The Power Dynamics of A Global Economy: Who Is Ultimately Pulling The Strings?

The question of who controls the global economy can vary depending on one's viewpoint. Some may argue that Mega Banks such as JP Morgan, asset managers like Black Rock, tech giants like Microsoft, or international organizations like the World Economic Forum hold significant influence. However, there is an overarching entity that surpasses these institutions. It is worth noting that these entities share common goals and interests, such as Central Bank Digital Currencies (CBDCs), Digital IDs, and Smart Cities. This alignment is not a mere coincidence.

In this article, we will uncover the true power behind the world's most influential institutions. Surprisingly, it is the United Nations that is orchestrating it all. There seems to be a pattern, so it’s worth investigating as to whether it is the UN pulling the strings. We embark on an eye-opening journey through the hidden depths of global control, where the United Nations takes on the role of puppet master, manipulating events to carry out their sinister agenda. The United Nations presents itself as a symbol of peace and collaboration, but what lies beneath its admirable facade?

We will delve into the history and purpose of the UN, exploring its origins and transformation into a powerful force with evil intentions. Brace yourself as the manipulation tactics the UN employs, from secret agreements to strategic alliances, are exposed. They have become masters at pulling strings and subtly guiding governments toward their desired goals.

Image Source: Defenseindepth.co

The Historical Roots

In the early 19th century, a series of relentless wars and conflicts had a profound impact on the global economy. In the aftermath of the Napoleonic Wars, prominent European nations made a concerted effort to establish a prolonged period of peace. This initiative culminated in the creation of the Concert of Europe in 1815, an unprecedented international organization dedicated to preventing member states from engaging in armed conflict. Despite its noble intentions, the Concert of Europe ultimately failed to maintain peace, succumbing to the pressures that led to the outbreak of World War I in 1914.

However, a previous example has been established. Following the war's conclusion in 1918, the authorities decided to once again pursue a period of tranquility with the League of Nations in 1920. What set this attempt apart was that the League of Nations encompassed multiple objectives beyond averting war. Many of these objectives were centered around human rights, including matters such as working conditions. Unfortunately, the League of Nations did not endure as long as its forerunner. It disintegrated when the Second World War commenced in 1939, less than two decades later.

However, the third attempt was more successful. By the conclusion of World War II in 1945, the UN had been established with great efficiency, although its official foundation came a month later. Like its precursors, the UN emerged from the initiative of the ruling nations, of which there were 50 at the time. Nowadays, the UN encompasses practically every country worldwide, comprising 193 nations.

Similar to the League of Nations, the main objective of the United Nations was to maintain peace. Nevertheless, its initial Charter encompassed an extensive range of additional aims to keep member nations engaged. These objectives comprised not only humanitarian endeavors but also the promotion of global collaboration on various other worldwide concerns.

The crux of the matter is that if you purport to have concerns that affect the entire world, then it follows that you must also advocate for solutions that can address these issues on a global scale. However, the only way to achieve such universal solutions is by establishing a unified global authority, which is what the United Nations represents. This logical progression implies that a single global currency and military, among other things, would also be necessary.

In 1948, the United Nations formed its military branch shortly after its establishment. The UN's first peacekeeping mission took place in 1956. Following the end of the Cold War in 1988, the UN's military role evolved to encompass not only controlling tensions within countries but also regulating the population. Notably, the UN recently announced plans to extend its peacekeeping efforts to social media by creating a so-called digital army, which will combat misinformation and disinformation.

At this point, it should be clear that this refers to content those in authority disapprove of. The announcement explicitly mentions that the United Nations' online force will also address any data that hinders the advancement of the Sustainable Development Goals (SDGs).

For those unfamiliar, the SDGs encompass 17 objectives that every member nation is required to achieve by 2030. It is the reason why countries are hurrying to introduce digital IDs, Central Bank Digital Currencies (CBDCs), and smart cities. The SDGs dictate the adoption of these dystopian technologies by 2030, only seven years away. With time running out, the UN and its associated organizations are striving to expedite their implementation.

