Does This New Trend Correlate With This Flagrant Prediction?

By now, many of us have heard of the declaration, “You’ll own nothing and be happy,” cited by Klaus Schwab of the World Economic Forum and all part of The Great Reset. Yet, only a few believe this infamous prediction will actually become a reality. Sadly, our ownership of things is vanishing, and many of us unwittingly embrace this new normal.

There is an alarming trend permeating every sector of the economy, and in this article, we’ll cover where this trend came from and why cryptocurrency could be the only defense. The following will explain how “they” plan to make you happy while owning nothing, and there can be no doubt it’s nothing to be happy about.

The Ownership Predicament

One of the things we all believe we own is our mobile phone. An essential item that all of us have and these days has become an extension of ourselves, and it’s difficult to function without it. So, the question is, how often do you need to change or upgrade your phone due to poor performance?

Statistics show that we change our phones every 2 to 3 years, consistent with the battery's life span. A solution to the periodical upgrades would be just to install a new battery so you can enjoy your phone for another two years until you need to replace the battery again, and so on. Well, that’s the theory.

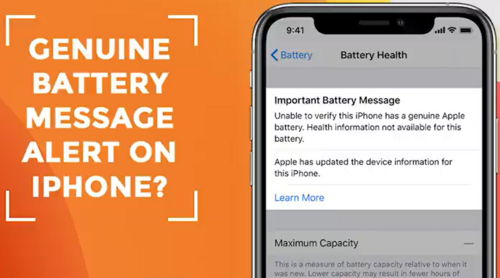

Image source: rapidrepair.in

In practice, however, changing the battery is not so simple and can damage the phone, providing you can actually get a replacement battery. In the case of newer iPhone models, the phone will detect when you've replaced the battery and give you all manner of warning messages, which push you to go to the Apple Store for an extensive repair, which could cost as much as a new phone.

Now, critics of this scheme have accurately observed that the inability to independently open, modify or repair a device that you own means that you don't actually own it because ownership literally means the ability to do all of the above and more.

These and other issues have given rise to a global movement called Right To Repair, which has pressured Apple and other tech giants to make repairs more accessible, albeit to a limited degree due to the lobbying power these corporations wield.

However, the right to repair doesn't entirely eliminate the underlying ownership issue. Did you know manufacturers slow down a smartphone’s performance to force you to buy a new one?

Samsung was fined for this practice in 2018, and as usual with all the big tech companies, Samsung’s fine amounted to nothing more than a rap over the knuckles compared to the profits it probably made from artificially slowing down phones. It’s something that the company is allegedly still doing today, and this level of control negates any aspect of ownership.

Solana co-founder Anatoly Yakovenko with Solana smartphone. Image: Solana Labs/Decrypt

On a positive note, Solana has developed a smartphone that has unique functionalities setting it apart from other phones. It is a web3-enabled device that features tight integration with the Solana blockchain. Anatoly Yakovenko, the co-founder of Solana, believes the key to unlocking the potential of crypto is to bring it into everyone’s hands. Solana Mobile bridges this gap by allowing easy access to the world of crypto and web3 and provides greater adoption and understanding of crypto.

The project is an open-source platform that aims for widespread adoption and seeks collaboration from other smartphone manufacturers. If these companies believe crypto is important enough, then billions of users can have the opportunity for self-custody. This has the potential to disrupt the industry, creating a new ecosystem that is not burdened by legacy software and hopefully minimizes artificial manipulation.

Planned Obsolescence

The practice of forcing people to upgrade through some nefarious means has found its way into everything from household appliances to hospital equipment, and it’s not a new practice. It’s been around for nearly 100 years, known as Planned Obsolescence. The term was coined by an American real estate broker named Bernard London in a paper titled “Ending the Depression through Planned Obsolescence," published in 1932.

Bernard said that the Great Depression made no sense because “factories, warehouses, and fields are still intact and are ready to produce in unlimited quantities, but the urge to go ahead has been paralyzed by a decline in buying power and, by extension, a decline in demand.” Given this situation, Bernard proposed the following solution;

“I would have the government assign a lease of life to shoes and homes, and machines to all products of manufacture, mining, and agriculture when they are first created, and they would be sold and used within the term of their existence, definitely known by the consumer. After the allotted time had expired, these things would be legally dead and would be controlled by the duly appointed governmental agency and destroyed if there is widespread unemployment.”

