Wall Street reaches perfect equilibrium of indecision on gold prices, Main Street maintains optimistic outlook

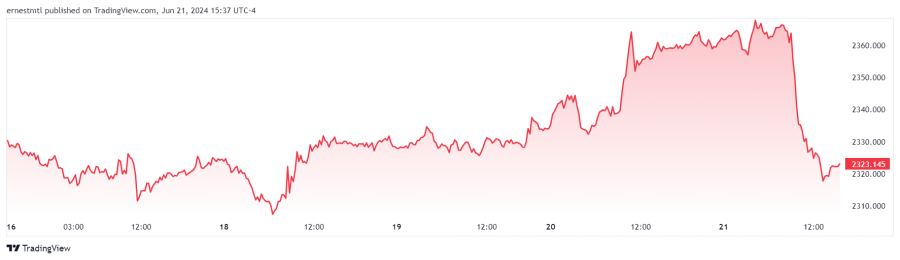

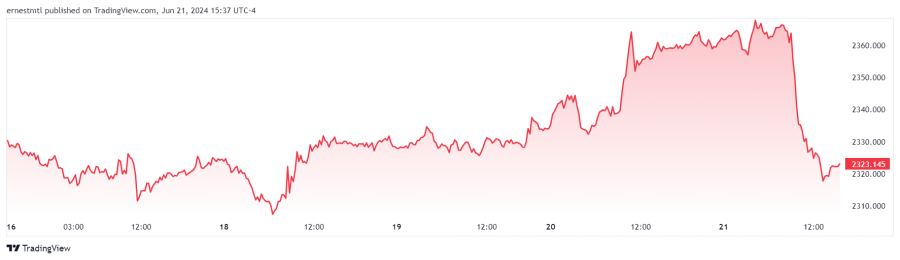

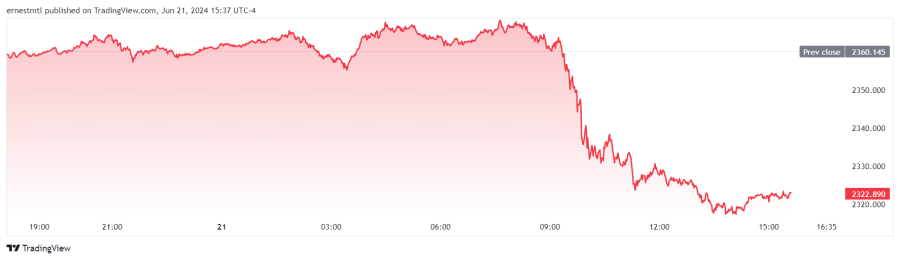

The gold market saw one of its least dramatic weeks of the year this week, but as has been the case of late, it saved some drama for market participants for the end.

Spot gold kicked off the week trading at $2,332.64, and after sliding to a daily low of $2,311.50 around noon EDT on Monday, it did very little other than set the weekly low of $2,307.38 early Tuesday morning.

So steady and narrow was the sideways churn that by the middle of the day Wednesday, which also marked the Juneteenth holiday in the United States, gold had traded in only about a $20 range and found itself flat on the week.