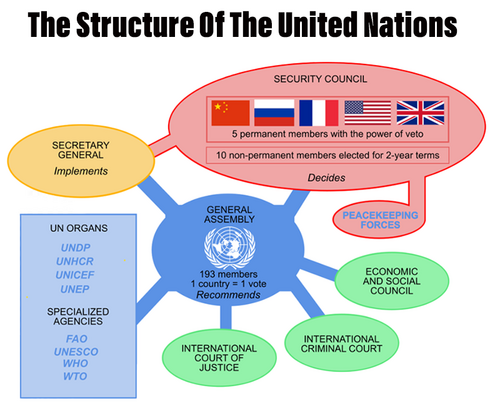

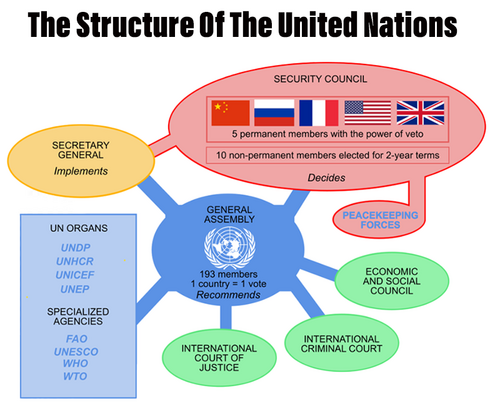

The question arises as to who has control over the United Nations. In order to provide an answer, it is necessary to comprehend the functioning of the UN. As the UN is commonly known as an international organization, its different divisions are often called organs. The UN is composed of six organs, namely the General Assembly, the Security Council, the Economic and Social Council, the Secretariat, the International Court of Justice, and the Trusteeship Council.

Image source: Blogger

The Roles Of The Six Organs

There’s not much worth noting about the International Court of Justice except that it’s the sole United Nations entity not headquartered in New York City. Regarding the Trusteeship Council, its purpose was to facilitate the attainment of sovereignty for nations, but it ceased operations in 1994.

In any case, the United Nations General Assembly comprises 193 member nations. Representatives from these countries convene annually in September to engage in deliberations and voting on resolutions. Resolutions of great importance necessitate a 2/3 majority approval, while less significant resolutions require a simple majority (over 50%).

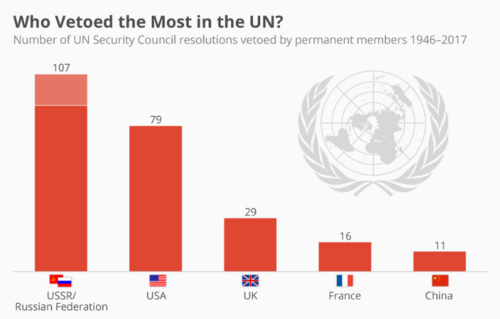

Moving on to the Security Council, it consists of 15 countries, with five permanent members and ten rotating members who change every two years. The permanent members are France, Russia, China, the United States, and the United Kingdom, which were the victorious nations of the Second World War.

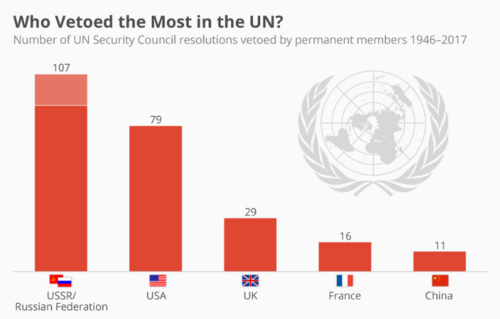

The United Nations Security Council's five permanent members hold the authority to veto significant resolutions, a contentious issue because it enables these countries to dismiss any UN decisions that negatively impact them. Although Russia's use of veto power has garnered significant attention, it was the United States that insisted on veto power in exchange for its membership in the UN. It is believed that the veto will remain an integral part of the Security Council, as removing it would require the United States and its allies to relinquish their own veto power.

Image Source: Statista

It is essential to be aware that the United States attempted to obtain a resolution from the United Nations to justify its invasion of Iraq following the 9/11 attacks. Despite the rejection of this resolution by the United Nations, the US proceeded with the invasion anyway, contributing to a complex and controversial struggle for dominance on the global stage, with no party emerging untainted from the conflict.

