Crypto: A Shield of Financial Stability Amidst Next Possible Pandemics and 2025 Depopulation Crisis

In our ever-changing world, reality sometimes feels more unbelievable than anything we could imagine in fiction. And when it comes to the hidden workings of global events, it's like trying to solve a puzzle with missing pieces.

One particularly intriguing aspect involves some major players on the world stage: the Central Intelligence Agency (CIA), the U.S. Department of Defense (DoD), as well as prominent foundations like The Rockefeller Foundation, the Bill and Melinda Gates Foundation, the World Health Organization (WHO), United Nations (UN) and other non-governmental and governmental organizations. Also, Deagel is a mysterious online entity that has gained attention for its extensive data on military capabilities and some eyebrow-raising predictions about depopulation by 2025. It's an enigmatic website that's caught the curiosity of many people.

The world as we know it has undergone a profound transformation in the wake of the COVID-19 pandemic. Societal paradigms have shifted, and nowhere is this more evident than in the financial sector. Amidst the chaos and uncertainty, cryptocurrencies have emerged as a beacon of stability and a potential safeguard against future global crises.

As economies grapple with the pandemic's aftermath, it has become increasingly evident that traditional financial systems are susceptible to shocks and vulnerabilities. In contrast, the rise of cryptocurrencies has been nothing short of meteoric, prompting us to ponder their role in preparing for the next possible pandemic.

As the world braces for what may come next, as Bill Gates and the World Health Organization said, the possibility of the next pandemic has added urgency to the discussion. According to Bill Gates, the risks of severe disease from COVID-19 have “dramatically reduced,” but another pandemic is all but certain because of the simulation called "Catastrophic Contagion." However, it is crucial to contextualize these simulations within the broader context of preparedness and foresight, as they have been conducted before, like the "Event 201" simulation in October 2019.

Let us embark on a journey of shedding light on how cryptocurrencies may hold the key to fortifying our financial systems and offering a shield of resilience in the face of future pandemics. By examining the growing significance of digital assets, we can better understand their role in shaping tomorrow's financial landscape.

Image source: International Man

Terrifying 2025 Depopulation Forecasts

In recent years, the website Deagel.com has become the center of a controversial discussion surrounding its predictions for the year 2025. These predictions, which were later removed from the website in 2020, sparked an intense debate due to their apocalyptic forecasts of massive depopulation in various countries. However, thanks to the Internet Archive, we can still delve into what Deagel initially forecasted before the information was taken down.

The figures projected by Deagel in 2020 were truly startling. They foresaw a jaw-dropping 77.1% decline in the population of the United Kingdom and an equally alarming 68.5% decline in the population of the United States by 2025. Furthermore, Germany was predicted to experience a substantial reduction of 65.1%, while Australia was projected to face a 34.6% decrease in population. Similar drastic declines were also forecasted for several other Western countries.

According to a tweet by an account known as The Researcher, it says:

"Not to be a Debbie downer, but the one world government cabal appears to be planning mass murder, aka carrying out their depopulation program, in 2025."

Understandably, these forecasts have left many people deeply concerned, particularly when considering the current global situation and the documented data on excess deaths. Some individuals speculate that these predictions may not be entirely speculative, as they uncomfortably align with real-world events. In this context, some argue that the COVID-19 vaccination campaigns, authorized for emergency use, might have played a significant role in these potential population declines.

The reported connection between Deagel.com and influential organizations such as the U.S. Department of Defense (DoD), the CIA, and The Rockefeller Foundation adds further intrigue and raises eyebrows. The alleged association between a seemingly obscure website and such influential entities has fueled suspicion and raised questions about the nature of Deagel's forecasts. This has led to unsettling inquiries about the DoD's potential involvement in COVID-19 research in Ukraine even before the virus was officially recognized and how it might relate to Deagel's predictions.

Are We Headed for Another Lockdown?

