Entrepreneur Spotlight – Using Politics To Your Advantage

.jpg)

Reading The Signs

We are midway through 2022. Dependant on your viewpoint and reflections of the last two years, and now that lockdowns and related restrictions have been removed, you may be hoping that we have come through a ‘global pandemic’ and can now pick up the pieces of life with the intention of getting back to some sense of normality over time.

If you were one of those who thought this was all about the money, mass surveillance and control, nothing which unfolded would have surprised you. You may have been observing this within the context of the World Economic Forum’s long held desire to perform a great global reset.

There were so many things that troubled me, particularly how critical thinking and debate were suppressed. No longer were the populace encouraged to think with an open and critical mind. We were told what to think.

Dr Robert Malone and Dr Geert Van Bosche are two examples. Both are vaccine creators, not anti-vaxxers, yet they called for the immediate cessation of the experimental jabs pending further enquiry due to what their research uncovered. Significant suppression of the natural immune system was one of the findings.

They were ignored and vilified. This was a big indication of a nefarious agenda, because the nature of truth is that it always welcomes debate and enquiry. It does not hide.

Incompetence or Beyond?

So what is the political weather forecast looking like today? What have we learned from the last two years? Did the government act well in the interest of health? Was error, incompetence or corruption at play? Is the war really about one country against another or is it something else?

It is difficult to make the case for incompetence when the same patterns of behavior keep repeating. For example, the CDC has just confirmed that they did not take into account VAERS [Vaccine Adverse Events Reporting System] in their analysis!

As I write this article many papers and conversations have been declassified over in the USA, and the process continues. It seems that history is repeating itself in certain ways.

In 2019 a tabletop simulation exercise around the release of a respiratory virus resulted in the ‘CV-19 pandemic’. In March 2021 a tabletop simulation exercise revolved around the monkeypox, and now we have the alleged occurrence of the monkeypox virus. [see page 8]

At the same time the BBC got caught out again resurrecting old photos of monkeypox and overlaying them in the main news, as if they were current. They also did this for the Ukraine-Russia conflict.

Picture Source: BBC

That is the same BBC that was found guilty in court many years ago of misrepresenting certain facts, by reporting the collapse of the World Trade Center building 7, more than 20 minutes before it collapsed. Video evidence was produced by Tony Rooke. The video has been removed from YouTube.

CNN were caught on camera in an underground initiative by Project Veritas, acknowledging the deliberate exaggeration of covid case numbers as part of a fear and propaganda strategy to get more viewers, not to mention their paymasters.

They added that the next target for fear and propaganda would be climate change. Yet the government and media project disinformation onto those who question them. It was just another example underlying that the media are not into independent journalism.

There is a report out directing that all UK airports should shut within 10 years, and the rationale given is climate change with none other than Neil Ferguson’s name popping up again.

True to form, in the UK Easyjet is canceling around 10,000 flights across the summer, Gatwick are canceling flights, and we are in the middle of major train strikes countrywide.

Several countries have triggered more emergency measures, among them are Italy, Australia, Denmark, Germany, Netherlands. Ecuador has recently declared a state of emergency, as the indigenous people rise in protest.

I would suggest that the real war seems to be the Global Elite versus We The People, rather than one country versus another. I would further suggest that it goes deep to the heart and soul of sentient beings, the war to stop you thinking for yourself, living from the heart in service to mankind.

Its roots go back a long way, and that is an article for another day. For now, how do you as individuals and entrepreneurs proceed moving forward? Let’s explore this.

Picture Credit: charlesdeluvio-OWkXt1ikC5g-unsplash

The Opportunity

In a world where deception, destruction and coercion have become rife, I believe there is always opportunity in times of challenge and adversity, to turn things around for the benefit of mankind. In doing so it can turn what appears to be a very rough storm into a perfect storm.

I would invite you to view current reality as a mirror and use it to mirror or reflect back the opposite of all that is not good being played out. I share some examples from my experience of what that might look like. Add or edit it for your situation.

Replace Blame With Responsibility

It's so easy to get stuck in blame mode, and while it may feel justified, what is more important is to take responsibility in how you move forward with what you know. Focus on the solutions that you can be a part of.

Be A Force For Good | Innovate

Instead of recycling the destructive forces at play out there, reflect peace and honor for what you believe. Show love and care in the way you go about your business, so that social distance can be replaced with heart and soul connection.

Image source: https://startups.co.uk/strategy/essential-start-up-tips-for-young-entrepreneurs/

If ever there was a time to innovate or bring radical change, it is now, and it needs brave and present entrepreneurs to do so, in order to build on different values. There are some great examples of this already going on, which you can be a part of.

