Gold, silver kick off 2023 in style

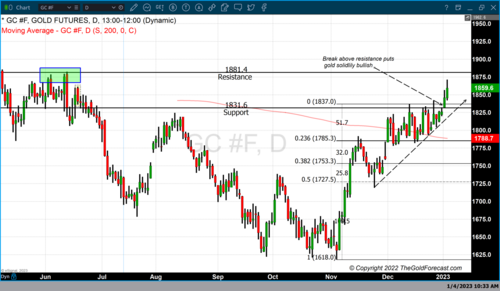

After a well-earned break, we are back in action… and what a time to be covering precious metals! Gold and silver are starting the year off on the front foot, with gold ending the first full trading week of the year at a nine-month high above $1,920 an ounce and silver prices solidly back above $24 an ounce

Gold prices are actually up nearly 5% since the start of the year, and while the year has only just started, the bullish sentiment in the marketplace is almost palpable. We have only just broken above $1,900 an ounce, but some investors and analysts have already set their sights on the $2,000 target.

Some heavyweight market players are jumping on the gold bandwagon as prices have risen $300 from November's two-year lows.

In an exclusive interview with Kitco News' Michelle Makori, Nouriel Roubini, CEO of Roubini Macro Associates and Professor Emeritus at NYU Stern School of Business, said that investors will flock to gold as 10 "megathreats" threaten the global economy.

Roubini said that he sees gold prices rising to $3000 an ounce by 2028.

"Over the next few years, I would expect that gold could have high single-digits into low double-digits rates of return," said the renowned economist, also known as "Dr. Doom," in the interview. "I expect… rates of return around 10 percent per year over the next five years."

Along with Roubini, billionaire "bond king" Jeffrey Gundlach said he turned bullish on gold when prices pushed above $1,800 an ounce.

In a webcast Tuesday, the Doubleline CEO said that gold was one of his recommendations for 2023. "It's a reasonably good time to buy gold and own gold," Gundlach said.

Many investors stayed away from gold in 2022 as the Federal Reserve's aggressive monetary policy stance pushed bond yields to a 12-year high and the U.S. dollar to a 20-year high; however, analysts have said that that trend could be reversing in 2023 as the Federal Reserve is nearing the end of its tightening cycle.

Analysts have noted that U.S. bond yields are pricing in a terminal Fed Funds rate below 5%, which in turn has caused the U.S. dollar to fall to a seven-month low this week.

Many analysts have said that both bond yields and the U.S. dollar have peaked, supporting gold's rally.

But gold is more than just the sum of investment demand. Global geopolitical uncertainty continues to support the precious metal as a critical element in global currency markets.

This week, the People's Bank of China announced that it bought 30 tonnes of gold in December. This follows November's purchase of 32 tonnes of gold, the first officially-recorded purchase since September 2019.

BNP Paribas market analyst Chi Lo said in a recent report that gold will be a crucial element in China's plan to strengthen the yuan's international credibility and challenge the U.S. dollar's status as the world's reserve currency.

"Making the renminbi convertible into gold effectively turns the currency into a global investable asset for foreign renminbi owners, boosting their confidence in and demand for the Chinese currency," Lo said in his report. "A gold-backed petro-yuan does not require full renminbi convertibility to function, so it allows China to simultaneously retain control of its capital account and boost the internationalization of the renminbi."

By Neils Christensen

For Kitco News

Tim Moseley

.png)