Wall Street's Money Game Puts Crypto Revolution At Risk

Many people who believe in the potential of cryptocurrencies hope that Wall Street, the famous financial hub, will eagerly invest in the growing crypto market and enjoy the same profitable returns that individual traders have experienced whenever the value of cryptocurrencies has surged. However, this belief overlooks two crucial facts: firstly, Wall Street is already heavily involved in the cryptocurrency market, and secondly, it has no intention of injecting its capital to boost this volatile market.

The world of institutional finance has had numerous opportunities to capitalize on the cryptocurrency space. However, as its influence expands, the cryptocurrency market is transforming, potentially into something entirely different. Whether this transformation is intentional or an unintended consequence of its shortcomings, Wall Street may gradually undermine the essence of cryptocurrency itself.

This article explores the intricate dynamics between Wall Street and the crypto world, shedding light on the potential implications of the Wall Street money game in the crypto industry. Let's unravel the mysteries and better understand this ever-evolving landscape.

Wall Street Is Not On Your Side

The recent exposure of Wall Street's Bitcoin conspiracy has shed light on some alarming developments in the market. It all began with the BlackRock Bitcoin ETF application. BlackRock, a powerful asset manager known for its extensive control over various industries, including media and pharmaceuticals, has been implicated in bribery and political manipulation over the years. It is essential to remember that Wall Street and these major players are not interested in your financial freedom. They are anti-revolutionary and do not have your best interests at heart.

The news of BlackRock's Bitcoin ETF application is significant due to its massive influence as a $9.1 Trillion asset manager. Even a tiny portion of their funds could potentially buy up all the Bitcoin available on exchanges. However, BlackRock is not the only organization venturing into the Bitcoin ETF business. Fidelity, a $4.24 Trillion asset manager, and other major players are also interested in entering the market. These ETFs are expected to be backed by real Bitcoin and traded on stock exchanges.

The paperization of Bitcoin raises concerns as it will move more Bitcoin into the hands of stockbrokers, reducing the amount of Bitcoin available on the blockchain and resulting in fewer fees for miners in the long run. Long-term investors currently hold a significant portion of Bitcoin. BlackRock, Fidelity, Wisdom Tree, and Invesco, have all filed for Bitcoin ETF applications. These developments cannot be ignored.

Furthermore, we have EdX, an institutional-grade cryptocurrency exchange backed by Fidelity, Charles Schwab, and Ken Griffin's Citadel Securities. The pieces start to come together when we see the bigger picture. A crackdown on the cryptocurrency industry led by Gary Gensler, the head of the SEC, raises eyebrows. Gensler's previous affiliation with Goldman Sachs, a major player on Wall Street, suggests a conflict of interest. It appears that Wall Street is orchestrating a deliberate attack on its major competitors, such as Coinbase and Binance, while simultaneously preparing to launch its own cryptocurrency exchange.

The entry of Wall Street into Bitcoin is not a coincidence. It is a meticulously planned move to manipulate the markets for their benefit. Institutions like JPMorgan and BlackRock are experts in market manipulation, and their involvement in Bitcoin will undoubtedly affect its price.

However, we must understand that inviting Wall Street into the cryptocurrency space comes with risks. They have a history of dismissing Bitcoin as a scam, and suddenly they are interested in Bitcoin. The agenda is clear; they aim to gain control over it and take surveillance to the next level. We can expect them to push for code changes in Bitcoin to exercise control, which organizations like Greenpeace have already discussed.

While the influx of ETF applications may seem exciting for regular consumers wanting to invest in Bitcoin, it comes at the cost of relinquishing the uniqueness of Bitcoin itself. Owning Bitcoin through Wall Street-backed ETFs means giving up control over your assets. The hope that these institutions will hold and redeem your Bitcoin in the future is not the vision that attracted many people to Bitcoin in the first place. If you genuinely believe in the principles of Bitcoin, buying and holding your own Bitcoin is crucial, securely stored in your personal wallet. Wall Street cannot be trusted with your financial sovereignty.

