The Evolution of Digital Marketing and Social Media. From its Inception, Markethive has maintained a Constant Presence.

Digital marketing, a dynamic and rapidly evolving field, has fundamentally transformed the way businesses engage with their customers. From its inception to its present sophisticated manifestations and promising future, the development of digital marketing exemplifies rapid technological advancements and enhanced human connectivity, with Markethive having played a pivotal role from the outset.

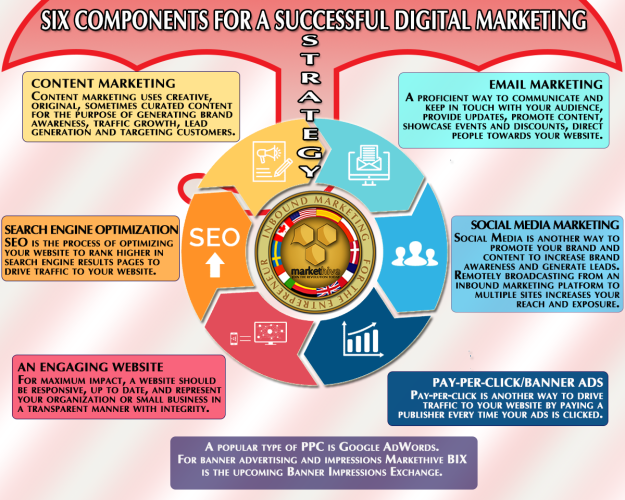

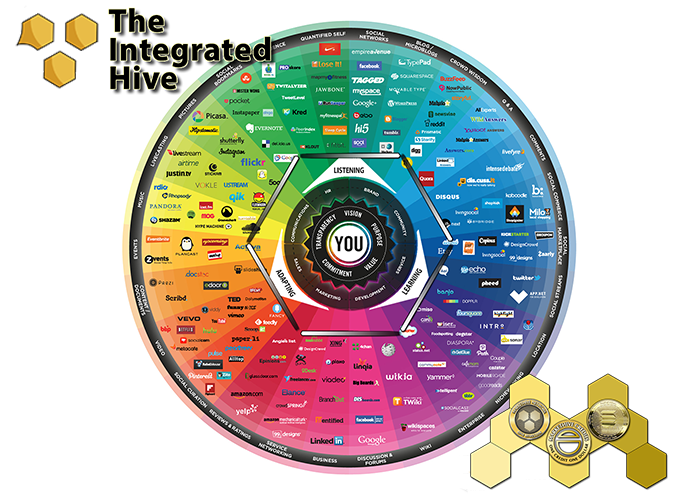

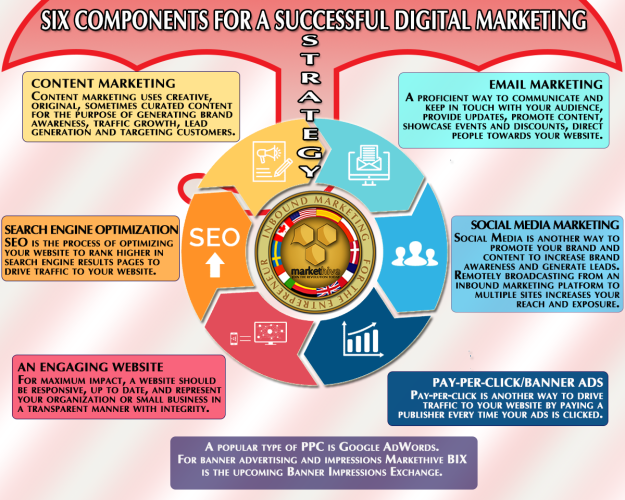

Digital marketing is an umbrella term for promoting and selling services or products using online strategies, as outlined in this article, which benefits all types of businesses and allows companies to;

- Reach their target audience: Connect with customers wherever they are online.

- Observe online behavior: Utilize data to gain insight into customer interactions and behaviors.

- Optimize marketing messages: By employing analytics to tailor communications effectively.

These digital marketing elements, highlighted in the infographic, help reach and engage customers, ultimately encouraging them to make purchases. The benefits include increasing brand awareness, generating leads, converting new customers, building trust, and driving sales growth.

For marketers, connecting with consumers and potential buyers at the right place and at the right time has always been paramount. Today, and for the foreseeable future, that place is the internet. While often called 'online marketing,' 'internet marketing,' or 'web marketing,' the term 'digital marketing' has become increasingly popular. This field is ever-evolving, with new technologies making it faster and easier, particularly for small businesses and marketers.

