WEF’s Cyber Attack Simulations: Klaus says a Cyber Attack will Dwarf the Pandemic by Comparison.

In late 2019, the World Economic Forum (WEF) co-hosted a global pandemic simulation known as Event 201 with the John Hopkins and Bill and Melinda Gates Foundation. A few months later, we were hit with an actual pandemic that began in early 2020. The WEF co-hosted a global cyber attack simulation with Sberbank, Russia's largest bank, in July 2020 called Cyber Polygon. In light of the aftermath of Event 201 has led to speculation that a cyber attack is on the horizon.

This article explains the Cyber Polygon and summarizes what was discussed in the 2020 simulation. There was another Cyber Polygon simulation in mid-2021, which I touched on briefly in this article. However, the 2020 edition is significant because it was the first simulation involving Klaus Schwab and the WEF and the first year of the C-19 pandemic. A lot has happened since the 2021 simulation; hence, the Cyber Polygon 2022 simulation was postponed indefinitely.

What Is Cyber Polygon?

Cyber Polygon is an annual cyber security event hosted by BI.ZONE, a cyber security subsidiary of Sberbank. The first Cyber Polygon event took place in 2019, which included simulations for DDOS, web applications, and ransomware attacks. The summary reveals a limited number of participants, the only notable being IBM. The WEF was yet to be involved.

However, the WEF’s cyber security initiatives predate Cyber Polygon by over a year. The WEF announced the Global Center for Cyber Security at its annual Davos conference in January 2018. At some stage in 2019/20, the WEF partnered with Sberbank to organize Cyber Polygon 2020. Not surprisingly, Cyber Polygon 2020 was much larger than the 2019 edition. Over 120 organizations from 29 countries were involved, and the online event had over five million viewers from 57 countries.

Image source: Cyber Polygon 2020 Report.pdf

The website for Cyber Polygon 2020 explains that many of these 120 organizations chose to remain anonymous, but it reveals that many big names were involved. Besides Deutsche Bank and Ernst & Young, ICANN is noted as being one of the key partners, and it provides global internet infrastructure. Whereas the focus of the 2019 edition was DDOS, web applications, and ransomware attacks, the focus of Cyber Polygon 2020 was a so-called digital pandemic. This digital pandemic would affect everything from financial infrastructure to healthcare and have a global impact.

The full Cyber Polygon 2020 stream is still available on the BI.ZONE’s YouTube channel, however, is almost 5 hours long. This article from Unlimited Hangout provides a detailed background on some speakers.

Image source: Cyber Polygon 2020 Report.pdf

Cyber Polygon 2020

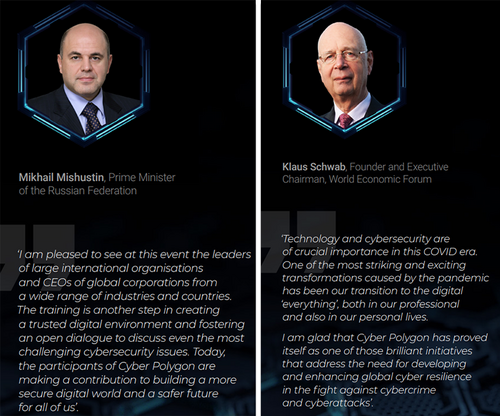

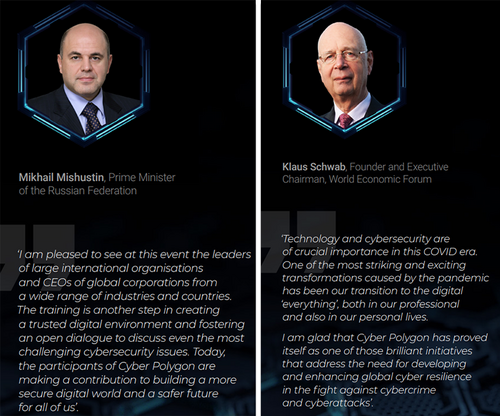

So Cyber Polygon 2020 began with opening remarks from Sberbank CEO Herman Gref. Herman explained that the speakers will discuss “the next pressing issue after the pandemic,” a global cyber attack. He revealed that Interpol is also a key partner of Cyber Polygon. Herman also announced that WEF founder and chairman Klaus Schwab is personally involved with Cyber Polygon.

