|

Tim Moseley

|

Tim Moseley

Extreme dollar weakness today overcomes sel

ling pressure in gold:

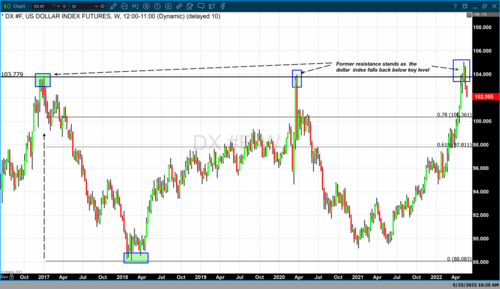

103.80 was and continues to remain an important price level of technical resistance for the U.S. dollar index. The dollar index has flirted with this price point on three occasions, first occurring at the end of 2016 and then again during the first quarter of 2017.

According to Investopedia, the U.S. dollar index (USDX) measures the value of the U.S. dollar relative to a basket of foreign currencies. The USDX was established by the Federal Reserve in 1973 after the dissolution of the Bretton Woods agreement. The index measures dollar strength or weakness against six primary currencies and was updated in 1999.

The chart above is a weekly Japanese candlestick chart of the dollar index. It begins at the end of 2016, with the dollar rising to a high just shy of 103.80. This is the first occurrence of dollar strength resulting in the index trading over 100 since the end of 2002.

This can be seen in a monthly Japanese candlestick chart of the dollar index below (chart 2). What followed after the dollar surged past 100 at the end of 2016 was a dramatic decline in value from 103.779 to a low of 88.08 during the first quarter of 2018. This represents a price decline of 16% during that year. From 2018 to the first quarter of 2020, the dollar index increased in value until it reached approximately 104, the second occurrence of the index reaching this level and then declining significantly immediately thereafter.

At the beginning of 2021, the dollar had fallen to approximately 89 before finding technical support and resuming a multi-year climb to a higher value. Dollar strength continued and breached this significant technical level 2 weeks ago. The dollar index traded to just above 105 during the week beginning May 9. However, last week the dollar index opened at approximately 104.70 and closed at approximately 103.20. Today the dollar index continued to spiral to lower pricing losing 1.04%. As of 4:55 PM EDT, the dollar index is currently fixed at 102.105.

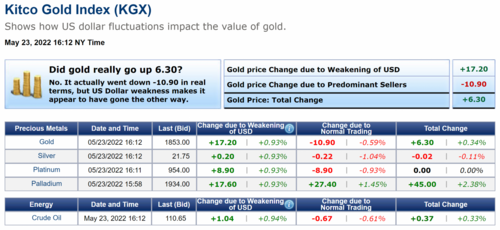

The decline in the U.S. dollar over the last two weeks has given gold significant tailwinds moving the precious yellow metal higher. Gold futures basis the most active June 2022 contract is currently up $9.90 or 0.54% and fixed at $1852. Gains in gold value today were 100% the result of dollar weakness in conjunction with selling pressure from market participants. The screenprint of the Kitco Gold Index above was taken at 4:12 PM EDT and shows spot gold fixed at $1853, a net gain of $6.30. On closer inspection, dollar weakness contributed $17.20 in gains while selling pressure resulted in a decline of $10.90.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

Tim Moseley

by Joakim Book

Warren Buffet’s most recent critique about Bitcoin is its lack of “producing” anything, which actually proves its monetary properties and usefulness as money.

Before I exited academia, I trained as a financial historian. I looked at balance sheets in dusty, old archives and I investigated what banks were doing in Victorian Britain; I ran fancy statistical analyses on 19th-century stock prices to see if they behaved like modern portfolio analysis suggests stock prices should; and I looked at how money operated and how monetary regimes changed over time.

In all my reading, nothing annoyed me more than established economists with equation-filled whiteboards and paper models arrogantly declaring that some feature of money and banking was defective. With zero knowledge of the past, academics often stood up from their endowed university chairs and proclaimed that money could not be private, financial markets would disintegrate without regulators, and banks could not operate without governments backstopping them.

Strange, I thought, looking at the historical documents in front of me. They clearly used to …?

Buffett’s Monetary Misadventures

When you say things that are directly contradicted by reality, historical or present, you should probably just stop doing that. But when you’re 91 years old, the fifth(-ish) richest person on the planet and carry a reputation as the greatest investor of all times, different rules apply. With cameras pointed at you and hungry newspaper fanboys praising your every word, you can get away with nonsense that otherwise wouldn’t fly.

Take Warren Buffett’s latest musings on bitcoin, from his company Berkshire Hathaway’s latest annual meeting on May 1, 2022:

“If the people in this room owned all the farmland in the United States and you offered me a 1% interest in it […] and said ‘pay us a bargain price of $25 billion dollars,’ I’ll write you a check this afternoon.

“If you tell me you own 1% of the apartment houses in the United States, and you offer me… uh… so I would have a 1% interest in all the apartment houses in the country, and you want, whatever it may be — another $25 billion or something, I’ll write you a check. It’s very simple.

“Now, if you told me that you owned all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it, because what would I do with it? I have to sell it back to you one way or another! Maybe they’re the same people [who sold it to him], but it isn’t going to do anything.”