But how and when did it all begin? Let's journey back to explore the history and timeline of digital marketing and social media, highlighting the more prominent platforms and some of the key technological milestones that have shaped the field.

Digital Marketing: Three Decades of Evolution

Coined in 1990, the term “digital marketing” is viewed as a key part of overall technological progress. The early history of digital marketing dates back to a significant moment in 1971, when Raymond Tomlinson, a pioneering computer programmer from New York, USA, developed and launched the first email program. This groundbreaking feat occurred on the ARPANET system, a precursor to the modern internet, underscoring its significance as a foundational event that preceded the widespread public adoption of the World Wide Web.

Tomlinson's innovation laid the groundwork for a new era of electronic communication, inadvertently creating one of the earliest and most enduring channels for digital outreach and engagement. His work not only revolutionized how information could be exchanged but also set the stage for the evolution of digital marketing strategies that would leverage email as a powerful tool for communication, promotion, and relationship building.

The Birth of Web 1.0: 1990

The 1990s marked a new era with the creation of the term "digital marketing," a concept that quickly transformed commerce and communication. This pivotal decade also brought significant technological progress, particularly with the work of Tim Berners-Lee. After establishing the foundation with the invention of the World Wide Web in 1989, Berners-Lee further changed connectivity in 1990 by creating the very first web client and server.

This early stage of the internet, often referred to as Web 1.0, primarily focused on reading. Users mainly viewed the web as a vast digital library where they could search for and passively consume information. Interaction was mostly one-way, with few opportunities for user-generated content or active participation. Websites served as static data stores, offering a new way to access information, but lacked the collaborative and interactive features that would later develop. Although limited in interactivity, this foundation was essential in building the infrastructure and initial user base that laid the groundwork for today’s rich, participatory digital experiences.

The Clickable Banner Ad Emerged in 1993

The year 1993 was a key moment in the early commercialization of the Internet. That year, the Global Network Navigator (GNN), an early online info service and web portal, made history by launching the first clickable paid ad on the growing World Wide Web. This innovative ad, sold to a Silicon Valley law firm, marked a shift from the internet's previous focus on academics and research. It showcased the vast potential for businesses to use this new digital space for commercial purposes, paving the way for the multi-billion-dollar online advertising industry we see today.

Just a year later, in October 1994, the online advertising landscape further evolved with the pioneering efforts of HotWired, the online arm of Wired magazine. HotWired introduced the groundbreaking concept of rotating banner ads. These graphical ads, strategically placed on web pages, automatically cycled through different creative designs, giving advertisers more exposure and the ability to test various messages. This innovation marked a crucial step toward dynamic and interactive advertising formats, moving beyond static placements.

Despite the success of online advertising, user sentiment remains a challenge. Intrusive formats, such as pop-up ads, which have been disliked since the internet's early days, led to the development of blockers and a desire for less intrusive experiences. Yet, most websites rely on advertising revenue, creating ongoing tension between monetization needs and user preference for an ad-free or minimally intrusive experience. This dynamic continually shapes the evolution of online advertising.

Worldwide spending on banner ads is projected to reach US$185.44 billion in 2025, according to Statista. This figure is expected to grow at an annual rate of 5.23%, reaching a market volume of US$227.40 billion by 2029.

While these ads can be a source of annoyance for some users, they play a crucial role in funding many digital publishers. This funding, in turn, helps maintain the predominantly free nature of various online platforms for users. Thirty-two years ago, banner ads were considered cutting-edge and marked the inception of the Internet advertising industry.

The first banner by HotWired. Initially, AT&T paid $30,000 for a three-month dedicated banner placement on Hotwired, which achieved an impressive 44% click-through rate. In that era, web analytics were rudimentary, involving manual click counting and a highlighter pen as the primary tool.

1994 – Yahoo's World Wide Web Debut

Initially called 'Jerry's Guide to the World Wide Web,' Yahoo, founded by Jerry Yang, launched and garnered nearly a million hits in its first year. Its original product, the human-edited Yahoo Directory, served as a guide for users navigating the internet. This marked a significant shift in digital marketing, prompting companies to optimize their websites for improved search engine rankings.

Yahoo continued to evolve, and in 2000, in what they believed was a strategic move in search history, they partnered with Google. This collaboration enabled Google to power Yahoo's organic search results, with "Powered By Google" appearing on every Yahoo search result. Unbeknownst to Yahoo at the time, this partnership introduced their most significant competitor to the world, making Google a household name.

