Gold price could 'easily' regain $2k next week as more debt ceiling troubles ahead – analysts

Even though gold is wrapping up the week down $30 — its worst performance since February — the Friday afternoon rebound keeps the bullish gold trend alive.

The gold market recovered after Federal Reserve Chair Jerome Powell said rates might not have to rise as much due to tighter credit conditions after the banking sector turmoil.

"The financial stability tools helped to calm conditions in the banking sector. Developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring and inflation," Powell said at the Thomas Laubach Research Conference Friday. "So, as a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals. Of course, the extent of that is highly uncertain."

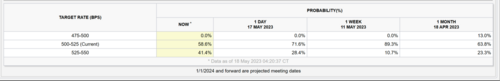

This was a sign that the Fed could pause in June. After Powell's comments, market expectations of a rate hike in June fell from nearly 50% to 20%, according to the CME FedWatch Tool.

The news calmed the gold sellers after market participants began to price in another 25-basis point hike next month and pared bets of a rate cut in the second half of the year.

At the May meeting, the Fed hiked for the tenth consecutive time, which brought the federal funds rate to a 5-5.25% range – the highest since mid-2007. In just over a year, the Fed raised rates by 5%. The next monetary policy meeting is scheduled on June 13-14.

On top of the shifting rate expectations, the debt ceiling progress was dealt a blow on Friday afternoon as talks to raise the federal government's $31.4 trillion debt cap paused.

"Wall Street thought we were going to see bill text over the weekend or early on Monday, with a potential vote in the middle of the week," said OANDA senior market analyst Edward Moya. "That seems less likely now and could raise the risk that we won't get an agreement before June 1st, the so-called X-date."

Keeping in mind the divisiveness of U.S. politics, the debt ceiling issue will get more heated again, Moya told Kitco News.

"You are going to start to see a bit more difficulty in negotiations. Gold will be in the wait-and-see mode to figure out which part of the economy will break," he said Friday. "The consumer is clearly weakening. A lot of the data still supports a recession."

Rate cut bets pared

One development that will continue to weigh on gold is pared-back rate cut expectations, Gainesville Coins precious metals expert Everett Millman told Kitco News.

"Almost everyone in the marketplace was convinced that the Fed was about to cut rates in the second half of this year. But because inflation didn't come down as much, the economy is holding up, and the unemployment rate is low, big traders are unwinding those rate cut bets," he said Friday.

And with gold testing record highs just over two weeks ago, traders are also taking some profits off the table, accelerating the move lower, Millman added.

Overall, it's been a disastrous week for gold, but it's ending on a positive note, Moya noted. "People are having second thoughts on whether we are headed towards a recession that is killing safe-haven demand," he told Kitco News. "This has been an interesting period where we really had so many risks on the table — banking crisis, debt ceiling, massive layoff announcements."

What's next for gold price

Millman's base-case scenario is that gold rebounds from here — something that it has done time and time again this past year.

"If you look at the pattern, gold does keep putting in higher lows and higher highs. Although I wouldn't rule out a drop to $1,900, my base scenario is to see gold rebound as it has each of the last several selloffs," Millman said.

After Powell's comments, there is a good chance that the Fed will pause in June, which gives the U.S. central bank optionality going forward, Millman noted.

"Keep in mind that it takes 12-18 months for rate hikes to really start showing up in economic data. The Fed has been hiking aggressively in a pretty short span of time, and we won't see results until the second half of this year. A pause in June would be reasonable," he said.

Gold's immediate resistance would be $1,980 and then $2,000 an ounce. A solid support level is at $1,960-50, Millman pointed out. If that fails, then $1,900 could come into play.

Moya also sees support at $1,950 and resistance at $2,000 an ounce. "If debt ceiling talks continue to struggle, prices could easily stabilize above the $2,000 level next week."

At the time of writing, June Comex gold futures were trading at $1,983.80, up 1.22% on the day.

Next week's data

Markets are closely monitoring the FOMC May meeting minutes next week, the U.S. GDP update, and the Fed's favored PCE inflation indicator.

"Inflation … looks set to remain elevated, which could keep the market on edge about a possible June interest rate hike," said ING chief international economist James Knightley. "Nonetheless, the activity backdrop continues to soften, with real consumer spending set to come in flat on the month in April. Recession risks remain high given the rapid tightening in lending conditions in the wake of recent bank failures, and we still see the potential for lower interest rates before the end of the year."

Tuesday: U.S. new home sales

Wednesday: FOMC May meeting minutes

Thursday: U.S. GDP Q1, U.S. jobless claim

Friday: U.S. PCE price index, U.S. durable goods order

By

Anna Golubova

For Kitco News

Tim Moseley

Gold price at risk of dropping to $1,900 as rally runs out of steam, markets pricing in Fed rate cuts too early, says ABN AMRO

Gold price at risk of dropping to $1,900 as rally runs out of steam, markets pricing in Fed rate cuts too early, says ABN AMRO

.png)

.gif)