From Financial To Physical. The Next Big Thing In Crypto – DePIN

Recently, there has been significant interest in decentralized physical infrastructure, also known as DePIN, within the crypto space. People are curious about the potential of this niche and which specific projects within it are worth noting. The latest detailed study, titled State of DePIN 2023 by Messari, aims to provide insights into these questions. This summary will highlight key findings from the report and discuss their potential impact on the cryptocurrency market.

What Is DePIN?

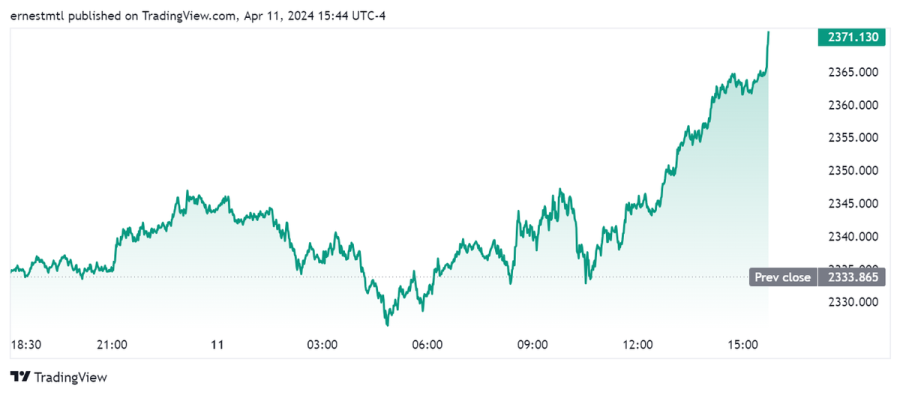

The report commences with a concise delineation of DePIN, an acronym for decentralized physical infrastructure. It encompasses a cluster of ventures that employ cryptocurrency-based incentives to foster a range of physical infrastructure. These initiatives span from decentralized Wi-Fi systems, decentralized computing clouds, decentralized cloud storage solutions, and decentralized mobile networks to other similar endeavors. A salient feature that sets most DePIN projects apart, in addition to their crypto-based incentives, is the accessibility for individuals to contribute, provided they possess the requisite hardware.

Source: The Messari Report.pdf

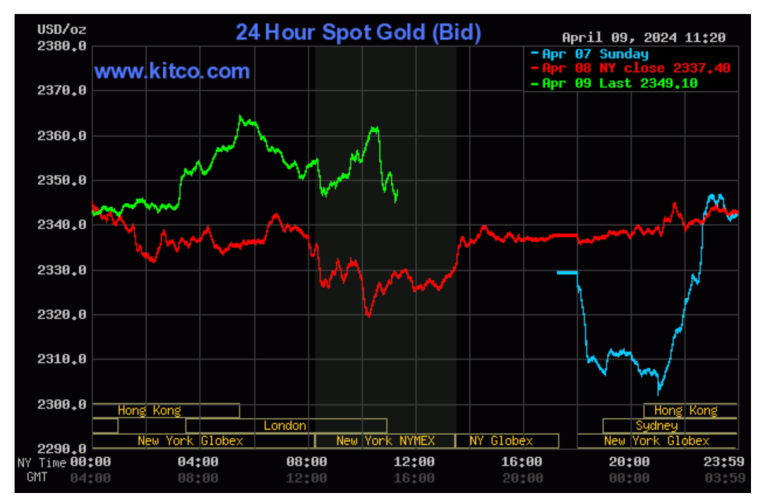

The report highlights that DePIN solutions have the advantage of being more efficient, resilient, and high-performing than their centralized counterparts. Additionally, DePIN projects can rapidly innovate and evolve due to community participation, which gives them a unique edge over centralized projects. This efficiency and resilience not only make them attractive to investors but also instill confidence in their long-term viability.