Additionally, in 1994, the development of online communication reached a significant milestone when Justin Hall, then a student at Swarthmore College, launched what he called a "weblog." This innovative platform served as a personal online diary, a space where Hall could share his thoughts, experiences, and links to other interesting parts of the growing World Wide Web. Its original format was a chronological record of his online activity and musings, laying the groundwork for what would become a widespread phenomenon.

The term "weblog" was originally a descriptive word, emphasizing its role as a log of web activity. However, in 1999, Peter Merholz cleverly shortened it to "blog." This linguistic simplification undoubtedly contributed to its increased popularity and widespread use in everyday culture.

1996 – Alexa Internet Launches

Founded in April 1996 by Brewster Kahle and Bruce Gilliat, Alexa Internet initially operated as an independent web analytics company. Alexa Internet's most notable contribution was the Alexa Traffic Rank. This metric offered a widely accepted and frequently cited estimate of a website's popularity. The ranking system was based on a combination of factors, including the number of unique visitors and page views over a specific period. Data was collected from a global panel of users who had installed the Alexa toolbar or other extensions. A lower Alexa Rank indicated a more popular website, with the top-ranked sites being the most visited worldwide.

In 1999, recognizing the strategic value of its data and technology, Amazon acquired Alexa Internet. This acquisition integrated Alexa's analytical capabilities into Amazon's growing suite of services, further solidifying its position in the e-commerce and internet services landscape.

On December 8, 2021, Amazon announced it would discontinue its website ranking and competitive analysis service, which had been available to the public for over 25 years. After that date, users could no longer create accounts or buy subscriptions, and the service officially ended on May 1, 2022. The Alexa.com domain now serves as a landing page for Amazon Alexa products.

Additionally, in 1996, the term "content marketing" was introduced during a discussion among journalists and members of the American Society for Newspaper Editors. This marked a pivotal shift in online promotion, highlighting that traditional advertising alone was insufficient. Companies need to deliver valuable, relevant, and consistent content to engage a knowledgeable online audience. This concept focused on creating and sharing engaging materials, such as articles, blogs, videos, and infographics, to attract and retain a specific target audience, ultimately encouraging profitable customer actions and shifting online marketing toward a more consumer-centric strategy.

1998 – Google's Incorporation

Google's origins date to 1996 when Stanford Ph.D. students Larry Page and Sergey Brin began a project to improve web analysis beyond keyword-based search engines. They created PageRank, an innovative algorithm that ranks websites based on the number and quality of links, giving more importance to links from reputable sites.

Their emerging search engine, called initially "Backrub," directly reflected this core approach. The name was a nod to its unique method of "backrubbing" or examining backlinks to measure a site's importance and influence within the vast web. This early stage involved intense research and development, establishing the fundamental principles that would become the foundation of a global information powerhouse.

Their work's transformative potential rapidly attracted attention and funding, enabling the shift from an academic project to a formal business. In September 1998, Google Inc. was officially founded and started operations from a small garage in Menlo Park, California. This was a key milestone, as their innovative PageRank algorithm and focus on users began to revolutionize the emerging search engine industry.

The year 1998 was a pivotal time for the growing internet, as it saw the launch of competing search engines from major tech companies: Microsoft introduced MSN Search, and Yahoo rolled out Yahoo Web Search, both vying for dominance in the rapidly expanding digital world. Despite these early rivals, Google's unique technology and user-friendly interface quickly distinguished it, leading to its rapid rise as the world's top search engine.

Veretekk launched in 1998, pioneering Automated Marketing and Social Networking.

As the competitive landscape among businesses grew increasingly intense, marketers faced a significant challenge: how to connect with potential customers in a way that was both efficient and effective, giving their business a vital edge. This growing need for a smoother, more powerful way to engage customers opened the door to an innovative technological breakthrough: marketing automation.

In 1994, Thomas Prendergast developed the first generation of the automated marketing system, laying the foundation for Wavefour and later evolving into Markethive. Their original proprietary technology was pioneering, introducing concepts that were years ahead of their time. Innovations like "automated emails," branded as Veremail, and advanced capture pages such as Blastomatic, Daily Messages, and Vacations4free enabled businesses to connect with potential customers in a proactive and automated way.

Even preceding the emergence of internet giants like Yahoo, Google, and Facebook, the company envisioned and built a centralized, member-secured social network. This groundbreaking platform, known as Inetekk, was a testament to their foresight. Inetekk offered a comprehensive suite of integrated tools, a genuinely innovative and value-driven concept, 32 years ago. This early iteration of a social network, coupled with its integrated marketing tools, showcased a commitment to providing a holistic solution for entrepreneurs, anticipating the interconnected digital landscape that would eventually define the 21st century.

