Central banks' gold holdings drop for the first time in over a year in April, says World Gold Council

Global central bank gold holdings fell for the first time in more than a year in April, as Turkey sold over 80 tonnes of gold, the World Gold Council (WGC) said in a report.

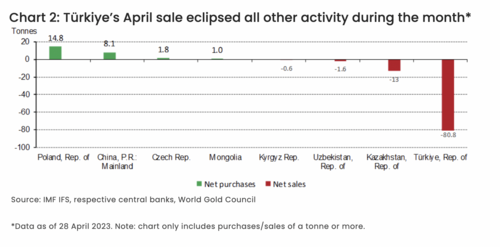

Total central bank gold reserves dropped by 71 tonnes in April. The last time central bank gold holdings declined was in March 2022, and the net drop was one tonne, the report pointed out.

The monthly decrease is not representative of a trend reversal, said WGC's senior analyst Krishan Gopaul. "Country-level data reveals that, far from a sudden wave of central bank selling, the drop in reserves was primarily due to Türkiye," Gopaul said Friday.

The Central Bank of Turkey sold 81 tonnes of gold in April, reducing its gold holdings to 491 tonnes. This was after the central bank already sold 15 tonnes in March.

Last year, Turkey bought the most gold out of all central banks, purchasing 148 tonnes and increasing its gold reserves to 542 tonnes — the highest level on record.

The report explained that country-specific circumstances led Turkey to offload some of its gold.

"This was a specific response to local dynamics rather than a change to their long-term gold policy: the gold was sold into Türkiye's domestic market to satisfy very strong bar, coin and jewelry demand following a temporary partial ban on gold bullion imports," the report noted. "It remains to be seen if this selling will continue and, if so, at what pace."

Other sales in April were significantly smaller tonnage-wise. The National Bank of Kazakhstan sold 13 tonnes, the Central Bank of Uzbekistan offloaded two tonnes, and the National Bank of the Kyrgyz Republic sold 0.6 tonnes.

While massive gold selling is not likely to become the new trend, central bank gold purchases are slowing down.

Only four central banks bought gold in April, with Poland reporting additional 15 tonnes, the People's Bank of China buying eight tonnes (its sixth monthly purchase in a row), the Czech National Bank adding two tonnes, and the Central Bank of Mongolia purchasing an additional tonne.

The WGC is looking past April's drop in central bank gold holdings and projects more buying throughout 2023.

"Our view is also supported by findings from our latest Central Bank Gold Reserves survey, which shows reserves managers remain broadly positive towards gold," Gopaul said. "It's also worth noting that the Central Bank of Iraq recently announced a 2.5t purchase in May and signaled more to come."

Turkey's case is unique

Turkey has seen a surge in gold demand in the past year as citizens embraced the precious metal as a hedge against inflation, political and economic uncertainty, and local currency devaluation.

"Local demand for gold in Turkey is simply a desire to protect their purchasing power from a declining Lira," William Stack, financial advisor at Stack Financial Services LLC, told Kitco News. "Gold is a great asset to own when you are in a financial pinch because it can be sold when necessary."

Rising gold demand led to a jump in gold imports, which weighed on Turkey's widening current-account deficit. In response, Turkey introduced steps to curb gold imports in February and began selling its gold reserves to meet domestic demand.

But the move to offload some of its gold is not necessarily a losing scenario for the Turkish central bank, Stack pointed out.

"One reason Turkey is selling is that gold has risen 10% from a year ago, in dollar terms. In Lira-terms, the gain is more dramatic — 70-85%," he explained. "If Turkey sold gold internationally, it would weaken the Lira further. But when they sell gold to Turkish residents for Lira, it reduces the amount of Lira in the marketplace, thereby helping to strengthen the currency."

By

Anna Golubova

For Kitco News

Tim Moseley

Bitcoin voters could decide close U.S. elections as bipartisan political support grows – Lyn Alden

Bitcoin voters could decide close U.S. elections as bipartisan political support grows – Lyn Alden

The gold market posted its first monthly loss since February, wrapping May down about $36. As markets eye the crucial Congress vote to lift the debt ceiling, some Federal Reserve speakers are pushing for a "hawkish pause" at the June 13-14 meeting.

The gold market posted its first monthly loss since February, wrapping May down about $36. As markets eye the crucial Congress vote to lift the debt ceiling, some Federal Reserve speakers are pushing for a "hawkish pause" at the June 13-14 meeting.

Gold price trades below $1,950 ahead of Congress debt ceiling vote and June Fed decision

Gold price trades below $1,950 ahead of Congress debt ceiling vote and June Fed decision

.gif)