Source: The Messari Report.pdf

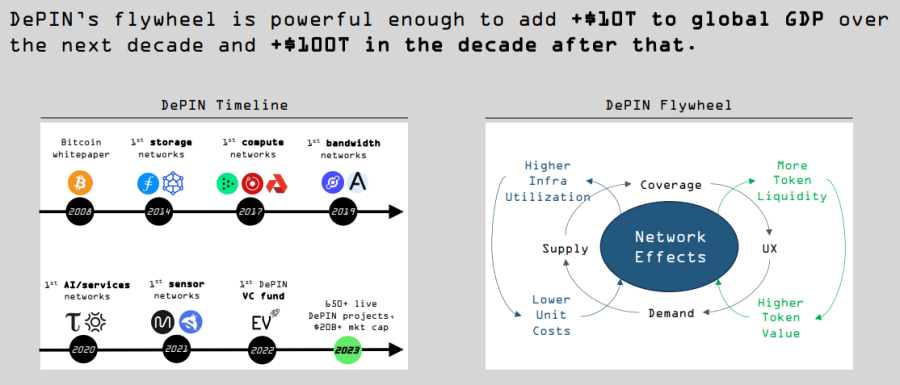

The authors posit that DePIN initiatives possess a self-reinforcing mechanism known as a flywheel, whereby their growth and influence fuel further adoption and expansion. As these projects gain traction and popularity among users and service providers, they become even more potent and widespread, creating a positive feedback loop. The authors project that DePIN will substantially impact the global economy, with the potential to augment GDP by a staggering $10 trillion over the next decade. This ambitious projection underscores the transformative potential of these projects.

Source: The Messari Report.pdf

The authors go on to list the industries in which DePIN is currently causing significant changes. These industries encompass various areas such as digital maps in the crypto sector, energy grid management, home internet services, food delivery platforms, ride-sharing services, and, surprisingly, even pet and livestock-related projects. It should be noted that these endeavors are still in their initial phases.

The authors have categorized crypto projects in the DePIN niche into six categories: compute, wireless, energy, AI, services, and sensors. According to their analysis, there are over 650 cryptos across these categories, with a combined market capitalization of over $20 billion.

Source: The Messari Report.pdf

The DePIN projects have garnered significant interest from venture capitalists, resulting in substantial capital being invested. To put it in perspective, the top ten DePIN projects alone have collectively secured a significant amount of funding. It's worth noting that many of these projects continue to attract investments even after their initial coin offerings (ICOs) and the launch of their main networks.

It is uncommon for a crypto project to secure substantial funding after its ICO. However, when this does happen, it indicates that investors have tremendous confidence in the project's potential. The DePIN niche has attracted significant post-ICO funding, with numerous projects raising substantial amounts. The top ten DePIN crypto projects in terms of funding raised include Filecoin and Helium, each securing $250 million, RNDR Network with $100 million, Fetch AI with $75 million, Livepeer with $50 million, Really with $35 million, Hivemapper with $25 million, Andrena with $25 million, Braintrust with $25 million, and DIMO with $20 million.

DePIN Blockchains

Intriguingly, most of the nearly thousand crypto projects operating within the DePIN space are opting to deploy on a select few cryptocurrency blockchains. This observation encompasses both layer one and layer two blockchains, with Solana emerging as the most favored layer one choice among DePIN projects.

The authors cite the high speed, affordability, and use of the Rust programming language as reasons for this. Among layer two solutions, Caldera and Eclipse are favored for DePIN projects. These platforms offer flexibility, enabling DePIN projects to blend Ethereum's security with Solana's performance, as seen in the case of Eclipse.

In addition to layer one blockchains that prioritize DePIN, the authors highlight some notable examples. Iotex is one such example, which was already utilized by the US military for health monitoring trials in November 2021. Peaq, on the other hand, is still in the pre-launch phase, but it has already generated significant interest and excitement within the community.

The importance of DePIN adoption cannot be overstated, as it will have a profound impact on both layer one and layer two. The success of DePIN chains and projects hinges on the demand side of the equation, which is carefully examined in the second part of the report.

Unlike many other cryptocurrencies, the authors emphasize that DePIN revenues are fueled by utility rather than speculation. They highlight that participants in DePIN projects typically need to purchase and lock or burn their associated tokens in return for access to the decentralized service or product being provided. This characteristic aligns DePIN projects with traditional crypto coins, which are utilized for various purposes, such as payment of fees and staking.

According to the authors, DePIN projects consistently yield an estimated $15 million in yearly on-chain revenue throughout the bear market. Given the large number of DePIN projects, this amount may seem insignificant. The authors, however, need to offer a clear answer to which DePIN projects are the most profitable, leaving it open to speculation.

However, it is worth mentioning that Livepeer has developed a dashboard named the Web 3 Index, which monitors the earnings of major DePIN projects. Decentralized storage and computing are generating the highest revenue.