Launching in 1998, this system attracted new customers. It was privately labeled for hundreds of companies and built a verifiable database that numbered in the hundreds of millions. It evolved into a service called Veretekk, a standalone Application Service Provider, and led the way in several areas, including a self-replicating website, a self-replicating PDF (designed for printing, signing, faxing, or mailing receipts), the first read-write server database, the first autoresponder email system, lead capture, and traffic portals, the first remote broadcasting system, and Internet Marketing training that ran for nearly 20 years.

All these features combined to create the first comprehensive Automated Marketing system. This represented a significant advance over traditional outbound marketing methods, enabling a more targeted and efficient approach to generating leads and nurturing customers.

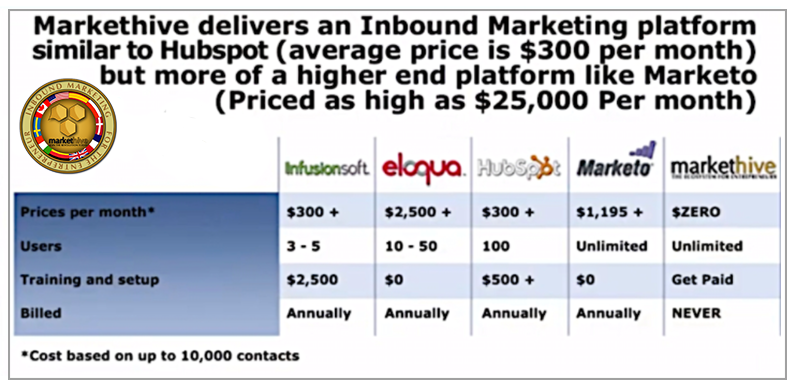

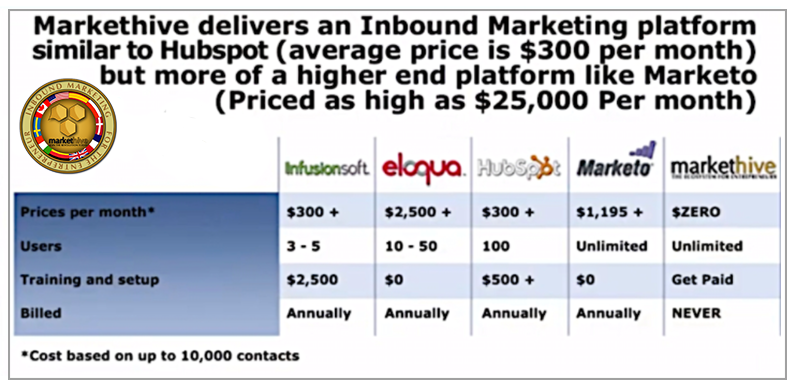

Many automated marketing platforms emerged from 2003 onwards, including Eloqua and Salesforce. Subsequently, in 2006, Hubspot and Marketo also appeared. This period marked the rise of Software as a Service (SaaS).

The emergence of automated marketing led to the coining of "Inbound Marketing." This approach emphasizes content marketing, which has been shown to build credibility and integrity for organizations, establishing them as trusted sources.

Veretekk underwent a complete transformation, now rebuilt with Blockchain technology and cryptocurrency. This new iteration, Markethive, integrates an inbound marketing platform, a social network, and a digital media broadcasting platform. It is recognized as the pioneering next-generation Market Network built on Blockchain.

2000 – AdWords Launched by Google

Google, a nascent but rapidly expanding internet giant, made a pivotal move in its commercial strategy by introducing the AdWords program. This innovative platform initially provided advertisers with the convenience of having their advertising campaigns meticulously managed directly by Google’s team of experts. This hands-on approach ensured that businesses, regardless of their online marketing expertise, could effectively leverage Google’s vast search engine reach to promote their products and services.

In March 2003, Google introduced its AdSense program, initially known as content targeting advertising. This program enables website publishers to display text, images, videos, or interactive media advertisements on their content sites. These ads are tailored to the site's content and audience, and they are managed, organized, and maintained by Google. Publishers earn revenue based on either a per-click or per-impression model. Currently, more than 44 million websites utilize AdSense.

2002 – LinkedIn Is Launched

Founded in December 2002 by Reid Hoffman, Allen Blue, Konstantin Guericke, Eric Ly, and Jean-Luc Vaillant, LinkedIn is the first business-focused social networking platform. Its primary function is to facilitate professional networking, enabling individuals to connect with colleagues, industry peers, and potential mentors. In addition to individual networking, LinkedIn is a key resource for the recruitment industry. Companies heavily use the platform to post job openings, reaching a large and highly targeted audience of professionals.

