Strong greenback, rising Treasury yields, lower oil sink gold, silver

Gold and silver prices are lower in midday U.S. trading Thursday, with gold hitting a six-week low and dropping below the key $1,700 level. Silver today scored a more-than-two-year low. Falling crude oil prices, a strong U.S. dollar index and rising U.S. Treasury yields are all bearish elements punishing the metals markets bulls. October gold futures were last down $18.80 at $1,698.10. September Comex silver futures were last down $0.277 at $17.65 an ounce.

U.S. stock indexes are lower at midday hit five-week lows. Risk aversion is higher on this first day of September, a month that history has shown can be a rocky one for stock and financial markets. Gold and silver market bulls are hoping some safe-haven demand develops if September sees rough trading waters.

There are new reports of major Covid lockdowns in China, the world’s second-largest economy. Reports said 21 million people have been locked down in a major industrial region of the country. Economic data out of China Friday was also dour, with the purchasing managers indexes (PMIs) and housing/property indicators showing weakness. This has prompted concerns of slowing consumer and commercial demand in China, which have pressured raw commodity markets this week, with crude oil leading the way down. Other major economies are tightening their monetary policies, which will also work to slow their growth. Many market watchers fear U.S. and global economic recessions are setting in.

Traders are awaiting Friday morning’s employment situation report from the Labor Department. That report is expected to show the key non-farm payrolls growth number at up 325,000 in August versus the July report showing a gain of 528,000 non-farm jobs.

The key outside markets today see Nymex crude oil prices lower and trading around $87.00 a barrel. The U.S. dollar index is solidly higher and hit another 20-year high today. Meantime, the yield on the 10-year U.S. Treasury note is fetching 3.25%. The 2-year U.S. Treasury note yield hit a 15-year high today. The inverted yield curve is another clue suggesting a U.S. economic recession is imminent.

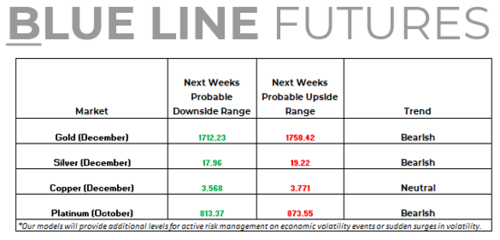

Technically, October gold futures prices hit a six-week low today. The gold futures bears have the solid overall near-term technical advantage. Prices are in a three-week-old downtrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $1,750.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the July low of $1,686.30. First resistance is seen at today’s high of $1,713.10 and then at Wednesday’s high of $1,728.70. First support is seen at today’s low of $1,689.80 and then at $1,686.30. Wyckoff's Market Rating: 1.5

December silver futures prices hit another more-than-two-year low today. The silver bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $19.00. The next downside price objective for the bears is closing prices below solid support at $17.00. First resistance is seen at $18.00 and then at $18.50. Next support is seen at today’s low of $17.40 and then at $17.25. Wyckoff's Market Rating: 1.0.

.gif)

December N.Y. copper closed down 1,030 points at 341.60 cents today. Prices closed near the session low and hit a four-week low. The copper bears have the firm overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the August high of 378.35 cents. The next downside price objective for the bears is closing prices below solid technical support at the July low of 315.55 cents. First resistance is seen at today’s high of 351.65 cents and then at Wednesday’s high of 359.90 cents. First support is seen at 340.00 cents and then at 335.00 cents. Wyckoff's Market Rating: 3.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

Tim Moseley

.gif)

.gif)

.gif)

.gif)

Gareth Soloway's Trading Tips: A Guide from a Master Trader

Gareth Soloway's Trading Tips: A Guide from a Master Trader.gif)

.gif)

The Ethereum Merge will be the biggest crypto event since the first Bitcoin was mined – Ran Neuner and Steven Sidley

The Ethereum Merge will be the biggest crypto event since the first Bitcoin was mined – Ran Neuner and Steven Sidley.gif)

.gif)