Source: The Messari Report.pdf

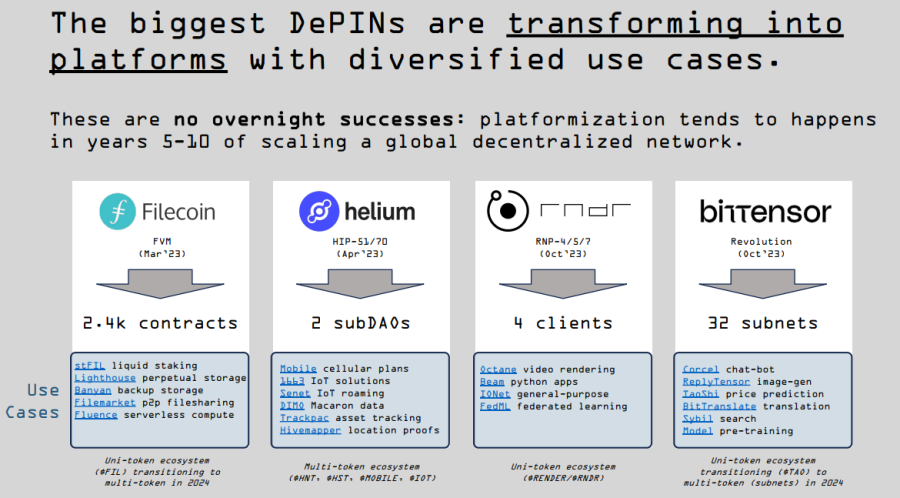

The authors highlight the evolution of DePIN projects, with many expanding their offerings to become comprehensive platforms providing a variety of decentralized products and services. They cite Filecoin, Helium, RNDR Network, and Bittensor as five notable examples of such platforms, demonstrating the diversification of DePIN projects beyond their initial scope.

DePIN Categories

Compute

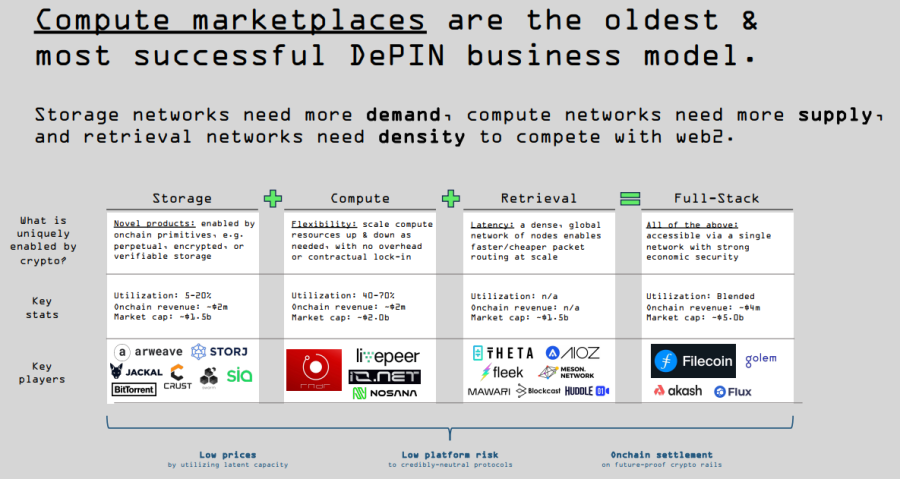

In the next section, the authors divide the Compute category into its previously discussed main elements: Storage, Compute, and Retrieval. They mention that specific DePIN projects within the compute category, such as Filecoin and Akash Network, provide a “full stack experience.”

Source: The Messari Report.pdf

In terms of Storage, it's suggested that DePIN could gain widespread acceptance by utilizing decentralized data storage. While other cryptocurrency projects and protocols have primarily adopted this technology, it's promising to see increased decentralization across the crypto space. This article provides an opportunity to delve deeper into the meaning of decentralization.

The authors highlight that Compute faces the opposite issue compared to storage. While there is an abundance of decentralized data storage but insufficient demand for it, the supply of decentralized computing power is lacking. Yet, there is a surplus of demand for it.

The authors note that decentralizing Retrieval poses a significant challenge, especially in maintaining competitiveness. This is primarily due to the fact that Cloudflare, a centralized retrieval protocol, currently serves 20% of all regular websites at no cost, making it challenging to monetize alternative solutions.