Bill Gates may not have a research background in public health, medicine, epidemiology, or infectious disease. Still, surprisingly, he has taken on a significant role in the lives of billions of people by influencing and suggesting what medical actions are needed to return the world to what he refers to as a state of normalcy. It's quite extraordinary to observe how he transitioned from a software kingpin to a prominent figure who influences global health matters. This transformation sheds light on our direction as we face an unprecedented crisis unlike anything we've experienced before.

John D. Rockefeller and Bill Gates were two individuals who recognized the importance of giving back to the public to win their admiration and, in turn, manipulated people's behavior to achieve their desires. Rockefeller, known for his vast oil monopoly fortune, generously invested hundreds of millions of dollars in creating institutions he claimed were for the greater good of the people. Notable examples include the General Education Board, the Rockefeller Institute of Medical Research, and the Rockefeller Foundation.

Fast forward to the present, and we have Bill Gates, who has been on a remarkable journey from a software tycoon to a humanitarian, thanks to the Bill & Melinda Gates Foundation. In fact, Gates has even surpassed Rockefeller's legacy, with the foundation now holding the title of the largest private foundation worldwide, boasting an impressive $67.3 billion in assets. Their primary focus areas are global health and development, global growth, and global policy advocacy.

The one thing both Rockefeller and Gates have in common is the strategic use of well-funded public relations campaigns to shape their public image. Gone are the theatrical PR tricks of the past; instead, Gates has mastered the art of gaining public favor through more straightforward means: investing in positive publicity.

For instance, the Bill & Melinda Gates Foundation spends substantial amounts of money each year on media partnerships. They sponsor coverage of their program areas across various platforms, including The Guardian's Global Development website, NPR's global health coverage, and the Our World in Data website, which tracks the latest statistics and research on the coronavirus pandemic. They also fund BBC coverage on global health and development through both BBC Media Action and the BBC itself and world health coverage on ABC News.

These initiatives show how Gates is committed to promoting awareness and understanding of critical issues and furthering public engagement in the areas that matter most to him and the foundation. It's a testament to his dedication to gaining substantial governmental and institutional powers, which ensures he pushes his devilish agenda on a global scale without any objection.

So, who is Bill Gates, you may wonder? Is he a software developer, a businessman, a philanthropist, or even a global health expert? Well, this question has evolved into something of a real concern for many. It is obvious that Gates' incredible wealth and influence have allowed him to gain significant power over various aspects of public health, medical research, and vaccine development.

As we face the challenges of our times, it's becoming evident that Gates' ideas and actions hold considerable sway. It's unprecedented to think that someone without medical training could wield such power, and it raises important questions about the implications of this influence on the lives of billions of people. The world is grappling with the very issues Gates has been discussing for years, and we can't help but ponder how his wealth and position might impact the future of global health and beyond.

Bill Gates believes that a potential new pandemic would likely stem from a different pathogen than the coronavirus family and that advances in medical technology could cut vaccine production times to six months if huge investments are made on time.

While it may sound alarming, it's essential to remember that these simulations have also been conducted in the past. In 2019, they organized "Event 201," which simulated a global response to a coronavirus, months before COVID-19 became a reality. When powerful people make predictions, you must understand it is usually a well-planned operation waiting to be carried out at the right time. The 2025 depopulation forecasts by Deagel.com and the possible global health crisis in the same year as Bill Gates projected it is not a coincidence.

Image source: Center for Health and Security

The latest simulation, called "Catastrophic Contagion," envisions a severe epidemic of enterovirus respiratory syndrome in 2025, originating in Brazil. They conducted this tabletop exercise involving health ministers and public health officials from various countries, along with pre-recorded news broadcasts. It might interest you to know that as Bill Gates has already earmarked 2025 for the next pandemic, the White House is getting all of its ducks in a row for it. Get ready for it, people!

In an interview with Maria Bartiromo, host of “Sunday Morning Futures” on Fox News, Sen. Rand Paul said:

“Gates is the largest funder of trying to find these viruses in remote caves and bring them to big cities. So what happened in China is they went eight to 10 hours south of Wuhan, 200 to 300 feet deep into a cave, found viruses, and took them back to a city of 15 million.”

