Will gold price benefit from classic bear market rally in equities?

There is a new battle in the gold market as the precious metal continues to benefit from a weaker U.S. dollar and falling bond yields; however, shifting risk sentiment, as equity markets end their seven-week losing streak with a 6% rally, presents a new headwind for the precious metal.

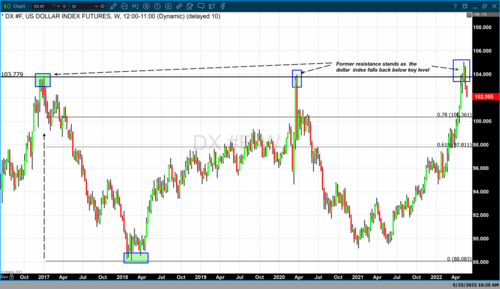

The gold market managed to hold steady around the critical psychological level of $1,850 this week as the U.S. dollar dropped from its highs earlier in the month. The U.S. dollar index ended the week below 102 points and is down 3% from its 20-year peak.

Meanwhile, bond yields have fallen to 2.74%, down more than 13% from their recent highs above 3%.

Nicky Shiels, head of metals strategy at MKS PAMP Group, said that the weak U.S. dollar and falling bond yields could help gold push solidly above $1,850 in the shortened trading week. However, she added that risk sentiment among equity investors will be a wild card.

"The missing piece is equities are entering a vicious short-covering rally now and there's limited panic about either a recession, stock crash, or Fed hikes," she said.

According to some market analysts, risk sentiment in the marketplace has improved inflation fears have receded. Investors breathed a little easier Friday after the U.S. Department of Commerce said that annual inflation rose 4.9% last month, down from 5.2% in March and from February's peak of 5.3%. Inflation fell in line with market expectations.

The data also reported healthy consumption; however, economists note that U.S. consumers continue to dip into their COVID-19 savings, which could be unsustainable.

Some economists have said that the inflation data gives the Federal Reserve some room to raise interest rates less aggressively in the fall and into year-end. Wednesday, the Federal Reserve signaled that it is looking to raise interest rates by 50-basis points at the next two meetings, in line with market expectations.

However, for many analysts, the current risk sentiment is not sustainable as inflation pressures are far from over, ultimately supporting gold.

Billionaire Bill Ackman says Fed needs to raise rates now to beat inflation, protect the economy

Billionaire Bill Ackman says Fed needs to raise rates now to beat inflation, protect the economy

"Energy prices continue to rise and will drive inflation pressures higher," said Sean Lusk, Co-Director of Commercial Hedging with Walsh Trading. "Inflation will add to growing recession fears, making gold an attractive safe-haven asset."

Phillip Streible, Chief Market Strategist at Blue Line Futures, said he sees the jump in equity markets as a classic bear market rally. He added that he also considers gold a critical safe-haven asset.

"Technically, gold holding $1,850 an ounce looks good," he said. "Not only did gold see a solid bounce off last week's low, but its measure of volatility has fallen. Gold does well when it sees low volatility. Investors are attracted to that stability when there is uncertainty everywhere."

Not all analysts are optimistic that gold prices will be able to hold the line at $1,850 an ounce.

While inflation may have peaked, Bark Melek, head of commodity strategy at TD Securities, said it will remain quite sticky through 2022.

"It is probably more wishful thinking that inflation will fall significantly and that the Federal Reserve will stop aggressively raising interest rates," he said. "The Fed will continue to raise interest rates and that will be negative for gold."

Melek added that he still likes selling rallies in the gold market.

Some analysts have noted that a plateau in inflation within the Federal Reserve's aggressive tightening cycle will push real yields higher, making gold less attractive as a non-yielding asset.

" Looking at gold, in particular, the US TIPS yield is now comfortably in positive territory, which will dampen investment demand for gold given that it offers no yield," said commodity economists at Capital Economics.

U.S. data to provide little direction for markets

Although U.S. markets are closed Monday for Memorial Day, it will be a busy week for economic data.

Friday, economists and analysts will be anxious to see the latest non-farm payrolls report to see how the labor market fairs in the current economic environment.

While major data reports will be released next week, market analysts have said that they will have little impact on interest rate expectations.

Economists have said that the central bank looks set to move by 50-basis points at the following two monetary policy meetings, no matter what the data says.

Next Week's Data

Tuesday: U.S. Consumer Confidence

Wednesday: Bank of Canada monetary policy decision; ISM Manufacturing PMI

Thursday: ADP Non-Farm Employment Change

Friday: U.S. Non-Farm Payrolls; ISM Service Sector PMI

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

.gif) Gold price still on pace to push above $2,000 as stagflation, recession risks rise – In Gold We Trust

Gold price still on pace to push above $2,000 as stagflation, recession risks rise – In Gold We Trust.gif)

.gif)

The coming recession will be mild; the U.S. economy could boom if Republicans win elections – Mark Skousen

The coming recession will be mild; the U.S. economy could boom if Republicans win elections – Mark Skousen.gif)

.gif)

Hedge funds continue to sell gold but sentiment is shifting

Hedge funds continue to sell gold but sentiment is shifting.gif)

.gif)

.gif) 2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

2022's $1 trillion crypto wipeout: 'necessary cleansing' of excess speculation just like dot-com bubble – Bloomberg Intelligence

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova

U.S. dollar will keep gold price under pressure – VanEcK's Foster and Casanova.gif)

.gif)