UPDATE: Markethive On The Cusp Of Internal Wallet Launch

Great things are taking place behind the scenes at Markethive. It’s time for another important update, as we are on the cusp of releasing what has been an extraordinary task of building and integrating an extremely complex wallet and accounts system into Markethive. This has never been done before in the social media, marketing, and broadcasting spectrum. Hence, we’ve needed to take every precaution to make it impenetrable in terms of security and achieve scalability for the influx of users once the floodgates open.

The way forward for any business is to be online, given the current state of the world, not to mention the virtual technology that has become part of our daily lives. Considering the many entrepreneurs, businesses, and startups that use Markethive for various reasons, it embodies a cottage industry, allowing members to monetize their various initiatives within Markethive. Individual merchant accounts for eCommerce payments from your storefronts are just one aspect that will be available. Find out more about that here.

.png)

Image source: ILP. A Powerful Way To Spread The Wealth

Bonus ILPs Just Got Bigger

As all Entrepreneur One holders will know, the 0.5 ILP bonus for the last year’s loyalty to Markethive will be added to your wallet under the ILP summary by the end of February 2023. But wait, there’s more…

The CEO and founder of Markethive, Thomas Prendergast, has announced there will be another bonus of 1 ILP for all Entrepreneur One Upgrades who stay current with their subscription from February 2023 until February 2024. That means, as well as the 0.1 ILP you accumulate yearly, you will receive one whole ILP as a bonus for being consistent with your E1 subscriptions for that 12 months.

Also, if you have any number of accounts, for example, ten E1 accounts, you will receive a bonus of 1 ILP for each account. It is a highly generous gesture and one that will be upheld. It is a gift for your loyalty, so the acquisition of your regular portions of ILPs is not negated; it is not capped.

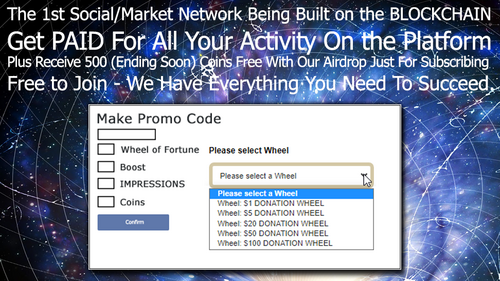

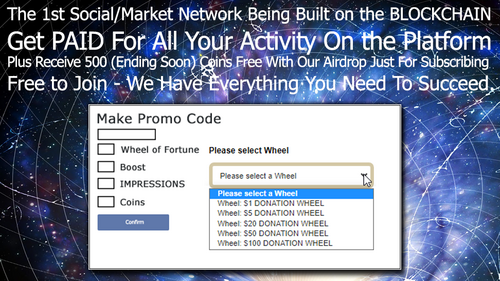

Entrepreneur One Promo Code Pending

Apart from the many other benefits of being an E1, the Promo Code gives a substantial advantage in your marketing efforts. Attach the Promo code to your Markethive capture page or storefront group for prospective sign-ups or members participating in your offer.

You can use any of the Markethive products, such as The Boost or Wheel of Fortune, impressions and tokens, pay with Hivecoin, and offer these giveaways as an incentive. So, not only do they get the Markethive airdrop of tokens upon joining, but they also receive extra rewards to help them in their marketing efforts. The great news is that the Promo Code is on the threshold of being released to Entrepreneur One members.

The Entrepreneur One Exchange

Once the release of the wallet is announced, the Entrepreneur One Upgrade will not be available for any new or free members from the Markethive administration. However, there will be an E1 Exchange where existing E1 associates can sell their E1 accounts to any member who desires the subscription. Some members have more than one or even ten E1 accounts, so they may choose to sell one.

This means the person buying the E1 assumes the monthly subscription and, if the account is kept current, will receive a 0.1 ILP at the end of 12 months of consecutive payments. This will accumulate for 20 years, whereby a balloon payment is paid out, or you have the option to continue and roll it over.

It’s important to note the E1 associates that sell their accounts will keep the ILPs they’ve accumulated. They will not be given to the new subscriber. The new subscriber will earn their own ILP portions when they take over the account.