This particular accusation is old and Buffett himself has repeatedly levied it against gold: the yellow metal can’t be valuable and must be a poor investment since it doesn’t produce any yield, return or interest — “It doesn’t do anything but sit there and look at you.” For bitcoin, being an improved version of gold, we can understand that this busy nonagenarian simply recycled his gold rant. Buffett continues:

“The apartments are going to produce rental [income] and the farms are going to produce food […] and that explains the difference between ‘productive assets’ and something that depends on the next guy paying more than the last guy got.”

Bitcoin is all a scam, a circus, according to Buffett: “There’s no more money in the room, it’s just changed hands — with a lot of maybe fraud and costs involved […] Basically: assets, to be of value, they have to deliver something to somebody.”

Let’s unpack this.

What Holds For Bitcoin, Holds For Other Monies Too

It is amusing how opponents of bitcoin levy arguments against it that apply equally well to all other monies: You’re not persuasively attacking or denouncing bitcoin by stating that it has features of other well-functioning money; or refer to practices in bitcoin that regularly occur also in the currency at the top rung of the monetary ladder.

It is too expensive to transact with bitcoin!

Yes, for the times when block space has been congested and network fees high — but even then, properly considering bitcoin as a first-layer settlement media rather than a censorable third-layer fiat digital entry, it’s probably cheaper than the legacy system (Bitcoin is comparable to Fedwire, not Visa). With financial hedging and price-level uncertainty, the resource-cost debate of fiat versus hard money has clearly come out against the fiat dollar.

Bitcoin is used by criminals and money-launderers!

Yes, to a surprisingly small extent — but more importantly: so is the dollar. The features that make a money good for us well-behaved and law-abiding citizens also make it a good money for criminals. Criminals want anonymity, transaction privacy and reliable settlement just like the rest of us — and they want to tap into the most accessible and liquid monetary network that provides those things. All monies are for enemies.

Bitcoin wallets can be hacked and funds lost!

Yes, and so can bank accounts and credit cards in the fiat world — or plain old cash if you physically lose it, or if you’re mugged on the street, or suffer the flash kidnappings that Brazil’s new fiat fast-payment system enabled. Not to mention the perfectly legal extortions that fiat banks routinely engage in: insanely slow payment mechanisms, blocked transactions, overdraft charges and below-inflation interest rates. (Source)Bitcoin Doesn’t Produce Anything

“The gold and silver money which circulates in any country, and by means of which the produce of its land and labor is annually circulated and distributed to the proper consumers, is, in the same manner as the ready money of the dealer, all dead stock. It is a very valuable part of the capital of the country, which produces nothing to the country.” – Adam Smith, (1776)

Buffett’s main concern with bitcoin (and gold) is that owning some doesn’t “produce” anything. To be of value, assets have to “deliver something to somebody” in his view.

If we had a look at Buffett’s fiat wallet, would we not find cotton-and-linen bills with U.S. presidents on them? If we peeked into his bank account, would there not be fiat digital entries sitting there, not “producing” anything? Bitcoin is a way of holding money that isn’t an investment — it’s a refusal to finance commercial banks’ assets or the Federal Reserve’s seigniorage-yielding assets, both of which emerge when individuals hold their notes or deposit funds with them. Even while doing nothing, producing nothing, the institution of money is crucial to any society more complex than a self-sufficient household. Wrote Ludwig von Mises

“Money, in fact, is indispensable in our economic order. But as an economic good it is not a physical component of the social distributive apparatus in the way that account books, prisons or firearms are. No part of the total result of production is dependent on the collaboration of money, even though the use of money may be one of the fundamental principles on which the economic order is based.”

Long ago, monetary economists established that money, a non-interest-bearing asset, provides its value to individuals through acting as a hedge against the uncertainty of the future — the transaction possibilities that may emerge down the line but that we can’t predict or appraise right now. We give up the potential return we could have earned had we invested that money in some venture that “produced” something — grain, dividends, interest — in exchange for the convenience of having ready cash for transactions not yet made.

Buffet’s company, Berkshire Hathaway, holds north of $100 billion in bank deposits and short-term Treasurys, explicitly to protect the company against unexpected expenditures and allow it to take advantage of future investments. Dissonance, anyone?

From John Maynard Keynes to Mises to Carl Menger and further back through the history of erudite economists, money is crucial to the facilitation of trade while not producing anything on its own. Its purpose isn’t to produce “something to somebody.” Instead, money has the strange property that it is acquired not to be consumed or used, but to be given away in future transactions.

If we were a little snarky with Mr. Buffett, then, we could ridicule his claim that he has to sell bitcoin “back to you one way or another” by once more pointing to the dollar bills in his pocket or the cash balances his company holds. Those don’t “do” anything either; to procure anything real with them, they must be sold back to others — others from whom, collectively speaking, he once acquired them.

… And What About Those Apartments?

If the above ironies and own goals weren’t enough, there is something strange going on with the examples that Buffett picked in illustrating his argument. Farm and farmland is hard to argue with, as plants literally grow more plants — though not automatically, and not without considering assistance from farmers, machines and fertilizers.