For context, the WEF is an organization consisting of the world's most influential individuals and institutions, which come together each year to decide the future of the world without our input basically. The first speaker was Mikhail Mishustin, the Prime Minister of Russia, the second most powerful person in the country after President Vladimir Putin. Mikhail revealed that the post-pandemic recovery will focus on digitization, a process accelerated by pandemic restrictions.

The second speaker was Klaus Schwab; he revealed that he'd been working closely with Herman, the CEO of Sberbank. Klaus also said that he was pleased to have recently met with Putin, a meeting which apparently took place in Saint Petersburg in November 2019. On that note, Putin was a so-called young global leader of the WEF. Although the WEF removed Putin's profile from its website when the Russia/Ukraine war started, the association has led to speculation that the war is being used as a pretext for a cyber attack.

In any case, Klaus explained that they need a “great reset to bring everything together,” AKA to centralize control. He said that all WEF stakeholders must be mobilized, and everything must be digitized. He added that the cyber attack will make the pandemic look like a small disturbance by comparison.

Image Source: Unlimited Hangout

BI.ZONE Simulation

The presenter of the 2020 event was Alexander Tushkanov, head of sales at BI.ZONE. He explained that a cyber attack simulation would take place in real-time at the Sberbank headquarters during the event where BI.ZONE employees are the hackers, and participants are the cyber defenders. Alexander also said it's been many years since the WEF announced the Fourth Industrial Revolution. He explained that the WEF’s initiative has resulted in two groups: those who support it and those who oppose it. He asked whether trust or fear would be the motivator for future cooperation.

Alexander also asked whether it would take another crisis to unite the world after the pandemic. As this article about resisting the great reset illustrates, the WEF is keen to create crises for this exact purpose: Centralized control.

This ties into what was said by the third speaker, Tony Blair, the former prime minister of the UK and a frequent contributor to the WEF’s global agenda. He noted that digitization would continue after the pandemic and that rolling out a digital ID is the key to successful digitization. Tony went on to complain the governments weren’t doing enough to crack down on privacy-preserving technologies and then warned that a “globally impactful scandal is inevitable soon.” He also said that the lack of cooperation in the pandemic response makes him concerned that digitization will fail.

On that note, Klaus saw the pandemic as an opportunity to test the great reset philosophy. Still, in hindsight, he acknowledged that the WEF’s top-down approach failed, so they are now focusing on young global leaders for a bottom-up approach.

The fourth speaker was Jeremy Jurgens, chief business officer at the WEF. Jeremy explained that the speed of digitization will drive the kind of intimate public and private cooperation the WEF is looking for. Note that private and public integration are common in authoritarian regimes. Jeremy went on to explain that there will be another global crisis that will be worse and happen fast. He then revealed that the WEF has been working closely with intelligence agencies on cyber security related to energy infrastructure. He not-so-subtly asked what would happen if the energy grid went down.

The following speakers were Sebastian Tolstoy, head of Erikson's Russian operations, and Alexei Kornya, CEO of MTS, Russia's largest telecom company. The pair talked about the rollout of 5G and how its purpose is primarily for the operation of smart cities, not for civilian use.

Fake News: The Real Pandemic?

Nik Gowing, a former BBC News journalist, and Vladimir Pozner, a Russian journalist, were up next. They discussed whether fake news is the real digital pandemic. Nick began slamming then-US President Donald Trump for calling the mainstream media fake news. Vladimir continued by questioning whether it's good that people have more access to information in the modern day. He said that journalists used to be soldiers under the Soviet Union.

Funnily enough, there was much disagreement, and Vladimir said he wasn't enjoying the conversation. Vladimir won the argument, though, because governments worldwide are in the process of passing online censorship laws, some of which will go into force in the next few months.

Other speakers were Jacqueline Kurnot, who works in cyber security consulting at Ernst & Young, and Hector Rodriguez, a senior vice president at Visa. The topic of discussion was how to prepare for a cyber crisis, and what the panelists said was eye-opening. Jacqueline insisted that the next global crisis is imminent and said that the only solution is government regulation. Thankfully, Hector was not as convinced that there would be another global crisis but revealed that Visa already had a plan for dealing with the pandemic shortly before it began. Coincidence?

Image source: X Interpol

Interpol And WEF Aligned

Troels Ørting Jørgensen, the West Center for Cyber Security chairman, and Jürgen Stock, the secretary general of Interpol, then had their say. For those unfamiliar, Interpol fights international crime with the help of law enforcement agencies from 195 countries and counting. While the Interpol Charter states that the organization is supposed to be politically neutral, it appears to be very closely aligned with the WEF. Troels revealed that he and Jürgen have been close friends for 30 years.

Jürgen also said that Interpol and the WEF are aligned. Jürgen is particularly passionate about the WEF’s Fourth Industrial Revolution, which essentially involves the digitization of everything so that it can be closely monitored and controlled. To that end, Jürgen believes that software and hardware should have security by design features that allow this control.

Craig Jones, who also works at Interpol, specifically as the organization's cybercrime director, was next. Craig's answers were less revealing than the questions from Alexander, who asked about cyber attacks being executed in waves across multiple countries. Notably, Alexander asked the last few speakers if cybercrime groups collaborate better than countries. The answers were mixed, but the consensus is that cybercrime groups collaborate better than countries, which makes sense, given the tense political climate.

Image source: Transforming our World 4 IR

Petr Goradov, head of international legal cooperation at Russia's General Prosecutor's Office, watched the simulation at Sberbank headquarters. Alexander asked him why cyber crime was rising in Russia and why only 8% of cases were solved. Petr dodged the question and called on the United Nations to create a new convention focused on cybercrime.

John Crain, chief security officer of ICANN, was asked by Alexander about the collaboration comparison between countries and cybercrime groups. John was the only speaker who claimed that the pandemic had increased the collaboration between countries. John also revealed that ICANN is keeping track of the registration of internet domain names worldwide and their correlation to crime. As an international organization, ICANN cannot pursue any enforcement action, but it has forwarded this information to the appropriate authorities.

The final speaker was Stanislav Kuznetsov, chairman of Sberbank. He thanked the WEF, Interpol, and others for helping put together Cyber Polygon 2020. He explained that the outcome of the ongoing cyber attack simulation would be published in a subsequent report. As mentioned earlier, the attackers in the simulation were BI.ZONE employees and the defenders were the participants in the event. The identities of the defenders are not revealed in the simulation results.

The simulation results seem to suggest that the participants are unprepared for a cyber attack regardless of their industry. The results also specify that more than 20% of participants could not identify cyber threats before they occur. Not surprisingly, financial institutions and IT companies performed the best across the three cyber attack scenarios.

Image source: The Last American Vagabond

Cyber Polygon 2021 Highlights

As stated in the introduction, the Cyber Polygon 2020 gave rise to speculation that a global cyber attack was imminent. This speculation rose higher in mid-2021 when the WEF and Sberbank co-hosted a second cyber attack simulation. Like Cyber Polygon 2020, Cyber Polygon 2021’s key partners were the WEF, IBM, and Interpol, and the 2021 edition was almost twice as large as the 2020 edition, with 200 participants from 48 countries and 7 million viewers from 78 countries. Most participants again chose to remain anonymous.

Whereas the theme of Cyber Polygon 2020 was a so-called digital pandemic, the focus of Cyber Polygon 2021 was a supply-chain cyber attack simulation similar to the SolarWinds hack that would “assess the cyber resilience” of the exercise’s participants. The website for the 2021 event ominously warns that, given the digitalization trends primarily spurred by the COVID-19 crisis, “a single vulnerable link is enough to bring down the entire system, just like the domino effect,” adding that “a secure approach to digital development today will determine the future of humanity for decades to come.”

In addition to the same globalists and bureaucrats of the 2020 edition, Steve Wozniak, the co-founder of Apple, was present at the 2021 event. It’s worth mentioning that Steve seemed surprised by the event because of Alexander's questions. Alexander asked Steve about data, and Steve boasted that he's proud that Apple doesn't share user data like other big tech companies. Alexander asked Steve about AI, and he said he was not all that impressed by it. Alexander also asks Steve about digital ID. Steve expressed that he doesn't like it at all but knows it's inevitable and hopes it's done in a way that protects user privacy. Steve went on to say that he hates authoritarianism and loves freedom.

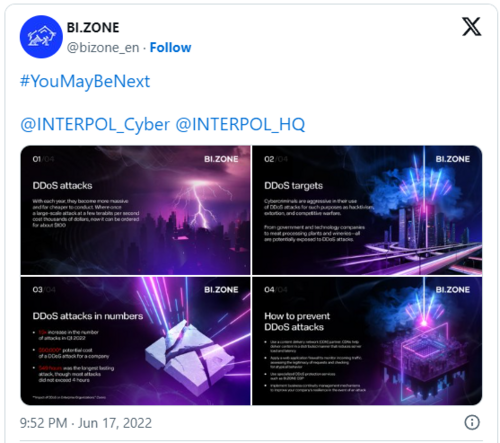

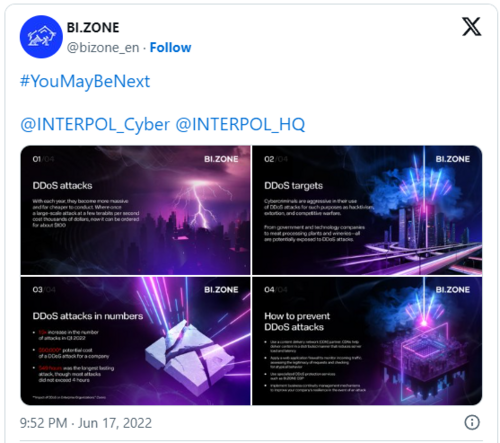

The results of the 2021 cyber attack simulation can be found here. The difference is that the 2021 report did not contain a detailed breakdown of how the participants did. It only provided a paragraph, suggesting the participants did even worse than the previous year. A third simulation was set to occur in mid-2022 but was postponed. BI.ZONE announced on Twitter [X] that Cyber Polygon had been delayed indefinitely, and many would argue it was because of the war in Ukraine.

According to this website, no official reason was given for the postponement, and there was no mention of sanctions or Ukraine. It’s interesting to note that BI.ZONE has since been posting about cyberattack scenarios with the hashtag “You may be next,” often tagging Interpol in the tweets.

Image Source: X [Twitter]

Global Cooperation Waning

So, is the WEF, in fact, planning a global cyber attack to achieve even more control? Executing a global cyber attack would also require the same kind of cooperation the WEF is trying to push with cyber defense simulations just like Cyber Polygon.

The catch is that the cooperation the WEF requires for a global cyber attack has been breaking down ever since the pandemic began. The conflicts over the distribution of things like medical equipment and medicine have led to a decline in trust between countries. This is probably why Alexander, the presenter of Cyber Polygon, felt compelled to ask whether trust or fear would motivate cooperation during the next crisis.

Interestingly, the only person Alexander asked this question to was WEF chief business officer Jeremy Jurgens. Jeremy admitted that fear achieves compliance but cautioned that compliance is not the same as cooperation. Jeremy also acknowledged there is serious competition between countries. It brings into question how the WEF will achieve cooperation without using fear in a way that won't be affected by the competition between countries.

Answer To The Perfect Global Crisis

The answer is a global crisis where no individual or institution is to blame, a crisis some speakers alluded to. The only problem with this kind of crisis is that the WEF wouldn't have nearly the same degree of control over its emergence and response as it did with the pandemic. Ideally, the WEF would have a way of secretly creating or exacerbating a crisis where it's impossible to detect their influence.

It raises the issue of what kind of a global crisis meets this criterion, and the answer is a climate crisis. The WEF and its allies have been talking a lot about this lately. It is also a crisis that they could secretly create or exacerbate.

If you know anything about weather modification, you'll see that it is a very real technology that's been around for almost 100 years. Today’s weather modification technologies are more sophisticated and highly potent, and it's reportedly impossible to detect when they're being used. A climate crisis made or made worse by this undetectable weather modification would be the perfect path to total control for the WEF. They would only need to manage the online flow of information, which they're currently addressing with those online safety laws.

Food For Thought

Could the elites in power be using a series of successive crises to get everyone on the same internet? An internet where everyone is registered, and everything is monitored. Consider that every time there's been a disruption to the internet due to some crisis, Elon Musk has stepped in by offering internet via Spacex's Starlink service. If some cyber attack takes down the internet, Starlink is an alternative.

The good news about this situation is that people will always be able to recreate new internet using peer-to-peer networks. This will be easier said than done, but it is possible and will be done if this is the path that the people in power decide to take.

The silver lining to all of the WEF’s plans is that the WEF doesn't only require the collective trust of countries to make this master plan work; it requires the trust of the average person. This trust has been broken beyond repair, and what's left of it is being pounded into dust by the WEF’s ever-more dystopian plans.

There are more of us than there are of them. If we work together to fight for freedom, we will always achieve it because our collective consciousness and energy will always be greater than theirs. And though it may take some time for the equation to play out, the outcome is inevitable.

(32).gif)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

(32).gif)

(1).gif)

.gif) Gold price outlook remains bullish but record highs pushed out to the end of Q1 2024 – ANZ

Gold price outlook remains bullish but record highs pushed out to the end of Q1 2024 – ANZ