In the past, when the COVID-19 pandemic hit, there were hopes that companies and world leaders would come together to create vaccines and distribute them globally, free of charge. Unfortunately, profit motives seemed to dominate, leading to the emergence of new billionaires in the vaccine industry. Now, you understand that these health crisis projections are a means of profit-making at the expense of humanity.

During the simulation, there was a strong focus on targeting children, which could be an attempt to create fear and mobilize the public if a real-life scenario unfolds. The idea might be to incorporate any new pandemic into routine vaccination schedules as a way to control its spread.

While simulations are meant to help us prepare for potential crises, it's essential to be skeptical and question the intentions behind certain decisions and policies related to these developments. We need to stay vigilant and ensure that any measures taken are genuinely in the best interest of public health and safety. Let's keep asking questions and seeking transparency to protect ourselves and our communities.

Consolidated Financial System

The financial landscape is about to witness a significant change as the Federal Reserve prepares to launch a new fast payment system. But this isn't the only development in the works. Central banks worldwide have been quietly working on their own fast payment systems for quite some time, backed by influential organizations like the World Bank and the Bill and Melinda Gates Foundation. The lack of public information about these initiatives raises concerns and draws attention to the potential implications.

To better grasp the situation, let's delve into some background information. The World Bank, established during World War II, has close ties with U.S. interests and provides loans to developing countries. These loans often come with conditions for achieving the United Nations' Sustainable Development Goals (SDGs). From the look of things, these SDGs might lead to the forceful adoption of concepts such as digital IDs, Central Bank Digital Currencies (CBDCs), and Smart Cities.

What's intriguing is the connection between the World Bank and the Bill and Melinda Gates Foundation. Both organizations have been actively working on implementing digital IDs and fast payment systems. The World Bank's Payment Systems Development Group has been at the forefront of modernizing payment systems worldwide.

So, what exactly are fast payment systems? These systems aim to enable instant fund availability 24/7 through central infrastructures, allowing banks and non-banks to connect and offer additional services to end-users. Various countries have already established their own fast payment systems. The ongoing project seeks to transform existing payment systems into fast payment systems and eventually integrate them with CBDCs. The idea is to create a global financial system that is fully interconnected and controlled.

Reports from the World Bank, especially one from September 2021.pdf, suggest that integrating fast payment systems and CBDCs is a likely direction. The plan involves leveraging the existing fast payment infrastructure to facilitate the operationalization of CBDCs, making them more accessible to the public.

As these developments unfold, concerns arise about centralized control over financial systems to keep the people under strict surveillance. This coordinated effort undermines people's financial freedom and subjects them to a predetermined agenda. The fear is that such a system will dictate people's spending habits and even restrict access to their own funds in case of disagreements or non-compliance with certain policies.

In light of these concerns, many in the crypto community see cryptocurrencies, particularly decentralized stablecoins, as a viable alternative. By leveraging crypto, individuals can take control of their financial sovereignty, moving away from centralized systems and safeguarding their financial autonomy.

Although implementing fast payment systems and CBDCs seems inevitable, the crypto community has an advantage and can play a significant role in providing a secure and decentralized alternative. By staying informed and proactive, individuals can navigate the financial landscape and be better prepared for any potential crises due to these developments.

As the world moves towards a new era of economic systems, staying educated about the evolving trends in crypto can empower individuals to retain greater control over their financial destinies. It's a journey toward financial freedom, one that requires vigilance, awareness, and an openness to exploring the possibilities of decentralized finance.