Apartment buildings and real estate, however, are a different story. Manhattan condos don’t spin off little apartment babies that grow into valuable real estate in the fertile soil of a housing boom. Certainly, owning some would let you rent them out to other people who in turn benefit from what the statisticians at Bureau of Labor statistics would call “shelter services” — or, in case you own the house in which you reside, using some creative accounting in the consumer price index calculations they result in “owners’ equivalent rent.”

At the end of a given number of real estate transactions there are, per Buffett, “No more [apartments] in the room, it’s just changed hands.” Does that mean apartments have no use and no value?

But here’s the awkward point for Mr. Buffett: Bitcoin, just like other monies, can only provide a profit for its owner if it’s rented or sold to somebody else at a future (higher) price. Apartments, owned outright, can only recoup their cost of investment by selling them to another buyer at a higher future price. In Buffett’s example, he rents them out (possibly to the same nondescript collective of people from which he hypothetically purchased them), a service that must be sold at high enough a rent to cover costs and repairs — an income stream, economically speaking, equivalent to a high enough sale price, spread out over time.

To be valuable in a free market, any good, service or asset must “deliver value to somebody.” The fact that we might not be able to tell what that value is does not automatically undermine it as an asset in some objective sense. For its viability, bitcoin does not require Mr. Buffett's understanding.

In whichever version they emerge (academics, central bankers or as one of the richest men alive), angry, old men incessantly yelling at clouds, are rarely persuasive. Saying things that are instantly undermined by reality, or history, makes for poor presentation.

In this case, however, Warren Buffett was surprisingly correct about bitcoin and its monetary properties.

The fact that an item’s only feasible use is to be sold back to the community at a later stage is almost definitionally what money is — an item you acquire not to use, produce or consume, but to give away later. Money, unlike farmland or dividend-paying stocks, doesn’t equate to earnings for its owner.

Instead, it allows us to navigate transactions in an uncertain future. Like the quotes from Mises and Smith illustrate, we’ve long known how the seemingly wasteful use of costly money improves the overall economy’s operation.

Perhaps Mr. Buffett didn’t realize it, but he just denounced bitcoin by accusing it of having monetary properties. Hurray!

Tim Moseley

With the U.S. stock market still at risk, should gold be trading higher? Analysts see next week as an important test for gold as markets debate the effects of the Federal Reserve's oversized hikes.

Gold is ending the week with its first weekly gain in five weeks as the precious metal finally saw renewed safe-haven demand on concerns over inflation and economic growth. June Comex gold futures were last trading at $1,841.40, up 1.8% on the week.

Going into next week, the steep selloff in the equity space might not be over as the S&P 500 is now 20% below its all-time highs posted in January.

"During the last few weeks, we saw the stock market selling off and gold going along with it. But then we got a short-term peak in Treasury yields, which opened the door for gold to behave as a safe haven," OANDA senior market analyst Edward Moya told Kitco News. "The U.S. stock market is still at risk. We could see one last major plunge. And we'll probably see gold's safe-haven [properties] being tested once more. Selling exhaustion should be settling soon."

Markets are concerned whether inflation and growth can react quickly enough to the Fed's interest rate hikes, said CIBC World Markets chief economist Avery Shenfeld.

If that is not the case, the Fed would be forced to step up its already aggressive tightening schedule, Shenfeld noted. "That's the one-two punch that the equity market is now fretting over: higher rates that lower equity multiples, coupled with a recession that crushes earnings. If, instead, a smaller dose of Fed medicine, and consumer resistance to higher prices, brings an earlier cooling, the recession risks would be significantly diminished," he said.

.gif) 2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

Expectations of steeper rate increases are again rising, warned DailyFX strategist Michael Boutros.

"Markets are having to reprice Fed's outlook on rates. There is doubt that 50bps at this level of inflation would be enough. If the Fed's 75bps hike is readjusted again, it will be a headwind for gold. Gold is stuck sideways as we wait for that story to flash out," Boutros told Kitco News.

The idea that the Fed is making a policy error by acting too slow is becoming more common, he added. "They need to slam on the break and accelerate rate hikes even faster. At this point, they are already late," Boutros stated.

This is why gold is in a tough spot and could be at risk of a further selloff below the $1,800 an ounce level, especially if there is a close below the $1,791 level.

"With what we are seeing in the equity market, you would expect gold to catch a bid. We did this week, but the rally was unimpressive. From a technical standpoint, we are at risk of testing the lows. The $1,781 level or deeper is still on the table," Boutros noted.

Investors should gear up for a sideways price action until gold can move above the $1,895 an ounce level, he pointed out.

Moya was more optimistic looking further out, with economic growth concerns remaining one of the main stories for the rest of the year. This narrative should weigh on the U.S. dollar index, which has been recently trading near 20-year highs and limiting gold's upside.

"We've seen weaker economic data in the U.S. this week. Even jobless claims went up. All expectations are for data to deteriorate. There should be some pullback for the dollar," he said. "It should be good news for gold. We should see gold hold $1,800 through the next week. But more downside movement in equities could break that."

Moya sees the Fed slowing down once financial conditions tighten enough and credit spreads widen. And this should not be too far out in the future.