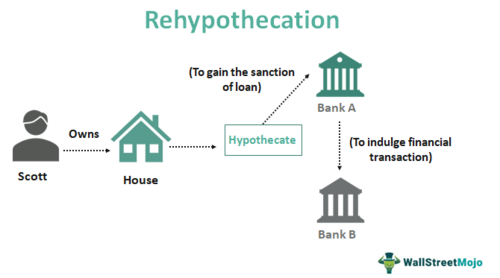

Image source: Wall Street Mojo

How Wall Street Can Potentially Harm Cryptocurrency

To understand how Wall Street can negatively impact cryptocurrency, let's delve into a concept called hypothecation. In simpler terms, hypothecation occurs when a company or firm pledges its equity shares as collateral to a lender. Here's an example to illustrate this: Imagine Company A needs $5 million, and Broker B agrees to lend them the money. In return, Company A offers $5 million worth of their securities as collateral to Broker B. This type of arrangement is known as hypothecation.

Now, here's where the potential problem arises. Rehypothecation comes into play when Broker B, the lender, reuses the assets received from Company A as collateral for their business activities. This practice allows Broker B to utilize the assets as a security for their transactions. In the traditional financial world, rehypothecation is relatively straightforward due to a few reasons.

Firstly, shares in the traditional financial system are not physically settled; ownership certificates represent them. This characteristic makes transferring ownership as an 'IOU' simple without physically moving the shares. Secondly, accounting and tax regulations permit the same asset to be attributed to different parties as long as each party records a distinct amount of debt on their balance sheets. However, this flexibility granted to banks and brokers increases the risk associated with counterparties involved in such a system.

Cryptocurrency, like Bitcoin and Ethereum, operates on decentralized networks that rely on blockchain technology. These digital currencies are not governed by centralized authorities like banks or governments. The underlying technology ensures transparency and trust in transactions by recording them on a shared, immutable ledger.

However, when Wall Street, with its established practices and financial mechanisms, enters the realm of cryptocurrency, it introduces potential threats. The concept of hypothecation and rehypothecation, which are prevalent in traditional finance, can pose risks to the stability and integrity of cryptocurrency.

One significant concern is the possibility of multiple parties claiming ownership of the same digital asset. Unlike traditional shares represented by certificates, cryptocurrency ownership is recorded and verified through complex cryptographic algorithms. If a broker were to hypothecate or rehypothecate digital assets without proper mechanisms in place, it could result in conflicting claims and disputes over ownership.

Moreover, the transparency and decentralization that define cryptocurrency could be compromised. Rehypothecation often involves leveraging assets for additional borrowing, which can introduce systemic risk and potentially lead to market manipulation. This practice could undermine the principles of fairness and equal opportunity that many proponents of cryptocurrency value.

The risk of counterparty failure increases with rehypothecation. In the traditional financial system, where banks and brokers hypothecate, and rehypothecate assets, the complexity of transactions and the interdependency among market participants heighten the risk of a domino effect if one party defaults. Such failures can have far-reaching consequences, including financial instability and loss of investor confidence.

The Implication Of Rehypothecation For The Crypto Industry

There's an important issue to consider when discussing cryptocurrencies like Bitcoin. Many of these digital currencies claim to have a system that ensures their security and reliability, such as a proof-of-work (PoW) or proof-of-stake (PoS) mechanism. However, these cryptocurrencies are often traded on centralized exchanges despite these claims.

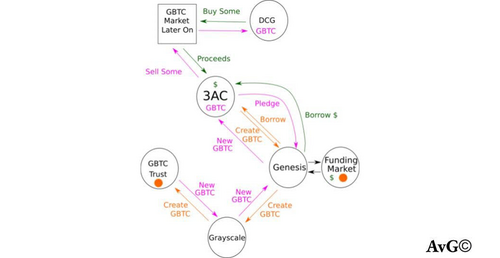

Let's delve deeper into the problem. Imagine a scenario where a Bitcoin is rehypothecated multiple times as brokers and exchanges trade debt and collateral. In such a situation, who gets to claim ownership if there's a need for it? Who indeed possesses the cryptocurrency at the end of the day when multiple parties know the private key, or worse when no one does?