By 2015, LinkedIn's business model had matured, with the majority of its revenue coming from premium services, particularly for recruiters and sales professionals, which generated substantial income. In December 2016, Microsoft acquired LinkedIn for $26.2 billion. Since then, LinkedIn has operated as a wholly owned subsidiary of Microsoft, integrating its professional networking features with Microsoft's broader suite of enterprise software and services.

2003 – Myspace's Debut

Myspace, an American social networking service, was co-founded by Tom Anderson in August 2003 along with Chris DeWolfe and Jon Hart. It became a dominant player in the digital world during the mid-2000s and was the largest social networking site worldwide from 2005 to 2009, with over 100 million unique users each month. Its rapid rise peaked in June 2006 when Myspace overtook major internet giants like Yahoo and Google, becoming the most visited website in the United States.

Myspace's impact went beyond simple user counts; it deeply affected technology, pop culture, and the music scene. As the first social network to reach a truly global audience, it established essential foundations for the growth of online communities. Additionally, Myspace made significant contributions to the early development of other digital giants, particularly YouTube, by providing a platform for sharing and discovering content. Yet, the social media landscape was constantly changing. In April 2008, Facebook challenged and eventually overtook Myspace, surpassing it in unique visitors and marking a major shift in online social networking.

2003 – The Genesis Of WordPress

WordPress, a well-known name in content management systems (CMS), traces its roots to a project called b2/cafelog, often simply known as b2 or cafelog. This basic platform was the collaborative creation of Matt Mullenweg and Mike Little. Their joint effort resulted in a system that quickly gained popularity, with about 2,000 blogs running on b2/cafelog by May 2003.

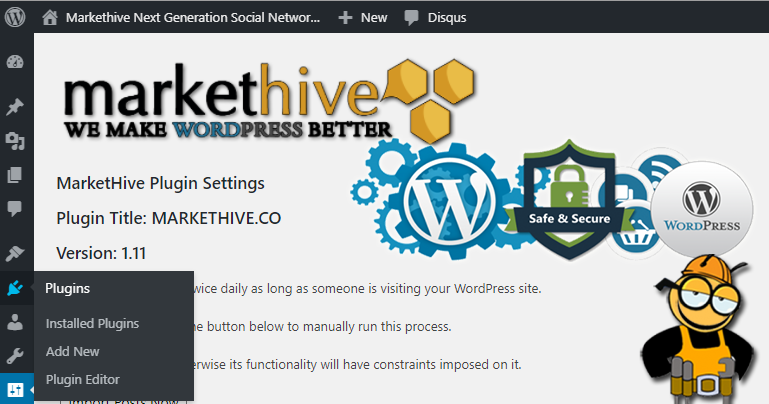

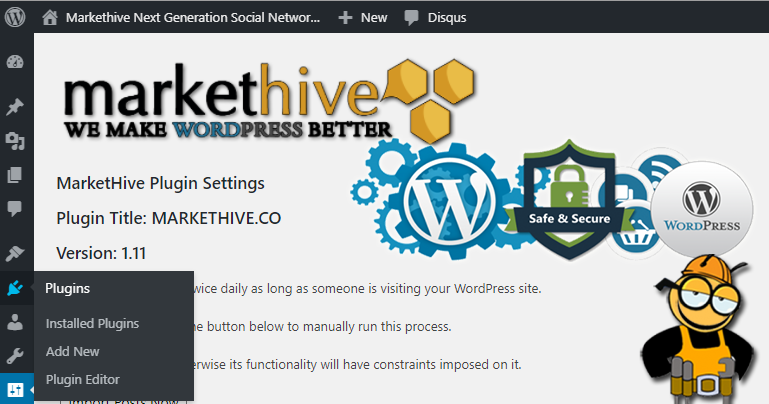

Originally designed as a simple blog-publishing platform, WordPress has significantly evolved and now far exceeds its initial purpose. It supports a wide range of web content, from basic blogs to complex websites, e-commerce stores, portfolios, and more. A key reason for its widespread use and flexibility is its extensive plugin system, a feature used by Markethive. These plugins, developed by a global community, enable users to add numerous features, including SEO tools and social media integration, thereby significantly enhancing their online reach and engagement.

The growth of WordPress has been exponential, and its impact on the open-source community has been substantial. By October 2009, it had established itself as the leading open-source content management system, boasting the strongest brand presence and demonstrating its reliability, flexibility, and an active community supporting its development. This strong brand recognition continued to fuel its growth. By June 2019, WordPress had solidified its dominance, powering over 60 million websites worldwide. Today, WordPress powers 43.6% of all websites, holding a 62.1% share of the CMS market. As of 2025, WordPress supports 861 million sites.

