Blogcasting At Markethive. Innovative Broadcasting System Delivers Massive Reach

Markethive stands out as a unique and refreshing alternative to the often mundane and isolating world of business. It fosters a supportive and collaborative atmosphere where members can connect, share ideas, and grow together. As an inbound marketing platform, Markethive empowers entrepreneurs and businesses to effectively reach their target audience and expand their global reach through the innovative concept of Blogcasting. Furthermore, the platform's integrated social media interface creates a sense of community and encourages cooperation.

By offering a comprehensive suite of inbound marketing tools and resources, along with a vibrant and engaged community, Markethive enables users not only to achieve their business goals but also to build meaningful relationships and foster a sense of belonging. This unique blend of business support and social interaction makes Markethive a truly exceptional platform for entrepreneurs and businesses looking to thrive in the digital age. In this article, we examine the proven broadcasting system that Markethive has aptly named Blogcasting.

Markethive’s Blogging System

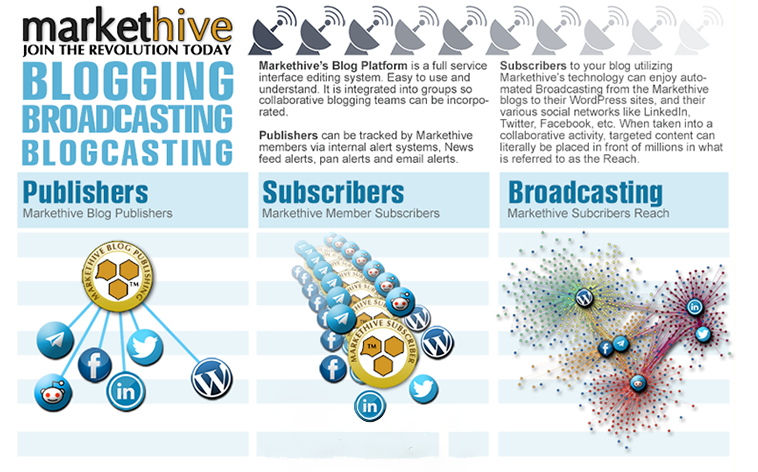

A blogging system serves as a cornerstone for any successful inbound marketing strategy, acting as a powerful tool to attract, engage, and convert potential customers. A robust platform like Markethive's blogging system offers a dedicated hub for content creation and distribution, allowing businesses and individuals to share their messages in various formats. This includes written content such as articles and press releases, as well as multimedia elements like videos, thereby catering to diverse audience preferences and maximizing reach.

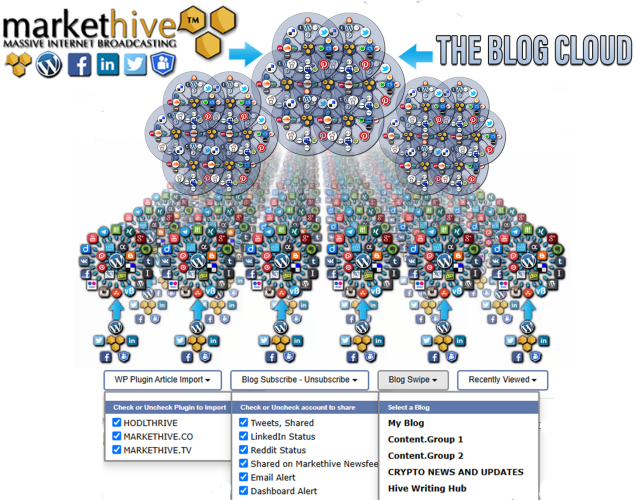

Blogcasting, a term coined by Markethive, revolutionizes the way blog and newsletter updates are shared and disseminated. It’s an enhanced broadcasting system that transcends the limitations of traditional email notifications by simultaneously broadcasting your published content across a vast network of social media and blogging platforms. This amplified reach has the potential to expose your content to millions of users, far exceeding the audience you might reach through traditional email subscriptions.