"That's starting to happen. If the stock market drops another 5% lower, volatility will spike higher, and credit markets will force the Fed into a less hawkish stance of 25-basis-point hikes. And that's not too far away. It should be good news for gold," Moya said.

Next week's key data releases are flash PMI and personal spending. "Consumer spending is projected to weaken. The FOMC minutes are likely to be dated as we already heard Fed Chair Powell and other FOMC members after the May meeting. Flash PMI will be important, especially if we start to see if data get closer to contraction territory," he outlined.

Next week's data

Monday: U.S. manufacturing PMI

Tuesday: U.S. new home sales

Wednesday: U.S. durable goods orders, FOMC meeting minutes

Thursday: U.S. GDP Q1, initial jobless claims, pending home sales

Friday: PCE price index

By Anna Golubova

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

Lobo Tiggre, of The Independent Speculator, claimed that the market selloff is not yet over, and that gold will do well in this environment. Tiggre spoke with David Lin, anchor and producer at Kitco News.

“My concern about a near-term ‘waterfall event’ in the broader markets… is higher now than it has been since 2021,” said Tiggre. “I don’t want to be putting any more cash at risk right now… I sold everything.”

When it comes to gold, Tiggre suggested that the precious metal is resilient in the face of bond-buying and a stronger U.S. dollar.

“People are dumping stocks, they’re buying bonds, even though the Fed is going to be selling because there’s fear in the air,” he explained. “So to see gold still holding 1,800 [USD] in the face of these headwinds tells you something.”

He also commented on the U.S. dollar’s recent performance against gold, “The reality is that the dollar only appears strong. The mayor is still in the glue factory, the dirty laundry hamper is still the dirty laundry hamper. Anybody going to the store, anybody paying rent, they know that their dollars are worth less on their way to perhaps being worthless… [To] the degree that, you know, gold is trading more directly with the dollar, I’m actually a dollar bear.”

Tiggre’s macroeconomic outlook is grim. He said that uncertainty, high inflation, and an economic slowdown will affect markets.

“Nobody really knows what’s going to happen, not even me,” he admitted. “We could be in a recession right now with high inflation… And to think that the Fed can just, you know, raise rates and cure inflation so easily, I think it’s a fantasy. It’s not going to happen.”

To find out Tiggre’s outlook for gold mining stocks and uranium, watch the above video.

By Kitco News

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

|

Freedom and democracy may appear to be struggling to stay alive in America, but there may be a knock-out punch ready to be released. The evolution of the blockchain-enabled metaverse is going to enable the 'Citizens of the World' to gain their own Freedom by democratizing power and creating a new world with new rules, new players, and new opportunities. For 99.99% of us, the metaverse will improve our real-world lives through the democratization of power and opportunity.

Along with the major long-term trend of society towards decentralization and smaller-scale organizations, there are new opportunities developing to help 'Preparers' in the cryptocurrency sector. Businesses are beginning to issue their own Crypto Coins that can be traded on Cryptocoin Exchanges.

Markethive.com for example will be releasing its HiveCoin (HIV) in the coming weeks. It has tremendous upside potential that is outlined in a Video by Founder Tom Prendergast, "Entrepreneur Advantage…".

Not only that, if you go to their website and register as a FREE Member, you will be given 500 HiveCoins for "FREE" along with access to several Earning Opportunities and online tools to increase your HiveCoin balance.

Be sure to check it out today – Markethive.com

Tim Moseley

Gold prices closed higher on the day and the week resulting in solid gains. As of 5:50 PM, ET gold futures basis most active June contract is currently up $3.90 or 0.21% fixed at $1845.10. Considering that gold futures traded to a low this week of $1785 and closed near the highest value this week of $1848.60 gold had a good week.

Gold pricing had been under pressure for the fourth consecutive week before this week’s trading activity resulting in defined technical chart damage with gold breaking below its 200-day moving average last Thursday, May 12. This week’s low occurred on Monday, May 16 when gold prices hit a low of $1785, and traded to a high of $1825 before closing above its opening price on Monday and above Friday’s closing price at $1813.60. On Tuesday gold traded to a higher high and a higher low than Monday, even though gold closed fractionally lower than its opening price. On Wednesday gold traded to a lower low and a lower high than Tuesday’s price action but that all changed on Thursday.

Thursday’s price action moved gold solidly higher opening at $1816 and closing at $1841, above its 200-day moving average of $1837. Although today gold had only a small gain it opened and closed above its 200-day moving average which on a technical basis is significant. If gold can maintain pricing above $1837 on a technical basis, we can derive that gold prices are now back in a solid long-term bullish demeanor.

The recovery in gold this week was based upon market sentiment shifting their attention from the recent and future activities of the Federal Reserve in regards to their tightening monetary policy in which they have raised the Fed funds rate by ½ a percent at this month’s FOMC meeting which follows the quarter-percent rate hike they enacted in March. Recent statements by Chairman Powell indicated that they will get more aggressive when he said that he is open to raising rates well above the Federal Reserve’s interest rate target for normalization which is been set at approximately 2%. This was interpreted as a more aggressive monetary policy in an attempt to stop inflation from spiraling higher.

