Wall Street is balanced and cautious on gold next week, Main Street remains optimistic about price gain

Precious metals traders rode a roller coaster of optimism and greed higher this week, as markets cemented expectations for a rate cut from the Federal Reserve at their September meeting. But gold prices may have pushed too high too quickly, with the ensuing pullback dragging the yellow metal right back to where it started.

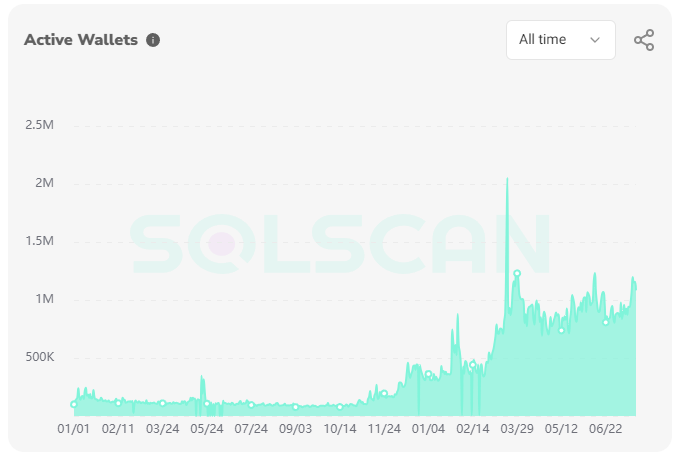

Spot gold opened the week trading at $2,411.65 before moving down to test support near $2,400 per ounce shortly after 3:00 am early Monday morning. This level of support held, and it started the precious metal’s upward climb. After hitting an intraday high of $2,436 per ounce shortly after 11:00 am EDT on Monday, spot gold saw a retracement down to the $2,420 area following comments from Fed Chair Jerome Powell, which were dovish on balance.

Prices then began trending higher during the Asian session, and by Tuesday morning gold was trading above $2,440 per ounce. Prices saw a dip to the low $2,430s following the release of a slightly better-than-expected U.S. retail sales report for June, but they rebounded sharply thereafter, and by Tuesday evening spot gold had set a new all-time high above $2,482 per ounce.

Traders then turned their attention to the next Fed speaker on the docket, Christopher Waller, whose comments shortly after 9:30 am that “the time to lower the policy rate is drawing closer” appeared to confirm the market’s optimism for a fall rate cut. This drove spot gold to a fresh all-time high above $2,483 per ounce, but the yellow metal couldn't break decisively through resistance, and the sharp retracement that followed drove the price to an intraday low of $2,452 per ounce.

