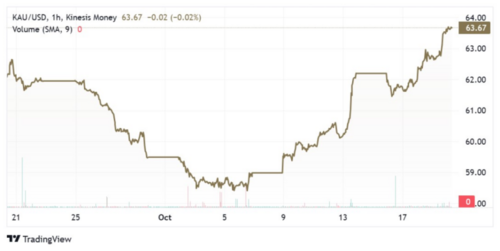

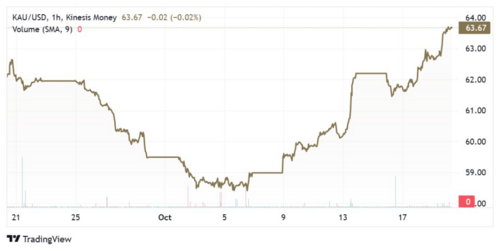

Gold Price News: Gold Leaps Ahead on Heightened Risk Aversion

← Back to Gold News

Gold continues to rally strongly, with recent gains taking the price to a three-month high of $1,979 per ounce. For now, the appetite for safe-haven assets is trumping stiff rate headwinds.

Market drivers for gold remain under significant tension. US economic data is still largely beating expectations, helping to sustain inflation and higher interest rates to combat it. US rates continue to climb with 10-year US Treasury yields now testing 5% – a level not seen since mid-2007. This is clearly a challenge for non-yielding assets, such as gold.

gold kau price on kinesis exchange

However, the risk environment also remains elevated. Geopolitical risk has risen in the Middle East. However, the muted rise in crude oil prices thus far suggests that the market is still pricing in a low probability of Iran being drawn directly into the regional conflict. As such, the risks here still arguably lie to the upside. Equity markets are also uneasy, with the VIX (‘Fear’) Index of implied S&P 500 volatility at the highest levels since the US banking scare in March.

In the meantime, the much-awaited speech by Fed Chairman Powell has done little to move the dial. While the probability of a rate pause until the end of 2023 seems to have improved, the chances of one last rate hike in Q1 2024 have hardly moved. Until greater clarity, bonds will be handicapped in their ability to attract safe-haven flows from gold.

Tim Moseley