In other words, everything produced in the economy would be artificially made obsolete by the government at a specific date to cause the population to consume more. So that the economy recovers while simultaneously providing ample employment, further fostering economic growth.

Bernard's problematic idea of planned obsolescence never really caught on because, arguably, it was the second world war that ended the Great Depression. This is primarily because the post-war period was one of incredible prosperity, particularly for the United States, as it managed to reap much of the rewards of victory while incurring little in the way of losses compared with its allies. Also, the US dollar had just become the world's reserve currency.

Image source: Investopedia

More importantly, the populations of countries like the United States and Canada exploded after the second world war; hence the generation referred to as Baby Boomers. It’s important because the rapid increase in population meant a rapid rise in consumption, so there was no need for planned obsolescence business practices.

Companies could comfortably sell high-quality hardware that would last for decades because they knew there would always be another wave of buyers coming next year as more baby boomers became adult boomers. However, by the 1970s, it became clear that baby boomers weren’t having the same number of children as their predecessors.

Ostensibly, many western countries tried to fill this future demographic gap by introducing immigration, and this seems to have worked for a while. However, by the early 2000s, it turned out that immigration alone wasn't enough to fill the demographic gap, which continued to grow as companies needed increasingly future consumption to continue their future expansion.

Meanwhile, native birth rates continued to decline, and this seems to be the period when Bernard's idea of planned obsolescence started to become a reality. Companies were effectively forced into selling low-quality products requiring a repurchase every few years to continue consumption trends in the absence of a growing population.

Hardware As A Service

So, what does all of the above have to do with us owning nothing and being happy? If you’re an iPhone user, you may recall that Bloomberg reported that Apple would be rolling out a subscription service, and it’s nothing like their current service. It applies to the hardware, not the software, meaning that the subscription service will be for the physical phone itself.

Louis Rossmann, a popular YouTuber, and computer repair shop owner who has gone head-to-head with anti-repair corporate lobbyists, reacted to the Bloomberg article, pointing out that a service is when someone or something does something for you. A phone is not a service; it’s a product, and it should be yours entirely from the moment you purchase it.

Louis also highlighted that many Wall Street investors are pushing for publicly traded companies to adopt this so-called Hardware as a Service business model (HaaS) because it will make them trade at higher valuations, regardless of their actual earnings.

This sounds disturbingly similar to the ESG investment trend, which effectively consists of asset managers moving their money into companies that comply with their ever-changing criteria, causing their stocks to pump even though no actual profits are being made.

Hardware as a service satisfies Environmental criteria because the number of devices in circulation can be reduced, and the ones in circulation can be reused. Any old devices can be easily recycled; you'll likely need to give back your old device to get a newer version.

Hardware as a service also satisfies Social criteria because everyone will have subscription services for the same devices. There will be no phone with a better camera or a bigger memory. Nor will there be a faster or slower, bigger or smaller car, which means everyone will be truly equal.

Hardware as a service satisfies Governance criteria because it will put the company producing the product in total control of its creation, use, and destruction. Furthermore, HaaS will result in actual profits because people will pay for subscription services for just about everything they have in their possession until they die.

Whereas Planned Obsolescence was formulated to solve the Great Depression, it appears that Hardware as a Service is being introduced to ensure consumption continues to increase even as the demographic decline continues.

HaaS is not likely to be forced upon us consumers. As we’ve recently seen in other products, applying too much force tends to result in an equal or more significant amount of resistance because people know something is up when they don't have a choice.

Instead, however, the ability to own anything will likely become ever more difficult as time goes on, starting with items that tend to be the most expensive purchases for the average person. Housing is at the top of the list, with costs going through the roof.

Image source: The Guardian

Housing

The housing market and the rising costs in this sector of the economy will eventually cause the population to push politicians to do something—for example, Berlin’s campaign to resocialize housing. One of the outcomes could be that the government starts nationalizing housing. In other words, taking it away from landlords in the name of the greater good, and while these policies will be directed towards the big fish at first, the small fish will come next, just like with taxation.

Alternatively, if the housing market collapses, we could see asset managers like Blackstone swoop in and acquire as many properties as possible with the freshly printed money they received from their respective central banks. Basically, you’ll rent from the government or Wall Street.

Personal Transport Vehicles

The next item on the list is vehicles of all kinds. A lot of activity is already in play by car-sharing companies, electric scooter companies, and shared bicycle companies. There’s every chance these entities are extracting as much data as possible in preparation for HaaS models for similar vehicles. And the fact that many of these companies continue to receive large investments, despite being barely profitable is evidence of this effect.

Interestingly, HaaS in cars is likely a reason why there's such a massive push for electric vehicles. That's because it's easy to break the rules of a sharing economy when the car is powered by petrol and hardware, but it's much harder to break the rules when the vehicle is powered by electricity and software.

Moreover, there's a limit to how many electric cars can be made because there doesn't seem to be enough lithium on the planet to replace existing vehicles with electric cars, according to the World Economic Forum's own research. So it effectively guarantees that electric vehicles will need to be shared.

Phones And Computers

Phones and computers will probably be the third class of products to get sucked into the hardware as a service scheme, but the average person could take quite a while to accept it. That's because phones and computers are frequently listed as a person's most valuable possessions, primarily because it's something that you can truly shape to meet your personal needs.

These devices also contain lots of sensitive personal data that you'd rather keep to yourself and not share with anyone. Keeping track of phones and computers would also be very difficult without a digital ID, which is also a prerequisite for the rollout of Central Bank Digital Currencies and internet censorship, which the powers that be have explicitly stated they want to enforce.

Is The Tradeoff Worth it?

The number of people on board with this Hardware as a service idea seems to be increasing. This is simply because an increasing number of people can't afford a home, a car, or even a quality computer or phone. But many think the tradeoff is too great, given that we are all unique, inherently sovereign human beings with Divine free will bestowed upon us. It’s not in our nature to be enslaved by any physical entity without the freedom to make choices, grow and prosper.

There is something precious that we do own, and that is ourselves. The few things we should have a right to own are ultimately an extension of ourselves. They allow us to exercise ownership of ourselves in the world so long as the path to ownership exists. This is why having a place to call home, a way to get around, and the ability to communicate and express oneself is objectively vital and universally sought after. Where there’s a will, there’s a way.

I can’t imagine anyone being “happy” in a world where the path to ownership of literally everything except our physical body is obstructed. To make matters worse, we may even lose ownership of ourselves because of a digital ID “they” plan to roll out.

What’s The Solution?

It should be clear by now that our current financial system is not working, and some say it hasn’t been working for decades or even longer because it’s not just Hardware as a Service, as Planned Obsolescence was proposed almost 100 years ago. As all crypto enthusiasts know, cryptocurrency was built to replace this broken financial system. Although cryptocurrency still has a very long way to go, it has already fixed one of the most critical aspects of finance: the ability to truly own your assets.

.png)

Image source: wtfhappenedin1971.com

Some may consider this is nothing new, but it really is! The money in your bank can be seized, and authorities can confiscate any physical property you have. Even your house can be taken from you if you don't pay your taxes, and in some countries, the government can take your property at will using Eminent Domain.

Some might think this is fine, but it's not. These are the sorts of legal levers that governments and corporations are slowly starting to pull to take control of everything you own. Once realized, it’s easier to understand why the Entrepreneur and CEO of MicroStrategy, Michael Saylor, is a colossal Bitcoin advocate.

Image source: Markethive.com

BTC can't be seized because a third party does not technically own it. It can't be confiscated because it's not physical. And it can't be taken by the government through some obscure law because the only law in crypto is immutable computer code. This makes BTC the best hedge against a world where you will own nothing because it guarantees you will own something.

A growing number of companies and individuals also realize what’s happening and are building a Parallel Economy to counter the “woke trend” and the elite pushing for this new world order and planning the great reset of the world. We must be aware of what’s happening and what’s in store before we are blindsided. Be part of communities that believe in liberty, financial sovereignty, and the freedom to live the way we have been accustomed to so that the legacy may continue for future generations.

Tim Moseley

(11).gif)