Wars, Asset Stripping and The Real World War

With rumors of World War III and nuclear war abounding in the mainstream news, especially in the wake of the Nord Stream enquiry, this article explores the concept of wars, and looks at how asset stripping suggests that the real war lies elsewhere.

Most importantly it shares how you can play your part in bringing an end to the wars. It is hard to do justice to this topic in one article so as with all articles of this nature, please use it as a point of reference for your own further investigation and research.

Definitions

When you think of a war what is the first thing that comes to your mind, and how would you define a war? A working definition might be that a war is something that happens between 2 countries or more. The Vietnam War, The Iraq War, and most recently Russia v Ukraine are examples of wars. However in examining the roots of war I would like to suggest another angle from which to view it, which starts within an individual.

If you agree with the natural law of cause and effect, you would appreciate that all wars start as a thought within a person, and that the manifestation is an effect of that cause, as it takes shape and materializes, whether through an individual or a collective group of people buying into the idea.

In simple terms a war is the result of a lack of capacity to resolve conflicts in a peaceable way, such that they get displaced onto people, things and nations, causing harm and loss of life and/or possessions.

Most if not all wars carry the themes of the control of money and possessions in their wake, whether it be in the name of religion or otherwise. You may think that the government funds the wars, but it is ultimately borne by we the people through multiple taxation, and the misappropriation of that money by the government in so doing. Wars can come in many forms and sizes. Here are some examples.

Cold War

A Cold War is defined online as ‘a state of political hostility between countries characterized by threats, propaganda, and other measures short of open warfare.’

Proxy War

According to the online oxford dictionary the definition of a war is one that is ‘instigated by a major power which does not itself become involved’ In other words someone else is doing their bidding knowingly or unknowingly. The Russia Ukraine war has been posited as an example of a proxy war. Take a listen to this exposition by Aaron Mate on the Russell Brand Show.

Guerilla Warfare

This is the description given to a less common war where a small group of people are up against a bigger group. It is usually revolutionary in nature against occupying forces or armies.

It is also highly tactical due to the difference in size of the two opposing factions. In fact Lao Tzu covered such tactics in his book The Art of War.

“Appear weak when you are strong, and strong when you are weak.”

The above is one example of how, deception and propaganda are tactics used to defeat the enemy.

War Re-examined

While it may seem that each government involved in war puts up the funding for their country, this idea has been challenged across history, with a different assertion, which carries the tones of the mix of a cold war, a proxy war scenario, and guerilla warfare throughout.

9/11 Revisited

You may be able to recall quite vividly your whereabouts on the day the events of 9/11 hit the news. I know I did. Like many I watched the horror events unfold as they were reported on the news media, along with the swift verdict of a terrorist attack as the conclusion.

Image Source: New York Times

I went along with that at first because by all appearances it seemed that way. It was only as the dust settled on the event that certain disparities became evident that went beyond government incompetence. Some of those disparities included:

- The premature contamination of a crime scene

- The quick dismissal of the suggestion that what was witnessed was akin to a controlled demolition

- The BBC news reporting the collapse of one of the buildings before it actually happened

- The discovery of relatively untainted passports in the molten ash

Over time more of the American people have concluded that they have been misled by their government. The fast gaining view is that 9/11 was a false flag which saw The Patriot Act come into play, allowing the government to increase surveillance on its people. Some have gone further to suggest that the removal of trillions of dollars and gold was part of the agenda for which a diversion was needed.

Covid – 2019 Revisited

There are some striking parallels between 9/11 and the so-called CoVid outbreak. Imagine you are in a theater watching a production when somebody stands up and shouts ‘fire’. The immediate reaction is that everyone runs for the exit. There is no time for analysis at that point. Benefit of the doubt is given.

Then imagine that you turn around from a distance, and do not see the gathering smoke and flames which usually accompanies an event? Like 9/11 many things did not add up. At first most people ran for cover and did as they were told. When the figure slipped in that this had a 99.9% approximate recovery rate, the wheels that validated this as a pandemic started to come off the proverbial wagon.

That does not sound like the figures which equate to a pandemic, unless you focus on the number of cases, and then amplify those figures by labeling non related deaths as Covid. The implosion gathered pace when the PCR test was stopped in December 2021 on the grounds that it was inaccurate. Even though Chris Whitty [UK] heralded this as no more than the common cold back in March 2020, and Bill Gates recently and belatedly backed that up, the desired effect had gripped much of the population.

They had been conditioned to believe what the government told them without question. Many complied with the jab recommendations out of trust, and any that questioned or decided otherwise were labelled as conspiracy theorists and potential murderers.

If we venture beyond the obvious matters of lockdown, marketing of jabs and silencing of those who questioned the narrative, there was the incredible line of inquiry about patents discussed by David Martin. David Martin worked in national intelligence as an analyst studying linguistic genomics and exposed one of the biggest tax fraud operations in America.

His scrutiny of patents and how they relate to certain diseases was an education to say the least, and added more fuel to the fire of the efficacy of the narrative we were sold. Note in the documentary, his comment about coronavirus being deemed to be an easily exploitable mechanism for ‘good and ill’.

