Mysterious Whale Suddenly Transfers 2,000 BTC Mined in 2010, Now Worth Over $140 Million

By Arnold Kirimi – March 28, 2024

Bitcoin’s mysterious early adopters continue to make waves in the cryptocurrency space as an unidentified individual or entity recently consolidated 2,000 BTC mined in 2010 into a single wallet.

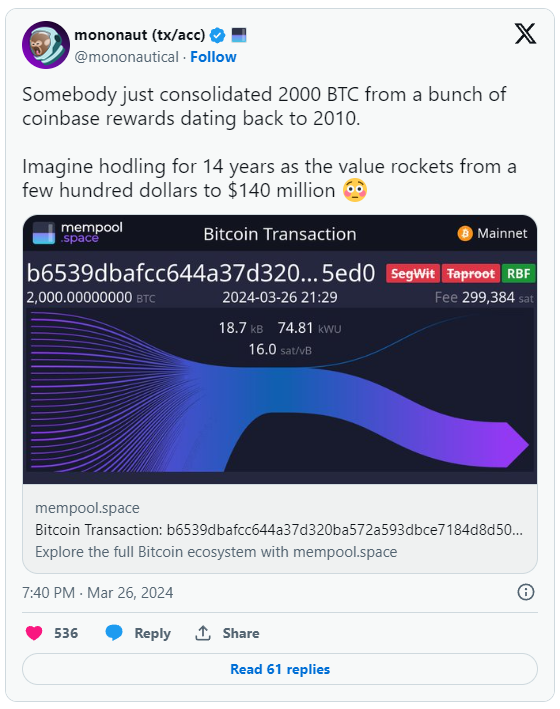

This move, highlighted by developer mononautical on X, underscores the remarkable value appreciation of Bitcoin over the past 14 years, with the 2,000 BTC now worth a staggering $140 million.

This significant transfer of wealth from the early days of Bitcoin mining is a testament to the foresight and patience of these early adopters, who have held onto their coins through volatile market cycles and exponential price increases.

Consolidation of 2,000 BTC Mined in 2010

The consolidation of 2,000 BTC mined in 2010 into a single wallet marks a notable event in Bitcoin’s history. This move involves the transfer of 40 sets of mining rewards, each consisting of 50 BTC, into one wallet.

The sheer size of this transaction underscores the value of Bitcoin’s long-term holding strategy, with Satoshi-era adopters now reaping the rewards of their patience.

Developer mononautical, upon noting the consolidation, commented on the remarkable journey of these early mined coins, which have seen their value skyrocket from a few hundred dollars to $140 million.

This long-term holding strategy highlights the belief early adopters had in the potential of Bitcoin, even during its early days when its value was highly volatile and uncertain.

While some have raised concerns about a compromised key generation or the possibility of a security breach, mononautical clarified that the miner remains unidentified. This suggests that the consolidation may have been a strategic move by the miner, rather than a result of compromised keys.

The fact that the transfer went straight to an over-the-counter (OTC) desk further supports this notion, as it indicates a deliberate decision to liquidate the holdings through official channels.

It’s a familiar phenomenon in the world of cryptocurrency to see long-dormant addresses become active again. Recently, this trend was observed in the Bitcoin market when an address, previously inactive and ranked as the fifth richest in Bitcoin holdings, suddenly showed signs of activity.

This particular address had been funded with 94,500 BTC back in 2019, valued at $6.05 billion at the time. After lying dormant for years, the Bitcoin from this address was recently split and moved to new addresses.

As reported by ZyCrypto, a Bitcoin wallet that remained inactive for over 13 years and nine months recently became active again, reawakening after nearly a decade and a half. This wallet, dating back to Bitcoin’s early days, holds 50 BTC, which was relatively small in value when last used but has since surged to over $3.3 million in today’s market.

Impact on Market Liquidity

The consolidation of these old Bitcoin holdings has broader implications for the cryptocurrency market, particularly in terms of liquidity. CryptoQuant founder and CEO Ki Young Ju noted that the consolidation indicates a “sell-side liquidity crisis waking up old Bitcoin.”

This suggests that the movement of these long-dormant coins is contributing to a tightening of the Bitcoin supply available for sale, which could potentially drive up prices.

It’s not unusual for early cryptocurrency adopters to resurface after long periods of dormancy. This trend was

The consolidation of these old Bitcoin holdings comes at a time when the cryptocurrency market is experiencing significant growth and adoption.

The introduction of spot Bitcoin exchange-traded funds (ETFs) in the U.S. has led to a surge in demand for Bitcoin, further reducing the available supply for sale. As a result, Bitcoin’s liquid inventory has reached its lowest level ever, indicating a potential supply crunch in the market.

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Arnold Kirimi and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe

** Loans, secure funding for business projects in the USA and around the world. Learn more about USA & International Financing at Commercial Funding International. **

Tim Moseley