Gold, silver gain on bargain hunting, bullish outside mkts

Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day's top stories directly to your inbox. Sign up here!

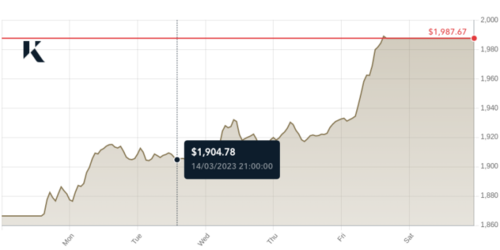

(Kitco News) – Gold and silver prices are up in midday U.S. trading Tuesday on some perceived bargain hunting, and amid a lower U.S. dollar index and higher crude oil prices on this day. April gold was last up $15.00 at $1,968.70 and May silver was up $0.21 at $23.355.

The key outside markets today see the U.S. dollar index lower and continuing to trend lower on the daily bar chart. Nymex crude oil futures prices are up and trading around $73.50 a barrel. Oil prices have made a good rebound from the March low and bulls are working on a price uptrend on the daily bar chart. Meantime, the benchmark 10-year U.S. Treasury note yield is presently fetching 3.558%.

Global stock markets were mixed overnight. U.S. stock indexes are mixed at midday. The U.S. and European banking crisis appears to have stabilized, at least for now. That’s allowing risk appetite to creep back into the marketplace. Continued easing worries about the banking crisis, and a continued uptick in risk appetite, would very likely cap gains in gold and silver prices for the near term.

Fed's 'Emergency rate cut' by June to precede 'controlled implosion' of banking sector, only 6 banks left as CBDCs rolled out by 2025 – Edward Dowd

Fed's 'Emergency rate cut' by June to precede 'controlled implosion' of banking sector, only 6 banks left as CBDCs rolled out by 2025 – Edward Dowd

It’s a busy week for U.S. economic data, but the highlight is Friday’s personal consumption and expenditures (PCE) data that will provide fresh clues on inflation and whether the U.S. economy is headed toward recession. It’s been said the PCE data is a favorite gauge of inflation for the Federal Reserve.

Technically, April gold futures bulls have the solid overall near-term technical advantage. Prices are still in an uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at the March high of $2,014.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at this week’s high of $1,984.00 and then at $2,000.00. First support is seen at this week’s low of $1,945.00 and then at last week’s low of $1,936.50. Wyckoff's Market Rating: 7.5

]

]

May silver futures bulls have the firm overall near-term technical advantage. Prices are in a steep uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.00. The next downside price objective for the bears is closing prices below solid support at $22.00. First resistance is seen at this week’s high of $23.485 and then at last week’s high of $23.705. Next support is seen at today’s low of $22.96 and then at $22.50. Wyckoff's Market Rating: 7.0.

May N.Y. copper closed up 105 points at 408.90 cents today. Prices closed near mid-range today. The copper bulls have the overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the January high of 435.90 cents. The next downside price objective for the bears is closing prices below solid technical support at the March low of 382.20 cents. First resistance is seen at last week’s high of 414.85 cents and then at the March high of 417.85 cents. First support is seen at this week’s low of 402.35 cents and then at 400.00 cents. Wyckoff's Market Rating: 6.0.

By

Jim Wyckoff

For Kitco News

Tim Moseley

.jpg) Gold bulls are in the driver's seat; market sentiment looking for prices to hold around $2,000

Gold bulls are in the driver's seat; market sentiment looking for prices to hold around $2,000

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

Consumers cash in on unwanted gold as its price soars amid a spreading bank crisis

.gif) Once $2,000 breaks, gold is off to the races – Willem Middelkoop

Once $2,000 breaks, gold is off to the races – Willem Middelkoop

.png)

.png)