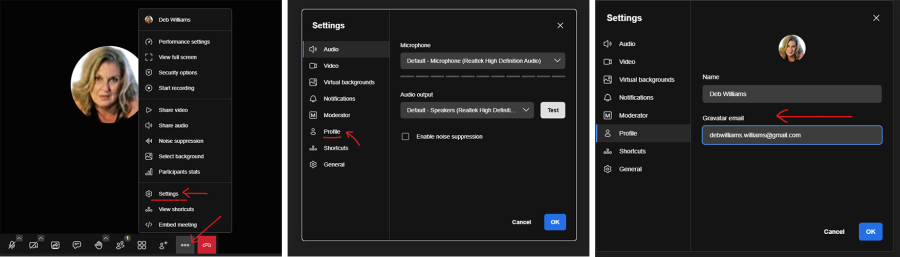

Markethive allows you to link your social accounts in your profile settings, enabling you and others to subscribe to each other's Markethive blogs freely. Additionally, Markethive utilizes a WordPress plugin that posts your Markethive blog directly to your WordPress blog, broadcasting it from that platform. Each blog entry is shared across hundreds or even thousands of social network feeds and WordPress sites.

A new version of the WP Plugin Article Import will be integrated into the new Site-Making system. All member accounts will receive a WordPress site and be assigned an email for both POP email and the default website, with the option to assign it to your WordPress or Markethive capture page. This distinctive and versatile feature is exclusive to Markethive, providing members with a unique advantage in managing their online presence and communication.

In essence, blogcasting acts as a content multiplier, taking your blog posts and newsletter updates and propelling them into the social and digital media sphere. This multi-platform approach ensures that your content isn't confined to a single channel, but instead leverages the power of social networks to reach a broader and more diverse audience. By tapping into the immense user base of platforms like Facebook, X, LinkedIn, and others, blogcasting significantly increases the visibility and potential impact of your content.

The Power of Extended Reach and Influence

Let's delve deeper into the concept of reach and influence through Markethive blog subscriptions, using the example below:

In this scenario, if I subscribe to your blog and have 20,000 followers across all my social media accounts, and you have 15,000 subscribers each with a similar following, your blogs have the potential to expand their exposure dramatically. The math suggests that your content could reach around 300 million people. These are people who are not directly subscribed to you. It is known as a “reach” and is extremely powerful.

This ripple effect showcases the true power of social media and content sharing. Each share, like a pebble dropped in a pond, creates ripples that extend outward, reaching new audiences and potentially sparking fresh conversations. Dubbed the “Blog Cloud,” it can generate massive reach, enhance SEO, and create backlinks at an exponential rate. Its influence transcends technology, facilitating a blend of cultural and viral shifts.

The influence of this extended reach is significant. It can lead to:

- Increased Brand Awareness: As your content reaches new audiences, your brand gains exposure and recognition. This can lead to increased trust and loyalty among potential customers.

- Website Traffic: The ripple effect can drive a substantial amount of traffic to your website. As more people are exposed to your content, they may become intrigued and want to learn more, which will motivate them to visit your site.âââââââ

- ââââââââââââââPotential Conversions: Increased traffic and brand awareness can lead to conversions, whether that's sales, sign-ups, or other desired actions.

- Community and Engagement: By reaching a wider audience, you can cultivate a sense of community and engagement around your blog's content. This can foster valuable feedback, discussions, and collaborations.

The Advantages Of Markethive’s Blog System For Supergroups

Markethive has effectively integrated all technical and tactical elements into a single system, transforming blogging into a collaborative group process. You can support your new associates or provide ongoing assistance to your customers through your Supergroup, which also serves as a virtual storefront.

Regularly publishing engaging and informative blog articles and other content can establish you as a trusted authority, start conversations with your audience, and subtly introduce them to your solutions in ways that traditional advertising can't. This consistent content creation builds relationships and fosters goodwill with potential customers.

It allows us to be more human in all our actions and interactions. It focuses on fostering genuine and authentic connections. The company that embodies humanity prevails, and technology should aid your organization in becoming more compassionate, open, engaging, and valuable.

Markethive’s Inbound Marketing platform delivers a blogging system that caters to beginners, is sophisticated for intermediates, and offers a compelling experience that advanced professional bloggers will appreciate. The system is designed to effortlessly set up a complete blog, serving as the engine that powers your WordPress blog with ease.

How Does Blog Subscribe Work?

