Silvergate Capital, Silicon Valley Bank, & Signature Bank Have All Collapsed. More To Come?

The recent scandals of Signature Bank, SVB, and Silvergate Bank have made headlines and left the industry reeling. However, the ramifications of these financial institutions' missteps for the crypto sector are yet to be entirely clear. To understand the impact, one must first look at the fundamental principles of blockchain technology and how it has upended traditional banking models.

The failure of these Banks in the United States means that many are questioning the sustainability of the cryptocurrency sector. The companies in question have all gone bankrupt, but this isn't the first time a major company has failed in the crypto sector. For example, the collapse of Mt. Gox and its affiliates in 2014 has cast a shadow on the industry, but this is not the only failure incident in this sector.

New York state financial regulators closed Signature Bank in what is believed to be the result of the Silicon Valley bank failure, as nervous depositors pulled funds out of Signature Bank. The bank's stock began to fall. The collapse of Silicon Valley Bank is expected to put pressure on several other small and regional banks in the United States.

In less than seven days, the largest bank for tech companies and two banks most accommodating to the cryptocurrency industry collapsed. The sad incidents generated uncertainty in the stablecoin market, despite cryptocurrency values rising Sunday night as the federal government intervened to offer depositors a safety net.

Silvergate Capital announced that it would be closing down and liquidating its bank. Major startup lender, Silicon Valley Bank, failed after its customers withdrew more than $42 billion in response to the bank's disclosure that it needed to borrow $2.25 billion to strengthen its balance sheet. Banking officials seized Signature on Sunday night; it had a significant crypto emphasis but was far bigger than Silvergate.

Approximately half of all venture-backed startups in the United States had cash on hand at Silicon Valley Bank, various firms that deal in digital assets, and venture capital funds that support cryptocurrencies. For bitcoin businesses, the two leading banks were Signature and Silvergate. The federal government stepped in to guarantee every deposit SVB and Signature depositors made. This action increased confidence and caused the price of bitcoins to increase briefly.

Nic Carter of Castle Island Ventures argues that the government is once again pursuing a loose monetary policy rather than one tightening since it is willing to support both banks. Historically, this has benefited speculative asset classes like cryptocurrency. However, the instability once more highlighted the frailty of stablecoins, a part of the bitcoin ecosystem that investors can often rely on to maintain a particular price. Stablecoins are intended to be tied to the value of a physical good, such as a fiat currency like the U.S. dollar or a commodity like gold. Yet, good financial conditions may prevent them from falling below their pegged value.

Image Source: Coindesk

Not Entirely Stablecoin

With TerraUSD's demise in May of last year, many of crypto's issues over the previous year have roots in the stablecoin industry. Meanwhile, during the last several weeks, regulators have focused on stablecoins. After much pressure from New York regulators and the SEC on its issuer, Paxos, Binance's dollar-pegged stablecoin, BUSD, saw significant withdrawals.

USDC lost its peg over the weekend and fell as low as 87 cents after its issuer, Circle, acknowledged having the sum of $3.3 billion banked with SVB. As a result, the sector's trust suffered once more. Circle has established itself as one of the best in the ecosystem of digital assets because of its links to and support from the conventional banking industry. It has long intended to go public and secured $850 million from investors like BlackRock and Fidelity.

Another popular dollar-pegged virtual currency, DAI, partially supported by USDC, dropped as low as 90 cents. For these reasons, USDC to dollars conversions has been temporally halted on Coinbase and Binance. Tether, the biggest stablecoin in the world with a market valuation of more than $72 billion, has seen many conversions from DAI and USDC in the past few days. The issuing company had no exposure to SVB. However, there have been concerns about tether's operations and the state of its reserves.

Circle published a post stating that it would "fill any gap utilizing company resources," this enabled the stablecoin market to recover. Since then, the USDC and DAI have turned back toward the dollar.

Reasons Behind The Ruins of Crypto-Friendly Banks

Silvergate Capital, a holding company for a bank that had made significant bets on serving the burgeoning crypto economy since 2016, announced that it would cease operating as a bank. State authorities ordered the closure of Silicon Valley Bank (SVB), which had long performed a similar function by handling funds for businesses with venture capital funding.

In broad strokes, the same problem classic bank runs brought down both banks. Whether they are crypto exchanges or software firms, their former clients deal with significant commercial difficulties, partly due to the current financial and economic climate. As a result, deposits have decreased, and cash withdrawals have increased at a time when many of the banks' long-dated non-cash holdings have also been negatively impacted by the markets.

