Restoring Humanity – From Mass Psychosis to Mass Awakening

The global events of the last three years have presented extreme economic, health, and freedom challenges while raising questions about the emerging dystopian nightmare.

Why is it that a minority of people can see through the crumbling official narrative imposed on the people while, by contrast, many seem so blissfully asleep in continuing to accept and defend a narrative that does not add up?

In order to answer this, it may be helpful to look at the relationship between perception and mind control and how this contributes to mass psychosis, which refers to a collective lack of insight where current reality is concerned. Even more important than insight is how to break the spell of harmful and destructive conditioning.

I start with a personal example. I was walking through our local hospital many years ago wearing a white jacket and skirt cotton suit. As I walked through the local hospital, it seemed that everybody I passed nodded at me respectfully; initially, I couldn't figure out why. After all, I didn't know them.

It took a minute to dawn on me that my presence was being acknowledged this way because most doctors wear white uniforms. They thought I was a doctor and, therefore, worthy of such respectful acknowledgment due to my perceived status and authority.

In another incident in 2020, an elderly gentleman in town gave me expletives due to my opposing views over a specific health matter. He abruptly stopped when I told him I was a former nurse, and his demeanor changed entirely to a more passive and accepting stance. Again, in his eyes, I represented authority.

Image source: Bgfons.com

MASS PSYCHOSIS

In the above examples, the keyword was authority, demonstrating the behavioral trend to accept what those in charge say without question. In an ideal world, that should not cause an issue, and there is merit in taking advice from those in authority who have the relevant expertise and a desire to help those they serve genuinely.

However, if you primarily serve your ego, then authority and status can lead to misuse and abuse of power if left unchecked. Money and status are aphrodisiacs to these types of individuals. With this in mind, Thomas Jefferson warned Americans about the need to be vigilant.

‘Freedom is not free; the price you must pay for freedom is eternal vigilance.’

So why do individuals accept authority blindly when a destructive use of power is in play? The clues lie in mind control.

MIND CONTROL

Mind control is the ability to influence the mind towards a specific objective. It can be positive when focussing on how to achieve a dream goal, for example. This is a constructive use of the mind, which impacts emotions and behavior too. When used for harmful or nefarious purposes, this becomes destructive.

Most, if not all of us, have been born into a time when such corruption is well established. This means that these practices have an air of normality about it. Normal becomes so through a process of conditioning over time. If you look at it from the angle of the law of cause and effect, these nefarious outcomes are the effects of things being created to cause them to happen.

So if the effect is that you wish people en masse to believe a lie, then certain ingredients would need to combine to cause that to happen. For example, combine authority with media, education, and health control, and you can control the message that will be delivered consistently to the people.

After a certain time, that message will get accepted to the point where it will remain unchallenged without question, even when it makes no sense. Mass conditioning becomes possible when you expose the public to specific information with frequency and intensity through commonly held technology devices such as the television.

George Orwell once said, “Who controls the past controls the future.”

Ask yourself the following question. Who controls the media, who owns education, and who owns the pharmaceutical industries? See if you can name them without research.

If you struggled with the answer, that is great feedback because it lets you know what you do and don’t know. It's on the basis of such ignorance that many make uninformed comments and decisions about things like health, education, and money.

To help advance your knowledge in this area, the documentary below called "MONOPOLY" is well worth watching as it shows you how to find the answer rather than just telling you who controls the world. It’s about one hour long and addresses the issue of who owns what when it comes to the primary industries in the world. It also develops your research ability in the process.

This pattern of control highlighted in the documentary is the creation of those with high status, money, presumed authority, and disdain for humanity. Once you determine who controls what, you can examine their connections regarding who they associate and with whom they merge their objectives. You can then more accurately predict the narrative that will come through the media channels.

So in the case of the Monopoly documentary, all roads lead to Blackrock and even more so to one in particular – Vanguard. The agenda with Blackrock and Vanguard has been addressed in previous articles from the team.