The question had been posed. How can you have a patent for a naturally occurring virus such as the novel coronavirus? Either the patent is illegal or the virus is man made.

There’s a saying that in a sea of corruption the truth takes a while to surface, and certainly serious questions are arising as time goes with this. It is notable that a war has broken out between Ukraine and Russia, at a time when declassified documents were evidencing gain of function studies with viruses.

Image Source: Kanekoa Substack

The list of jab injuries surpasses what has gone before, yet calls to stop the experimentation have gone unheeded. In the past they would have been stopped. This is remarkable given that it is now known that Pfizer blanked many of their documents relating to the experimentation and have also said they did not know before they went to market if their jabs would prevent the virus.

Their argument of course is that they needed to act quickly, which only begs the question as to why they did not at least exhaust the use of ivermectin and hydroxychloroquine as examples of effective and safe medicine against viruses. So why not allow people to make an informed choice, rather than coerce them into taking the jabs or villifying them if they objected and expressed reservation? This is especially relevant given that they have never isolated and identified this ‘novel’ virus, as verified through Freedom of Information Act requests.

The argument now gathering momentum is that there was an orchestrated attempt to crash the economy, as the nations were already bankrupt, in order to introduce the CBDC, which would undergird the New World Order, and essentially control the populace, a bit like the social credit system in China. The latest UK Prime Minister Rishi Sunak has wasted no time announcing CBDC as the intended direction.

The same question arises here as for 9/11. If we are being misled, why would the powers that be go to such lengths and turn on their own to do this? Former technical director of NASA Chief Bill Binney offers an inside view and explanation with reference to surveillance as it relates to population control, and totalitarianism.

Another clue that leaves an enduring trail is the assertion that the banking cartel funds both sides of the war. The obvious references are the Rockefellers and Rothschilds. Here is what David Rockefeller said before 1981 when he was Chairman of Chase Manhattan Bank.

“We are on the verge of a global transformation. All we need is the right major crisis and the nation will accept the New World Order.”

Is it a surprise to learn of John D Rockefeller’s controlling influence in media, money, education, health and politics, and that he was dubbed the founder of the pharmaceutical industry? Is it a wonder that medical error is the third leading cause of death in America with such influence behind the scenes?

So the concept of crisis is a core part of their strategy, and it goes back beyond the era of the Rockefellers, although they seem to turn up in a lot of places. This money masters article traces the history and interface between politics and banking and is well worth a watch to understand the context on which the assertion is made, namely that bankers rule the world and are the true perpetrators of such global events.

If this assertion is true that means most if not all wars are illegitimate if not unlawful. It also means that those funding the wars in this manner create and drive the narrative. What cannot be disputed is that wars reduce populations and leave massive debt, and ultimately it is we the people who pick up the bill indirectly through multiple taxation. Whilst I do not mind paying taxes to build my community and country I do mind paying taxes to fund illegitimate and unlawful wars.

Now in a genuine war you might expect deception and manipulation of information in order to defeat the enemy, as Lao Tzu alludes to in his tactics of war. However, when this strategy is turned against innocent people who fund their government believing that they are using those resources on their behalf to add to the quality of life, this becomes a different matter altogether.

As long as humanity remains ignorant to this the same few will just keep rinsing and repeating their agenda. When they don’t bother to hide their intentions you can glean from this that this is the acid test of whether their planned conditioning of the people through mass media and abuse of their status has succeeded.

"We'll know our disinformation program is complete when everything the American public believes is false." – William J. Casey, CIA Director (1981).

The Real War

Some have described the real ongoing war as one based on religion or race, and while this may have merit, the concept of asset stripping carries a greater clue and broader scope as to the nature of the real war in play.

Asset Stripping and War

One of the dictionary definitions for asset stripping is as follows:

‘the practice of taking over a company in financial difficulties and selling each of its assets separately at a profit without regard for the company's future.’

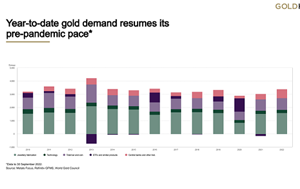

Now if you apply that definition to the well known true story of the confiscation of gold from the people in 1933 when America went bankrupt, it seems that the definition was flipped in favor of the ones experiencing ‘financial difficulty’ in the form of bankruptcy.

They, the government, were able to strip the people of their hard earned money through an executive order, so that they could continue to operate in business. They managed to convince the people that the ownership of gold was hurting the economy, and most bought into it through belief or fear or both.

The abuse of power led to the selling of a false narrative, which enabled them to profit from the gold they confiscated, while pushing the people into further debt and enslavement. This game of smoke and mirrors has been played for so long, that they do not bother to hide it anymore, leaning instead on the ignorance and conditioning of the people so they can openly pillage them.

Image Source: Thesaurus.Plus

Asset stripping can take many forms. Since 2020, here in the UK certain bills have been passed through parliament by decree, which further restricts privacy and freedom of choice.

The Coronavirus Act 2020 – this allows you to be medically detained and injected against your will if you are suspected to be infected.