It’s also important to note that if you decide to opt out of the E1 subscription, the ILPs or part thereof you have garnered to date remain active, and you will be compensated when the revenue payments commence. The Entrepreneur One Upgrade is fundamentally a way to reward loyal associates of an ILP worth $10,000 for only $1,200 or $1000 if you pay the subscription yearly.

Wallet Security Ready – Wallet Launch On The Cusp

Phase Two of the wallet, which includes the extra layer of security, the 2FA, is complete and activated. It’s crunch time for Phase Three and on the verge of launching the wallet. The technology built for our cold and hot wallet security is now ready for the interfaces to be installed and will be in the BETA phase for approximately two weeks. The announcement of the wallet release will take place soon after, along with the Promo Code advantage for Entrepreneur Ones only.

Immediately following the wallet launch, the Premium Upgrade will be activated for members who want to take advantage of the many features and benefits that will accelerate their earnings and results. The upgrade has five price levels starting at $9.95 per month. You can find out more about the Premium Upgrade here.

The revenue generated from the Premium Upgrade initiative is primarily income which means the ILP holders can look forward to the dividends of their ILP shares. Also, once the wallet is ‘all systems go,’ the new dashboard development and integration is the priority. This is an exciting time for Markethive and its community; all is coming to fruition, and all in the Lord’s timing.

Bitcoin Talk Engagement

With all the security in place, it’s time to introduce Markethive and our coin to the world of crypto exchanges. Also, prepare for coin transactions in our four coin wallets, Hivecoin, Bitcoin, Solana, and Elrond, in the Markethive internal wallet.

As part of Phase Three, the final stage before launching the wallet, we, as a community, are obliged to help get the word out and increase the posting activity at the Bitcoin Talk Forum. This prominent crypto meeting place is the #1 place to create activity, and crypto exchanges use it for their due diligence on prospective coins that have applied to be listed. They also look at how old, and active the thread is, so the more active, the better.

As discussed at the last Markethive meeting, the members participating in the Bitcoin Talk campaign will be rewarded. All you need to do is post in the forum, copy your post link, and paste it into the Markethive group created for this engagement.

Image source: Entrepreneur One Explained

If you are considering upgrading to Entrepreneur One before the opportunity ends (and remember that you get a bonus of 1 whole ILP this year for the full 12 months), there’s still time. Just click on the round E1 icon in the tray at the top of the home page. There will also be a countdown badge of 30 days placed on the Markethive home page in full view, giving you ample notification of its cessation to members.

Come to our Sunday meetings at 10 am MST as we approach massive significant upgrades and the wallet launch. See and hear explanations, ask questions, and witness the ever-evolving technology and concepts of Markethive. The link to the meeting room is located in the Markethive Calendar.

P.S. When we close the ability for members to acquire an Entrepreneur One from the company, it will also signify closing access to purchasing anymore ILPS from the company. There will also be an exchange for members to buy and sell their ILPS. But I want to make something very clear.

"For those early members who purchased ILPs with Bank wires and Bitcoins, we will distribute all remaining ILPs left over to you. Think about that. We appreciate what you have done."

In 2020 LinkedIn revenue reported 8.05 billion. Markethive will eventually eclipse this but when Markethive reaches 1% of LinkedIn subscribers, with revenue reaching 85 million, the ILPs will receive 20% of that revenue shared with the 1000ILPs, making each ILP worth $17,000 that year. And ILPs pay this revenue year after year. Think about that.

Tim Moseley

Gold price is going to $2,200 as central banks break the global economy – Degussa's Thorsten Polleit

Gold price is going to $2,200 as central banks break the global economy – Degussa's Thorsten Polleit

Gold is looking at its third consecutive week of losses after January's rally, which saw its best start to the year in over a decade. And now all eyes shift to next week's U.S. inflation report, with analysts saying it could be the next big catalyst for the precious metal.

Gold is looking at its third consecutive week of losses after January's rally, which saw its best start to the year in over a decade. And now all eyes shift to next week's U.S. inflation report, with analysts saying it could be the next big catalyst for the precious metal.

.png)