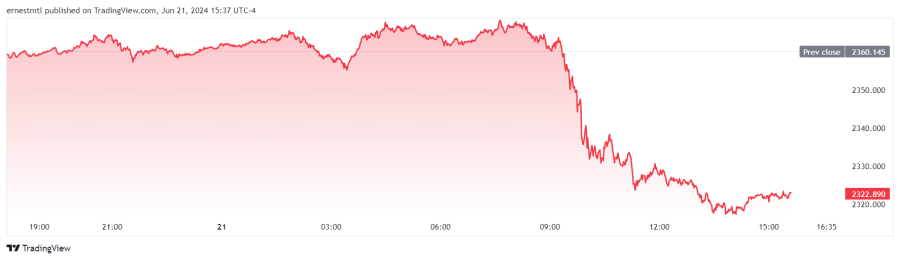

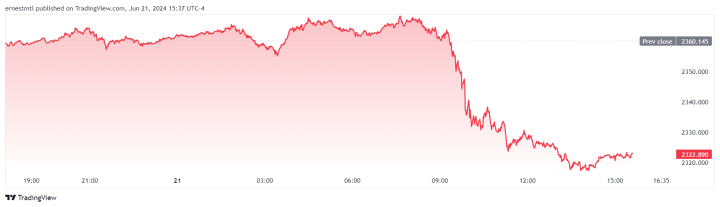

U.S. traders brought renewed energy to the markets with their return on Thursday morning, driving spot gold from $2,332 in the early morning to the then-high of $2,364.09 by 10:45 am EDT. Gold then traded in its newly elevated range between $2,350 and the weekly high of $2,367.70 until Friday morning’s precipitous decline that saw spot gold slide from $2,363.71 at 9 am EDT all the way to $2,317.70 shortly after 1 pm, leaving traders and investors wondering whether the key psychological support level of $2,300 per ounce would hold into Friday's close.

.png)

The latest Kitco News Weekly Gold Survey shows industry experts indecisive about gold’s near-term path, while retail sentiment remains positive.

Marc Chandler, Managing Director at Bannockburn Global Forex, sees geopolitics pushing bullion prices higher next week.

“US rates remain soft and although Mexico’s president-elect has made some market-friendly cabinet appointments, political tensions continue to run high in Europe (EU, France, and UK),” he said. “And we note elevated tension between China and the Philippines.”

Chandler said the slippage in U.S. rates “seems to run against the grain of the rally in crude oil, where the Aug WTI contract reached its highest level since the end of April.”

“The yellow metal is testing the $2368 area, and a push higher could see $2388-$2390,” he concluded.

“BULL,” wrote Mark Leibovit, publisher of the VR Metals/Resource Letter.

“Down,” countered Adrian Day, President of Adrian Day Asset Management. “Gold is in a short-term trading range right now and, after last week’s rally, could pull back next week. The market is in a holding pattern, looking for news on the resumption of Chinese official gold buying as well as clarity on US inflation and employment, which will provide insight into the timing of any rate cut.”

Darin Newsom, Senior Market Analyst at Barchart.com, sees gold prices trending higher next week.

“August gold’s short-term uptrend has turned up on the contract’s daily chart, with August posting a new 4-day high of $2,5379.50 Thursday,” Newsom wrote. “While the early part of next week could see renewed light selling interest, by the time we get to next Friday, the contract should be higher again.”

Newsom said he’s looking for a higher weekly close this week and next, which would constitute a string of three straight weeks against the intermediate-term downtrend on the August contract’s weekly chart. “At that point, based on the Benjamin Franklin Fish Analogy (Like guests and fish, markets start to stink after three days/week/months of moving against the trend), I’m looking for the futures contract to turn down again,” he said.

“The short-term upside target area is between $2,370 and $2,390, with an outside shot at $2,410.”

Analysts at CPM Group are also projecting higher gold prices over the next week or two.

“A wide range of political, economic, and financial market issues are likely to push gold higher, toward $2,400 if not $2,450 during this time,” they said. “A stronger dollar is not likely to be a negative for gold: The dollar and gold are both expected to find strong investor demand as the safer currencies to be in. Silver prices are expected to exhibit strength next week ahead of the July Comex futures delivery period starting on 28 May, which may help pull gold prices higher.”

“The increase may be short-lived, however, and dissipate beyond the first week of July,” the analysts warned.

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and their responses produced a perfect equilibrium of indecision about the near-term prospects for precious metals. Five experts, representing 62%, expect to see gold prices climb higher next week, while an equal number of analysts predict a price decline. The remaining four, or 28% of the total, expect gold to trade sideways during the coming week.