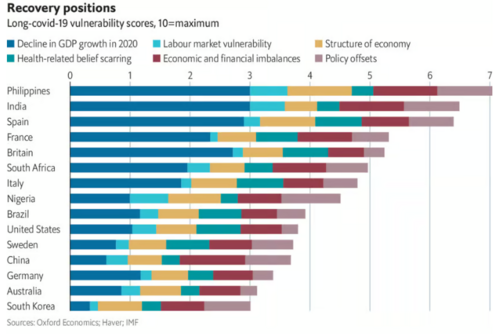

Image source: The Economist

Covid-19 Exposed The World Economy Vulnerability

When the COVID-19 pandemic hit in March 2020, millions of people in the United States and around the world had to go into lockdown to control the spread of the virus. This significantly impacted the economy, as many businesses and industries came to a standstill. While these measures were necessary for public health, they brought about global repercussions.

The economic downturn during the early months of the pandemic was so severe that it was compared to the initial declines of the Great Depression. However, as the year progressed, the U.S. economy started to recover thanks to unprecedented stimulus measures introduced by the government. The rapid rollout of vaccinations also played a crucial role in boosting the economy.

Despite some progress, the pandemic's economic impact is far from over, especially with the emergence of new, highly contagious variants of the virus. Specific industries, like travel and hospitality, were hit hardest. Many shops and restaurants had to close their doors entirely or operate with limited capacity, leading to a significant loss of revenue. Airlines, cruise ship operators, and small businesses that relied on tourism suffered massive financial setbacks due to the disappearance of nonessential travel.

Even seemingly unrelated industries were affected by the secondary effects of social distancing. Manufacturers, especially those outside the medical field, received fewer orders as consumer spending slowed. Banks faced challenges with mortgage payments because of government-mandated forbearance rules, and oil companies saw prices plummet as everyday travel declined sharply.

Adding to the economic strain was the fear of uncertainty. Even people with stable jobs reduced their spending, anticipating potential financial aftershocks. The pandemic's widespread impact on various sectors of the economy has created ongoing challenges that continue to be felt.

The COVID-19 pandemic caused significant economic disruption, with various industries facing exceptional challenges. Though efforts have been made to recover, the situation remains dynamic, with new variants or possibly a manufactured virus posing ongoing economic threats.

When we think about the potential chaos that might come with another pandemic, it's crucial to remember the ongoing struggles many businesses and families face after the COVID-19 crisis. The pandemic has left deep scars; many people are still trying to pick up the pieces and get back on their feet. Even though we've shown resilience during this challenging time, we can't ignore that our economies and societies are fragile and can be disrupted by unexpected events.

It's only natural to feel worried and anxious when we consider the possibility of a 2025 pandemic, especially if the projections are valid. The consequences could be severe, affecting every aspect of our lives and society. The challenges we faced in the past will still linger, and new ones might arise, making things even more challenging for us.

Imagine the struggle for businesses that have only begun to recover; they could find themselves again on the brink of closing down. And think about the entrepreneurs who had big dreams and worked hard to build something innovative. They might face insurmountable obstacles, and it could feel like everything they've worked for is falling apart. It's not just the business world that will suffer; countless families' financial stability might crumble, leading to despair and uncertainty.

The impact of another pandemic wouldn't just stay within borders; it would affect the global economy and nations worldwide. It would be a burden that everyone would bear and could worsen inequalities between countries. Things like supply chains, trade, and financial markets could be thrown into chaos. Governments would struggle to find the right balance between protecting public health and keeping their economies afloat.

The effects would be widespread, crossing boundaries and affecting developed and developing nations alike. Countries already struggling with poverty and weak healthcare systems might face even more severe challenges. The pandemic could worsen existing vulnerabilities and deepen the disparities between different parts of the world. In this uncertain scenario, learning from the past and being better prepared for the future is essential.

Image source: Markethive.com

Prepare Yourself Financially

When we talk about cryptocurrency, the word "stable" may not be the first thing that comes to mind. However, it's worth acknowledging that despite its reputation for volatility, cryptocurrencies like Bitcoin are still more stable than other fiat currencies currently in circulation.