Wireless

This relates to the next DePIN category the authors detailed earlier: Wireless. The growth of the total addressable market for decentralized wireless services has been exponential, and it's no surprise why. The demand for decentralized wireless services is rising as the world becomes increasingly interconnected. This category of DePIN has even earned its own name – DeWi, short for decentralized wireless – highlighting its significance in the industry.

The authors also divide this category into three parts: mobile, fixed internet, and Wi-Fi. Helium, in particular, is gaining significant attention due to its rapid expansion and popularity. As an illustration, Helium has collaborated with T-Mobile to offer affordable mobile plans across the US.

Source: The Messari Report.pdf

Data Sales

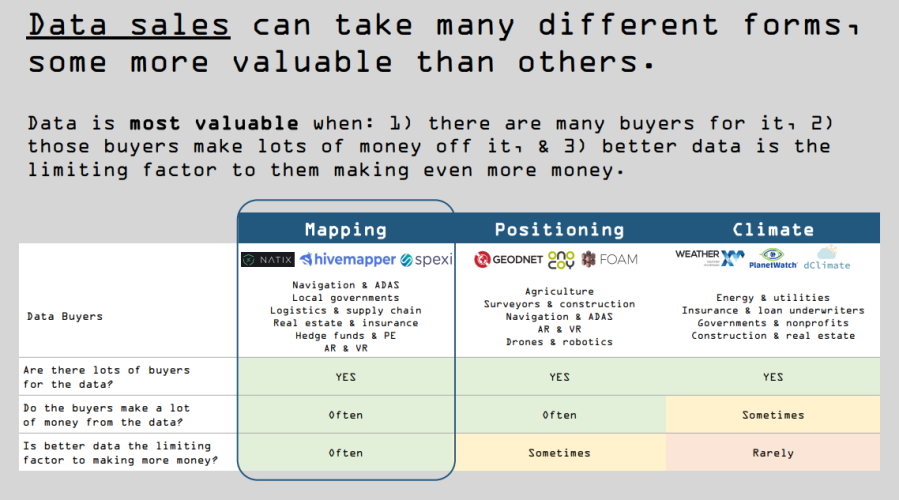

The authors decided to examine a new category not initially included in their list but gaining significant interest: Data sales. They point out the importance of data in a world that is becoming more digital.

That is why they are optimistic about DePIN initiatives such as Hivemapper, which motivates individuals to map their local surroundings, similar to Google Maps but without a central authority. They also highlight other specialized DePIN projects, such as one that monitors noise pollution in a community-driven manner.

This relates to another category detailed earlier: Services. According to their perspective, they classify services into two types: horizontal services, like decentralized marketplaces for freelance work, and vertical services, such as decentralized ride-sharing systems.

The conversation shifts to the emerging DePIN category of Vertical Ads, but surprisingly, they don't offer much insight into it. Notably, they fail to mention the Brave browser in this context. The situation is similar regarding energy-related DePIN initiatives, as they are also in the early stages of development.

DePIN Growth, Potential

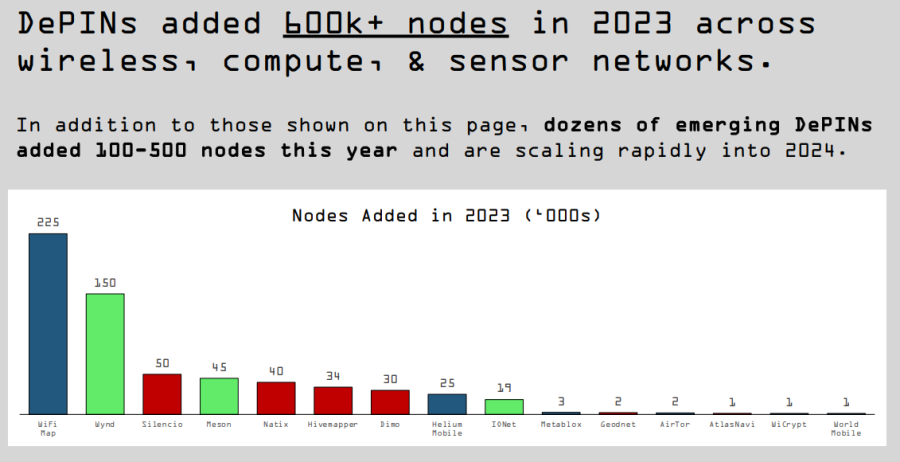

The report now shifts its attention to the supply side of the equation, specifically examining the remarkable growth and potential of DePIN nodes. The authors begin by presenting an interesting fact: The number of DePIN nodes continues to grow and has now surpassed 600,000. The graph below illustrates that the Wi-Fi map nodes are the most numerous, with more than 200,000 nodes being a part of the DePIN project.