Meanwhile, 209 votes were cast in Kitco’s online poll, with Main Street investors maintaining their positive outlook on the yellow metal. 114 retail traders, or 55%, look for gold prices to rise next week. Another 38, or 18%, expected the yellow metal to trade lower, while 57 respondents, representing the remaining 27%, saw prices chopping sideways during the week ahead.

The highlight of next week's economic news calendar is the release of the core PCE price index report for May, as markets will be very interested to see if the Federal Reserve's preferred measure of inflation shows further improvement, increasing the likelihood of interest rate cuts in 2024.

Markets will also receive U.S. consumer confidence for June, the S&P Case Shiller home price index for April on Tuesday, and MBA mortgage applications, new home sales, and the results of the Federal Reserve’s bank stress tests on Wednesday. Thursday will bring the May durable goods report and final Q1 GDP, along with initial jobless claims and pending home sales for May, and the week wraps up with the final University of Michigan consumer sentiment for June on Friday.

There will also be a battery of central bank speakers for markets to tune in to, including the Fed's Waller and Daly on Monday, speeches from Cook and Bowman on Tuesday, and Barkin and Bowman again on Friday.

Daniel Pavilonis, Senior Commodities Broker at RJO Futures, said gold appears to be in its summer doldrums, but there’s a lot more happening under the surface.

“If you look at the retracement of the dollar, the dollar is still moving higher, we're inching our way up there, and we're also looking at energy prices move higher,” he said. “This could cause a rebound in rates, which may put some pressure on gold.”

“But ultimately, we're going to see some major headwinds here coming into the elections, and possibly some flaring up of rates in Europe with the situation in France, and French yields moving higher because of the elections.”

“At the base of it, everywhere you look, in terms of de-dollarization, rates, debt, political instability, I still think this is very, very beneficial for gold,” he said. “But it may take a little bit of a pause here.”

Regarding gold’s slide on Friday, Pavilonis said he thinks it was likely driven by hawkish Fed commentary.

“I think some of it was the Fed talk yesterday, with Brainard, on the possibility of not cutting rates,” he said. “Then, coming into this morning, we had some European data that was maybe weighing on the markets, but then we had the global composite PMI and manufacturing PMI, and I think that ticked a little bit higher.”

Pavilonis said the data is inconclusive right now, and it’s creating a weird situation for market participants. “Are we walking into a recession because rates are too tight, or are they not tight enough?” he asked rhetorically. “Some of the data is just all over the place, and I think it's causing a little bit of uncertainty in the market.”

While Pavilonis sees a lot of global instability pushing gold prices higher in the coming months, as far as next week is concerned, he still thinks the yellow metal could fall further.

“I still think there may be some downside,” he said. “We have that double top up there around $2,440. We come back and we try to make a new high, and we actually make a new low, and then we start grinding higher from the beginning of June, all the way to where we've been over the last couple of days… but the candlesticks on the daily [chart] on futures don't look that great.”

“I think the path of least resistance is to the downside,” he concluded. “Maybe we start getting back down to $2,250, somewhere around there.”

Michael Moor, founder of Moor Analytics, wrote that based on where gold is trading on Friday, the charts are indicating further downside.

“The trade above 23386 (-1.2 tics per/hour) should bring in decent strength,” he said. “Decent trade back below 23520 (-2 tics per/hour starting at 6:00am) should bring in decent pressure. Decent trade below 23249 (+1 tic per/hour) will project this downward $35 minimum.”

And Kitco Senior Analyst Jim Wyckoff said traders appear to be positioning themselves long for next week.

“The near-term technical postures have turned more bullish for gold and silver this week, which is inviting the chart-based speculators to the long sides of the markets,” he said. “Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the June low of $2,304.20.”

“First resistance is seen at $2,390.00 and then at $2,400.00,” Wyckoff said. “First support is seen at the overnight low of $2,368.60 and then at $2,300.00.”

Spot gold last traded at $2322.89 at the time of writing for a loss of 1.59% on the day and 0.41% on the week.t

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.png)