Since they have a monopoly on every major industry, it stands to reason that it is not in their interest to allow an even playing field for all. They do not believe in meritocracy. Hence they will use everything in their arsenal to remove the competition.

Does the trail stop with Vanguard, or is there another type of hierarchy with controlling influence?

Well, depending on how far you want to take your research, there is consistent commentary from various ex-government officials turned whistleblowers to suggest there are individuals in the shadows hiding behind these corporations pulling the strings.

Some talk in terms of thirteen ruling families. Others talk of the Club of Rome or The Committee of 300. The theme of Masonic Orders and The Illuminati are other names. They are collectively referred to as The Cabal or Deep State.

Where this trail ends is hard to say, but a common theme is this hatred for humanity, reflected in destructive rituals and behaviors. This theme of unjust enrichment for the few by those in authority and enslavement of the masses is an enduring theme, irrespective of the exploration angle.

So how does that corporate control relate to you? It goes beyond you buying their stuff. Let’s loop back on the subject of mind control and see if we can get nearer to the roots of this.

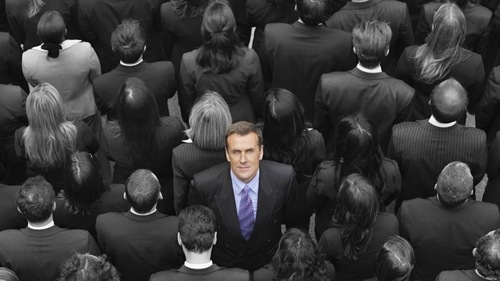

MK Ultra

MK Ultra was a collaboration between the government and approximately 80 institutions in the 1950s, a central point of which was the Tavistock Institute. Certain people were selected to be experimented on regarding mind and behavior control. It was brought into being off the back of the war as a strategic initiative for defense purposes. For more background, look up Project Blue Beam, Operation Paperclip, and P20 CointelPro.

Image Source: All That’s Interesting

Director Sidney Gottlieb, an integral figure in that program, joined the CIA in the early 1950s. He was an expert in poisons and devised many projects to remove the enemy. This program became controversial because such experiments were used more widely to experiment on the public without their knowledge. The nature of the experiments was barbaric in that they were designed to break the human will and spirit.

The mind would become fragmented as the conditioning process of subliminal messages, drugs, alcohol, mental disruption, fear, blackmail, hypnosis, and sensory deprivation kicked in to induce specific behavior. The subject would automatically and unconsciously respond to a pre-programmed objective once triggered by a stimulus or command at the required time.

MK Ultra is deemed to be behind certain assassinations where the assassin has no knowledge of performing the act. It protects the real killer, and hence these subjects become proxy killing machines, weaponized to do the bidding of those that control them.

Once this program became known in the public domain in the early 1970s, the program was supposed to be terminated. However, it got morphed into Project Monarch, and many believe the project continues in some way, with the use of subtle tactics.

Strategies and Tactics

To bring it forward to the present day, the use of artificial intelligence for population surveillance and the internet of things is deemed to be the medium through which the public is being spied on. Here are a few tactics employed in the process.

Plausible Deniability

Plausible deniability is about insulating yourself from blame based on the fact that someone else performed the misdeed without your knowledge, coupled with the fact that there is no clear trail of evidence that links you directly with the act in question.

The following testimony from a whistleblower from a private security firm in Seattle demonstrates this and how far these global powers are willing to go to control the masses for their own agenda. What he shows undoubtedly aligns with the attempted removal of law enforcement and the introduction of robots.

It enters the realms of direct energy weapons, which lays the groundwork for plausible deniability because, in this scenario, you can harm someone without touching them and distance yourself through a lack of evidence.

As much as what he shares is not for the faint of heart, it does prove that these things did not happen overnight, and the view that the so-called virus was created for a global reset rather than the other way around is gaining momentum by the day.