Hence, Silvergate and Silicon Valley Bank were forced to sell those underlying assets at significant losses when cash demands reached a certain level. In the fourth quarter of last year, Silicon Valley Bank, which had a bigger total balance sheet, and Silvergate reported losses on the sale of assets of $1 billion and $1.8 billion, respectively. Importantly, a substantial amount of the losses in both situations were attributable to the liquidations of U.S. Treasury bonds.

This serves as a valuable counterpoint to the careless mischaracterization of FTX's collapse as a "bank run" by several prominent media outlets back in November. There are a few similarities between what occurred at FTX and the liquidity difficulties that impacted Silvergate and SVB. These challenges have two upstream causes: the business cycle and the Federal Reserve's tightening interest rates. These elements are connected and fundamentally refer to disturbances brought on by COVID.

Image source: cryptoofficiel.com

The initial pressure that destroyed Silvergate and SVB resulted from Fed rate rises. It was clear that the increasing Treasury rates would discourage new investment in high-risk industries like tech and cryptocurrency. But another, mostly disregarded danger to the health of banks is the rise in interest rates. As the Wall Street Journal notes in uplifting clear language, issuing new Treasury bonds with greater yields has decreased the market value of pre-hike Treasuries with lower yields.

Most banks are legally required to keep significant quantities of Treasury securities as collateral, so they are susceptible to the same risk that affected Silicon Valley Bank and Silvergate. That's one of the reasons why bank stocks, especially those of regional or mid-sized banks, are falling.

Yet, Silvergate and Silicon Valley Bank had unique business cycle problems that might only apply to a select audience. Both catered to markets that witnessed enormous runups in the early phases of the COVID-19 pandemic, namely the crypto and venture-funded tech industries. The COVID lockdowns benefitted both industries, but cryptocurrency specifically profited from the pandemic relief funds distributed to Americans.

So, through 2020 and 2021, both banks had significant inflows. The balance sheet of Silicon Valley Bank quadrupled between December 2019 and March 2021. In 2021, Silvergate's assets also rose significantly. When interest rates on those bonds were still at or near 1%, both banks would have purchased more of them as collateral to support that deposit growth. Because of Fed rate increases, rates on new bonds are now closer to 4%, which reduces demand for older bonds. That's why Silvergate and SVB were forced to sell liquid assets at a loss when clients in booming or turning industries began withdrawing their deposits.

We're still in Covid Economy

If you focus only on one aspect of the situation, you can cherry-pick explanations to blame this disaster on whoever suits your prejudices. But the reality is that everyone is trying to escape the same COVID-caused disaster in the same leaky lifeboat, battling over who gets eaten first.

Some people may criticize the Fed for raising interest rates, especially the crypto traders, yet doing so is required to control inflation.

The inflation, in turn, was brought on by COVID-19-related actual cost increases and a materially increased money supply due to COVID relief and bailout actions. An anti-Fed criticism at this time is, at best, reductive since it will take years to fully assess the total cost and value of such initiatives.

On the other hand, it will be alluring for many in the mainstream to attribute the impending banking crisis to the cryptocurrency industry as a whole. The fact that Silvergate, ‘the crypto bank,’ failed first is the strongest argument in favor of this assertion. You could hear it described as “the first domino to fall" or other such nonsense in the coming weeks, but that isn't how things stand.

Due to its involvement in a sector-wide degenerate long bet on cryptocurrencies that was well in advance of real acceptance and a sustainable source of income, Silvergate was more vulnerable. Yet that wasn't what started its liquidity issue, and its decline won't significantly contribute to any further bank failures in the future.

Instead, all American banks are subject to many of the same structural forces, regardless of whether they are financing server farms or the physical corn and pea version. A deadly virus that has killed more than six million people is the core cause of their severe economic upheaval. If there is one thing to learn right now, adjusting financial levers won't completely eliminate that type of instability in the present chaotic world.

About:

Prince Chinwendu. (

Nigeria) Rapid and sustainable human growth is my passion, and getting a life-changing opportunity into the hands of people is my calling. Empowering entrepreneurs provides me with enormous gratification. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

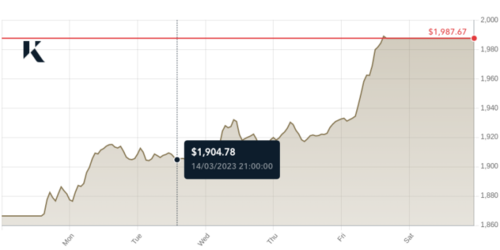

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

.gif) Once $2,000 breaks, gold is off to the races – Willem Middelkoop

Once $2,000 breaks, gold is off to the races – Willem Middelkoop

.png)

.png)