The Blog Subscribe feature allows other Markethive members to subscribe to your blog. They can do this by selecting the status of any medium displayed in the drop-down menu. Additional sites may be added in the future, depending on the cooperation and agreement of the relevant parties. Such a proactive approach ensures that Markethive remains at the forefront of digital communication trends, providing its members with the most comprehensive and up-to-date tools for networking and content dissemination.

When they subscribe, your blog posts will be automatically distributed across multiple channels, reaching a vast audience. This includes not only the newsfeeds and email inboxes of potentially thousands of subscribers but also any connected social media accounts they may have. This multi-platform approach significantly amplifies your message's reach and potential for engagement.

Furthermore, becoming part of the Markethive community connects you with a network of fellow entrepreneurs. As these individuals share your content with their connections, a downstream effect is created, exponentially increasing your exposure. This organic sharing acts as a powerful endorsement, enhancing your credibility and expanding your reach. Through this process, your popularity and brand awareness will steadily grow, opening doors to new opportunities and collaborations.

Sharing your blog posts on other platforms will increase their visibility and drive traffic to your website, which in turn improves your search engine ranking. As your content gains traction and attracts more visitors, search engines recognize your website's relevance and authority, leading to higher search rankings and increased organic traffic. This positive feedback loop reinforces your website's credibility, helping you attract even more readers and potential customers.

Moreover, consistently creating and sharing high-quality, original content that resonates with your target audience establishes your website as a valuable and authoritative resource in your niche. When you provide content that is informative, engaging, and addresses the specific needs and interests of your readers, you cultivate a loyal following and encourage them to share your posts with their networks, further expanding your reach and influence.

The News Feed and Blogcasting Hub offers a powerful platform to amplify your brand's visibility and reach a global audience. By leveraging the integrated blogcasting feature, your products and services can be showcased to billions of potential customers worldwide.

The discoverability of your blog extends beyond the platform's existing user base, as search engines can index your content, making it accessible to non-members and significantly expanding your reach. This integrated approach to content creation and distribution can play a pivotal role in your international marketing strategy, driving engagement, generating leads, and ultimately fostering business growth.

Why Blog Swipe?

Sharing your content may seem counterintuitive, especially after investing a significant amount of time and effort into its creation. However, granting others access to your work can yield numerous benefits, both personally and professionally. Sharing your work can lead to valuable feedback, helping you identify areas for improvement and refine your writing. Collaborating with others can also spark new ideas and perspectives, enriching your content and leading to innovative solutions. Below are some appropriate reasons:

Curating:

Content curation is a vital process in today's digital landscape, where the sheer volume of information available can be overwhelming. It involves sifting through the vast amount of content on the web and organizing it around specific themes or topics. This process includes selecting the most relevant and high-quality information, arranging it logically and meaningfully, and then publishing it for others to access and benefit from.

By selecting this option, you grant permission for your content to be reproduced and automatically copied to other members’ Markethive Blog Systems. This means that your article can be shared and displayed on various pages and sections within the Markethive platform. This can increase the visibility and reach of your content, potentially attracting a wider audience within the Markethive community.

In addition to internal sharing within the Markethive Blog System, this option also allows you to syndicate your blog articles to the WordPress blogs of other Markethive members. Syndication refers to the automatic distribution and publication of your content on external platforms. In this case, a WordPress plugin facilitates the seamless sharing of your blog posts to the individual WordPress sites of other Markethive users. Syndicated articles often include backlinks to your original blog, which can improve your website's search engine rankings and drive additional traffic to your site.

Furthermore, Markethive enables users to set up Curating Groups, which provide a centralized space for collecting and organizing content for future publications. This feature streamlines the curation process, making it easier to collaborate with others on content curation projects.

To further enhance the content curation experience, Markethive is developing a new interface that will include a dedicated newsfeed for content curation. This newsfeed will be designed to allow for intuitive organization and increased reach, making it easier for users to discover and share curated content.

Content curation is a valuable process that helps to make sense of the vast amount of information available online. Markethive provides a range of tools and features that can streamline and enhance the content curation process, making it easier for users to discover, organize, and share high-quality content.

Proofing:

Markethive fosters a dynamic and collaborative environment where members actively help one another, often through editing and rewriting content. This cooperative spirit not only enhances the quality of the produced content but also serves as a valuable mentorship opportunity for those seeking to refine their writing and blogging skills while amplifying their online presence.