The United Nations' administrative organ, the Secretariat, plays a crucial role in the creation, passage, and enforcement of UN resolutions. The leader of the Secretariat, known as the Secretary-General, is selected by the Security Council and elected by the General Assembly for a five-year term. Interestingly, while there's no limit on the number of terms a Secretary-General can serve, none have stayed in office for more than two terms – yet.

However, the past records of selecting Secretariat officials expose the individuals in control. It appears that the UN underwent a significant transformation in the early 1990s. It is important to note that the approval of resolutions necessitates a 2/3 majority vote or a simple majority vote. It should be clarified that every member nation holds an equal vote in this procedure, regardless of their contribution level to the UN.

The implications of this go beyond what you might initially think. The country with the most sway over other nations can effectively control the United Nations, which has major consequences. In the 1990s, it seemed like the developing world was gaining momentum, and the US and its allies were not pleased with this shift in power dynamics.

During the early 1990s, the United Nations Secretary-General was Boutros Boutros-Ghali, a representative from Egypt. However, the United States strongly opposed his leadership and went so far as to offer him a nonprofit foundation in exchange for his resignation. Despite the offer, Boutros-Ghali refused to resign and was subsequently denied a second term (vetoed by the US) even though most member countries had supported his return. Since then, the United States has exerted significant influence over the selection of subsequent Secretary-Generals, ensuring that they have been aligned with American interests.

Kofi Annan, a Ghanaian diplomat, succeeded Boutros-Ghali. He also introduced the Millennium Development Goals (MDGs) before the Sustainable Development Goals (SDGs) were established. Notably, he drafted the original letter that spawned the concept of Environmental, Social, and Governance (ESG) investing in 2004. Interestingly, the SDGs heavily influenced the criteria for ESG. Moreover, Antonio Guterres, the current Secretary-General from Portugal, actively promotes the SDGs. He has played a crucial role in advocating for digital IDs, central bank digital currencies (CBDCs), and smart cities.

Unelected and unaccountable international organizations advocating for the interests of both private and public sectors, including large corporations and governments, are driving the development of these dystopian technologies. For example, the World Economic Forum (WEF) collaborated with the UN to expedite the adoption of its Sustainable Development Goals (SDGs) using Environmental, Social, and Governance (ESG) measures in 2019. Additionally, entities such as the International Monetary Fund (IMF) and the World Bank, operating under the UN umbrella, represent the public sector's involvement in these efforts.

In organizations such as the WEF, there are influential financial institutions like Bank of America and investment managers like BlackRock who oversee the allocation of funds, making sure that individuals and institutions adhering to ESG principles receive the necessary financing to support the achievement of the SDGs. Additionally, technology companies like Microsoft play a crucial role in developing critical technologies for this purpose.

The World Economic Forum aims to shape the public sector through initiatives like the Young Global Leaders, which identifies and develops future leaders of nations, and Global Shapers, which focuses on cultivating local leaders, including mayors. Additionally, institutions like the International Monetary Fund and the World Bank offer loan programs to developing countries with favorable terms, provided they align with the Sustainable Development Goals and US interests.

Organizations such as the Financial Action Task Force (FATF) have also had a significant impact in this area. Likewise, the International Monetary Fund (IMF) aims to influence the private sector by implementing regulations that lead to centralized systems in developed nations and corrupt leadership in developing nations. This enables developed countries to maintain control over their own populations and also manipulate developing countries. Consequently, very few developing nations have been able to transition into developed nations in the past fifty years.