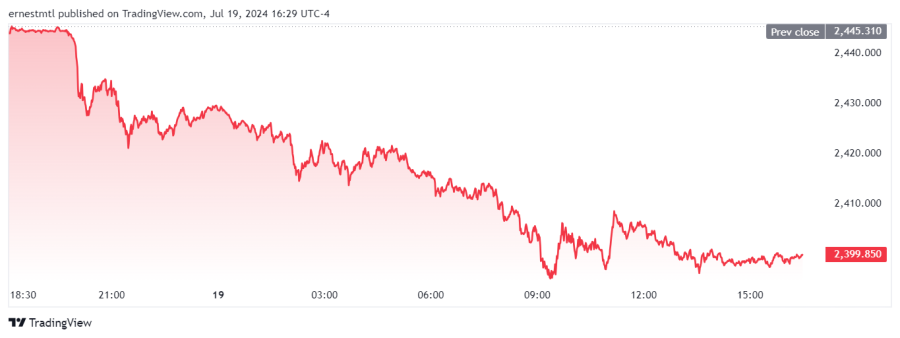

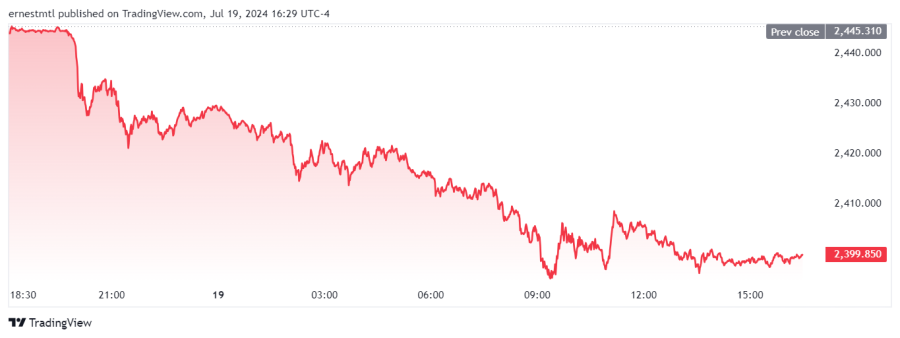

Asian and European traders once again boosted gold into the low $2470s, but after a higher-than-expected weekly jobless claims report on Thursday morning followed by a failure to break back above $2,470, spot gold began its long march lower, falling from $2,468.48 just before 11:00 am EDT on Thursday to Friday morning’s weekly low of $2,393.88 just before the North American market open.

.png)

Gold prices have continued to test the critical $2,400 per ounce level throughout Friday's trading session, but at the time of writing, spot gold had yet to see a decisive break below.

The latest Kitco News Weekly Gold Survey shows industry experts returning to a balanced stance, while retail sentiment remained optimistic about the coming week.

“Unchanged,” said Adrian Day, President of Adrian Day Asset Management. “Gold will likely need to consolidate before moving back up. Additional hints of the Federal Reserve starting its rate cutting cycle, however, could see gold up any time.”

Darin Newsom, Senior Market Analyst at Barchart.com, sees gold continuing to trend lower in the near term.

“I’m sticking with the idea gold remains in an intermediate-term downtrend on weekly charts,” Newsom said. “Looking at the more heavily traded December issue, a close below last Friday’s settlement of $2,469 would bring to an end the string of 3 consecutive higher weekly closes, fitting with a normal technical pattern. With weekly stochastics still neutral, meaning there is time and space for Dec futures to move lower, I’m looking for Dec24 to test its previous series of lows near $2,350.”

“Neutral,” said Adam Button, head of currency strategy at Forexlive.com. “The market impressively shook off the news that China has halted buying (at least temporarily) but the heavy profit-taking late in the week will be tough to reverse. Eyes are on US politics.”

“May have seen a double-top in gold,” said Mark Leibovit, publisher of the VR Metals/Resource Letter. “I have been cautious and occasionally hedging with inverse gold and silver ETFs. Risk is a near-term move down to 1900-2000, despite my longer term of 2700.”

“As always, taking it a day at a time,” Leibovit added. “Currently own NO precious metal positions, which were sold a few days ago.”

Analysts at CPM Group are recommending that investors stand aside next week, cautioning that the $92.7 price decline over the last two days “could potentially be repeated in the coming days or weeks, not only on the downside, but also on the upside.”

“Should prices settle below $2,400 today, Friday 19 July, liquidation selling on Monday could be heavy,” they said. “Or, with more bad political news the price could spike higher once again.”

CPM sees the price action for the next two weeks skewed to the downside, but the outlook is skewed to the upside after that. “In such a volatile environment, prices could move sharply either way, potentially testing $2,300 and possibly reaching $2,500 once more,” they said. “Any downside risk is likely to be short-lived, with investors using price softness as a reason to buy gold to hedge against the numerous risks.”

Bob Haberkorn, Senior Commodities Broker at RJO Futures, said that while Friday’s price weakness looked dramatic, it wouldn’t impact gold’s appeal in the medium term.

“The pullback we're seeing this morning is pretty significant,” he said. “But I think, news-wise, nothing's really changed. Bond futures are down, but the rates are pretty significant, they’ve come up a little bit here, and the dollar’s a little stronger.”

“I think what you're seeing here is just a liquidation of some of the weaker longs from the week, and it's overdone itself,” Haberkorn said. “I mean we tested $2,400, the low on the August [contract] was $2,395. I think overall it's just a shakeout of some of the weaker longs and concern about weakening demand out of China.”