The Telecommunications Leasehold Act 2021 – applies to leasehold properties where access can be gained to install communication transmitters, receivers including 5G masts without needing the permission of the landlord.

Financial Services Act 2021 – allowing funds to be removed automatically from your account.

Data is an inherent theme and of itself another asset being stripped. This got highlighted in the case of Facebook and Cambridge Analytica. Two years ago the UK government under Boris Johnson intimated that they cannot guarantee they would not sell off the NHS and share our health data with external third parties.

Coming up in the UK is the move to remove Human Rights with the abolishment of peaceful protest, as one example. Also unfolding under the guise of climate change are climate lockdowns. In Kent and Oxford you can now be fined for driving outside of your zone for more than 15 minutes.

Over in the Netherlands there is a concerted targeting and shutting down of farmers by the government, in the name of climate change. It is not that there are no issues regarding health and climate, yet much of what we are told through the media relies on the controlling influence, the motive and the agenda of those invoking their powers.

So far it appears that at the very least there is an overreach and disproportionate attention given to these matters which are not advancing humanity in general, but are stealing from them in a dystopian fashion.

Is it possible therefore, that 9/11, Covid 19, Ukraine v Russia, are examples of distractions or trojan horses to the agenda of a new world order, using false narratives to bring in surveillance technologies such as vaccine passports and control via climate agenda restrictions.

It seems that way, in which case the objective is human enslavement and the reduction of the world’s population. Apart from Bill Gates's open admission of a depopulation agenda, the biggest indicator yet that this is true is the censorship on anyone who questions the established narrative. If you fit that profile as someone with a free thinking mind who welcomes debate and discussion, you are now an enemy of that state, where the real war is the globalists versus we the people.

Under the guise of proxy wars, guerilla wars and cold wars, our freedom of speech, health, travel and general liberty is being eroded in a tactical masterclass, with the latest lockdown taking the form of climate agenda restrictions.

The weapons may be different, whether it be propaganda, mind control, biowarfare or lately, direct energy weapons to fuel the climate agenda. The studies of fires in California lend weight to the use of direct energy weapons to convey a climate emergency.

The nature of the war may seem unconventional and insidious, but it is very real. What will they resort to next? Will they use holographic technology as expanded in Project Bluebeam, to simulate an alien invasion so they can secure central power and a new world order?

We are being weaponized to kill in the name of war, to be carriers of propaganda in the latest global event, or injected with DNA altering substances which renders unsuspecting individuals as potential candidates for the next patent where they are literally owned by the government.

All of these things take place because of the unwitting acceptance of the government's propaganda through our misplaced trust in them. This behavior suggests that the real enemy of the state as seen through the eyes of the government are we the people. By the same token it means the real enemy from our perspective are the puppet masters of the corrupt officials in government worldwide.

The prevalent actors and puppet masters appear to be The Banking Cartels with their supporting cast such as The Vatican, The Committee of 300, The Illuminati, and so on.

Cessation of War

Lao Tzu also leaves clues as to how to end war – by knowing self and the enemy

“The supreme art of war is to subdue the enemy without fighting.” “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Since all change starts within we must remain conscious and particularly become conscious of the war within when we are not able to resolve inner conflicts. We must know ourselves in that respect.

We need to find peaceful ways of resolving these conflicts through forgiveness, compassion, responsible thinking and resolve, so they do not become projected into society on a bigger scale. As within so without, according to the natural law of cause and effect.

Secondly, we must also know the enemy from without, and recognize the real war going on in the external world. We need to journey from being brainwashed to cleaning our minds from the pollution and propaganda that is designed to reduce our lifespan or enslave us, and awaken to understand the game that is being played out with a disdain for humanity as a whole.

Does the greater populace of a country really want a war, or is it down to a few who are perpetrating wars with hidden agendas? Do we want the control of transhumanism where we are patented through abusive use of artificial intelligence, and programmable CBDCs that can switch our money off. Do we want to be told what we can think, where we can go and how we can live our daily lives, like puppets on a string?

Are we willing to go beyond the labels of calling people sheep or conspiracy theorists to simply seek the truth that will enable all to be and live freely, because the truth is what is at stake, and therefore true freedom?

Thirdly we must be practical and create structures that enable humanity to go beyond survival, and share abundance, so all may thrive. Whether this be in technology, money, organic farms or otherwise, it is important to create a better world for all to experience so they can step into something new and shed the old.

When these alternate societies become prominent the old controlling powers that feed off the life force of the people can be extinguished. In its place, true power can return to the people where they become stewards and facilitators of abundance in all its forms.

About: Anita Narayan. (United Kingdom) My life's work is about helping individuals to greater freedom through joy and purpose without self-sabotage, so that inspirational legacy can serve generations to come. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

Tim Moseley

.gif) Expect a '75 bps hike,' as Powell zeroes in on inflation – Chance Finucane

Expect a '75 bps hike,' as Powell zeroes in on inflation – Chance Finucane

.gif)

.gif)

.png)

.gif) World Bank sees gold prices falling another 4% in 2023

World Bank sees gold prices falling another 4% in 2023