Analysts doubt gold’s strength next week, retail traders don’t stop believing

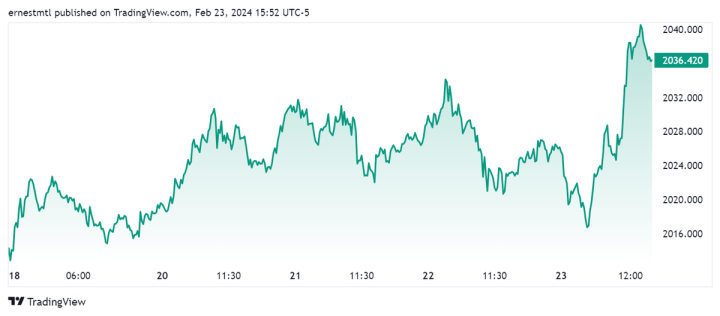

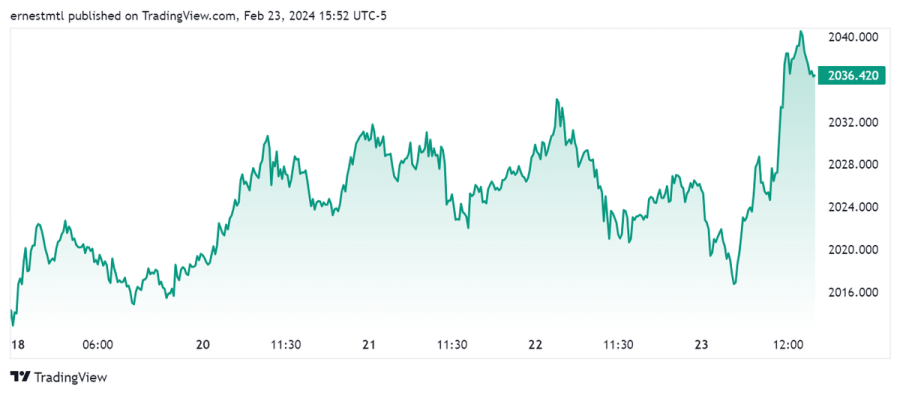

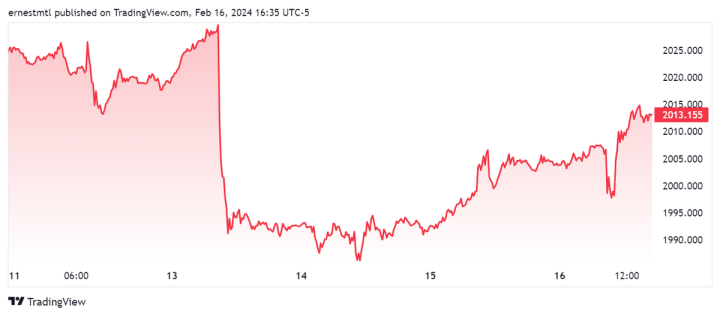

As expected, the gold market got its direction from inflation data this week, with the only major move being the sharp price decline on Tuesday morning following hotter-than-expected CPI data for January, which drove spot gold from just under $2,030 per ounce in the minutes before the 8:30 am EST release all the way to $1,991 an hour and a half later.

After that, prices largely traded within a narrow $12 channel on both sides of the $2,000 level until Friday morning’s PPI release caused another smaller selloff. This was followed by a sharp if shallow rebound, after which prices climbed steadily into the President’s Day long weekend.

(1).png)

The latest Kitco News Weekly Gold Survey showed Wall Street and Main Street diverging once again in their price expectations, with a large proportion of retail investors seeing potential gains next week, while analysts see a strong case for precious metal prices to slide.

“April gold posted a bearish breakout of its previous short-term sideways trend this week, extending its intermediate-term downtrend to a low of $1,996.40 (so far),” said Darin Newsom, Senior Market Analyst at Barchart.com. “At the same time, the long-term uptrend of the US dollar index is gaining momentum. The next downside target for April gold is $1,970.50.”