2004 – Web 2.0 and Facebook Emerge

Darcy DiNucci first introduced the idea of Web 2.0 in 1999, predicting its impact on public relations. However, the term gained widespread recognition in 2004, primarily thanks to Tim O'Reilly and Dale Dougherty at the O'Reilly Media Web Conference. This shift marked a move from the static, one-way Web 1.0 to a more dynamic, interactive, and user-centered Web 2.0, emphasizing user-generated content, collaboration, and social networking.

In 2004, another pivotal moment happened in the digital world: Mark Zuckerberg launched "TheFacebook." Created as a private online directory and social platform for Harvard students, its rapid success and increasing popularity quickly led to expansion to other elite US colleges. This initial version provided students with a digital space to connect, share information, and build communities, laying the groundwork for a global phenomenon.

The following years saw rapid growth for this emerging platform. In 2005, a strategic rebranding changed "TheFacebook" to simply Facebook, dropping its definite article and reflecting a broader, more inclusive vision. This simplification of its name coincided with ongoing growth and feature upgrades, making it an increasingly appealing platform for social interaction. By 2006, a key milestone was reached when Facebook opened to the general public, expanding beyond its college roots to serve a global audience.

This key decision sparked a wave of growth, pushing Facebook into an unprecedented phase of worldwide popularity and turning it into one of the most dominant and influential social media platforms globally. Its widespread adoption fundamentally changed how people communicate, share information, and connect on a large scale, embodying the core concepts of the interactive and social web envisioned by Web 2.0 advocates.

YouTube Emerged in 2005

The origin of YouTube, a platform that would transform online video, is a fascinating story rooted in a cultural moment: Janet Jackson's famous wardrobe malfunction during the 2004 Super Bowl halftime show. This surprising incident, which caught the attention of audiences worldwide, unintentionally sparked the idea for a new type of online video-sharing service. Former PayPal employees Steve Chen, Chad Hurley, and Jawed Karim, noticing the public's difficulty in finding and sharing clips of the event online, identified a major gap in the digital world. This realization laid the foundation for what would become YouTube.

The platform's first video, 'Me at the Zoo,' uploaded by co-founder Jawed Karim on April 23, 2005, shows him at the San Diego Zoo commenting on elephants' trunks. It marked a key milestone in online media. A beta launched in May 2005, leading to YouTube's official launch on December 15, 2005, reaching a global audience. Initially, YouTube faced competition from Vimeo, which was launched earlier in 2004, focusing on higher-quality content and a curated community. Vimeo gained recognition in some circles. However, YouTube's user-friendly design, broad appeal, and ease of uploading quickly led to its success.

In 2006, Google bought YouTube for $1.65 billion in stock, recognizing its vast potential. The acquisition made YouTube a major digital player and fueled its growth. Now, with over 2.7 billion users worldwide, YouTube is an extensive platform for entertainment, education, news, and social sharing, transforming global video consumption.

2006 – Twitter Launch and Growth in Search Engine Traffic

Conceived in 2006 by a visionary team including Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams, Twitter emerged as a revolutionary platform. Dorsey initially envisioned it as a continuous stream of "short bursts of inconsequential information" similar to "chirps from birds." This core idea immediately set Twitter apart from its peers, positioning it more as a dynamic microblogging platform and real-time information network rather than a traditional social media site. Its unique design enabled the quick sharing of concise updates, allowing users to exchange thoughts, news, and observations instantly, effectively fostering a global conversation.

What further distinguishes Twitter, and indeed contributes to its enduring appeal and commercial viability, is its remarkable user engagement with advertising. Counterintuitively, for a platform often characterized by its rapid-fire content and user-generated discussions, statistical analyses consistently show that Twitter users interact with advertisements at a rate 26% higher than users on other prominent social media platforms.

In 2022, Elon Musk purchased Twitter for $44 billion. He rebranded the platform as X in 2023, officially changing the name in July. Furthermore, the website's domain shifted from twitter.com to x.com in May 2024. Statistics also show that 55% of American users still refer to the platform as Twitter rather than X, while 70% of UK users continue to use the name Twitter.

Additionally, in March 2006, digital marketing emerged as a vital business strategy, driven by 6.4 billion search engine visits that month, marking a shift in consumer behavior toward online information. This period saw improvements in SEO, the rise of content marketing, and the growth of PPC advertising, especially Google AdWords, for targeted campaigns.