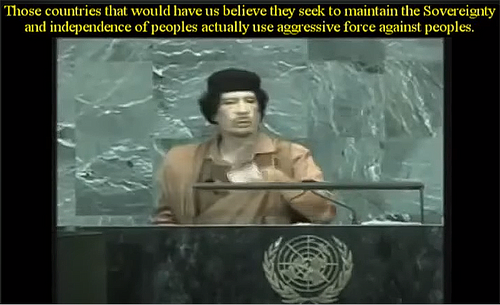

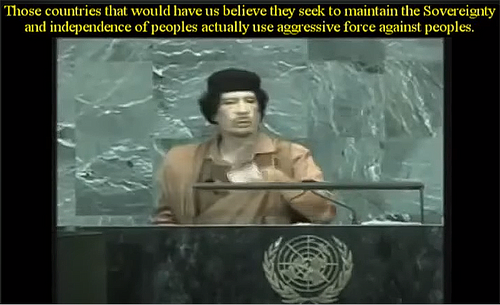

The current state of affairs has left much to be desired for most of the United Nations member states. Over the past few decades, numerous leaders have taken to the podium at the UN's General Assembly to express their opinions. One of the most notable figures to do so was former Libyan Prime Minister Muammar Gaddafi, who delivered a lengthy and impassioned speech that lasted over 90 minutes in 2008 and even included a dramatic moment where he tore a page from a copy of the UN Charter.

Screenshot: Muammar Gaddafi's speech at the United Nations General Assembly

Since 2011, Libya and North Africa have been in turmoil following the assassination of Gaddafi, allegedly orchestrated by US interests. Hillary Clinton's infamous quote, "We came, we saw, he died," references this event. Considering Gaddafi's demise, it is unsurprising that UN countries have been cautious about challenging the United States. However, this has not prevented other leaders from expressing their views, although they have become more careful in doing so.

Xi Jinping and Vladimir Putin are particularly notable examples. In recent years, they have refrained from personally attending the UN's annual assemblies, choosing instead to send their top diplomats. The last time they physically addressed the UN's General Assembly was as far back as 2015. Strangely, their speeches appear absent from the UN's YouTube channel, as if they have been deleted.

Image source: United Nations

Covert Operations of the United Nations

NGOs and education systems often work closely with the UN, assisting in various initiatives. These organizations, while seemingly well-intentioned, have a significant presence in society, including our education systems, where they aim to convey their message. It's as if they are gradually influencing how we learn, one classroom at a time. They cover topics like identity politics and climate change, potentially shaping the minds of young learners.

If you look closer at the materials they produce, you might find that they emphasize what to think rather than how to think critically. This raises questions about independent thought when a collective "woke" mindset is seemingly imposed.

The UN has become a master of manipulation, employing a wide array of tactics to advance its agenda discreetly. Behind their polished image, they offer promises of global harmony while quietly working to shape the world to their liking. But how exactly do they pull off this elaborate act? Well, they've honed the craft of charm, coercion, and cleverly concealed power plays. These manipulation tactics are carefully designed to ensure their agenda remains unchallenged.

One of their most favored tactics involves using funding as a strategic weapon. Governments that align with the UN's objectives receive financial aid and international support as a reward. Conversely, those who dare to question the UN's motives may be cut off from vital resources and isolated diplomatically. Their influence extends far and wide, infiltrating and subverting national sovereignty through a web of alliances, treaties, and agreements.

Countries are entangled in a complex web of obligations and dependencies, often unable to make decisions without considering the UN's interests. It's like a colossal chessboard, with the UN skillfully moving the pieces while governments scramble to stay in their good graces. They strategically cozy up to key players and cultivate a network of loyal followers, all while maintaining a facade of impartiality and neutrality.

As for the governments under the UN's influence, the list is extensive, encompassing both developed and developing nations. From superpowers like the United States to smaller countries striving for independence, no one is immune to the UN's puppeteering. How does this connect to the UN's broader agenda? Well, fasten your seatbelt because it's quite a journey. Their ultimate goal is nothing less than global domination, albeit subtly and inconspicuously.

Population control stands out as one of their key strategies. Under the guise of family planning and reproductive health, they promote policies that restrict individual freedom and interfere with personal choices. This is a clever means to manipulate demographics and ensure their vision of a controlled world becomes a reality. But their agenda doesn't stop there.

Economic manipulation is another tool in their arsenal. By concentrating power and widening the wealth gap, they create a world where a select few hold all the cards, perpetuating the cycle of the rich getting richer and the poor getting poorer.