Haberkorn doesn’t expect the yellow metal to stay down for long. “I think this move lower is going to be short-lived, and you'll see it as a buying opportunity,” he said. “There's no comment by the Fed that I saw on rates, or not doing a rate cut, that would justify this kind of move.”

“The geopolitical situation hasn't changed this week,” he added. “If anything, it's gotten even riskier on the geopolitical front, and with the U. S. election. And then there was news last night of some attacks inside of Israel along with the continuation of what's going on in Europe and the Ukraine.”

On the recent turmoil surrounding the U.S. election, Haberkorn said he doesn’t think a Biden withdrawal would materially impact precious metals.

“I don't think if he drops out, it would necessarily be a shock to anybody, or to the market, where it would impact gold prices or silver prices,” he said. “If there were, the shock would be the unknown. Do they go with Harris, or do they go into an open convention floor in Chicago in two weeks? There's unknowns there, but I think a lot of this is baked into the cake.”

Haberkorn sees the Fed and interest rate expectations as the main driver for gold right now. “I think If Biden drops out, it'll be a big deal, but I don't think it will be for gold. It's not going to be a game-changer in any direction.”

This week, 16 Wall Street analysts participated in the Kitco News Gold Survey, and the results showed a return to a balanced and uncertain outlook for the precious metal. Six experts, representing 38%, expect to see gold prices rise next week, while the same number predict a price decline. The remaining four analysts see gold trending sideways during the week ahead.

Meanwhile, 168 votes were cast in Kitco’s online poll, with Main Street investors remaining bullish but tempering their expectations compared to last week. 103 retail traders, or 61%, looked for gold prices to rise next week. Another 36, or 21%, expected the yellow metal to trade lower, while 29 respondents, representing the remaining 17%, saw prices trading within a range next week.

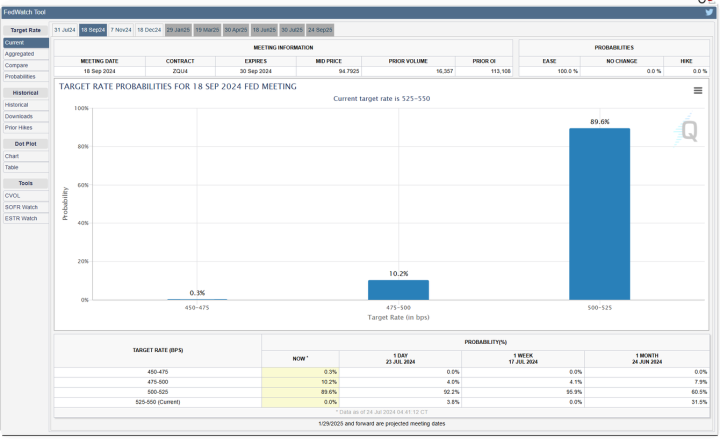

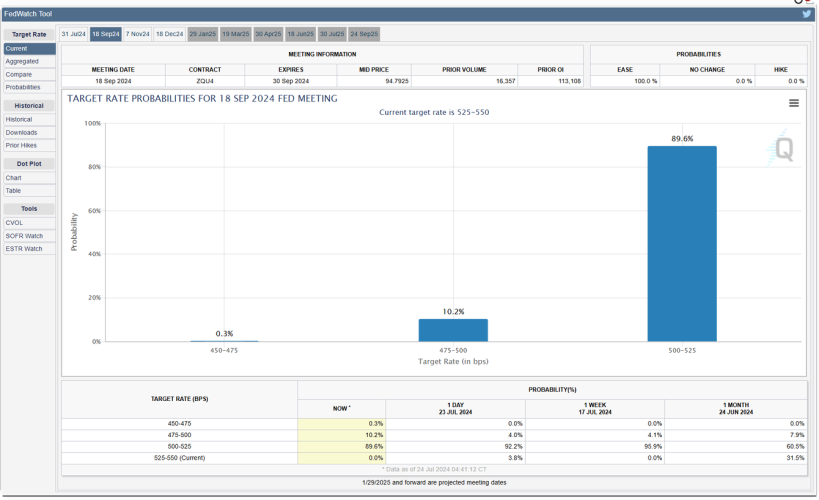

Investors will be paying attention to key inflation data next week with the release of June’s core Personal Consumption Expenditures Index on Friday morning. The Federal Reserve’s preferred inflation gauge could deliver the final confirmation that inflation is trending definitively downward, with the CME’s FedWatch Tool already indicating a more than 90% chance of a rate cut by the end of the summer.