Cryptocurrency enthusiasts strongly believe in the idea that if you don't have control over your private key, you don't have control over your crypto assets. This means that if you don't directly manage and secure your private key, you can't truly claim ownership of your cryptocurrency.

Now, let's consider some potential problems that can arise. What if a broker goes bankrupt, and someone needs to be compensated? Or what if a hard fork happens, and someone needs to participate by voting with their stake in the cryptocurrency? In such cases, determining the rightful owner of the Bitcoin becomes exceptionally complicated due to the long chain of transactions involved. It becomes unclear who should be considered the valid owner, and this uncertainty creates a significant challenge.

Moreover, the current transient ownership model, where cryptocurrency ownership changes hands frequently, simply doesn't work well for assets recorded on a ledger. This flawed model can lead to multiple parties expecting compensation simultaneously, creating a chaotic situation. The risk of a complete breakdown in this scenario is alarming and could have devastating consequences.

One empirical example of the catastrophic consequence of rehypothecation in the crypto industry was the lucrative Grayscale Bitcoin Trust (GBTC) “premium arbitrage,” which led to the demise of 3AC, Genesis, and Grayscale. Rehypothecation generated credit from assets and allowed multiple transactions to be collateralized by the same asset. This unstable chain of transactions supported by the same collateral was poorly understood and resulted in the collapse.

Image source: Hackernoon

Addressing these concerns and finding solutions to ensure the proper ownership and control of cryptocurrencies is crucial. The complex and convoluted nature of ownership in the current system poses significant risks that could undermine the stability and reliability of cryptocurrencies as a whole. Therefore, exploring alternative models and frameworks that can provide a more robust and secure ownership structure for digital assets is essential. By doing so, we can build a stronger foundation for the future of cryptocurrencies and protect investors from potential disasters.

Why Investors Are Eager For A Bitcoin ETF

The idea of a Bitcoin ETF has captured the imagination of cryptocurrency enthusiasts for a couple of important reasons. First, ETFs are built on a solid foundation of tangible assets, and second, they are seamlessly integrated into the traditional financial market through brokers. If a Bitcoin ETF were to become a reality, it would make Bitcoin much more accessible to everyday investors who may not have the patience or technical know-how to buy Bitcoin on cryptocurrency exchanges or manage a blockchain wallet. In simple terms, a Bitcoin ETF could be the key to achieving widespread adoption of Bitcoin.

The hope for a Bitcoin ETF received a glimmer of optimism in October 2021 with the launch of the ProShares Bitcoin Strategy ETF (BITO) on the New York Stock Exchange (NYSE). However, it's important to note that this particular ETF is not directly tied to Bitcoin itself. Instead, it tracks the Bitcoin futures contracts offered by the Chicago Mercantile Exchange (CME), which are essentially bets on the future price of Bitcoin.

On the other hand, ETF proposals directly linked to Bitcoin from various companies have either been outrightly rejected, as was the case with early Bitcoin investors Cameron Winklevoss and Tyler Winklevoss or are still awaiting approval from the U.S. Securities and Exchange Commission (SEC).

Although there are opportunities for profit in the cryptocurrency market, and the industry has experienced a surge in popularity in recent years, there remain numerous uncertainties surrounding the future relationship between cryptocurrency and Wall Street and its broader acceptance among the investing public.

Many investors believe that the influx of Wall Street money might lead to more regulation, oversight, and accountability in the crypto space, which could ultimately benefit users and investors.

In the end, the impact of Wall Street money on cryptocurrencies will depend on how regulators, policymakers, investors, and users find the right balance between risk and reward, trust and verification, centralization and decentralization, and innovation and stability.

Tim Moseley

.png)