Statements from the Federal Reserve before this week were indicating that they believe that inflationary pressures had peaked and using the most recent numbers from last month’s CPI inflation index is the validation of that assumption. The CPI index came in at 8.3% for April, below the 8.5% rate that occurred in March.

It has been the tightening of the Federal Reserve’s monetary policy which has resulted in a tremendous selloff in U.S. equities which continue through this week taking all three major indices into a defined tailspin with seven consecutive weeks of price declines.

However, gold had been selling off for the last four consecutive trading weeks based upon anticipation of much higher interest rates to stave off inflation. However, this week we have seen a clear and defined reversal of market sentiment as investors are now clearly focused on the reality that inflation has not peaked and is most likely continuing to move higher and the prolonged risk-off market sentiment has shifted market sentiment from the higher yields of U.S. Treasuries to the safe-haven asset; gold

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

Tim Moseley

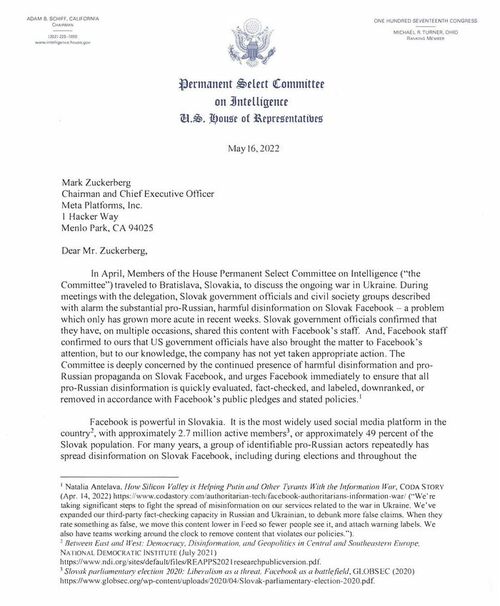

US congresmen write Zuckerberg to act against Slovak users of facebook

from Czech alternative web

US congressmen wrote Zuckerberg a letter to take action in Slovakia against supporters of Putin and Russia on Facebook

US Congress decides who should be deleted and blocked on social networks in Slovakia ?

Today, American congressmen are already writing public letters and intervening against the internal affairs of another "sovereign" country.

A total of 5 members of the US House of Representatives Intelligence committee, headed by committee chairman Adam B. Schiffem wrote an open letter to Facebook chief Mark Zuckerberg to crack down on Slovak citizens who glorify Russia, Vladimir Putin and spread alleged Russian disinformation on his social network. It is said to pose a huge threat to the security of the US and its allies.

In the letter, five Democratic Party congressmen call on Zuckerberg to increase the number of Censors in Slovakia, that is, in their words, “fact checkers” for verifying and deleting Russian disinformation and posts that express sympathy for Russia, Russian officials, the Russian army, etc.and also to launch an investigation into who publishes this information on Facebook .

These congressmen are Adam B. Schiff

Mike Quigley

Peter Welch

Sean Patrick Maloney

Jason Crow

Slovakia is officially an American colony with everything ? The civil rights of Slovaks to opinions on Facebook are controlled by US congressmen…. And the prime minister of Slovakia Eduard Heger still thanks them? Is this normal?

Slovak prime minister Eduard Heger already sent his thanks to US congressmen also saying that this is result of a common truth-seeking effort and wrote also "It is highest time for as many people as possible to be clear about the values and to be able to navigate correctly in the complexities of the contemporary world."

Member of Slovak parliament Luboš Blaha from political party SMER has already responded to the intervention and wrote an open counter-letter to Zuckerberg.

Yes, it is obvious that Americans are afraid of massive anti-American sentiments in Slovakia among the ordinary population. Anti-American signs are beginning to appear, according to our information, everywhere, in all cities, and the police do not have time to blur the letters " Z " appearing in hundreds of cases. It is something like a form of” Zorro Avenger " protest against censorship and against American aggression in Ukraine, against the American nationalization of political and media processes, against the deployment of American occupation forces in Slovakia with the assistance of the government, which part of the Slovak public and especially the opposition calls treasonous.

Facebook is powerful in Slovakia. It is the most used social media platform in the country, with approximately 2.7 million active members, which is approximately 49% of the Slovak population.

Slovakia is very important for the US Congress from the logistical point of view of supplying weapons to Ukraine. It is a country that shares a border with Ukraine, and this makes Slovakia an extremely important vassal for the United States, so important that the US Congress is straining to eliminate resistance and opposition in Slovakia, including the criminalization of representatives of the strongest opposition party.