Markets will get the first look at the second-quarter Gross Domestic Product with the release of Advance Q1 GDP on Thursday, along with durable goods orders and weekly jobless claims. Traders will also watch for key housing data with Tuesday’s existing home sales and Wednesday’s new home sales.

And the Bank of Canada will issue its monetary policy decision on Wednesday, with economists saying that weaker inflation data gives the central bank room to cut its interest rate.

Marc Chandler, Managing Director at Bannockburn Global Forex, believes the dollar and bond yields will strengthen, tamping down gold’s potential gains. “Gold is correcting lower after setting a record high near $2484,” he said. “I look for USD and US rates to push higher. This will likely see gold come off. A break of $2388 gives potential toward $2350-$2365. Momentum indicators look positioned to turn down.”

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, was attempting to gauge the drivers of market sentiment amid Friday’s downturn.

“I think we're mostly seeing fairly significant trading correction in gold,” he said. “It ran up pretty hard over a couple of weeks, from $2,300 to $2,480. That's $180. So it's given back not quite half of that, which is not unusual, and a 50 percent correction after a short-term move is no big deal.”

Cieszynski said it looks like gold is stabilizing around the $2,400 level. “If it does, then that gets encouraging again,” he said. “I still think the medium-term outlook for gold remains positive. There's just so much uncertainty and there's so much volatility out there.”

He also pointed to the moderate bounce in treasury yields and the U.S. dollar. “I think that might have just been enough to spark a bit of a correction,” Cieszynski said. “Plus, of course, it's a Friday in the summertime ahead of a weekend. Over the last several weekends, there was last week with Trump, there was two weeks ago, the French election, there was a European election. You could have people just taking a step back before weekends, especially here in the summertime.”

Cieszynski said Friday’s pullback to support at $2,400 just means that gold prices will have a clear path higher ahead of them to start next week. “It looks like gold has moved up into a higher range, and based on trading so far, it looks like around $2,400 to $2,480,” he said. “And of course, you've got that big $2,500 round number just sitting out there.”

Alex Kuptsikevich, senior market analyst at FxPro, sees significant downside risk to gold prices.

“Pullbacks after making new highs have been a typical pattern for gold in recent months, with similar retreats in May, April, March, and December,” he said in a note shared with Kitco News. “The highs were followed by a pullback, which subsided within about two weeks, leading to a stabilisation of the price and a return to the upside.”

“However, bull markets do not last forever, and traders should look for signs that this bullish trend is reversing,” he warned. “Next week could determine the momentum for months to come. Drops of more than 3% next week could repeat the pattern of 2020 and 2022 with protracted corrections of more than six months.”

“Most worrisome would be a repeat of the 2011 pattern, when the high of $1921 was followed by a 20% sell-off over four weeks,” Kuptsikevich concluded. “This peak was not rewritten until nine years later, and from the global peak to the global bottom, the value of a troy ounce almost halved, declining for more than four years.”

“Down,” said Michael Moor, Founder of Moor Analytics. “The trade above 23276 (-2 tics per/hour) warned of decent strength—we have attained $160.8. The trade above 23437 (-1 tic per/hour) projected this upward $15 minimum, $45 (+) maximum—we have attained $144.7. These are ON HOLD. I warned trade below 24648-12 will warn of pressure, likely decent—we have come off $48.6. Decent trade below 24102 (+2.5 tics per/hour starting at 6:00am) will project this downward $58.00 (+); but if we break below here decently and back above decently, look for decent short covering.”

And Kitco Senior Analyst Jim Wyckoff said he expects a period of near-term consolidation from the yellow metal. “Choppy and sideways amid routine chart consolidation after the record high set this week,” he said.

Spot gold last traded at $2,399.85 per ounce at the time of writing for a loss of 1.86% on the day and 0.54% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

Tim Moseley

.png)

.png)

.png)