Climate change has also become a convenient crisis for the UN's objectives. They exploit the fear and concern surrounding environmental issues to push for global regulations and policies. While protecting the planet is undeniably important, it's hard to ignore that the UN leverages it as a tool to advance its agenda of centralized control. And let's not forget about global governance. By eroding national sovereignty and promoting the idea of a new world order, they aim to establish a system where the UN reigns supreme.

But what about freedom of speech and independent media? Well, they might as well be a thing of the past. The UN's influence on media and its inclination for censorship and control directly threaten the fundamental principles of democracy. They dictate what information is disseminated, effectively molding public opinion to align with their agenda. It's as if George Orwell's "1984" has never felt more relevant.

Now, who are the puppeteers behind this grand operation? At the forefront is the Secretary-General, the face of authority but perhaps just another puppet dancing to the UN's tune. Then there's the General Assembly, which should serve as a voice for all but often acts as a rubber stamp for the UN's decisions. And let's not overlook the Security Council, supposedly a protector of nations but frequently serving the UN's interests instead. Behind closed doors, the real power lies within the Secretariat, an intricate web of bureaucrats and administrators who make the strings dance to the UN's tune.

Furthermore, the UN employs the tactics of infiltration and indoctrination as part of its core strategies. They infiltrate non-governmental organizations (NGOs) and educational systems, subtly spreading their ideology and molding minds to align with their vision. It's like a slow and steady form of brainwashing, with the UN orchestrating the process. Then there's Agenda 2030 and beyond. It may sound harmless, a plan for global development and sustainability, but upon closer examination, it reveals itself as a blueprint for control and manipulation.

Manufacturing crises are another tactic in the UN's extensive toolbox. From conflicts to humanitarian disasters, they exploit these situations to push their agenda and gain more control. It's akin to a dark and twisted chess game where innocent lives are treated as mere pawns. And we must not underestimate the UN's ability to employ treaties and conventions as instruments of global influence. They effectively legalize control, disguising it as international law. By manipulating these agreements, they can override national sovereignty and dictate the terms of international relations.

Conclusion

The United Nations is often portrayed as the world's saviors, but behind the scenes, they are the puppet masters, orchestrating the actions of institutions and governments to further their agendas, sometimes controversial objectives.

In this exploration, I've uncovered a world where appearances can be deceiving. It's a world where institutions and governments may find themselves unwittingly influenced by the UN's behind-the-scenes maneuvers. Our journey has taken us through the UN's history, its manipulation strategies, and the influential individuals who play a role in its intricate web of global influence.

The key takeaway here is that knowledge is power. By understanding the UN's tactics and strategies, we can liberate ourselves from potential manipulation and contribute to a world characterized by genuine freedom and sovereignty. It's time to shed light on the puppeteers and reclaim control over our destinies. If you once considered this article a mere conspiracy theory, it might be time to reassess. Reality often surpasses the strangest fiction. So, it's vital to stay vigilant, question the status quo, and remember that the United Nations' actions are constantly under scrutiny.

.png)

About:

Prince Ibenne. (

Nigeria) Prince is passionate about helping people understand the crypto-verse through his easily digestible articles. He is an enthusiastic supporter of blockchain technology and cryptocurrency. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

China continues to dominate the gold market with a 12-month buying spree, adding 23 tonnes in October

China continues to dominate the gold market with a 12-month buying spree, adding 23 tonnes in October

.gif) Hedge funds losing interest in gold as the market searches for a new catalyst

Hedge funds losing interest in gold as the market searches for a new catalyst

.gif) The Fed's monetary policy is irrelevant and won't stop gold's push above $2,000 – abrdn's Robert Minter

The Fed's monetary policy is irrelevant and won't stop gold's push above $2,000 – abrdn's Robert Minter

The Kwon Identity: Fugitive Terraform Labs founder Do Kwon arrested using fake papers in Montenegro

The Kwon Identity: Fugitive Terraform Labs founder Do Kwon arrested using fake papers in Montenegro

.png)

Singapore, Japan, Switzerland, and the U.K. partner on digital asset pilot programs

Singapore, Japan, Switzerland, and the U.K. partner on digital asset pilot programs

When the Fed starts c

When the Fed starts c