Adam Button, head of currency strategy at Forexlive.com, sees lower gold prices next week. “I think there are seasonal adjustment problems with the latest CPI and PPI numbers, but it could be months before that’s clear to the market,” he said. “For now, it’s tough to fight the tide of rising Treasury yields and a higher US dollar.”

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he expects gold prices to rally after a possible correction.

“The question is at what point will the gold suppression stop to help implement physical acquisition,” he said. “First big support range is in the mid-1900s and with risk clear down to the mid-1700s. Our cyclical model in our VR Forecast Report opens up both possibilities before we surge as high as 2700.”

Leibovit pointed out that the U.S. still faces significant economic and political risks at home. “Will the U.S. default on its debt? Is the banking crisis just on hold due to the upcoming Presidential election? The overall stock market has a 'crash' risk between now and mid-year which has to be factored in,” he said. “Next week gold looks higher.”

Adrian Day, President of Adrian Day Asset Management, sees gold continuing in its sideways price channel next week. “Gold will react up and down to the various economic reports that come in, until it is clear that the Federal reserve is going to cut rates,” he said. “We are not yet at that point.”

James Stanley, senior market strategist at Forex.com, remains bullish on gold’s near-term prospects.

“Dollar bulls had an open lane to run this week, but the comment from Goolsbee on Wednesday about not getting ‘flipped out’ over an inflation print turned that around quickly,” he said. “I think we’ll see the Fed continue to lean dovish and that’s a positive for gold.”

Stanley said spot gold’s test below $2,000 this week was telling, because it couldn’t hold below for very long. “I think we’ll see bulls try to run it back towards 2039 next week,” he said.

Sean Lusk, co-director of commercial hedging at Walsh Trading, was trying to decipher the significance of the gold market’s price movements on Friday.

“The dollar's backed off here, so the metal's got to jump, but this might be one last push per the seasonals on the metals,” he said. “They usually die around Valentine's Day, you're in the Presidents Day weekend and then it backs off. We've had some technical damage done there. Silver's carving out a nice little bottom here, $23.20 on the low.”

Lusk said part of gold’s subsequent move higher was probably driven by traders wanting to be long gold over the long weekend, given the conflicts and other geopolitical risks at play.

“We dipped below $2,000 in gold, and boy it didn’t stay there for long, did it?” he said. “But the CPI number did that in, and I think the market is slowly starting to realize that things are becoming more inflationary, given the recent data. You had retail sales moving lower yesterday, a poor number there. You had one big down day in the stock market, and then they just bring it back up.”

“It just doesn't make any sense,” Lusk said. “The interest that we're going to have to pay on our debt is just going to be so massive moving forward here, and the trade does not care. Seven or eight stocks are driving this thing higher. That's primarily the reason why you're getting the reaction in the stock market that you are, because of earnings results that didn't disappoint.”

“But underneath, you’ve got geopolitical [issues], you have shipping routes shut down,” he warned. “What are they going to do about Russia? Is this war going to expand? Is it going to get nastier? Hezbollah's coming out and saying they're not going to stop attacking Israel. So you're going into a long weekend and saying ‘okay, if the market doesn't break on bearish news, which is positive dollar, it's inherently bullish,’ and that's pretty much the reaction. But, again, the reaction's limp.”

Lusk is now looking at the mid-November low of $1,975 on the April contract. “About a month prior to that they took it up on a spike to $2,171,” he noted. “Dips continue to be bought and support levels are holding here. We haven't turned over this market.”

Lusk said that one thing the recent data has achieved is to eliminate “all this nonsense about rate cuts” and markets are slowly starting to come to grips with this, even though the stock market doesn't seem to care, as evidenced by its recent all-time highs.

“But what would send ripples through the stock market would be if they had to raise rates to combat inflation,” he said. “If these numbers, CPI, PPI next month continue to surge, because we got a little uptick in energy prices and some other things, we could see this thing push higher.”

But Lusk predominantly sees downside risks for gold since the last employment report was released.

“We broke gold over $80 here,” he said. “It could go a lot further next week. If they take this rally and dunk it, it would go to 5% down from here, which is about $1,968. We're going to blow through those early November lows and retest that area.”