I welcome members to swipe and edit my articles and implement any changes they consider necessary. If the suggested changes are beneficial and align with my vision, I will swipe them back. This iterative process of feedback and collaboration fosters an atmosphere of continuous learning and growth, where members can learn from each other and collectively enhance their skills.

Furthermore, this collaborative approach reflects the ethos of Markethive, where the collective intelligence and expertise of the community are leveraged to achieve mutual success. By sharing knowledge and insights, members can accelerate their learning and development, ultimately reaching their goals more effectively.

Markethive's emphasis on collaborative learning and mentorship has played a crucial role in nurturing a new cohort of skilled and enthusiastic bloggers. By fostering a supportive environment where experienced bloggers can guide and advise newcomers, the platform has accelerated the growth of emerging content creators.

Additionally, Markethive's innovative Blog Swipe feature has significantly streamlined the blogging process, making it more accessible and less intimidating for new users. This user-friendly tool has empowered individuals who may have previously struggled with infrequent and subpar content to consistently produce high-quality, relevant blog posts daily. As a result, Markethive has not only cultivated a thriving community of bloggers but has also elevated the overall standard of content produced on the platform.

Cocktails:

Markethive provides you with the ability to create and oversee a diverse range of groups, each with its unique cocktail blend of content. This content can be:

- Specifically Curated: Handpicked and tailored to suit the group's theme or purpose.

- Aggregated from Various Sources: Gathered from different online platforms, social media, or other relevant sources.

- Combined from Multiple Groups within the Platform: Merged and integrated from other groups within the Markethive ecosystem.

This versatility enables a multitude of possibilities for producing diverse and original content. This content can then be seamlessly distributed to an unlimited number of WordPress blogs. The management of these blogs, along with content creation and group interaction, all occur within the integrated Markethive environment. This provides a dedicated hub for your entire online presence, streamlining your workflow and maximizing your efficiency.

Furthermore, Markethive's content flexibility allows for a dynamic and adaptable online presence. As trends shift and your audience's interests evolve, you can effortlessly adjust your content mix and distribution strategy. This ensures that your online presence remains relevant and engaging, helping you to cultivate a loyal following and achieve your online goals.

Activating the Blog Swipe Feature

When you initially publish an article on the Markethive blog platform, you have several options to control the blog swipe functionality.

- Members: This setting allows all members of the Markethive community to copy and republish your article on their blogs or within groups they belong to.

- Friends: By choosing this option, you restrict the ability to copy and republish your article to only those individuals you have designated as friends on the Markethive platform.

- Group Members: This setting limits the ability to copy and republish your article to members of specific groups you are part of on Markethive. This can be useful for sharing content within niche communities or collaborative projects.

- Only Me: Selecting this option ensures that your article remains confidential and cannot be swiped or republished by any other member of the Markethive community. When you select this option, the Blog Swipe tab is disabled and is no longer visible on the article.

The other settings include Privacy and Comments, where you can choose the level of visibility and enable commenting on your article. These include public, members, group members, and group admins. Additionally, you can adjust these settings after your initial publication.

Conclusion

Markethive is a dynamic platform designed to accelerate your personal and professional brand, enhancing your influence and authority within your chosen field. It doesn't matter if you're a seasoned industry leader or an ambitious newcomer; Markethive's integrated suite of tools, resources, and supportive community environment will empower you to overcome limitations and seize new opportunities.

By harnessing the power of Markethive, you can:

- Expand Your Network: Connect with like-minded professionals, potential collaborators, and industry leaders to forge valuable relationships and partnerships.

- Unlock New Opportunities: Discover untapped avenues for growth, innovation, and expansion through targeted resources and strategic guidance.

- Achieve Ambitious Goals: Surpass your previous benchmarks and realize your full potential by leveraging a comprehensive toolkit designed for success.

- Make a Lasting Impact: Establish yourself as a thought leader and influencer within your industry, leaving a lasting legacy and making a significant contribution to your field.

Whether you're an entrepreneur seeking to scale your business, a creative professional looking to showcase your work, or an individual with a burning desire to make a difference, Markethive provides the platform, support, and guidance you need to turn your aspirations into reality.

Tim Moseley

.png)

.png)

.png)

.png)

.png)

.png)