Yes, cryptocurrencies can experience significant value fluctuations on a day-to-day or even hourly basis. But interestingly, these fluctuations are not exclusive to cryptocurrencies alone. Both fiat currencies and cryptocurrencies face the risk of value changes, and sometimes, these changes can be pretty dramatic.

Throughout history, we've seen instances of severe hyperinflation, like the case of the Weimar Republic in the inter-war period. Unfortunately, these stories of extreme inflation aren't just confined to the past; they continue to pose a dangerous risk to many countries, even today, like Venezuela's case.

So, while cryptocurrencies may have ups and downs, it's essential to recognize that they aren't alone in facing the challenges of fluctuating values. Understanding the broader context of currency fluctuations can help us better navigate the ever-changing financial landscape. Despite the volatility associated with crypto, it firmly hands humans the power of financial control.

The Federal Reserve is openly working on developing its digital currency. But here's the thing: it's not just about modernizing the financial systems; there's more to it than meets the eye. This move is part of a more extensive agenda driven by globalists to limit people's financial privacy and gain more control over their lives. They aim to keep a closer eye on your transactions and have a say in how you manage your money.

But you know what's interesting? Those who choose to accumulate cryptocurrencies are taking a different path. They're sidestepping the elite's growing obsession with controlling every aspect of their finances. By embracing cryptocurrencies, they're keeping their financial choices more private and retaining a level of independence from centralized authorities.

It's like a digital rebellion against the system. It is a way for people to protect their financial freedom and have more control over their destiny. As the world moves towards digital currencies, staying informed and understanding the implications of these changes is essential. You should keep exploring and learning about the crypto world and decide what path you want to take in this evolving financial landscape.

Being Truly Free

In the pursuit of financial freedom, we often envision a life where we no longer rely on a traditional job and have a steady income from other sources. But let's examine this conventional "financial independence" idea more closely. Even those who achieve this status might not be as independent as they think.

In reality, those labeled as "financially independent" still rely on intermediaries like banks, governments, and financial institutions to access and manage their money. They may face restrictions and limitations these middlemen impose, which can undermine their true sense of freedom. Moreover, unexpected circumstances or changes in regulations could lead to the removal of these services, leaving them vulnerable.

Now, enter the world of cryptocurrencies. This is where the concept of genuine financial freedom gains prominence. Cryptocurrencies are rooted in liberating ourselves from external dependencies and limitations. If you've ever felt frustrated by restricted access to your funds, cryptocurrencies offer a solution. In the realm of crypto, you become your own bank, empowering yourself to transact, save, and invest on your terms without interference from intermediaries.

Furthermore, cryptocurrencies can serve as a potential shield against unforeseen crises and economic upheavals. Unlike traditional financial systems, which can be heavily impacted during pandemics or economic downturns, cryptocurrencies provide an alternative avenue for safeguarding your assets and financial future.

Of course, entering the crypto world requires some research and understanding, but it opens up a realm of possibilities. With access to decentralized networks and digital assets, you gain greater flexibility and autonomy in navigating the financial landscape.

Taking control of your financial destiny through cryptocurrencies promotes self-reliance and empowerment. It's an opportunity to embrace the idea of "be your own bank" and trust your ability to navigate the ever-changing financial world and a world full of wickedness.

So, if you've ever felt restricted by traditional financial systems or scared of what may happen to your financial freedom and longed for a more liberated approach to managing your wealth, exploring cryptocurrencies could be the answer. Embrace the ethos of economic liberty that lies at the heart of crypto and pave your own path to a more empowered financial future.

It's time to trust yourself, trust the technology, and embark on a journey towards being your own bank, giving you the financial freedom you deserve. Break free and unlock the potential of financial independence through the power of crypto amidst the global crisis. As the world faces unusual challenges, understanding the forces that shape international events becomes crucial for ensuring a more informed and empowered future. If we don’t own our futures, someone else will. So, gain the capabilities to be in complete control of your time, your earning power, and your life’s path. Hurry! The clock is ticking, and things are happening so FAST.

Tim Moseley

.png)