“If this thing really gets hammered… we closed last year at $2,071. They'll punch this sucker 10% down, a $200 break in the market from that level.”

Lusk said that amid all the uncertainties, he’s bullish over the weekend at least. “But you’ve got to watch out for that seasonal, because the second half of February through March into tax season is usually met with more sellers than buyers, and the path of least resistance is lower.”

“We need some follow through here,” he said about gold’s modest Friday gains. “If not, I wouldn't be surprised if next week, all things being equal, we take out $2,000 and start moving lower.”

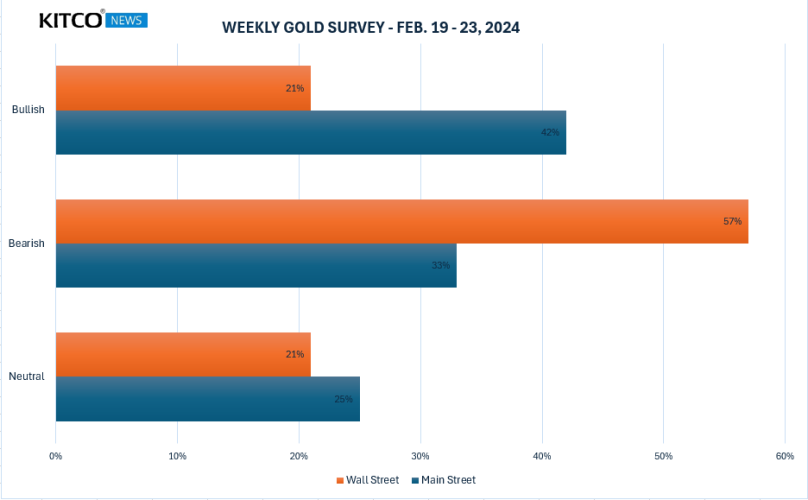

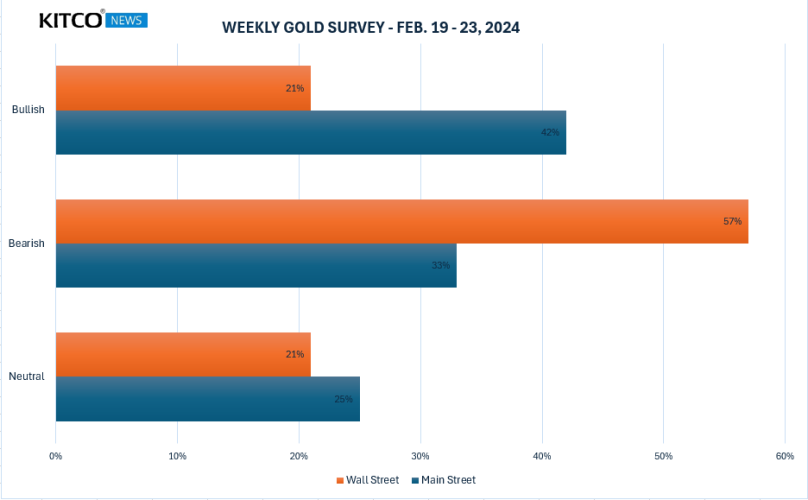

This week, 14 analysts participated in the Kitco News Gold Survey, and Wall Street seems to see very little upside potential for gold in the near term. Only three experts, or 21%, expected to see higher gold prices next week, while the clear majority of 8 analysts, representing 57%, predicted a price drop, and another three experts, or 21%, expected gold prices to trade sideways during the coming week.

Meanwhile, 221 votes were cast in Kitco’s online polls, with a plurality of Main Street still maintaining a bullish attitude. 94 retail investors, representing 42%, looked for gold to rise next week. Another 72, or 33%, predicted it would be lower, while 55 respondents, or 25%, were neutral on the near-term prospects for the precious metal.

Aside from weekly jobless claims and a smattering of Fed speakers, next week promises to be a quiet one on the data front, with Wednesday’s release of the FOMC meeting minutes the only significant event on the docket.