The broadband expansion enabled video marketing and more advanced website design while emerging social media platforms began offering new ways to connect. The integration of analytics provided essential insights for refining campaigns. Overall, March 2006 marked a significant milestone for digital marketing, laying the foundation for today's complex digital landscape. Microsoft also launched Live Search to compete with Yahoo and Google.

2010 – Instagram Launches

Created by Kevin Systrom and Mike Krieger in 2010, Instagram is a social media platform that specializes in sharing photos and videos. It quickly gained popularity after its launch and was acquired by Facebook in 2012. From 2013 to 2024, Instagram experienced significant growth, increasing from 110 million to 2.4 billion users. However, in 2024, the platform saw a slight decline of 4 million users compared to the previous year.

Despite its influence, Instagram faces criticism for its frequent policy and interface changes, algorithm updates that affect content visibility, and censorship impacting marginalized communities, political discussions, and artistic expression, leading to allegations of bias and opacity. Additionally, problems with illegal content, such as hate speech, harassment, explicit images, and misinformation, raise safety concerns, especially for minors.

With over 2 billion monthly active users, Instagram users spend an average of 33 minutes per day on the platform in 2025, with 62.7% actively following or researching brands, underscoring its significance for marketing and brand visibility.

The year 2010 also marked a pivotal moment, signaling the start of an era of unprecedented growth and change in the digital marketing industry. This period was defined by a rapid increase in digital media use and engagement, fundamentally changing how businesses connected with their audiences.

The massive amount of online engagement resulted in an incredible rise in advertising impressions, with approximately 4.5 trillion online ads delivered annually across various digital platforms. This enormous reach highlighted the growing influence of the internet as a marketing tool.

As a result, businesses quickly shifted their marketing budgets to capitalize on this digital transition. Digital marketing spending saw a significant increase, jumping by an impressive 48%. This substantial investment reflected a growing recognition among companies of the vital role digital strategies would play in their future success, setting the stage for the digitally driven marketing landscape we observe today.

2012 – Saw The Launch Of Zoom

Zoom, the widely used video conferencing app, was first released in beta on September 10, 2012. The initial version allowed up to 15 video participants in meetings. Positive feedback and quick updates led to the official launch of version 1.0 in January 2013, increasing the participant limit to 25. This early growth reflected Zoom's focus on scalability and its goal to support larger virtual meetings, paving the way for its widespread use in both work and personal contexts.

Zoom rapidly gained popularity, reaching 400,000 users in its first month and surpassing 1 million by May 2013. The COVID-19 pandemic further sped up its growth, resulting in an explosive increase of 2.22 million users in 2020. This period transformed Zoom from a popular business tool into a ubiquitous household name, fundamentally altering how individuals and organizations communicate, collaborate, and connect in a rapidly changing world.

In March 2020, the Zoom app saw an astonishing 2.13 million downloads in a single day, and by April 2020, it boasted over 300 million daily meeting participants. However, this rapid expansion was not without its challenges. On August 24, 2020, the platform experienced a significant, several-hour-long outage that disrupted countless meetings and activities worldwide before service was eventually restored.

That same year, Zoom faced significant controversy over its attendee tracking features, raising concerns about user privacy and data collection. Additional worries have arisen about the company's practices for sharing personal data, with critics pointing to potentially questionable methods used in handling sensitive user information. A general lack of transparency from Zoom on these critical issues has increased public scrutiny. Due to these growing concerns, users are increasingly advised to "Zoom" at their own risk, sparking a broader debate about data privacy and corporate responsibility in the digital age.

2014 – Smartphone usage increased, and Long-Form Content became Strategically Effective

In 2014, mobile usage surged, with 4.55 billion users (70% of the global population) and 1.75 billion smartphone users. This year also marked the introduction of the Facebook Messenger app, followed shortly by the Apple Watch.

In 2014, long-form content emerged as a highly effective digital marketing strategy, shifting away from shorter formats. Several converging factors fueled this evolution. Search engine algorithms, particularly Google's, were becoming increasingly sophisticated, rewarding websites that offered comprehensive, high-quality, and authoritative content.

Keyword stuffing was no longer enough; instead, content that genuinely answered user questions and offered in-depth information began to rank higher. This motivated marketers to create more detailed articles, guides, and whitepapers, providing value through comprehensive material, building trust, and establishing thought leadership.

Increased broadband access and the proliferation of mobile devices also enabled consumers to engage with longer content. Consequently, marketers focused on producing extensive blog posts, e-books, and case studies, thereby solidifying the role of long-form content in nurturing leads, establishing authority, and driving organic traffic.