Markethive of course, is one such example, creating an ecosystem for the entrepreneur that is safe and honoring of free speech, while combining a social network with an inbound marketing platform for you to develop and hone your marketing skills in business.

One Small Town is another example of a global movement to put new structures in place that are based on values of sharing, kindness and compassion, designed to make these nefarious structures obsolete.

The opportunity is there to become part of the solution, rather than waiting to be rescued. If innovation feels like a bridge too far, bring it back home to something more simple. Evaluate yourself and your business to see where you can reflect the changes you wish to see in the world.

Be Honest and Transparent

Where have you given your power away and compromised against your better judgment? Have you buried your head in the sand out of fear? Are there mistakes which need correcting?

Be willing to look with honesty at yourself and acknowledge where you may have fallen short of your own standards in business, and resolve to raise your game. Forgive yourself and resolve to be a better version of yourself.

Rebuild Trust

Trust toward government and businesses across were already hitting new lows before 2020 as indicated by the Edelman Trust Barometer Report in 2017. I wonder what the results would be today.

The advent of the blockchain will help to restore trust and transparency but on its own it is not enough. Learn to build trust again, not just in your abilities and expertise, but also in all your professional relationships, including how you conduct yourself in the process of business.

Look after Your Health

Health has been shoved in our faces in a ‘one size fits all’ manner. If your health is vulnerable right now, down tools and take the time to nurture it and strengthen your natural immune system. It does not have to cost money.

Learn to breathe slowly and deeply to oxygenate your system. Walk and be with nature, expose yourself to some natural vitamin D. Keep yourself well hydrated. Dehydration is a common cause of fatigue.

Health is more than just the physical stuff. Learn to take inventory of your mind and emotions. Take time to feed your mind so it can support your health. I recently read Emile Coue’s book ‘Self Mastery Through Conscious Autosuggestion’.

It is a simple and powerful read, especially when you apply it. Affirm that which you wish to be true but learn to embody those positive affirmations in practice for them to take root and shape your life.

Evaluate Your Business

Be willing to take a step back and evaluate where you are in life and business, especially if you suffered losses in business. What have you achieved that you can be grateful for in spite of your losses?

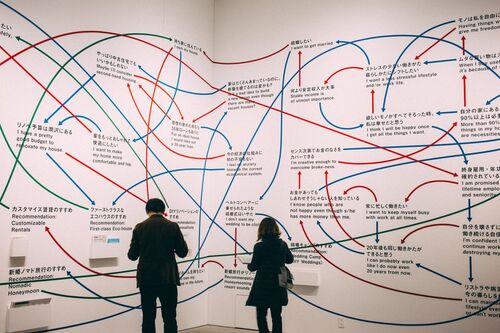

If you need a structure for evaluation there are tools like a PESTLE. This looks at the Political, Economic, Social, Technological, Legal and Financial factors which influence business.

Put one foot in front of the other with your action plan. It's better to do a few things well than a lot of things superficially. Restore depth of thinking and quality to become more accomplished.

Informed Consent

Replace coercion with empowerment through informed consent. Where your products and services are concerned make sure you walk your prospects through the plus and minuses of what you have to offer.

Allow yourselves and others their freedom of thought and expression. Let others know they can speak freely in your presence without fear. Then they can make an informed decision, and determine if it is ‘the glove that fits the hand’ rather than to be subjected to an aggressive marketing campaign with no substance, with forced solutions thrust upon them.

Show Courage and Develop Inner Strength

Do not give into fear. Believe in your gifts and abilities, and dare to keep expressing them, no matter what. There is nothing to be gained by living below the level of what you are capable of. Mankind needs to be raised up by your gifts and abilities, not kept down.

These are some of the many things I have been cultivating further in response to what is going on in the world. It doesn’t necessarily need 7 billion people to bring about a massive change. It starts with you.

Even if a small percentage focuses on the change outlined above, we can restore our planet from a warring planet to a more peaceful and prosperous one. Instead of cowering in the face of global adversity we can use what we see to mirror the opposite and allow it to cause us to rise. It is time for the rise of the entrepreneur.

If not you, who? If not now, when?

That is a narrative which we can create and a script that we can write.

About:

Anita Narayan. (United Kingdom) My life's work is about helping individuals to greater freedom through joy and purpose without self-sabotage, so that inspirational legacy can serve generations to come. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.jpg)

.gif) Will gold survive another 75 basis point hike

Will gold survive another 75 basis point hike