Source: The Messari Report.pdf

The authors note a rapid increase in the quantity of DePIN nodes. This growth is attributed to DePIN initiatives addressing scalability challenges related to the expansion of physical infrastructure. Consequently, DePIN offerings are becoming more affordable and of higher quality. It is worth noting that the development of this physical infrastructure is being encouraged through the distribution of crypto incentives, particularly tokens awarded to individuals contributing to such infrastructure.

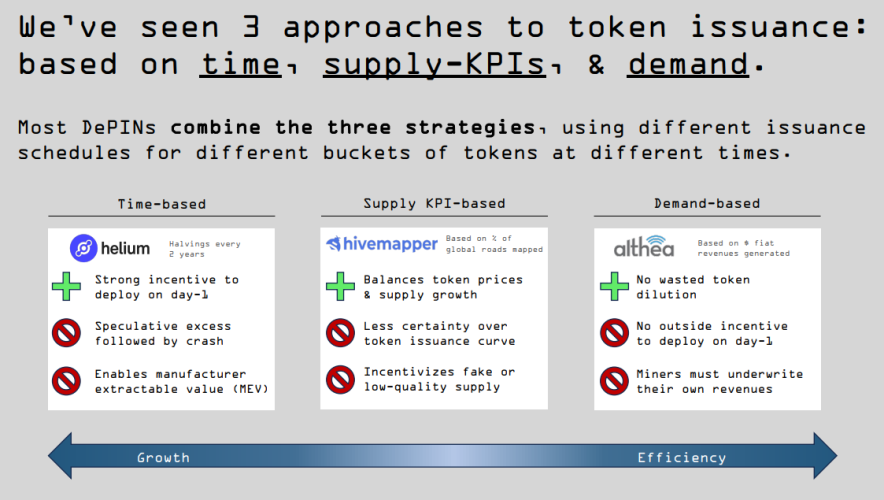

The tokenomics of these tokens are integral to the supply-side equation, and the authors recognize three distinct strategies. First, supply-based tokenomics encourages growth. Second, demand-based tokenomics promotes efficiency. Lastly, a combination of supply- and demand-based tokenomics strikes a balance between development and efficiency.

The advantages and disadvantages of the three methods are outlined in the image below. The authors also observe that certain strategies have been more effective for specific DePIN projects. For example, they note that projects that require a lot of hardware benefit the most from supply-based tokenomics, as it essentially rewards contributors with a large number of tokens. On the other hand, DePIN projects that are primarily software-based can expand by offering points that may eventually be converted into tokens.

Source: The Messari Report.pdf

In assessing the value of various DePIN projects, the authors recommend focusing on both the market cap and the fully diluted valuation. Their rationale is that DePIN projects often involve significant investments from venture capitalists, which can influence price movements.

Essentially, the authors suggest that the demand for specific DePIN offerings may be tempered by the influx of tokens from initial project backers. They imply that lower-quality DePIN projects may encounter challenges and predict that many early investors will opt to sell once their portfolios have appreciated five to tenfold.

Before making any investment decisions, it's crucial to thoroughly investigate cryptocurrencies, especially those in emerging sectors like DePIN. While some experts recommend investing in blockchains that support DePIN projects to mitigate risk, this approach may not yield returns as substantial as identifying and investing in promising DePIN projects early on, with their potential for 100x growth.

Source: The Messari Report.pdf

DePIN 2024 Forecast

The section of Messari's DePIN report that garnered the most excitement is the predictions for DePIN in 2024. According to the authors, the first theme you need to watch out for is the intersection of DePIN and AI, which is expected to play a crucial role in DePIN's development. DePIN AI has the potential to surpass centralized AI in terms of capabilities and effectiveness within the next one to two years.

