerns and the need for infrastructure and adoption. Other factors, such as geopolitical developments, trade policies, and macroeconomic trends, are likely to play a significant role in shaping the future of the global financial system. As such, the impact of cryptocurrencies on cross-border transactions and de-dollarization will depend on how quickly these challenges can be addressed and how widely cryptocurrencies are adopted.

Tim Moseley