Crypto weekend meltdown: Bitcoin price touches $17k, Ethereum below $900 as renewed selloff sends prices spiraling

The crypto space faced another sharp selloff during the weekend as Bitcoin plunged below $18,000 and Ethereum dropped below $900.

The overall crypto market cap plummeted to $847 billion, down nearly 10% on the day. Bitcoin touched $17,677, the lowest level since November 2020, and Ethereum fell to a low of $893, the level last seen in January 2021.

"Bitcoin appears to be hanging on for dear life as cryptocurrencies remain in meltdown mode. The worst week since the early days of the COVID pandemic has widespread crashes across Bitcoin, Ethereum and Dogecoin," said OANDA senior market analyst Edward Moya.

At the time of writing, Bitcoin was at $18,633, down 74% from its November all-time high of $69,000, and Ethereum was at $948, down 81% from its November all-time high of $4,878.

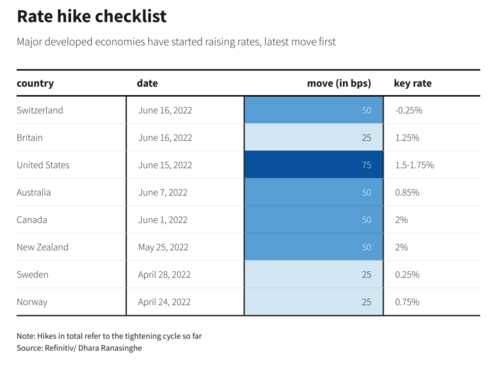

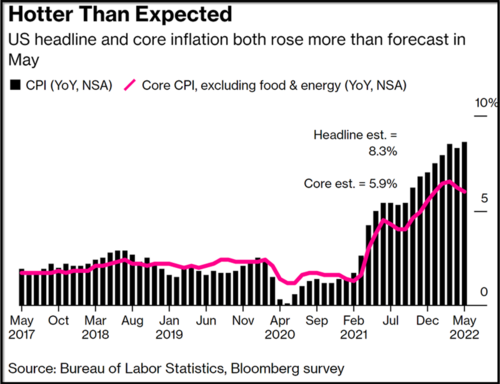

The initial trigger behind the massive crypto drop in June was the macro environment. First, a surprising hot inflation number from May caught markets off guard, followed by a 75-basis-point hike from the Federal Reserve on Wednesday – the biggest rate increase since 1994.

The dramatic shakeout in crypto also garnered steam following contagion risks from within the crypto community itself after a lending company Celsius said it was halting all transactions on its platform. To learn more about that, click here.

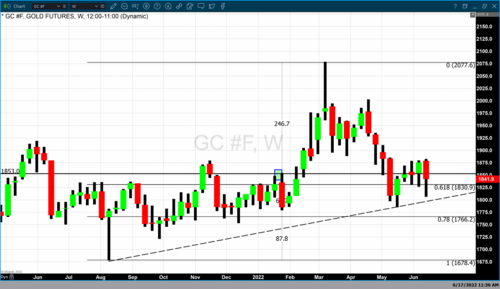

After failing to hold several key support levels, analysts now watch a price area below the $14,000 mark.

"Bitcoin is sharply lower today after having accelerated to the downside following the breakdown from its consolidation phase. It is currently down about 14%, bringing its month-to-date loss to about 44%," said Fairlead Strategies founder and managing partner Katie Stockton. "The breakdown is unconfirmed (it has not spent enough time below to make it decisive), but it shows the risk inherent to risk assets right now. If we see consecutive weekly closes below $18.3K, risk would increase to next support below $13.9K."

Stockton added: "We do not recommend counter-trend positions, however, noting momentum is strongly negative."

During the first two weeks of June, investors have continued to position themselves defensively, and crypto's upside potential remains limited until stagflation fears subside, said Bank of America's global crypto and digital asset strategist Alkesh Shah.

"Although painful, removing the sector's froth is likely healthy as investors shift focus to projects with clear road maps to cash flow and profitability vs. purely revenue growth. The digital asset ecosystem is an emerging high-growth speculative asset class with tokens that are exposed to similar risks as tech stocks. The upside is likely capped until risks associated with rising rates, inflation, and recession are fully discounted," Shah said.

For Kitco News

Tim Moseley

What's next for crypto after 'perfect storm' crashes prices? Ethereum's market cap is 'orders of magnitude higher' than Bitcoin — Messari

What's next for crypto after 'perfect storm' crashes prices? Ethereum's market cap is 'orders of magnitude higher' than Bitcoin — Messari

.gif)

.gif)

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov

Entire financial system is 'a black hole,' crypto will become the dominant force – Garry Kasparov.gif)

.gif)

Gold sees record bullish sentiment among European retail investors – Spectrum Markets

Gold sees record bullish sentiment among European retail investors – Spectrum Markets

(1).png) Gold market is waiting for next week's Fed meeting – StoneX's O'Connell

Gold market is waiting for next week's Fed meeting – StoneX's O'Connell.gif)

.gif)