Thank you for reading

Margaret

Tim Moseley

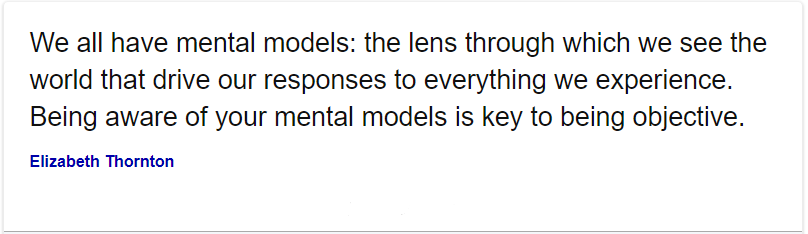

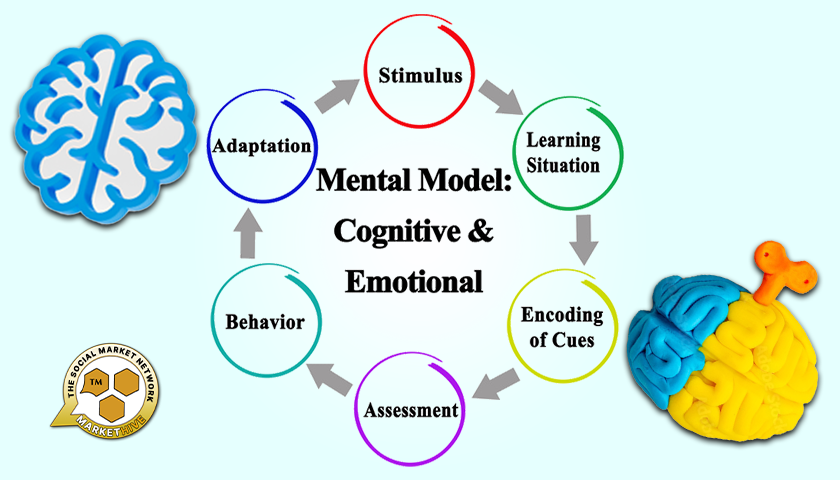

We have fitness gyms to improve our physical fitness. But what about a gym for our mental wellness? What would the mental equipment be? Building your mental gym is essential and mental models are some of the most potent mental tools at your disposal. They may help you think and react quicker.

We all have mental models, which are the lens through which we see the world that influences our reaction to everything we experience. It is crucial to be aware of your mental models to be objective.

Mental models are significant and rooted in human nature, and they affect how we see problems and how we see people. Mental models may either be extremely helpful or destructive, depending on how you use them.

Source: brainyquote

There are many different mental models, and it would take a very long time to study them all in detail. Some mental models are rooted in biological observations, while others have been described in behavioral studies. However, all mental models serve as beliefs or ideas that we form based on our experiences consciously or unconsciously.

Mental models help us understand life by providing a shortcut for reasoning. They guide our thoughts and behaviors and help us make sense of the world around us. By understanding how mental models work, we can improve our thinking and make better decisions.

Mental models are not a new concept; they are essential to understanding how our mind works. Below are 23 of the fundamental mental models that you can start observing in your daily life. They are helpful in understanding everyone’s thought process, and they will help you become a better communicator by considering other people’s mental models when speaking with them. Most importantly, they will help you become a more self-aware person.

1. Anchoring

Anchoring is a mental model that refers to the tendency for people to rely too heavily on the first piece of information they receive (the “anchor”). This can lead to bad decision-making because people often fail to adjust their thinking when new information contradicts the original anchor.

2. Bandwagon Effect

The bandwagon effect is a mental model that refers to the tendency for people to do something simply because other people are doing it. This can lead to bad decision-making because people often fail to think for themselves and blindly follow the crowd.

3. Bayesian Reasoning

Bayesian reasoning is a mental model that refers to the process of updating your beliefs in light of new evidence. This is a good way of thinking because it allows you to constantly learn and update your beliefs based on further information.

4. Behavioral Sink

A behavioral sink is a mental model that refers to the tendency for bad behavior to spread in a population of animals or humans.

This can happen when there is no punishment for bad behavior or when the rewards for bad behavior are more significant than rewards for good behavior. This can lead to disastrous consequences, such as the spread of disease, lowering of society's standard of living, or extinction of a species. A behavioral sink has been applied to many fields, including public health, marketing, and economics.

5. Classical Conditioning:

Pavlov's dog is an excellent example of classical conditioning. A biologically potent stimulus, such as food, is paired with a previously neutral stimulus, such as a bell, to condition response in animals. In this case, saliva is produced due to the neutral stimulus (the bell), just as it does when the biologically potent stimulus (food) is presented.

6. Commitment and Consistency Bias:

The desire to be and appear consistent with what we have already done.

It prefers consistency over change, maintains current behavior, and avoids discontinuity. Confirmation bias is the tendency to favor information that confirms your existing beliefs, and Conformity bias tends to be more responsive to social pressure when evaluating a decision in the presence of others (e.g., a purchasing decision)

7. Common Knowledge:

It's a wide-accepted truth that everyone or nearly everyone knows.

While common knowledge does not always signify fact or authenticity, most people will acknowledge it as such. In many cases, common knowledge can change. What was common knowledge in the past may not be common knowledge now. What was common knowledge in your country or society may not be common knowledge in another country or community.

8. Diversification:

The process of allocating your resources to reduce exposure to any particular risk and is essential when it comes to investing. By diversifying your portfolio, you reduce the risk that you might lose everything if one specific investment tanks. It’s also important to diversify when it comes to risk reduction in your life.

9. Game theory:

An umbrella term for the science of logical decision-making in humans, animals, and computers.