Everett Millman, Chief Market Analyst at Gainesville Coins, was also looking at the bounce gold got in the late morning on Friday.

“Part of it could just be the market realizing that it had overreacted to the downside,” he said. “It could be a little bit of mean regression. But I have to admit that I expected that move to be confirmed.”

“Both the hotter than expected PPI and the CPI we got recently, those all play into the narrative that the U. S. economy is a bit more robust than expected,” he said. “That's really gold-negative given that I think a lot of what's priced into the higher gold price is this expectation for some sort of nearing economic crisis or at minimum, a recession or economic downturn, so any positive economic data contradicts that.”

“Then at the same time, if PPI and CPI are higher than expected, that is going to play into the higher-for-longer expectation, and if rates are higher, that means real rates will remain higher, bond yields will go up,” he added. “All of that does work against gold.”

Millman said that with U.S. markets closed for the President’s Day holiday on Monday while China’s markets reopen again after the Lunar New Year holiday, traders may be positioning themselves for a higher move in the short term.

“China will be trading for basically a whole session before US markets reopen on Tuesday,” he said. “Maybe the thinking behind this move is they don't want to get caught on the wrong side of it.”

Turning to next week’s economic news, Millman said that with the FOMC minutes the only significant release, he believes gold prices are more likely to decline than to rally.

“I'm leaning towards downside risk,” he said. “I think that we got a pretty clear picture after the meeting and after Powell's comments that the Fed is definitely sticking to higher-for-longer for now. March was taken off the table for a rate cut. And the minutes are really the only data point other than Fed members speaking to the public. I think there's downside risk to the FOMC minutes, given that they could reveal or reinforce that more hawkish tone that the Fed seems to be taking right now.”

Millman said this week’s CPI and PPI data only reinforce that expectation for him. “Obviously that data came out afterward,” he said. “But I wouldn't be surprised if the Fed had some early indicators or some of their own data that showed that indeed, inflation is potentially bouncing back higher. Powell's comments lead me to believe that, if only because he was so reluctant to declare victory, or to say much about inflation coming down, although it has quite a bit.”

He said what he’ll really be looking for are any references to banking and a possible credit crunch.

“I’ll be interested to see if there was any mention in the minutes about the health of the banking sector,” Millman said. “We saw that was a big driver for gold last year around this time, when we started hearing about bank failures. Conspicuously, in the FOMC statement they removed any language about, ‘the banking system is resilient, blah, blah, blah’ that had stayed in there for nearly a year.”

“I think that may be a telling aspect of this,” he said. “Does the Fed have that on its radar? Are they worried about the banking system or on the other hand, are they trying to reassure markets about the strength of the U.S. banking system? I think that would be the main thing to watch. And in the absence of that, I feel like it can only be potential downside risk for gold.”

Ole Hansen, head of commodity strategy at Saxo Bank, will be watching Chinese buyers as they return from a week off after welcoming the Year of the Dragon. “Gold will likely struggle in the short term but as the rate cut expectations are being dialed back, but overall I look forward to see how Chinese investors respond to slightly lower prices next week,” he said.

“I like gold lower,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “US inflation–CPI and PPI–were a bit stronger than expected. This helped lift the dollar and US rates. To me, the dollar and rates are more important a driver of gold than its function as an inflation hedge.”

Chandler pointed out that markets learned this week that the Japanese and UK economies contracted for the second consecutive quarter in Q4 23. “While US retail sales and industrial output contracted in January, the momentum of the economy suggests something still above trend,” he said. “Data due in the coming days are unlikely to undermine the new divergence. That said, I do look for the dollar to top soon…DXY is up for the 6th of the past seven weeks this year. And the week it was down, it fell by about 0.1%.”

“I like the $1950-65 area,” Chandler said.

And Kitco Senior Analyst Jim Wyckoff sees gold prices skewing lower next week. “Steady-lower, as near-term price trend is down,” he said.

Spot gold last traded at $2,013.18 at the time of writing, up 0.44% on the day but down 0.55% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.png)

(1).png)