2015 – Markethive Arrives as The Next Generation Market Network and Genesis of Web 3.0

Markethive, a company with a rich history dating back to its earlier form as Veretekk, officially established its presence in the market in mid-2015. This period marked a crucial milestone for the organization, as it was formally trademarked and incorporated, setting the legal and structural foundation for its future growth.

After incorporation, Markethive strategically rolled out its platform. A private Beta, exclusive to foundational Veretekk members and dedicated users, refined the platform and gathered feedback, addressing issues before a wider release. This led to a full public Beta launch in January 2016, expanding reach and testing scalability for commercial release. This iterative approach ensured a polished product.

Over the course of three years, Markethive underwent a significant transformation, evolving from its initial role as a robust inbound marketing platform and social network. This deliberate development was driven by a clear and ambitious vision: to realize the concept of a decentralized, blockchain-based social market network. Created to achieve multiple aims, primarily to harness the growing influence of cryptocurrency, Markethive sought to develop a truly comprehensive and self-sustaining ecosystem.

This environment was specifically designed to meet the diverse needs of various professionals and organizations, ranging from ambitious entrepreneurs and experienced marketers to established companies, expanding small businesses, and creative commercial artists, providing them with unparalleled tools and opportunities in the digital realm.

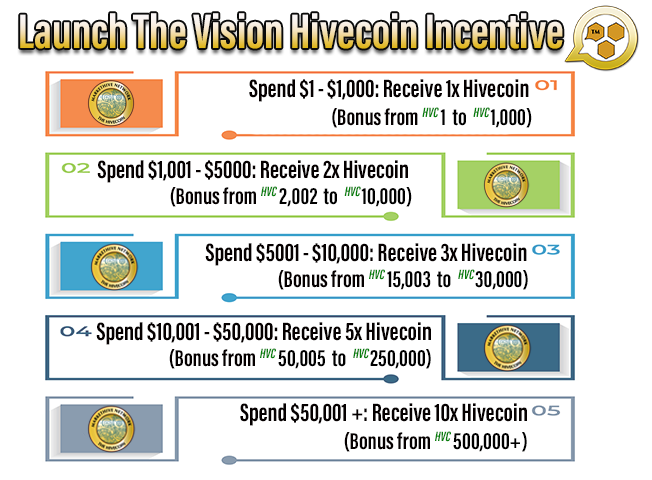

In 2019, Markethive introduced its inaugural cryptocurrency token, MHV, with the primary purpose of incentivizing and rewarding user engagement across its various functionalities. This token enables users to earn rewards through a diverse range of activities. The Markethive token, MHV, is a fractional representation of the native token Hivecoin (HVC), which serves as the principal transactional token within the Markethive ecosystem and is actively traded on prominent cryptocurrency exchanges.

In 2022, the Markethive wallet was introduced as a key part of the Markethive ecosystem. It serves as a versatile financial tool, offering a wide range of features. Primarily, it includes a detailed accounting system that carefully monitors all financial transactions within the platform. Additionally, it enables smooth payments and rewards distribution, ensuring that members are appropriately compensated for their involvement. The wallet is also equipped with a secure Vault and Staking system, allowing users to protect and expand their digital assets.

Fast forward to today, and Markethive has not only kept pace with technological advancements but has evolved into a sophisticated, ready-to-launch ecosystem. It stands as a powerful and comprehensive platform meticulously designed to empower modern entrepreneurs. The core of today's Markethive lies in its seamless integration of key technologies and principles: social networking, cutting-edge blockchain technology, robust security protocols, unparalleled user autonomy, absolute privacy, and a suite of advanced inbound marketing tools.

This significant combination goes beyond the boundaries of a typical social network or simple marketing platform. It creates what is known as a "market network," a vibrant space that encourages a flexible, collaborative, and intensely engaged community among its users.

Operating as a decentralized, distributed environment, Markethive provides comprehensive and unwavering support for all creative and entrepreneurial endeavors. This decentralized architecture ensures greater transparency, security, and user control, aligning with the growing demand for digital freedom and ownership.

By championing the rise of the individual entrepreneur, Markethive positions itself at the forefront of what it terms "the greatest renaissance in history." It offers a cutting-edge social environment that is not only secure and private but also intrinsically linked to the latest inbound marketing technology, web conference rooms, video channels, curation and blogging capabilities, and digital broadcasting. This unique synergy enables entrepreneurs to build, grow, and monetize their ventures with unparalleled efficiency and effectiveness, truly embodying the spirit of innovation and empowerment in the digital age.

.png)

Editor in Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.jpg)

.png)

.png)

.png)