Game theory is a branch of applied mathematics; it explores how we make decisions when faced with rules, rewards, and punishments. It is used in economics, political science, artificial intelligence, and many other fields. In its most common form, the game theory looks at strategic decision-making and its theory. When analyzing a game, we try to find the best strategy to win it. We look at what happens if everyone plays a certain way and what happens if they don’t.

10. Hyperbolic discounting:

A model states that, given two similar rewards, people prefer one that arrives sooner rather than later.

This is often referred to as ‘discounting the value of each reward according to how soon it arrives.’ Hyperbolic discounting is often thought to be an innate aspect of human nature rather than something that can be changed. It is often applied to explain why people often fail to save enough money for retirement.

11. The illusion of control:

The tendency for people to overestimate their ability to control events.

This illusion can lead to a false sense of security, a lack of preparedness, and a false sense of confidence in your ability to succeed. Researchers have found that this bias is common in people across cultures, backgrounds, and demographics. People with higher confidence levels seem to be more prone to the illusion of control. And though this bias can be quite beneficial, it can also lead to disastrous consequences.

12. Incentive:

Something that motivates or encourages someone to do something.

Examples of incentives include financial rewards, prizes, gift cards, and bonuses. Incentives can also be non-financial, such as public recognition, an employee of the month, or a thank you card. Incentives are most often used in marketing to encourage current or potential customers to buy a product or service.

13. Inversion Principle:

The process of looking at a problem backward. For example, imagine everything that could make your project go wrong instead of brainstorming forward ideas.

The principle can be applied to any situation where you want to develop new solutions to problems. Backward thinking helps you develop new ideas by challenging your current way of thinking. Inversion takes mental flexibility to apply to any situation in your life.

14. Loss Aversion:

Loss aversion can be observed in various situations, from investment decisions to risk perceptions. People tend to place more value on avoiding losses than on achieving equivalent gains. E.g., Some people are more distressed about losing $10 than pleased to find $10.

15. Maslow's Hierarchy of Needs:

A hierarchy of human needs is often represented as a pyramid in which lower-level conditions must be satisfied before higher-level needs can be addressed.

In this hierarchy, human needs are arranged in five categories: physiological needs, safety needs, needs for love and connection, need for esteem, and self-actualization at the top of the pyramid.

16. Mere-exposure Effect:

It is a psychological phenomenon by which people tend to prefer things merely because they are familiar with them.

The mere-exposure effect is a bias where people are more likely to select items based on past experience rather than new information. This can lead to confirmation bias, where people seek out information that confirms their existing beliefs and avoid information that conflicts with them.

17. Norm of reciprocity:

It's the expectation that we repay what another has done for us in kind.

It is a deeply ingrained social norm that is believed to promote a positive cycle of behavior rather than a negative spiral of consequences. This norm inspires us to do good deeds for others, and when we receive a favor, we feel the obligation to pay it forward. When you have been on the receiving end of a good deed, you now have the responsibility to go out and do something nice for someone else.

18. Operant conditioning:

A learning process where the strength of a behavior is modified by reinforcing or punishing it.

Operant conditioning can be used to modify any kind of behavior and is often used to treat problems like ADHD, but it's also used to help people wanting to improve their performance. Operant conditioning often relies on a system of rewards, like a token economy, to reinforce desired behavior. There are many different types of operant conditioning, but they all rely on classical and operant conditioning principles.

19. Scarcity:

An item in limited supply and thus in demand in the market. Also, artificial scarcity is created when the government restricts the amount of a commodity that may be bought.

People often react to scarcity by stockpiling goods and spending more money. This can be a response to anything from the uncertainty of a political climate to a natural disaster. In the face of scarcity, people often turn to each other for support, building communities and trust. Scarcity can also lead to conflict, as people fight over resources.

20. Status Quo Bias:

A status quo bias is a preference for the current state of affairs, where the current baseline is taken as a reference point, and any change from that baseline is perceived as a loss.

Status quo bias can also be understood as a preference for the “devil you know over the devil you don’t know” or inertia. Status quo bias is a common human bias often observed in decision-making. It can be beneficial in certain contexts, such as deciding whether to stay in or move out of a particular investment. However, it can also be very costly.

21. Surfing:

The business principle of “riding the wave” of new technology, a product, or a trend.

When a new technology, product, or trend has the potential to impact your business significantly, you can ride the wave by exploring how it can be integrated into your existing offerings. Stay ahead of the curve by keeping an eye on cutting-edge technology and monitoring changes in the marketplace. You might discover that new technology has the potential to be adopted by your existing customers or to attract new ones.

22. Survivorship bias:

The logical error of concentrating on the people that made it past some selection process and overlooking those that did not, typically because of their lack of visibility.

This frequently occurs in entrepreneurship. For example, if you profile successful entrepreneurs, you are unlikely to consider those who tried and failed. Examining the lives of successful entrepreneurs teaches us very little. We would do far better to analyze the causes of failure, then act accordingly. Even better would be learning from both failures and successes.

23. Tribalism:

A way of thinking in which people are loyal to their social group above all else.