Distraction

Consider this from Aldous Huxley back in the 1930s:

“As for the manual workers, they will be discouraged from serious thought: They will be made as comfortable as possible…; As soon as working hours are over, amusements will be provided, of a sort calculated to cause wholesome mirth and to prevent any thoughts of discontent which otherwise might cloud their happiness.”

Distraction is a tactic that keeps a person from realizing what is actually happening. A typical vehicle for this is the television.

Entertainment

Look up the film ‘White Noise’ and compare it to what happened in Ohio recently with the train incident. Many reported that the so-called virus reminded them of the film ‘Contagion.’ Most recently, there was talk of another virus called the Marburg virus.

Coincidentally Stanley Johnson, the father of former UK Prime Minister Boris Johnson, released a fiction book in 2020 called ‘The Virus,’ featuring the Marburg Virus. It was previously published in 1982 as The Marburg Virus.

A variation of these fiction movies and books is the simulated tabletop exercises facilitated by Bill Gates back in 2019 and written into the WHO papers. (World Health Organization)

Are these fictionalized movies, books, and simulations a tactic to get the mind to associate these things with fiction prematurely or to confuse the mind about what is real and fiction?

Could it be that when the real event happens, it has already been seeded in the collective mind? And any attempts to suggest this is premeditated get seen in a fictitious light as disinformation?

Or are we being told the agenda ahead of time, albeit presented as mere fiction, so we won’t take it seriously until it catches up with us in an unguarded moment? You decide.

The Trojan Horse

If you look up what a trojan virus is, it is a play of the trojan horse theme. In this scenario, some sort of malware disguises itself as legitimate code. Once it enters your computer, it wreaks havoc in a destructive manner.

Apply this to 9/11, where there was a supposed foreign terrorist attack. Through the back door came The Patriot Act, allowing for citizen surveillance.

In the case of the so-called virus Co-vid 19 [look up its patent]. The virus supposedly allowed the public to be inoculated through experimental jabs, which has given way to track and trace technology for our protection.

It was, in fact, the other way around. The problem was created in the form of a virus with a 99.9% recovery rate, yet, by sleight of hand, by solely focussing on cases, it was presented as a killer pandemic, suggesting a significant percentage of the population would be wiped out.

This, in turn, would provide a context and compelling case for mass injections and then, then morph into an emergency climate agenda based on reducing carbon emissions.

Now the proposal of a digitized CBDC becomes a controlling pinnacle mechanism for approved social behaviors in the form of social credits within smart cities. Spot the trojan horse. Welcome to the new world order.

.jpg)

Image Source: Stop World Control

In their new online playground, the lines between reality and virtual reality get consumed in the metaverse, ‘et voila’ we have the internet of things, where you now become a thing that can be switched on or off at the press of a button – the ultimate control.

A way to further verify these events is to look at where big money has been directed. For example, look up the list of US patents, and you will find related patents going back many years ago that laid the ground for what we are now seeing.

Duplicity

This is where you appear to be on one side while really serving the other. An example of this is when the government sugarcoats its lies with the truth to bait the people or keep them hooked.

Deception – The Overarching Theme

Deception is a theme that runs through all the tactics mentioned above, and the most dangerous kind is the duplicitous narrative that has a bit of truth sprinkled in to keep the masses onside and to mute any objections.

Robin de Ruiter sums it up in his book The Satanic Bloodlines,

“There is only one truth which has been purposely covered up and re-branded to ensure that those who dare to seek and question are unsuspectingly led into a dangerous cocktail of truth mixed with error.”

This can pave the way for things such as battered wife syndrome and Stockholm Syndrome. The latter is a term often used in psychiatry, where the subject perceives her abuser as more of a friend than a foe to the point where the abused will defend the abuser in the face of threat.

This is an example of codependency, where the abuser controls a vulnerable subject and where she is dependent on the abuser in some way for her survival.

In the book Fruits From A Poisonous Tree, Mel Stamper describes the other common form of deception, which is the use of language to deceive.

Nowhere is this more prominent than in the laws that were changed over time to create things like the birth certificate fraud and the debt economy fraud. This was done to enslave the masses and make it so difficult for them to recover, let alone have the strength to make those responsible accountable for their fraudulent and criminal actions.

If you accept that the very things that would bring charges of fraud and crime against us are things that the government seems to be immune to, then at some level, you have to accept that we are being ruled through organized crime by the very people we pay to serve us.

When errors are not corrected, this leads to incompetence. When incompetence is repeatedly ignored, this leads to corruption. That makes them criminals and fraudsters acting as a government.

The above construction of a mass psychosis through mind control and fear would suggest that certain globalists have succeeded in their orchestrated plan to numb, dumb, and stupefy the public into going along with their behavior. Authority has combined with force in the present day to keep it this way. Yet all is not as it seems, and truth has a way of coming to the fore in time.

MASS AWAKENING

This begs the question of how it is possible to go from mass psychosis, where there is no insight into current reality, to a mass awakening, where there is clarity of insight.

Thomas Jefferson reminded us of the important quality of vigilance; “Freedom is not free; the price you must pay for freedom is eternal vigilance.”

Vigilance is a form of being alert to guard against deception and lies, but it needs to feed off the clarity of insight. Here are three tips for facilitating awakening and anchoring it in vigilance.

1. Perhaps a starting point is to recognize what does not work so well, which has been attempted by many who have tried to wake people up. Many have tried to use reasoning in conversation, which has led to much angst and frustration. The key learning point here is that the act of reasoning with a conditioned mind is nigh impossible.

When faced with something new, the mind will tend to roam its inner filing cabinet, and if it cannot find a supporting experience in its memory bank, it will likely dismiss your reasoning. This is a description of conflict often referred to as cognitive dissonance.

Reasoning only works where there is an open mind and heart. An awakening usually bypasses the intellect and happens through the heart. So the first step is to open the heart and desire to seek truth in all things.

If you are a person that is trying to help someone wake up, the best way to help them open their heart is to simply show them what a better world looks like in thought, word, and deed through things like empathy, compassion, and presence.

This becomes like a contrasting mirror to the type of world that ruling authorities are ushering us into. This also provides a safety net in which the person you are helping can genuinely open up over time without fear and entertain something different from what they have held onto for so long.

2. Recognize the opportunity in adversity. There is something about the nature of adversity that causes individuals to evaluate life with greater depth compared to when things are going well.

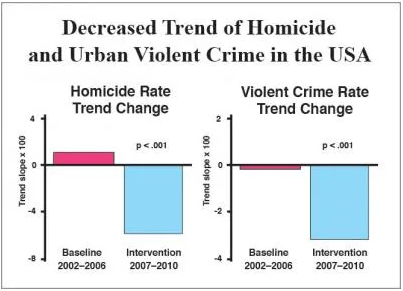

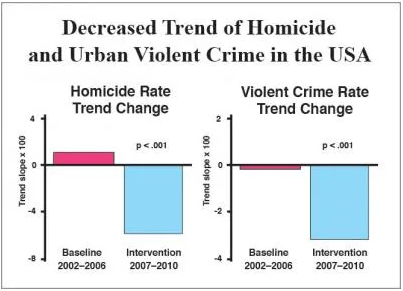

There is an opportunity to change the trajectory of life as more awaken to what is going on. That makes this a perfect storm if that opportunity is taken. Consider the example of Transcendental Meditation and the research conducted over four years, demonstrating its powerful ability to reduce crime and increase peace.

Image source: Meditation Lifestyle

This is an example of the opportunity to create a powerful impact in a positive way and bring restoration to the masses. Prayer is another form that can do likewise when we focus attention on the desired outcome with faith and expectation.

3. In keeping with the theme that showing is more powerful than telling, documentaries such as Monopoly, when done with an educational stance, are powerful to help move a person away from unbridled trust to reconstructing the basics of better research and verification of truth.

Do not be surprised if fear and apathy arise in the process of strengthening your mind. The dross of fear and apathy will surface as you break away from deeply engrained habits and learn to let go of those elements which have created the illusion of safety.

Fear can arise from the act of challenging authority, and apathy can be a buffer against disappointment. Apathy can show up as ‘what difference can I make?’ However, it also blocks the flow of life and is a lie against your true nature.

Simply move through it with a loving acceptance of yourself and a reminder of the loving soul that you are as you continue with the trajectory change and keep your eye on the prize. Keep exposing yourself to the mind-training tools, spiritual insights, and processes that will help you become strong and resilient where fear and apathy are concerned.

SUMMARY

From the example of mind control, we have seen how reality is changed from a place of perception first. Many make the mistake of trying to change the outer reality without the inner journey.

However, to constructively change reality as an individual or group, you must go beyond mind control to expand your inner resources and God-given potential to contain and cultivate new possibilities.

Many of the conditioning tools that lock you into a fearful agenda can also set you free when used responsibly, such as hypnosis, whole-brain synchronization, and heart-brain coherence.

Furthermore, when you surround yourself with like-minded people supporting your progress, you can anchor your own process in eternal vigilance. This way, we can create communities whose connection is based on genuine and authentic care for each other. We can usher in a golden age where natural law principles and parity of equality under the law are restored.

The light emitted from a heart of love for the well-being of our fellow man and woman can dispel any darkness. It can show us the way and help us remember who we truly are and what we can achieve together in bringing about restoration so that we can go beyond survival to become part of a thriving planet.

Let’s change the trajectory of our future now. Make a decision to give your attention to the sort of world you wish to see rather than dwell constantly on what is playing out, and get creative in harnessing your inner resources to make it a current reality. The future depends on what we create now.

(4).gif)

About:

Anita Narayan. (United Kingdom) My life's work is about helping individuals to greater freedom through joy and purpose without self-sabotage, so that inspirational legacy can serve generations to come. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.gif) Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

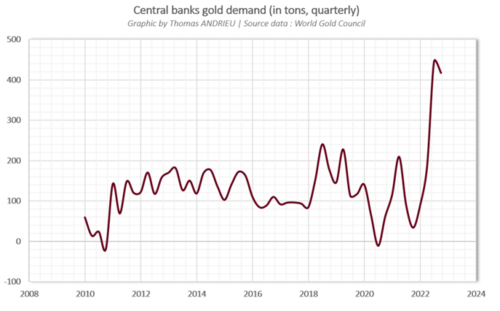

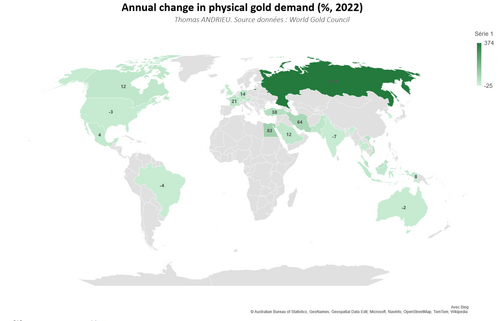

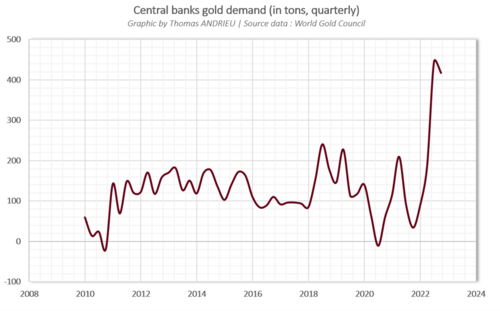

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion

.jpg)

(4).gif)