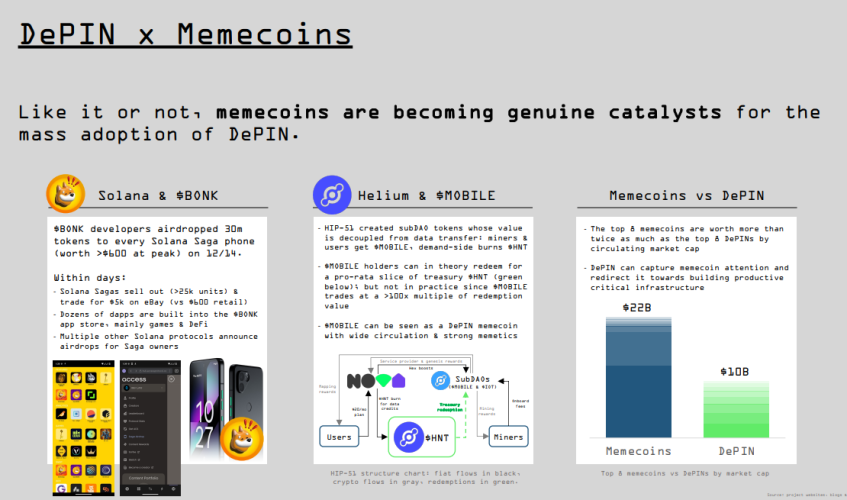

The second important topic is the intersection between DePIN and meme coins. While the idea may seem odd, the authors acknowledge this and use the Solana phone Bonk airdrop as an example to show how these two can be paired. This also hints at a future where physical infrastructure is encouraged through the use of meme coins.

The third important aspect to be mindful of is the intersection of DePIN with zero-knowledge technology. By leveraging advanced zero-knowledge technology, DePIN could carry out a form of cyber attack known as a vampire attack on Web 2, which involves taking control of users' content and activity.

The fourth theme to watch is similar to the third but focuses on the intersection between DePIN and gaming. Think of it as GameFi on steroids, where the cryptocurrency elements of gaming are integrated with cutting-edge gaming technology, such as VR headsets, to create a more immersive and interactive experience.

The fifth theme to be mindful of is the intersection between DePIN and privacy, with a particular focus on decentralized virtual private networks (VPNs) as a critical intersection area.

The authors highlight a curious trend in DePIN: The intersection between DePIN and Asia, referring to the continent, is expected to yield unexpected results. They foresee multiple top 10 DePIN projects emerging from this region, with most still in the nascent stages of development.

What It Means For Crypto

The DePIN report's findings have significant implications for the cryptocurrency market. In essence, they suggest that the most successful cryptocurrency narratives and niches during the current bull market will be those that are not financially focused. A previous article on crypto narratives supports this and is reinforced by the fact that some DePIN projects have already acknowledged this trend.

Several crypto initiatives acknowledge that applications related to finance will face increased scrutiny. In contrast, DePIN presents a significantly lower likelihood of antagonizing regulators, and its credibility is evident. The increasing presence of DePIN projects on global app stores and their partnerships with established companies and brands demonstrate that it operates within a safer realm, particularly in regulatory compliance.

Given its immense potential and the nascent stage of most DePIN projects, the DePIN niche is expected to be highly unpredictable from an investment standpoint. While some tokens may experience astronomical growth, others will likely plummet in value or become worthless. Despite the risks, the long-term outlook for DePIN indicates that it will have a lasting impact on the cryptocurrency landscape, contributing to increased adoption and mainstream acceptance.

Previously, the main factors driving cryptocurrency demand were primarily based on speculation. However, real-world adoption may occur with the rise of DePin and other non-financial sectors. This shift could make everyday individuals feel more at ease using and putting money into cryptocurrency, consequently boosting further adoption and investment. Advocates believe that the ultimate goal of cryptocurrency is to decentralize all aspects of life. If that is the desired outcome, we are on the right path.

The reaction of centralized equivalents to the decentralized alternatives of popular products and services is a topic of much speculation. Some anticipate a similar response to DeFi and other disruptors of the traditional financial system, characterized by intense regulatory opposition, mainstream media-fueled FUD, and attempts to suppress their growth. However, DePIN networks have an inherent advantage that will make them more resistant to suppression, as they are generally more decentralized than most cryptocurrencies. This resilience will demonstrate the staying power of crypto.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Tim Moseley

.png)