Tribalism is the opposite of individualism; it’s the idea that social status is more important than what you achieve. It’s the idea that your group — your family, friends, and co-workers — is more important than any other group.

Mental models should not be mechanically applied to enhance your cognitive performance. There is a common misconception that mental models should be rigorously studied and employed. There are several mental models that you should do your best to avoid. For instance, an “illusion of control” can be particularly dangerous in certain situations, and it's good to understand them, so you are aware of the pitfalls.

It is crucial to be able to recognize mental models to grow as a human being, whether you are using them or communicating with someone who is. Ideally, you should decide whether or not to employ them rather than being swept away by our brain's habitual thinking.

Source: AZ Quotes

How can you master mental models, identify them in others, and beneficially use them?

Here are a few strategies you may use to master mental models rather than being dominated by them.

â When thinking, ask yourself challenging questions.

â Challenge your thinking with actual facts by gathering information

â Ask others about their thoughts and challenge their opinions.

â Avoid jumping to conclusions and suspend your assumptions.

â Be on the lookout for habitual thought patterns, and disempower them.

Being aware of your mental models is critical, as a tool is only as good as its user. Once you know your mental models, you can use them effectively to achieve your goals.

In a fast-moving environment, mental models can be instrumental in helping you think fast and make decisions. After all, they’re great at giving you a rule of thumb to predict likely outcomes or behaviors if done well. However, to really benefit from mental models, you need to build them actively and put them into practice.

The best way to do this is to constantly challenge your assumptions, actively seek out new information, and work towards testing your mental models through active experimentation. Doing this will help you continuously improve your mental models and make them more accurate, reliable tools for critical thinking.

Begin developing your own mental models by finding inspiration in people. When you read a biography, ask yourself: why did they make this decision? What was the reasoning? What mental model did they employ?

It's not always about famous entrepreneurs or creatives. We all have a friend or colleague whose work we admire. When you see them make a particular choice in a difficult situation, ask them how they arrived at that decision.

Ask for feedback from a friend or colleague to see if you exhibit any undesirable behaviors. It may be difficult and perplexing to self-observe, but it can be incredibly beneficial and enlightening.

It's essential to be aware of undesirable mental models and recognize the positive ones. Instinctively, you'll notice mental models you don't want to replicate. Studying them is also worthwhile because it is easier to avoid a mental pattern when you know how to spot it in yourself and others. Write down your mental models, whether they are constructive or destructive.

To delve deeper and learn more about mental models, visit Farnam Street.

References:

Farnam Street

Anne-Laure Le Cunff

Also published @ BeforeIt’sNews.com: https://beforeitsnews.com/education/2022/05/understanding-mental-models-to-improve-your-life-and-enhance-the-lives-of-others-2461449.html

Tim Moseley

Gold and silver prices are posting good gains in midday U.S. trading Thursday. The precious metals are boosted by a sharply lower U.S. dollar index and a slight decline in U.S. Treasury yields on this day. A wobbly U.S. stock market is also working in favor of the metals market bulls. June gold futures were last up $25.40 at $1,841.30. July Comex silver futures were last up $0.321 at $21.86 an ounce.

U.S. stock indexes have seen strong selling pressure recently and are near 12-month lows amid heightened worries about corporate earnings after Wal Mart and Target posted dismal results this week. Both companies cited inflation as the main culprit for their dour earnings numbers. An economic recession in the U.S. is now on the minds of traders and investors who were already saddled with other concerns, including the Russia-Ukraine war and Covid cases causing major cities in China to be on lockdown, which is disrupting global trade. Those concerns are also prompting some safe-haven demand for gold and silver.

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova

The key outside markets today see Nymex crude oil futures prices firmer and trading around $110.00 a barrel. Meantime, the U.S. dollar index is sharply lower and hit a two-week low. The yield on the 10-year U.S. Treasury note is fetching 2.837%.

.gif)

Technically, June gold futures see a nine-week-old price downtrend still in place on the daily bar chart. Bears have the firm overall near-term technical advantage. Bulls' next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the May low of $1,785.00. First resistance is seen at today's high of $1,848.20 and then at $1,875.00. First support is seen at $1,825.00 and then at today's low of $1,808.40. Wyckoff's Market Rating: 3.5

.gif)

July silver futures prices scored a bullish "outside day" up on the daily bar chart today. A price downtrend is in place on the daily bar chart. The silver bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.00 an ounce. The next downside price objective for the bears is closing prices below solid support at the May low of $20.42. First resistance is seen at $22.25 and then at $22.50. Next support is seen at today's low of $21.25 and then at $21.00. Wyckoff's Market Rating: 2.5.

July N.Y. copper closed up 1,045 points at 428.30 cents today. Prices closed near the session high today. The copper bears still have the firm overall near-term technical advantage. A price downtrend is still in place on the daily bar chart. However, more gains in the near term would negate the downtrend. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 445.00 cents. The next downside price objective for the bears is closing prices below solid technical support at the May low of 403.70 cents. First resistance is seen at 430.00 cents and then at 435.00 cents. First support is seen at 420.00 cents and then at this week's low of 413.15 cents. Wyckoff's Market Rating: 2.5.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley